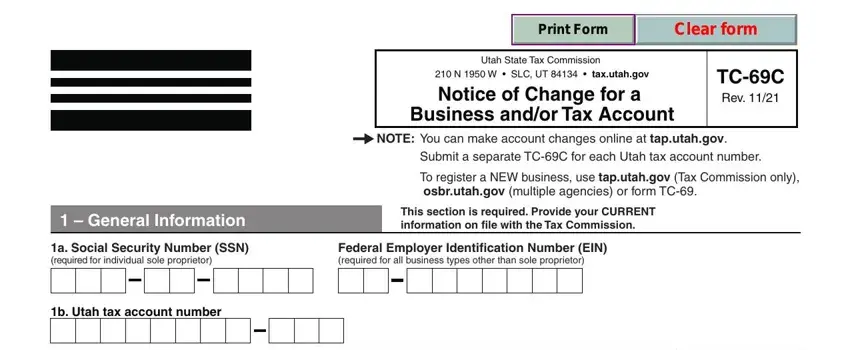

Completing 69c form is easy. Our experts developed our PDF tool to make it simple to use and assist you to prepare any form online. Listed below are steps that you should go through:

Step 1: Choose the "Get Form Here" button.

Step 2: Now, you can start editing your 69c form. Our multifunctional toolbar is available to you - add, erase, modify, highlight, and carry out similar commands with the text in the file.

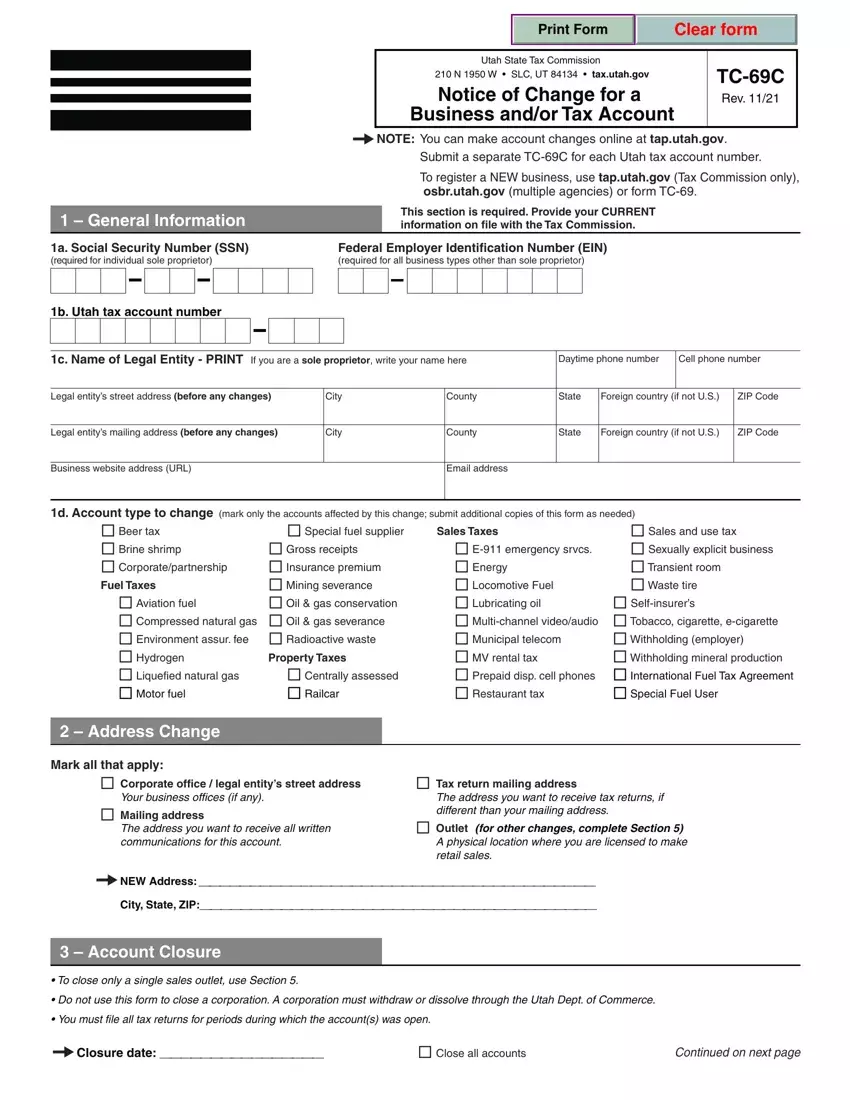

Provide the essential details in each one section to fill out the PDF 69c form

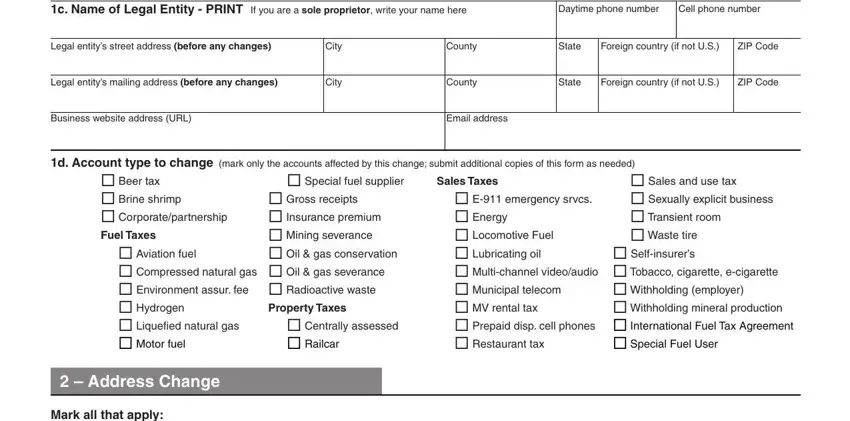

Note the required data in the section c Name of Legal Entity PRINT If, Daytime phone number, Cell phone number, Legal entitys street address, City, County, State, Foreign country if not US, ZIP Code, Legal entitys mailing address, City, County, State, Foreign country if not US, and ZIP Code.

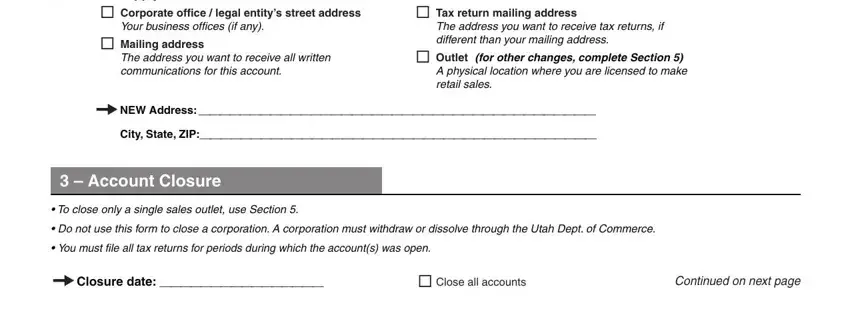

The application will ask you for information to instantly fill out the field Mark all that apply, Corporate office legal entitys, Your business offices if any, Mailing address, The address you want to receive, Tax return mailing address, The address you want to receive, Outlet for other changes complete, NEW Address, City State ZIP, Account Closure, cid To close only a single sales, cid Do not use this form to close, cid You must file all tax returns, and Closure date.

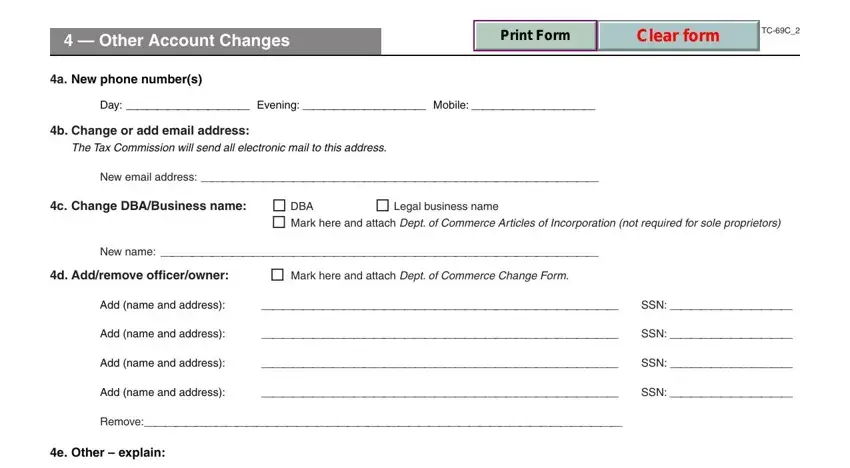

The Other Account Changes, a New phone numbers, Day Evening Mobile, b Change or add email address, The Tax Commission will send all, New email address, TCC, c Change DBABusiness name DBA, Legal business name, Mark here and attach Dept of, New name, d Addremove officerowner, Mark here and attach Dept of, Add name and address, and SSN area allows you to point out the rights and responsibilities of all sides.

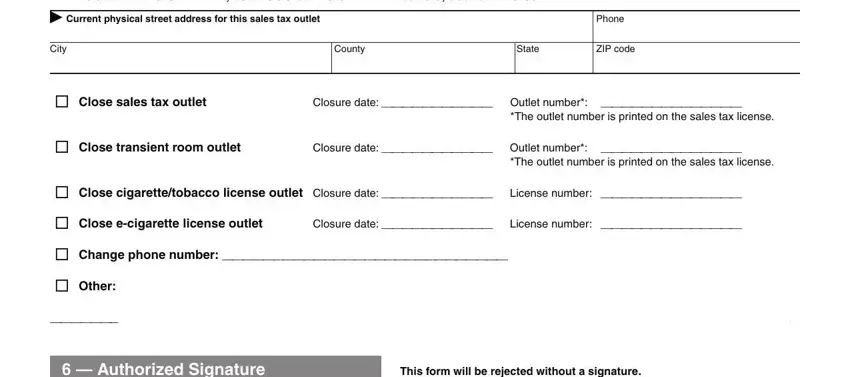

Check the fields cid Use Section to report CHANGES, Current physical street address, Phone, City, County, State, ZIP code, Close sales tax outlet, Closure date Outlet number, The outlet number is printed on, Close transient room outlet, Closure date Outlet number, The outlet number is printed on, Close cigarettetobacco license, and License number and next complete them.

Step 3: When you have hit the Done button, your file will be available for export to any electronic device or email you identify.

Step 4: Ensure you keep away from upcoming difficulties by having minimally 2 copies of your form.

Current physical street address for this sales tax outlet

Current physical street address for this sales tax outlet