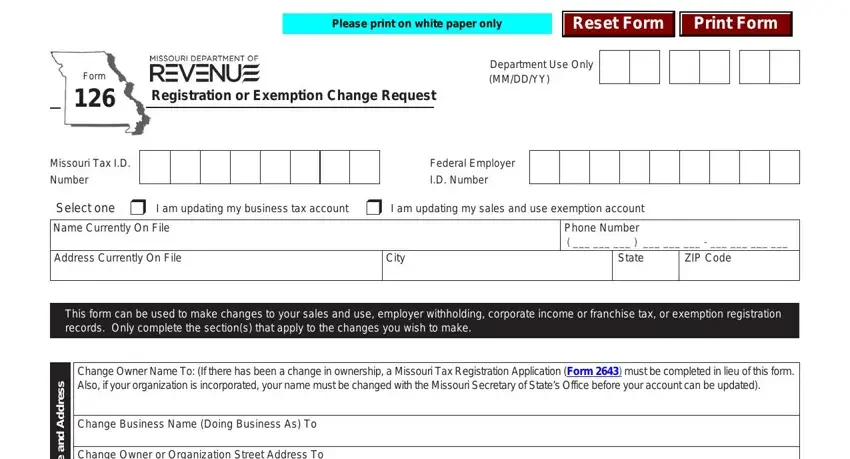

Filling out MASSACHUSETTS is a snap. Our team designed our software to really make it convenient and assist you to fill in any form online. Below are some steps you'll want to follow:

Step 1: Step one is to click on the orange "Get Form Now" button.

Step 2: Now it's easy to edit the MASSACHUSETTS. The multifunctional toolbar can help you include, eliminate, modify, and highlight text or carry out several other commands.

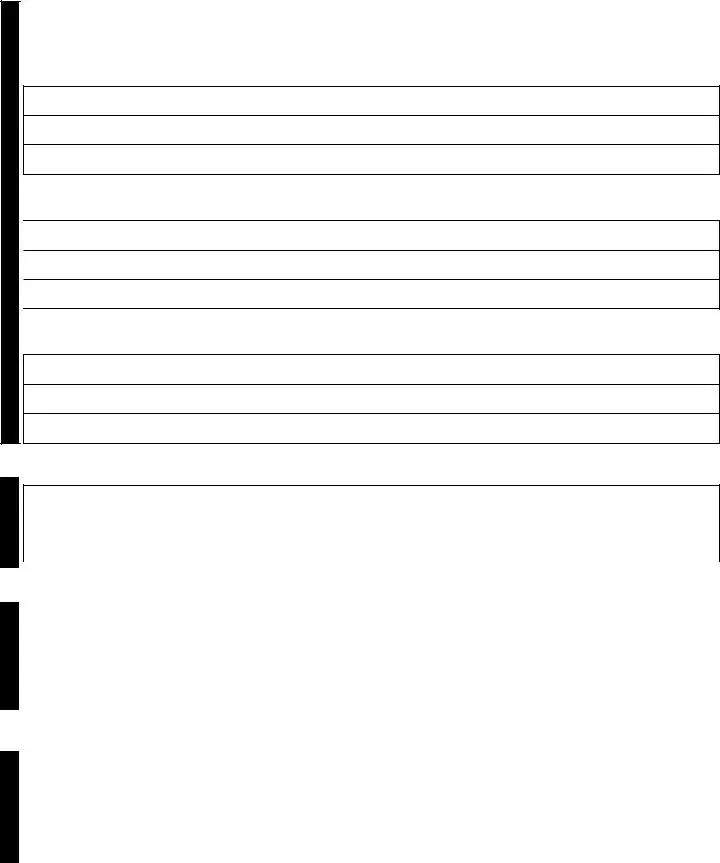

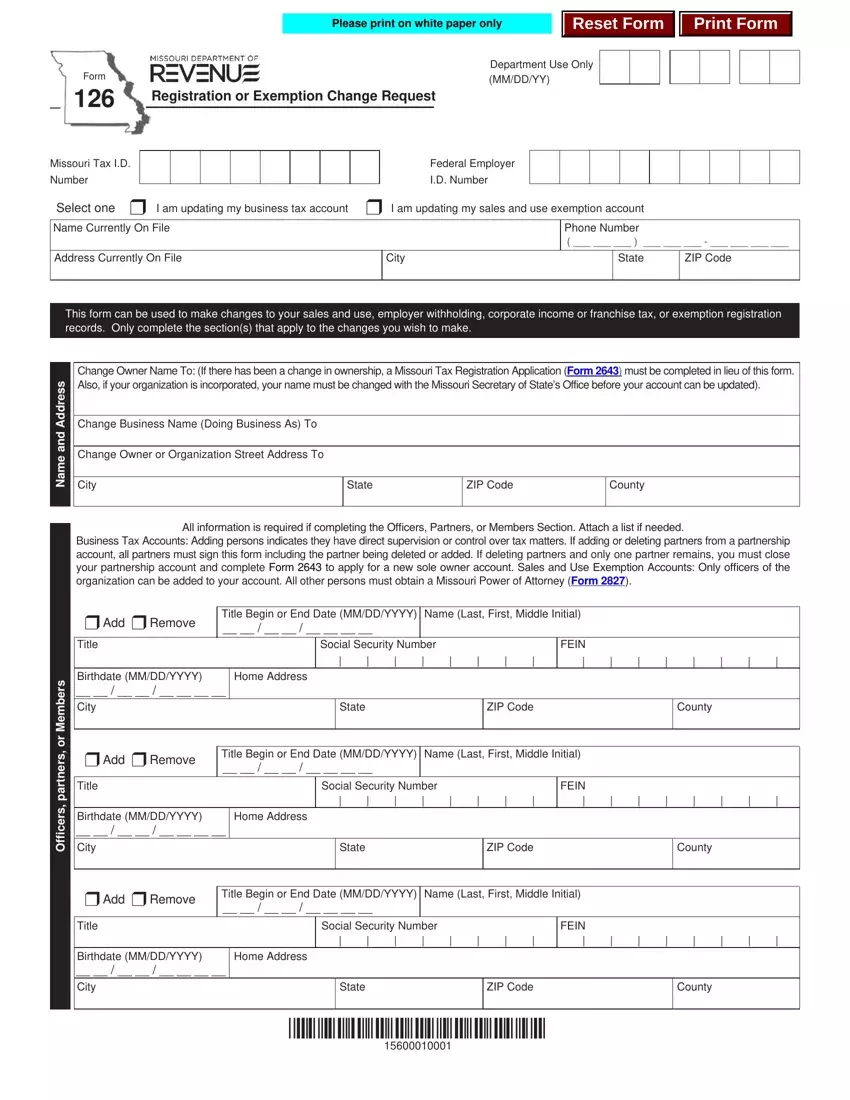

These particular areas are going to make up your PDF document:

In the part e m a N, s r e b m e M, r o, s r e n t r a p, s r e c i f f, City, State, ZIP Code, County, All information is required if, r Add r Remove, Title Begin or End Date MMDDYYYY, Title, Social Security Number, and FEIN note the particulars that the application requires you to do.

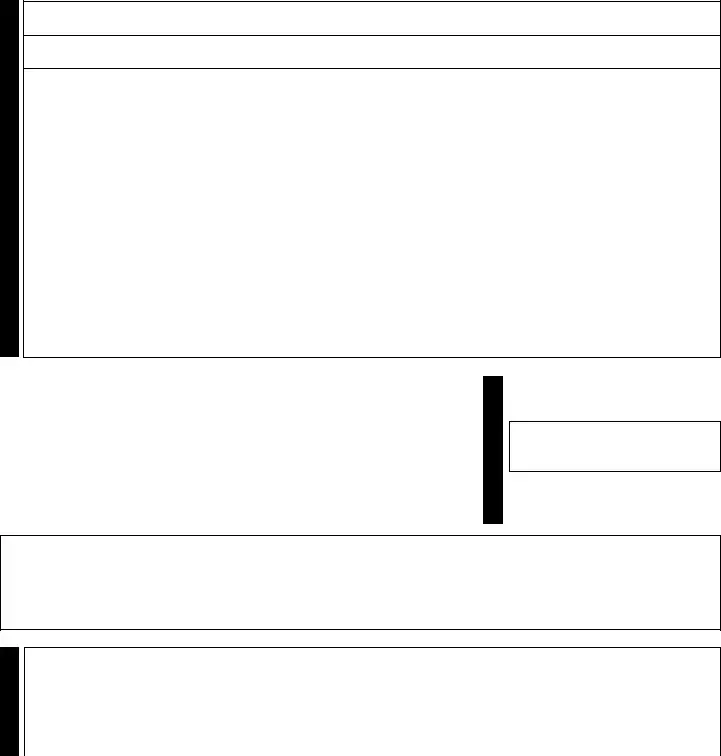

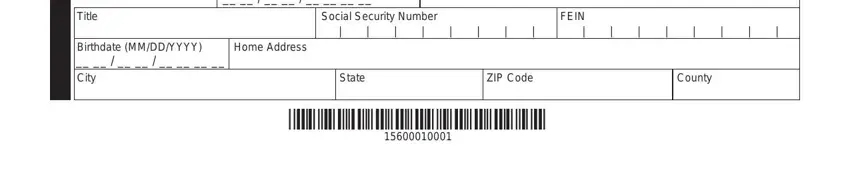

Be sure to highlight the relevant information from the Title Begin or End Date MMDDYYYY, Title, Social Security Number, FEIN, Birthdate MMDDYYYY City, Home Address, State, ZIP Code, and County box.

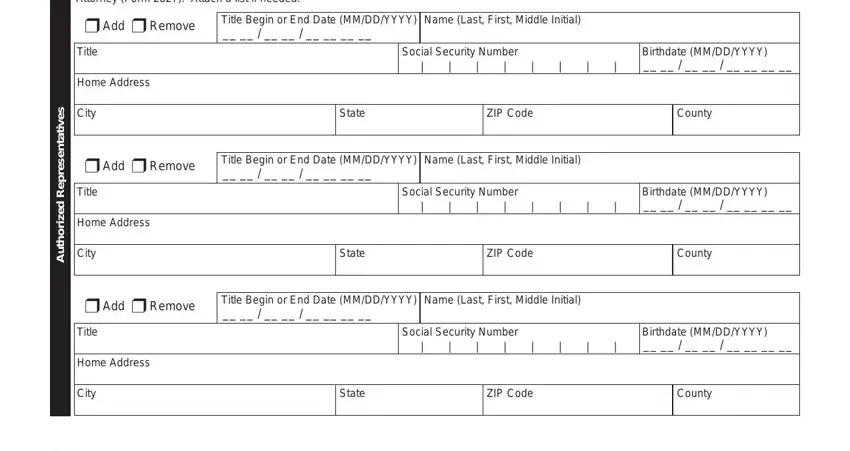

In the section All information is required if, r Add r Remove, Title Begin or End Date MMDDYYYY, Title, Home Address, City, Social Security Number, Birthdate MMDDYYYY, State, ZIP Code, County, r Add r Remove, Title Begin or End Date MMDDYYYY, Title, and Home Address, list the rights and responsibilities of the sides.

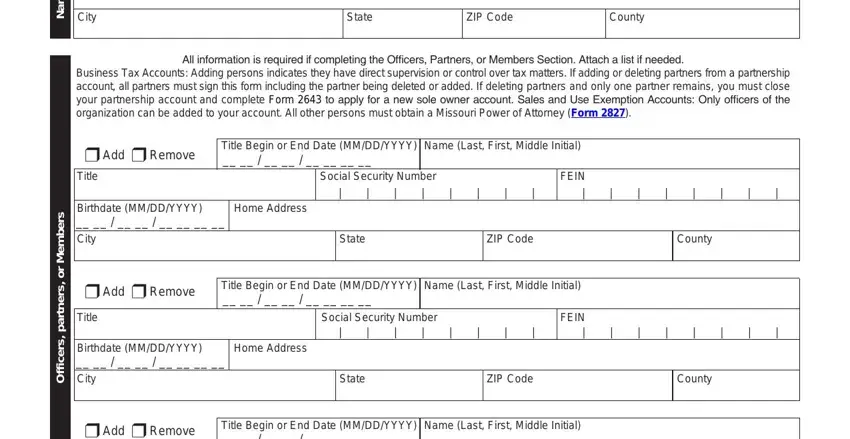

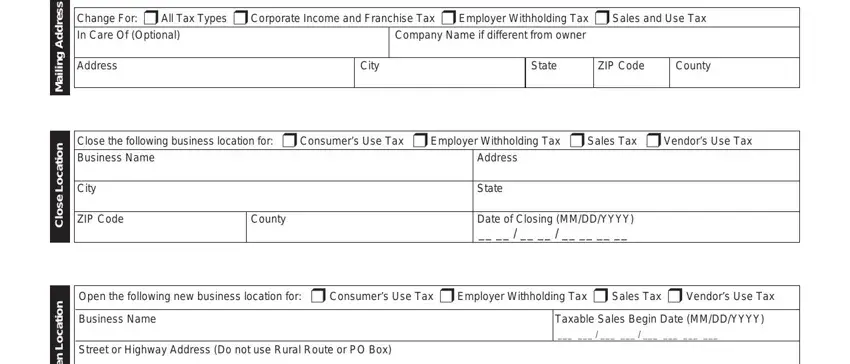

Fill out the form by reading the following areas: Change For r All Tax Types r, Company Name if different from, Address, City, State, ZIP Code, County, Close the following business, Address, City, ZIP Code, County, State, Date of Closing MMDDYYYY, and Open the following new business.

Step 3: Choose the Done button to make sure that your finished form may be exported to any electronic device you select or delivered to an email you specify.

Step 4: You can also make duplicates of the document tokeep away from any future troubles. Don't get worried, we do not reveal or monitor your data.

Officers, partners, or Members

Officers, partners, or Members