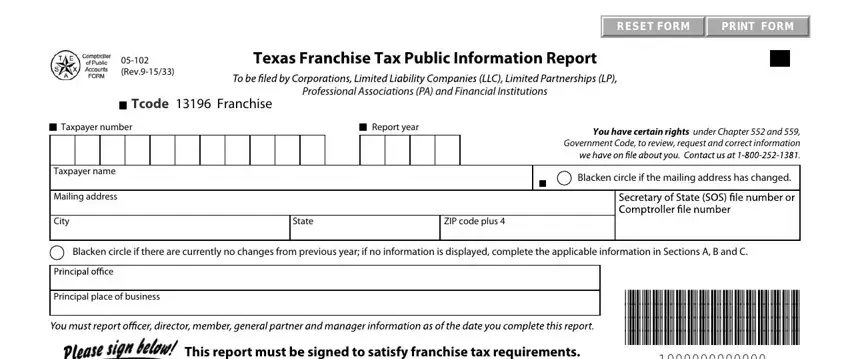

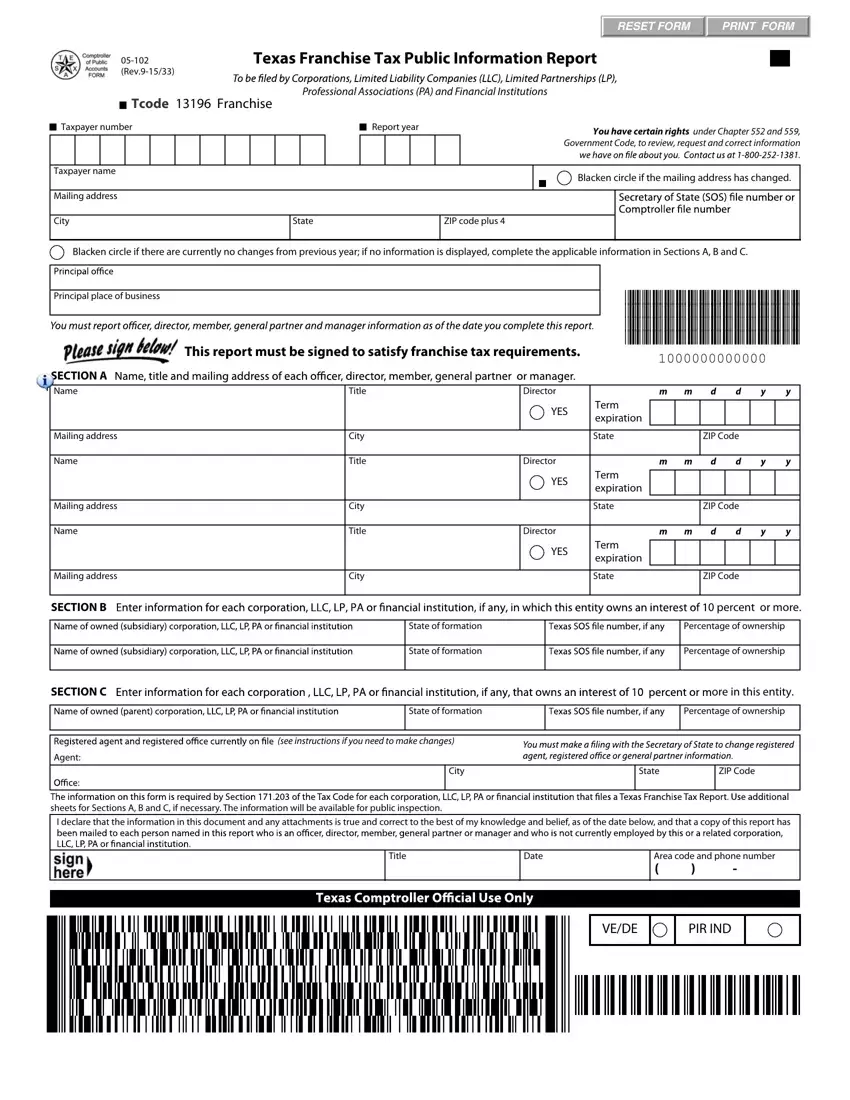

Very few things are easier than preparing documentation making use of the PDF editor. There isn't much you should do to edit the texas form 05 102 instructions 2020 form - just adopt these measures in the next order:

Step 1: Select the button "Get Form Here".

Step 2: After you have entered the texas form 05 102 instructions 2020 editing page you may notice all the options you may undertake about your document from the top menu.

In order to get the template, provide the content the program will ask you to for each of the next segments:

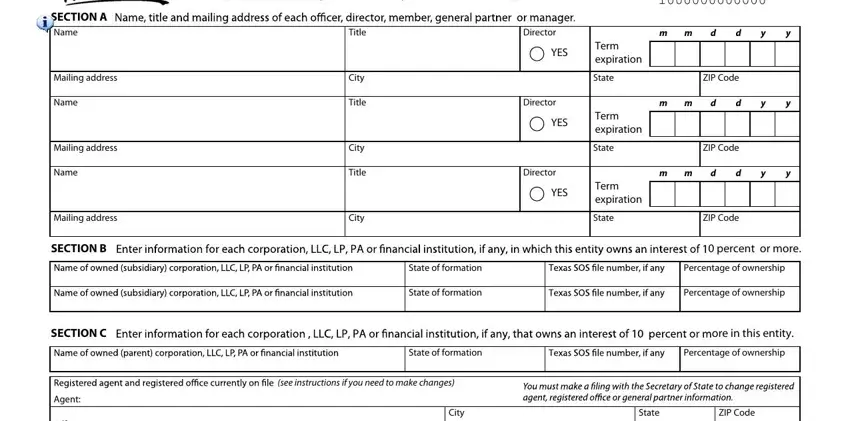

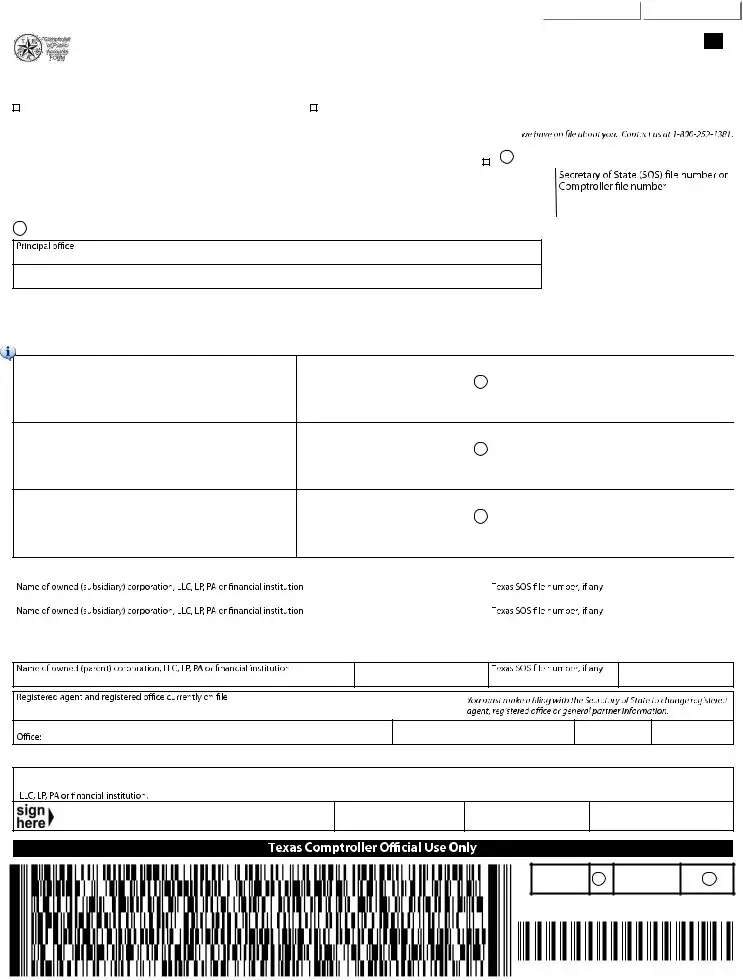

Provide the necessary data in the SECTION A Name, Mailing address, Name, Mailing address, Name, Mailing address, SECTION B, SECTION C, Agent, This report must be signed to, Title, City, Title, City, and Title field.

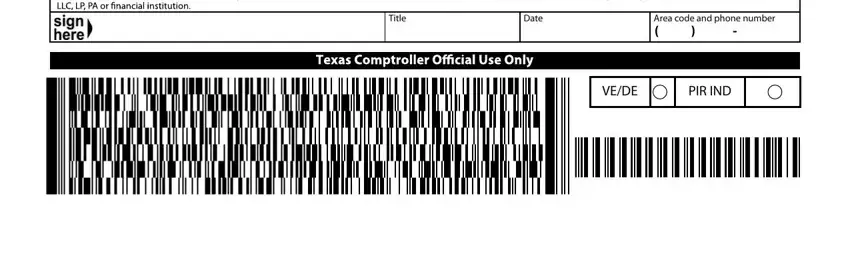

Within the segment referring to Title, Date, Area code and phone number, VEDE, and PIR IND, you have got to note some expected details.

Step 3: When you press the Done button, your finalized file can be exported to each of your gadgets or to email given by you.

Step 4: Get a duplicate of every different form. It can save you some time and help you remain away from misunderstandings down the road. Also, your information won't be distributed or viewed by us.

This report must be signed to satisfy franchise tax requirements.

This report must be signed to satisfy franchise tax requirements.