Our finest web programmers have worked collectively to get the PDF editor you are going to begin using. This application enables you to fill in form 05 158 a instructions documents quickly and effortlessly. This is certainly all you have to conduct.

Step 1: At first, pick the orange "Get form now" button.

Step 2: You will discover each of the actions you can undertake on your document after you've entered the form 05 158 a instructions editing page.

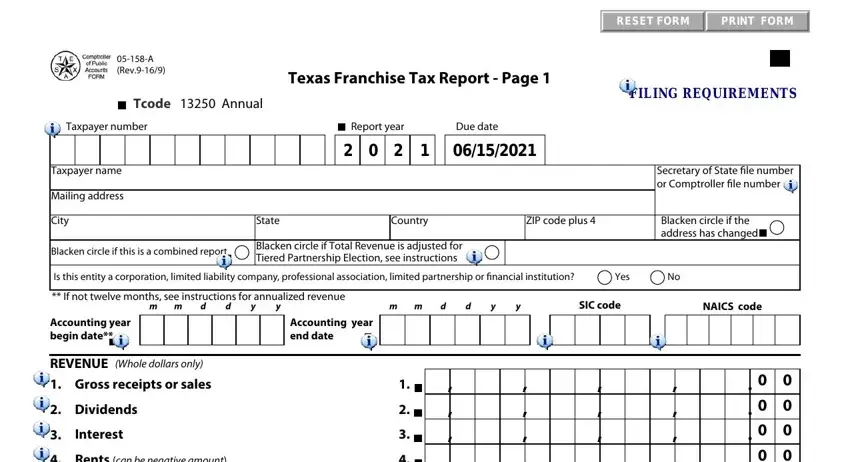

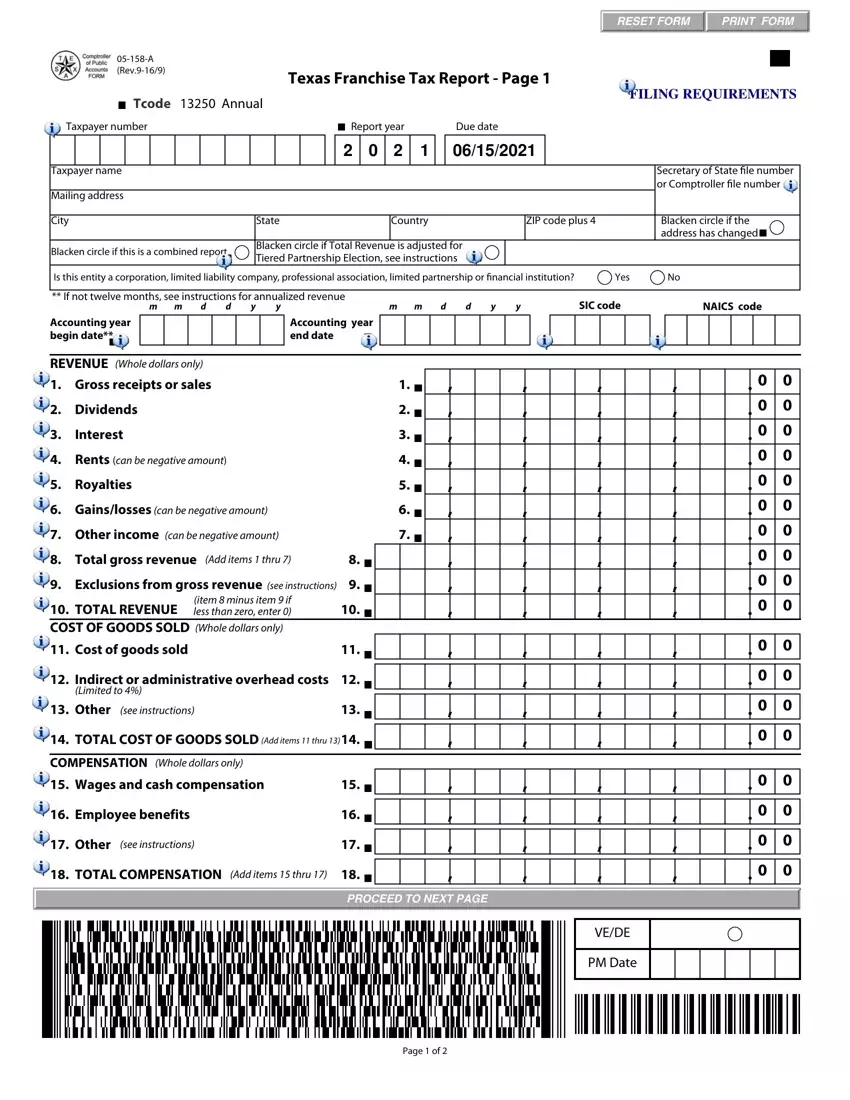

The following parts are inside the PDF document you will be completing.

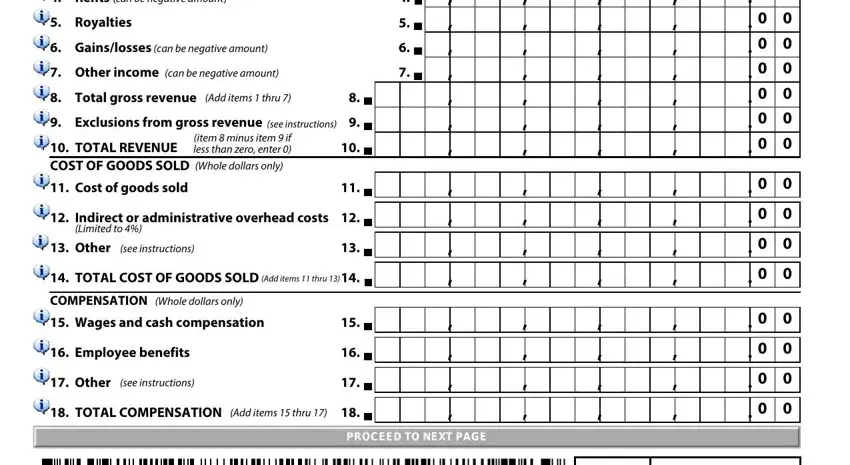

Include the required information in the Rents can be negative amount, Royalties, Gainslosses can be negative amount, Other income can be negative, Total gross revenue Add items, Exclusions from gross revenue see, TOTAL REVENUE COST OF GOODS SOLD, item minus item if less than, Cost of goods sold, Indirect or administrative, Limited to, Other, see instructions, TOTAL COST OF GOODS SOLD Add, and COMPENSATION Whole dollars only segment.

The software will require information to quickly prepare the segment Page of.

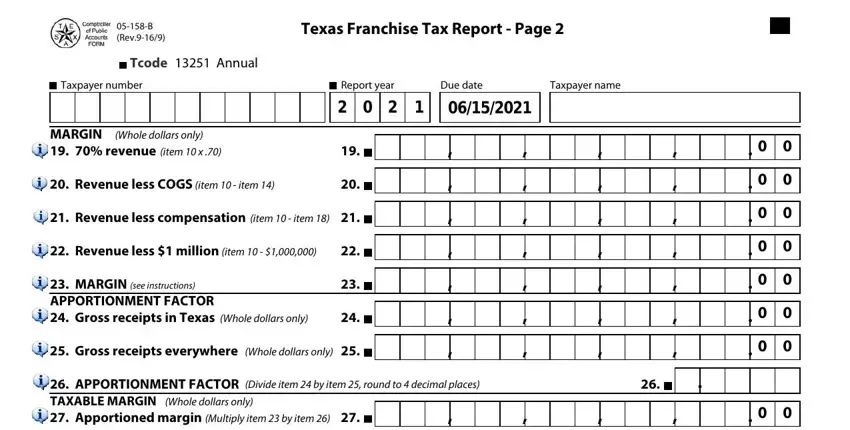

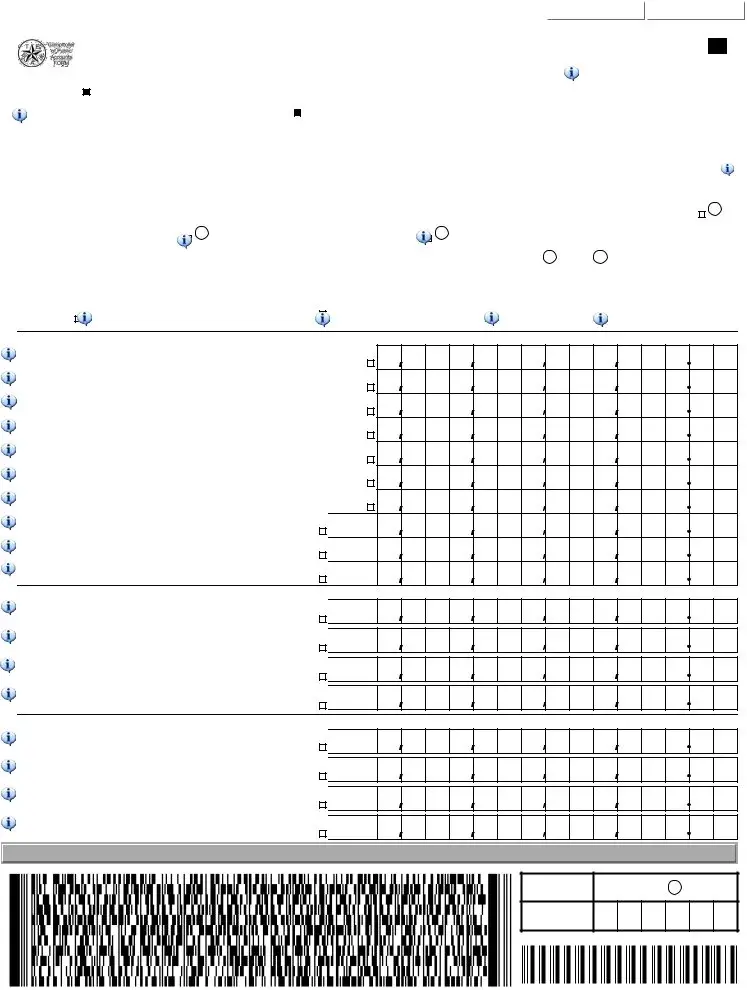

You will have to define the rights and obligations of both parties in section B Rev, Tcode Annual, Texas Franchise Tax Report Page, Taxpayer number, Report year, Due date, Taxpayer name, MARGIN revenue item x, Whole dollars only, Revenue less COGS item item, Revenue less compensation item, Revenue less million item, MARGIN see instructions, Gross receipts in Texas Whole, and Gross receipts everywhere Whole.

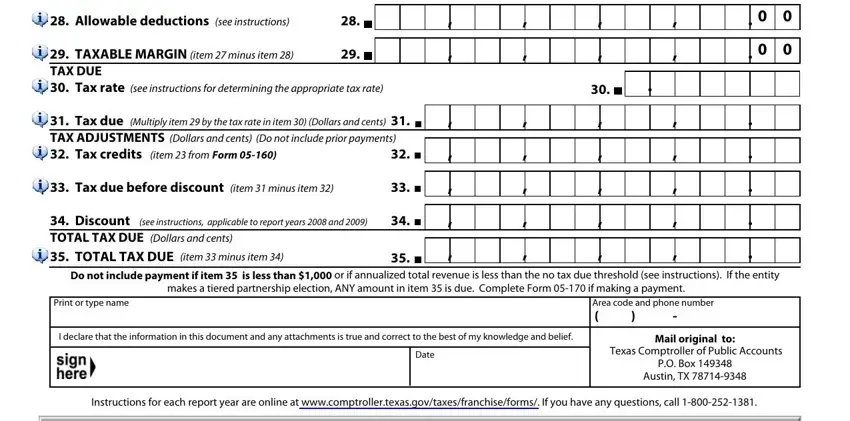

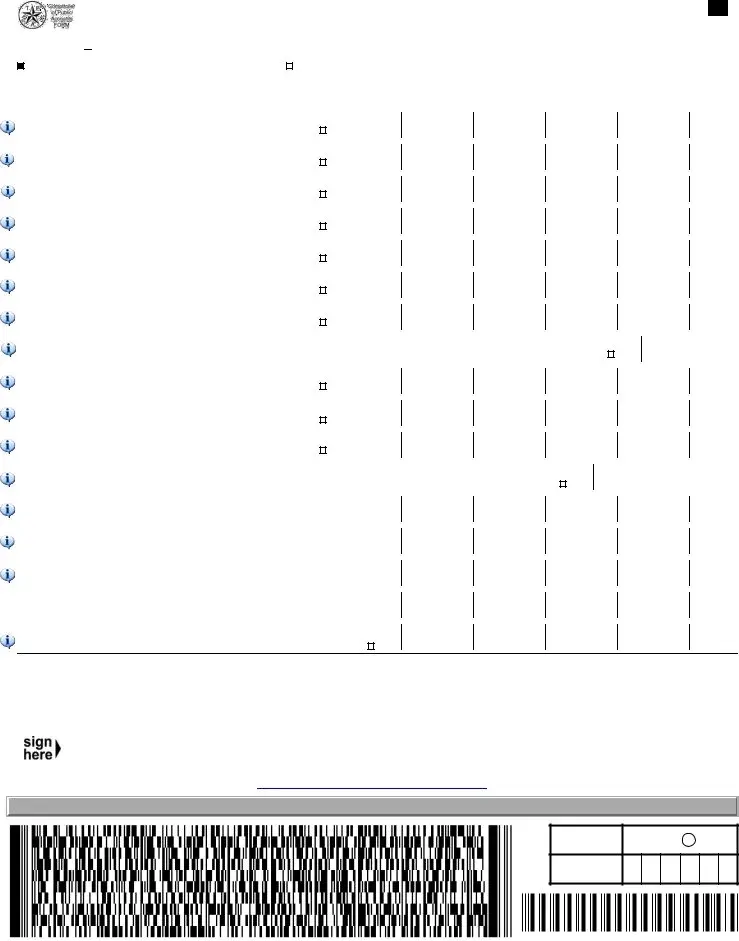

End up by analyzing the next areas and preparing them correspondingly: Allowable deductions, see instructions, TAXABLE MARGIN item minus item, Tax due Multiply item by the tax, Do not include prior payments, Tax due before discount item, see instructions applicable to, Discount TOTAL TAX DUE Dollars, X X, X XX, Do not include payment if item is, Print or type name, Area code and phone number, I declare that the information in, and Date.

Step 3: Choose the "Done" button. So now, it is possible to export the PDF file - upload it to your electronic device or deliver it by using electronic mail.

Step 4: It is better to keep duplicates of the file. You can rest assured that we will not share or check out your information.

Tcode

Tcode