ma tax form abatement can be completed online with ease. Just open FormsPal PDF editing tool to do the job right away. Our editor is continually evolving to deliver the very best user experience achievable, and that's thanks to our commitment to continual development and listening closely to comments from customers. All it requires is a couple of basic steps:

Step 1: Click the "Get Form" button in the top section of this webpage to open our tool.

Step 2: With our state-of-the-art PDF file editor, you can actually do more than merely fill in blank form fields. Express yourself and make your forms seem professional with customized text added in, or modify the file's original content to perfection - all that supported by an ability to insert stunning photos and sign the file off.

It really is easy to complete the document with this detailed tutorial! Here's what you should do:

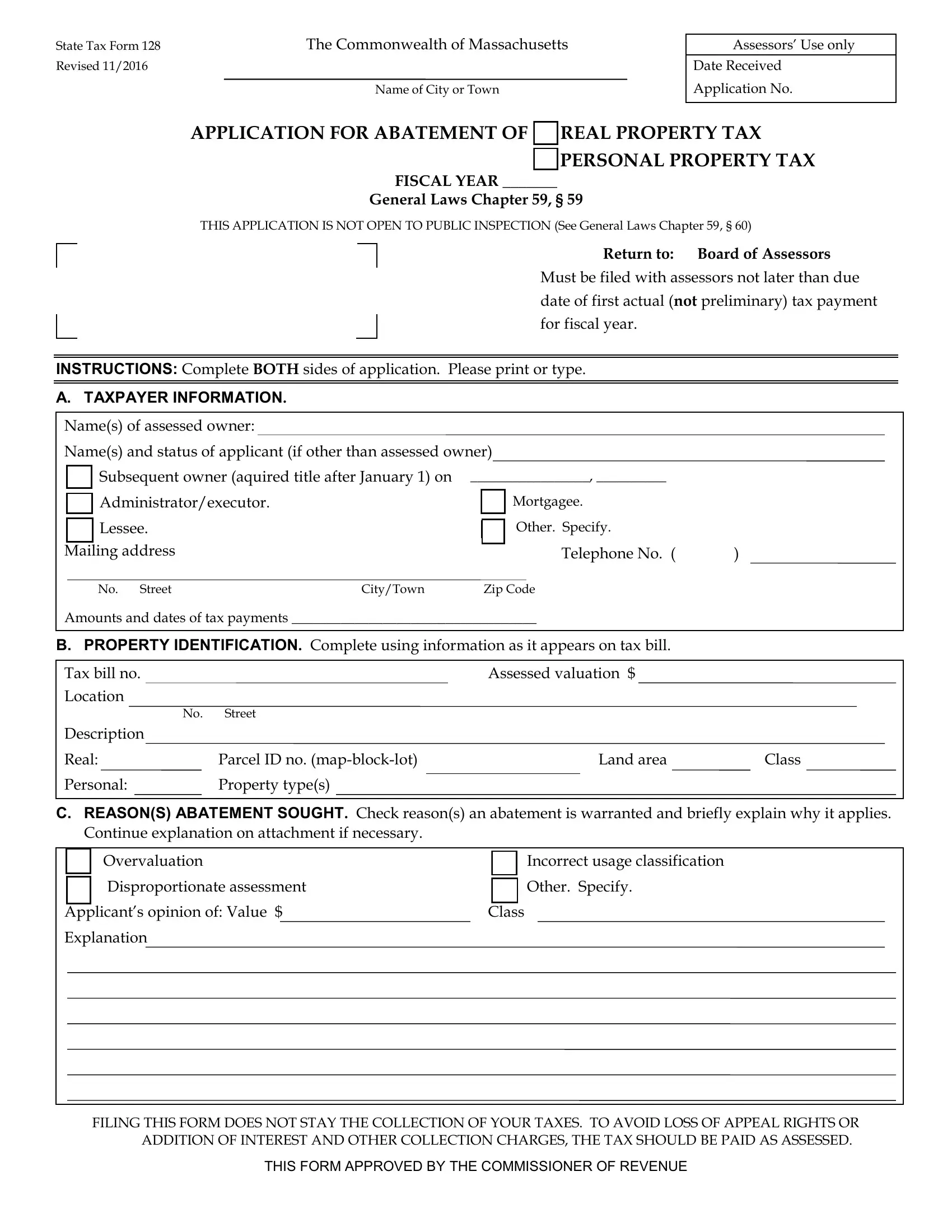

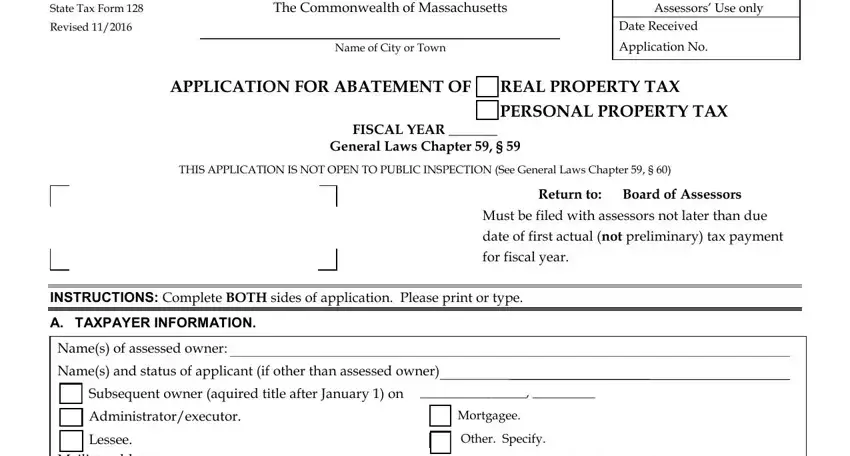

1. It is advisable to complete the ma tax form abatement accurately, so be mindful while filling in the parts that contain these blanks:

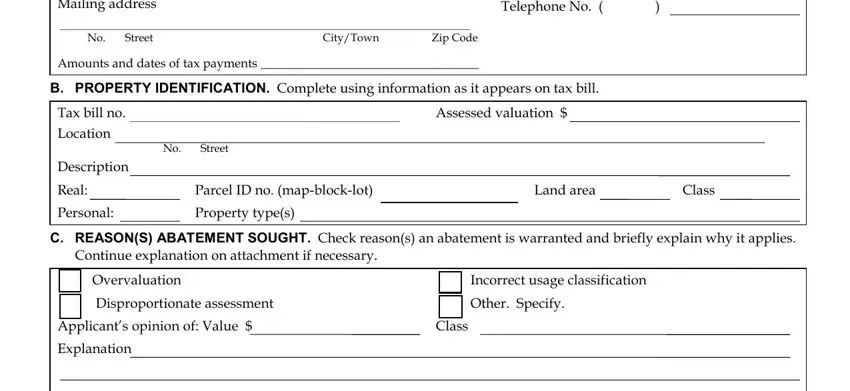

2. Just after filling in the last part, go to the next stage and fill out all required details in all these fields - Lessee Mailing address, Telephone No, No Street CityTown Zip Code, Amounts and dates of tax payments, B PROPERTY IDENTIFICATION Complete, Tax bill no Location No Street, Assessed valuation, Real, Personal, Parcel ID no mapblocklot, Land area, Class, Property types, C REASONS ABATEMENT SOUGHT Check, and Continue explanation on attachment.

3. Completing FILING THIS FORM DOES NOT STAY THE, and THIS FORM APPROVED BY THE is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

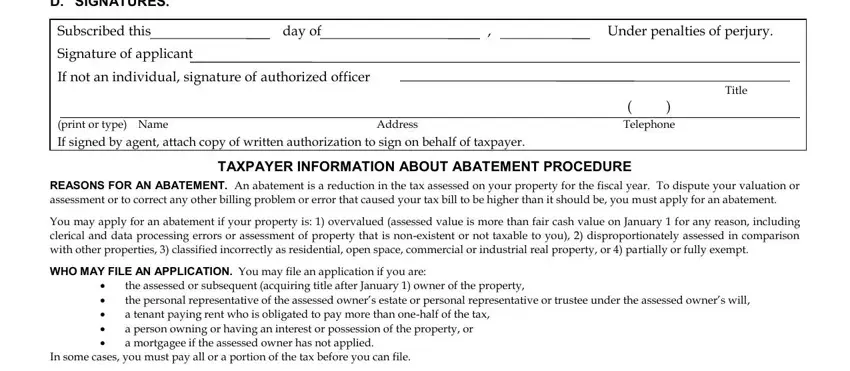

4. Your next subsection will require your input in the subsequent places: D SIGNATURES, Subscribed this day of, Under penalties of perjury, Signature of applicant, If not an individual signature of, Title, print or type Name Address, TAXPAYER INFORMATION ABOUT, REASONS FOR AN ABATEMENT An, You may apply for an abatement if, WHO MAY FILE AN APPLICATION You, the assessed or subsequent, and In some cases you must pay all or. Make certain you enter all required information to go forward.

It is possible to make errors while filling in your In some cases you must pay all or, therefore be sure to reread it before you'll finalize the form.

Step 3: Always make sure that the details are right and press "Done" to complete the task. Join FormsPal today and instantly gain access to ma tax form abatement, available for download. All adjustments made by you are preserved , which means you can edit the form further if needed. FormsPal is committed to the privacy of all our users; we make sure all personal information processed by our system is protected.