Once you open the online PDF editor by FormsPal, you'll be able to complete or alter uia account represent get right here and now. The tool is consistently updated by our staff, getting cool functions and growing to be even more versatile. Here is what you would want to do to get going:

Step 1: Just hit the "Get Form Button" above on this site to launch our pdf file editor. There you'll find everything that is needed to work with your file.

Step 2: With this handy PDF file editor, it is possible to do more than just fill in forms. Edit away and make your docs look perfect with customized textual content added in, or adjust the file's original content to excellence - all comes along with the capability to insert stunning photos and sign the document off.

It will be easy to fill out the document with our detailed guide! Here's what you must do:

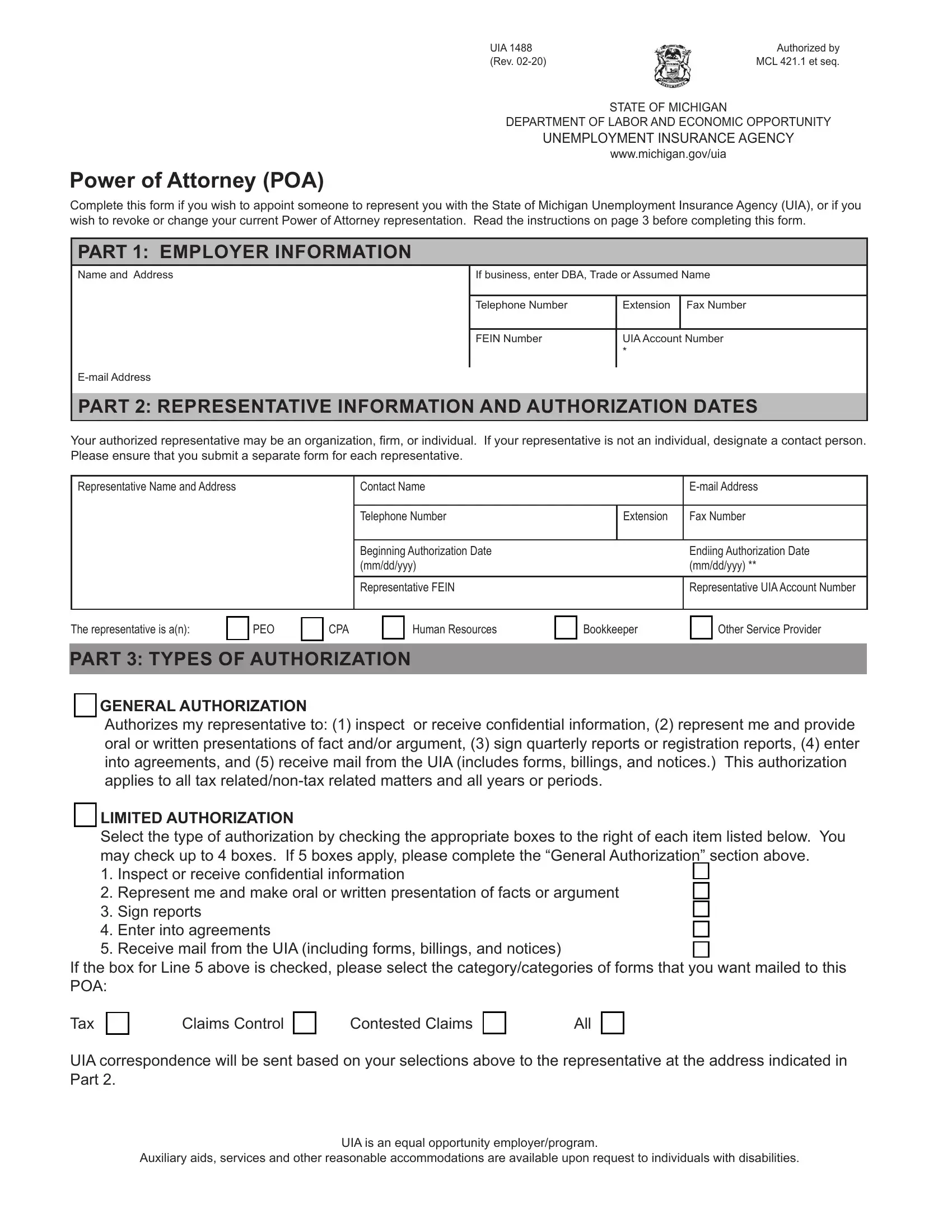

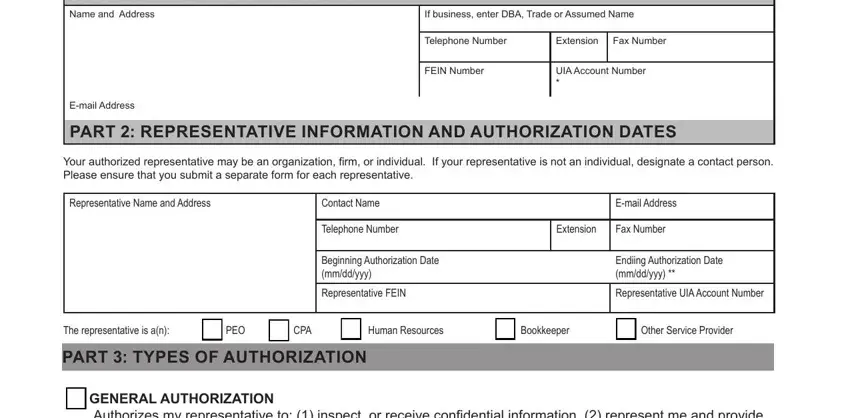

1. The uia account represent get needs certain information to be entered. Make certain the next blank fields are completed:

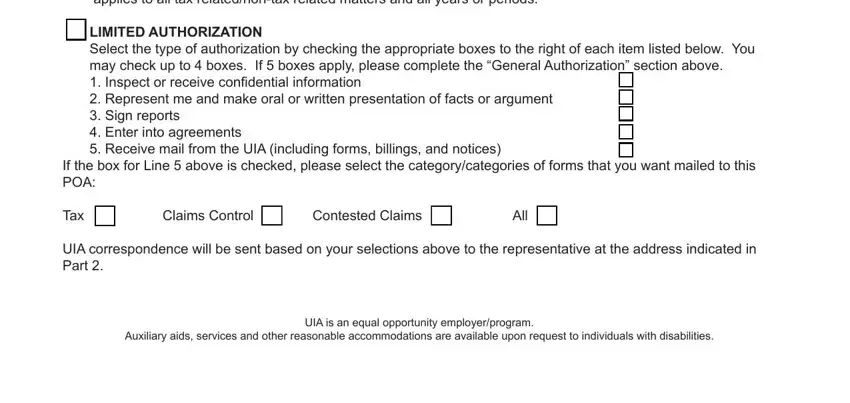

2. Once your current task is complete, take the next step – fill out all of these fields - GENERAL AUTHORIZATION Authorizes, LIMITED AUTHORIZATION Select the, Inspect or receive confidential, If the box for Line above is, Tax, Claims Control, Contested Claims, All, UIA correspondence will be sent, Auxiliary aids services and other, and UIA is an equal opportunity with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

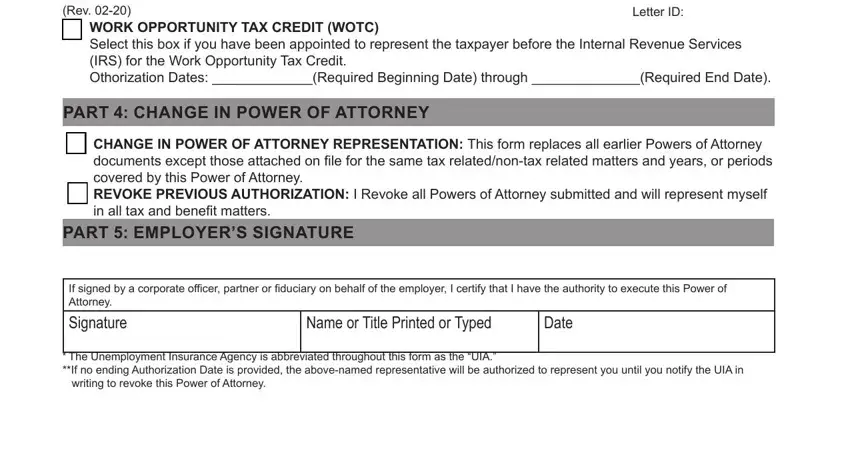

3. This next section will be focused on UIA Rev WORK OPPORTUNITY TAX, Letter ID, PART CHANGE IN POWER OF ATTORNEY, If signed by a corporate officer, Signature, Name or Title Printed or Typed, Date, and The Unemployment Insurance Agency - complete each of these empty form fields.

Be very attentive when filling in Name or Title Printed or Typed and PART CHANGE IN POWER OF ATTORNEY, as this is the section in which most users make some mistakes.

Step 3: Go through the details you have typed into the form fields and click the "Done" button. Get your uia account represent get after you subscribe to a 7-day free trial. Quickly gain access to the pdf document within your FormsPal cabinet, with any modifications and changes being all kept! When you work with FormsPal, you can fill out documents without being concerned about personal information leaks or entries getting distributed. Our protected system helps to ensure that your personal details are stored safe.