taxpayer questionnaire taxes can be filled out online in no time. Just use FormsPal PDF editing tool to perform the job promptly. Our professional team is ceaselessly working to develop the tool and help it become much easier for users with its cutting-edge functions. Discover an constantly revolutionary experience now - take a look at and find out new possibilities as you go! If you're looking to get going, here is what it will require:

Step 1: Click the "Get Form" button in the top section of this webpage to get into our tool.

Step 2: The editor will allow you to change your PDF in a variety of ways. Transform it with personalized text, correct what's already in the document, and include a signature - all at your convenience!

As for the fields of this precise form, here is what you should consider:

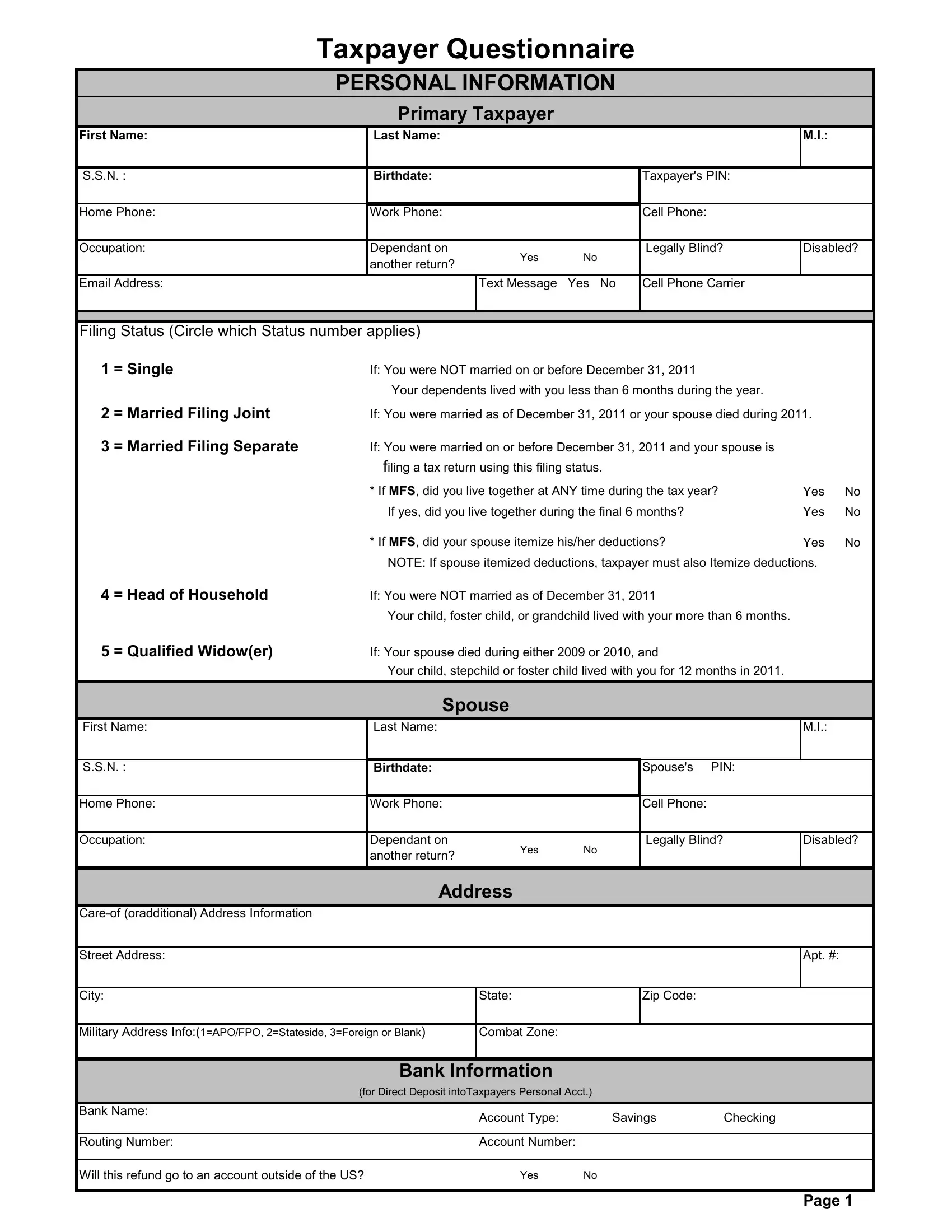

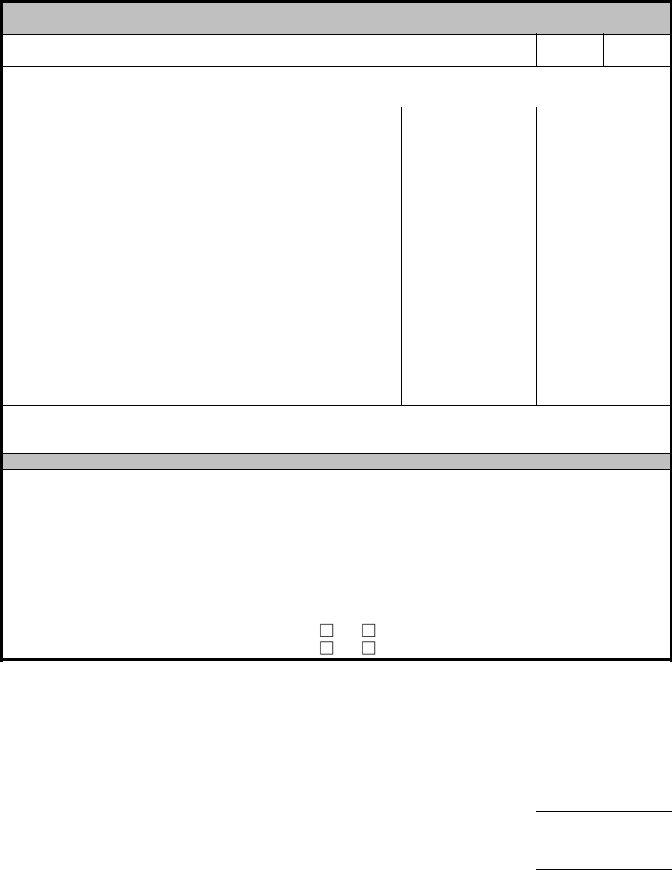

1. Before anything else, once filling out the taxpayer questionnaire taxes, beging with the part that features the following blanks:

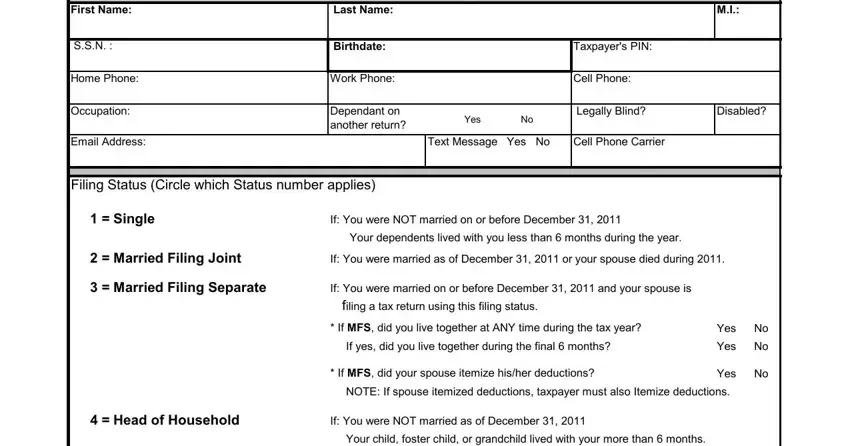

2. Right after filling in this step, go to the subsequent step and enter the essential details in all these blanks - First Name, SSN, Home Phone, Occupation, Spouse, Last Name, Birthdate, Work Phone, Dependant on another return, Address, Spouses PIN, Cell Phone, Yes No, Legally Blind, and Disabled.

A lot of people generally get some points incorrect while filling in Occupation in this area. Don't forget to re-examine everything you type in here.

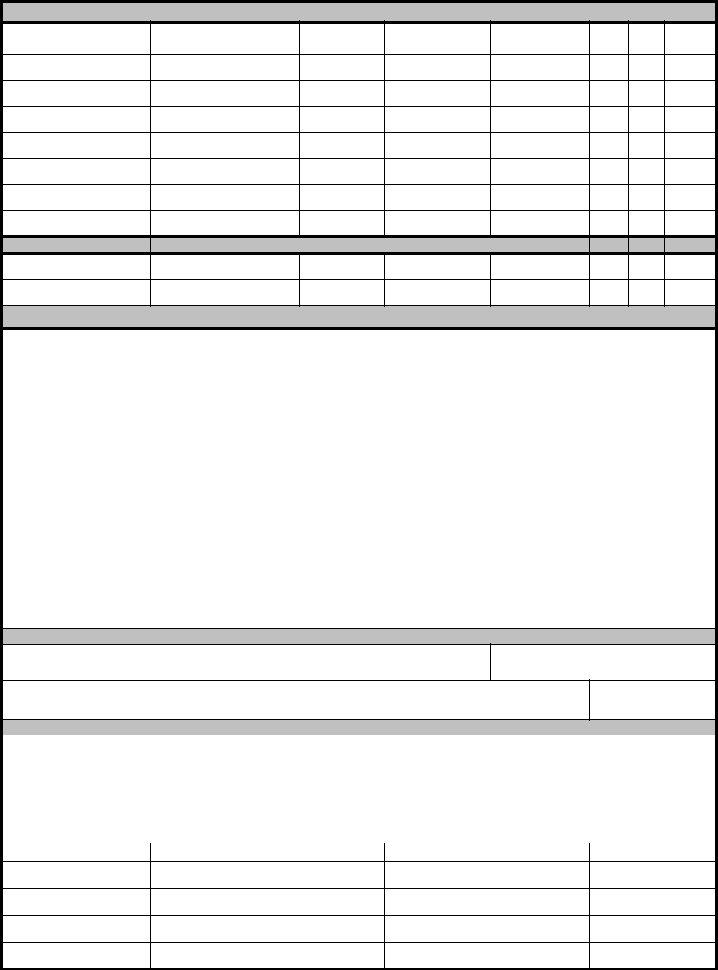

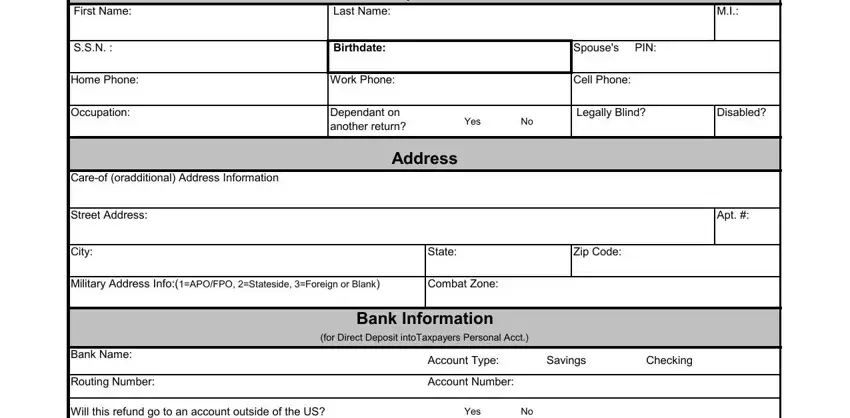

3. This next step is going to be hassle-free - complete all of the blanks in First Name, Last Name, Birthdate, SSN, Relationship, Months, Dep Code, EIC, Children who lived with you and, Enter the dependents name, E Eligible as of December under, EIC Codes, Child Tax and Earned Income Credit, Number of Children under age CTC, and Number of Children under age EIC to finish this process.

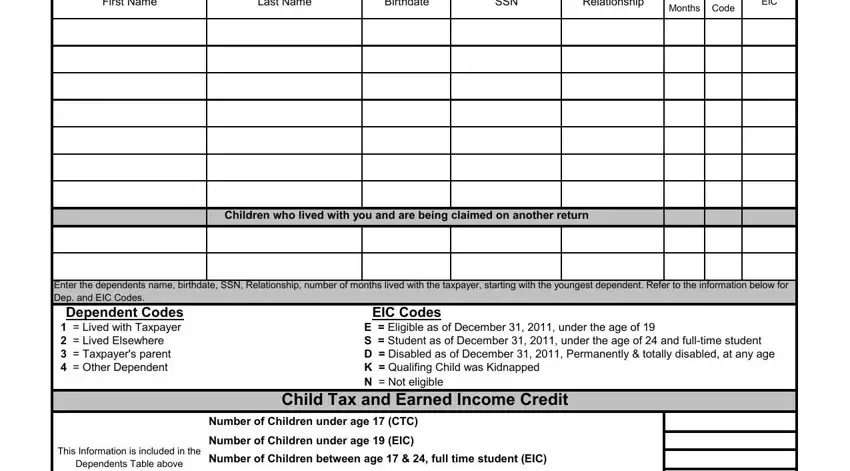

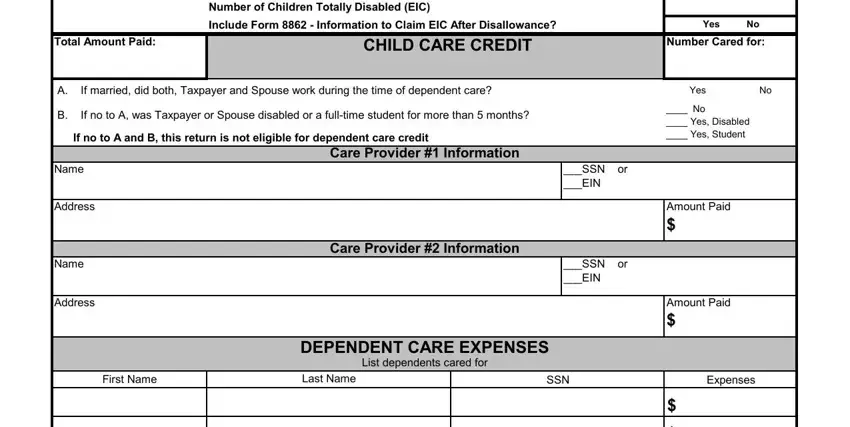

4. This next section requires some additional information. Ensure you complete all the necessary fields - Total Amount Paid, Number of Children Totally, Include Form Information to, A If married did both Taxpayer and, B If no to A was Taxpayer or, If no to A and B this return is, Care Provider Information, Yes No, Number Cared for, Yes No, No Yes Disabled Yes Student, Name, Address, Name, and Address - to proceed further in your process!

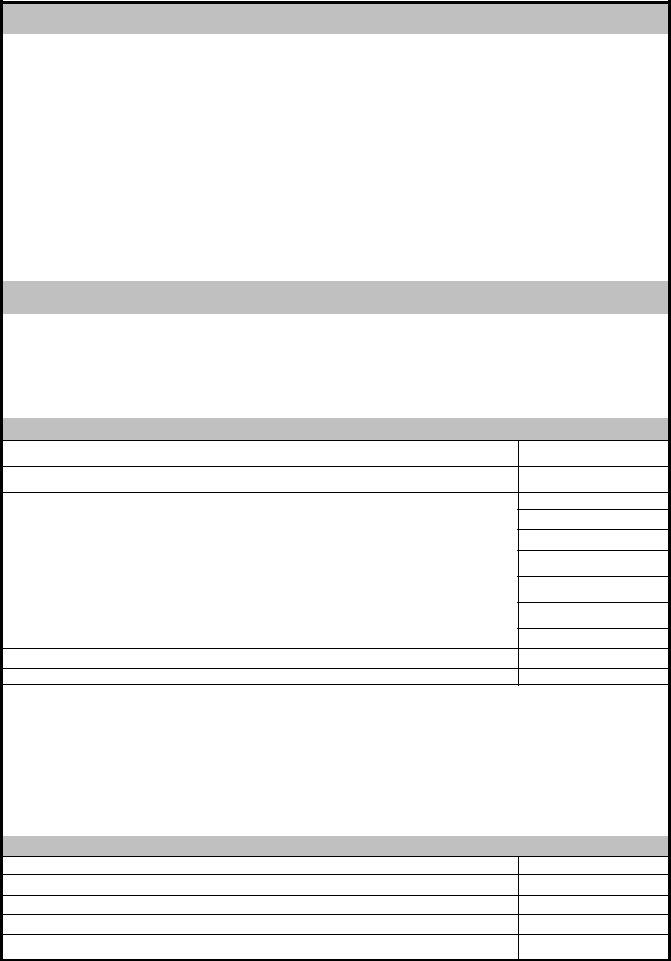

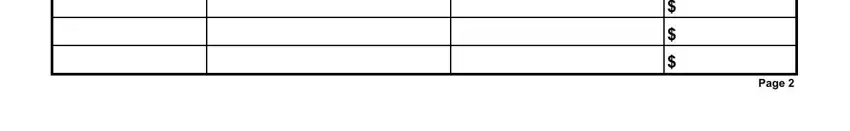

5. To finish your form, this particular part involves several additional blank fields. Filling in Page should conclude the process and you'll be done very fast!

Step 3: Soon after taking another look at the completed blanks, click "Done" and you're good to go! Try a 7-day free trial subscription with us and obtain immediate access to taxpayer questionnaire taxes - download, email, or edit in your personal cabinet. With FormsPal, you can certainly fill out documents without stressing about personal information breaches or records getting shared. Our protected platform ensures that your personal data is stored safely.