taxexpress can be completed with ease. Just use FormsPal PDF editor to do the job fast. Our editor is constantly evolving to provide the very best user experience possible, and that is because of our dedication to constant enhancement and listening closely to user comments. If you are seeking to get going, here's what it takes:

Step 1: Firstly, access the editor by clicking the "Get Form Button" above on this webpage.

Step 2: Once you start the tool, you will get the form all set to be filled out. Besides filling out various blank fields, you may also do some other things with the Document, including writing custom text, changing the initial textual content, inserting illustrations or photos, affixing your signature to the form, and much more.

It's straightforward to complete the document using out helpful tutorial! Here is what you want to do:

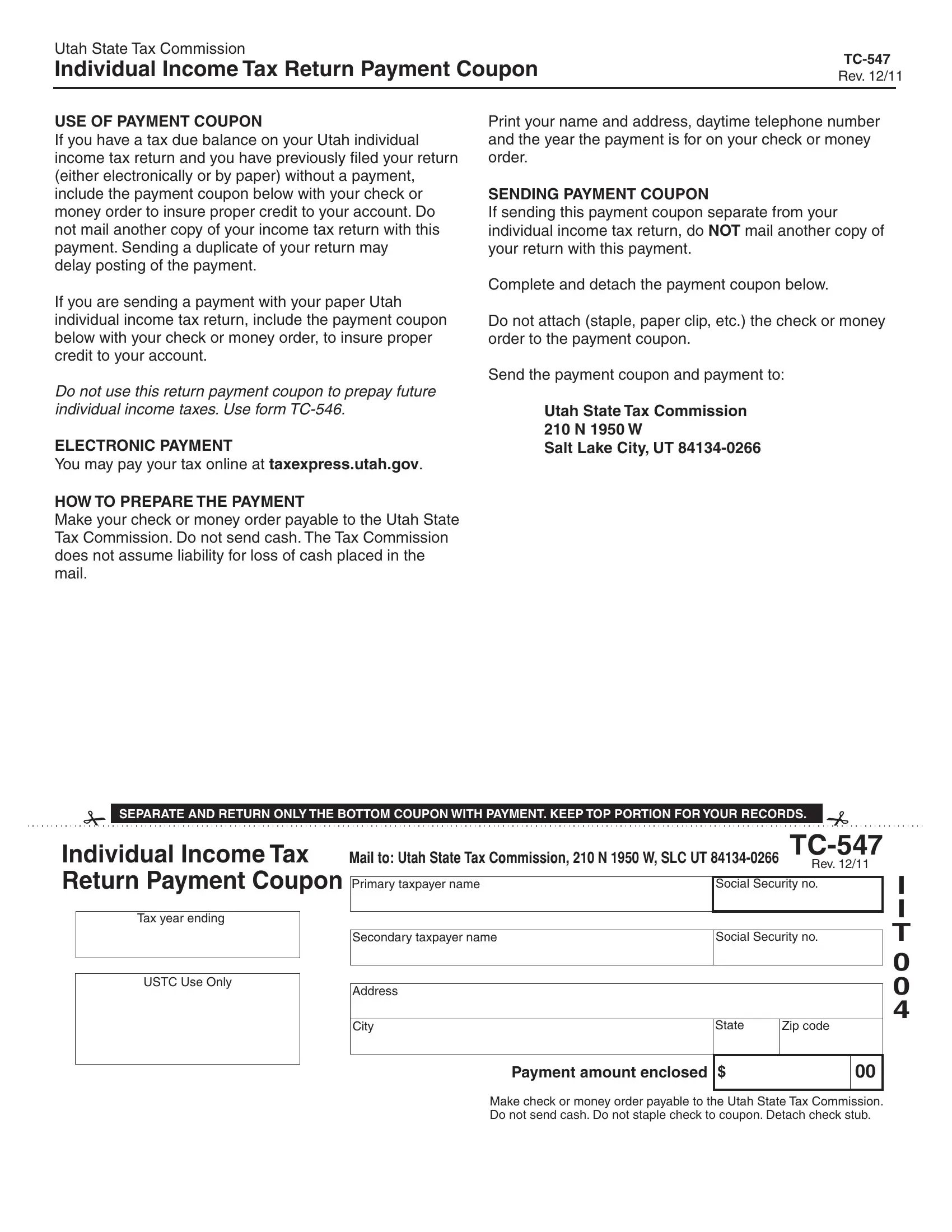

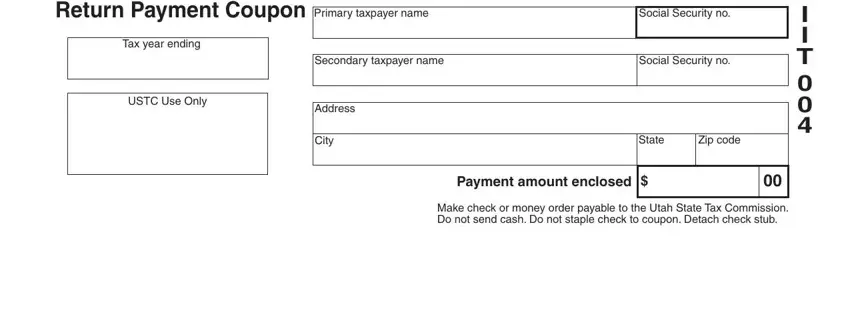

1. To begin with, while filling in the taxexpress, begin with the section that has the subsequent fields:

Step 3: Before finalizing the file, it's a good idea to ensure that all blanks are filled in correctly. As soon as you believe it's all good, click “Done." Try a free trial plan with us and acquire instant access to taxexpress - download or edit inside your FormsPal cabinet. FormsPal provides safe document editing devoid of data record-keeping or any kind of sharing. Rest assured that your data is in good hands with us!