Once you open the online editor for PDFs by FormsPal, it is possible to complete or edit form tc 62s utah here and now. The tool is continually maintained by us, acquiring handy features and growing to be more versatile. Starting is simple! All that you should do is stick to the next easy steps below:

Step 1: Open the PDF form inside our editor by pressing the "Get Form Button" above on this webpage.

Step 2: As soon as you launch the PDF editor, you will get the document all set to be filled in. Aside from filling out different blank fields, you may also do many other actions with the file, namely writing custom words, editing the initial text, inserting graphics, affixing your signature to the document, and a lot more.

It really is easy to complete the form with our detailed guide! Here's what you should do:

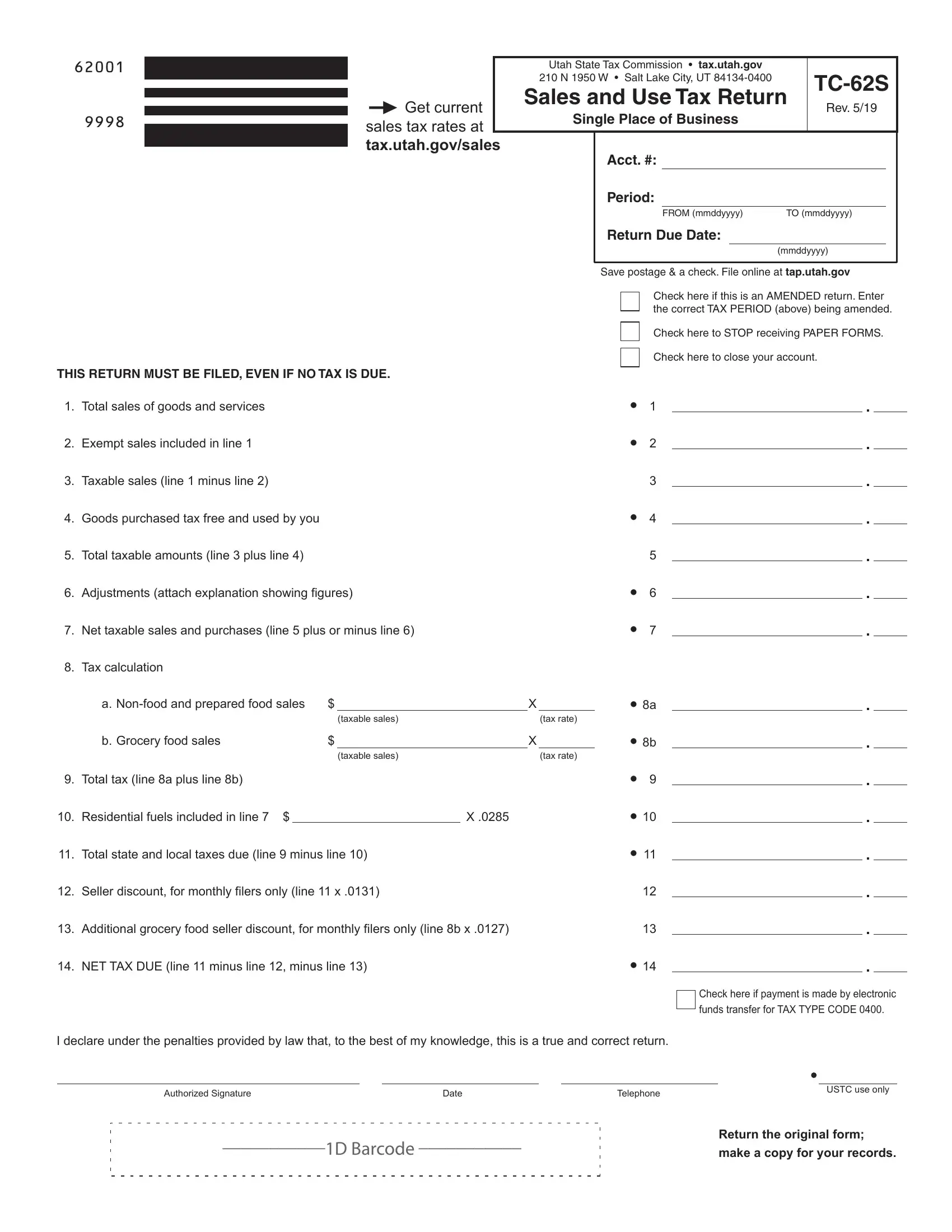

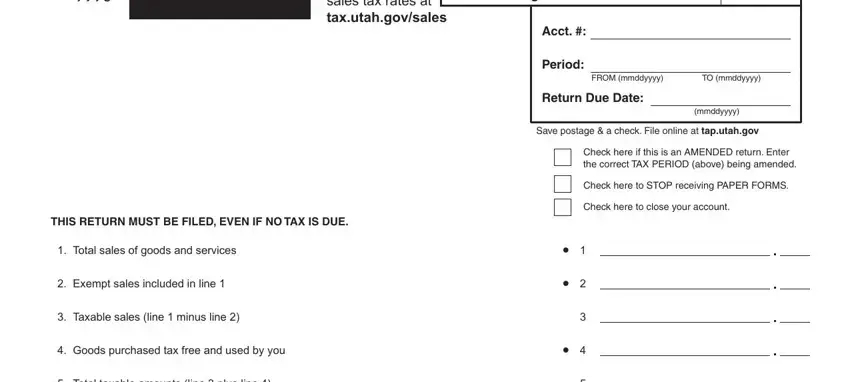

1. Begin filling out your form tc 62s utah with a group of major blanks. Get all of the necessary information and make certain there's nothing omitted!

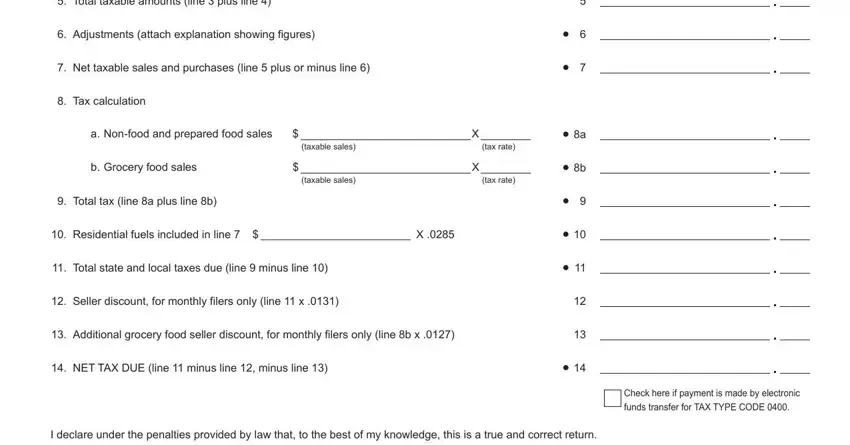

2. When this section is complete, it is time to put in the needed particulars in Total taxable amounts line plus, Adjustments attach explanation, Net taxable sales and purchases, Tax calculation, a Nonfood and prepared food sales, Total tax line a plus line b, taxable sales, taxable sales, Residential fuels included in, Total state and local taxes due, Seller discount for monthly, Additional grocery food seller, NET TAX DUE line minus line, a b, and X X so you can go further.

3. Through this part, have a look at Authorized Signature, Date, D Barcode, Telephone, USTC use only, and Return the original form make a. Every one of these should be taken care of with greatest accuracy.

It is easy to get it wrong when completing the USTC use only, therefore make sure to reread it before you decide to finalize the form.

Step 3: Check that the information is right and then click on "Done" to conclude the process. Join FormsPal now and easily gain access to form tc 62s utah, all set for downloading. All alterations you make are kept , meaning you can edit the file later if needed. FormsPal is focused on the confidentiality of all our users; we ensure that all personal data used in our tool stays protected.