You could fill out utah business tax registration instantly in our online PDF editor. In order to make our tool better and easier to work with, we continuously implement new features, with our users' suggestions in mind. By taking some simple steps, you can start your PDF editing:

Step 1: Press the orange "Get Form" button above. It is going to open up our tool so that you could start filling out your form.

Step 2: The editor enables you to change your PDF form in a variety of ways. Change it with personalized text, adjust existing content, and put in a signature - all when it's needed!

As for the fields of this precise PDF, this is what you need to do:

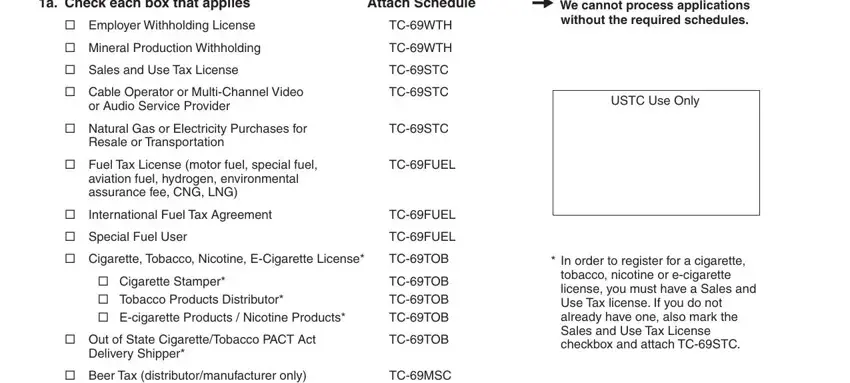

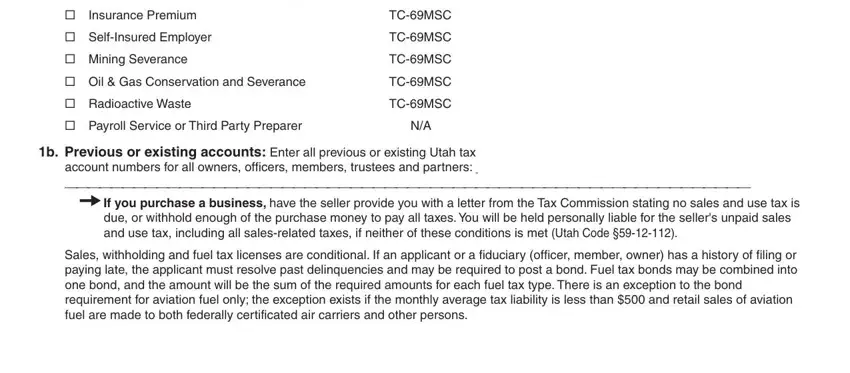

1. When completing the utah business tax registration, make certain to include all of the essential blanks in their associated part. This will help hasten the work, allowing for your information to be processed without delay and properly.

2. Once this part is complete, it is time to add the essential details in Beer Tax distributormanufacturer, Insurance Premium, SelfInsured Employer, Mining Severance, Oil Gas Conservation and, Radioactive Waste, Payroll Service or Third Party, TCMSC, TCMSC, TCMSC, TCMSC, TCMSC, TCMSC, b Previous or existing accounts, and account numbers for all owners in order to move on to the third part.

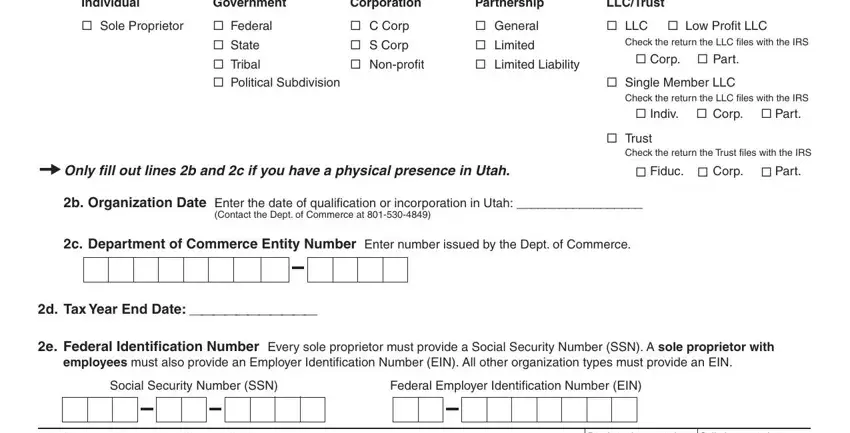

3. This 3rd section should also be relatively easy, Individual, Government, Corporation, Partnership, LLCTrust, Sole Proprietor, C Corp S Corp Nonprofit, Federal State Tribal Political, General Limited Limited, LLC Low Profit LLC, Check the return the LLC files, Corp Part Single Member LLC, Check the return the LLC files, Corp, and Part - all these blanks needs to be completed here.

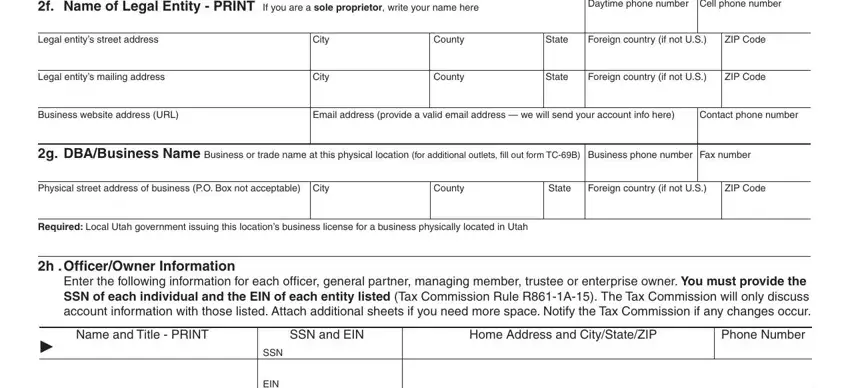

4. It is time to fill in the next portion! In this case you will have all these f Name of Legal Entity PRINT If, Daytime phone number Cell phone, Legal entitys street address, Legal entitys mailing address, City, City, County, State, Foreign country if not US, ZIP Code, County, State, Foreign country if not US, ZIP Code, and Business website address URL empty form fields to fill out.

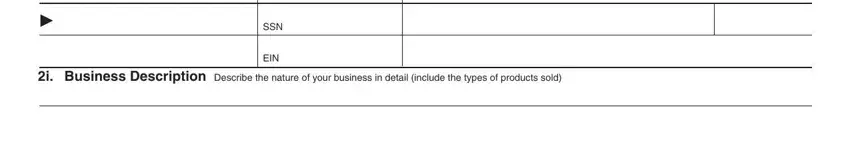

5. Lastly, the following last subsection is what you'll want to complete prior to using the PDF. The blanks in this case include the following: EIN, SSN, EIN, and i Business Description Describe.

Be extremely attentive while filling in SSN and EIN, as this is the part where most users make some mistakes.

Step 3: Prior to finishing this document, make certain that blank fields have been filled out properly. As soon as you think it's all fine, click “Done." Go for a free trial account with us and get direct access to utah business tax registration - which you can then begin to use as you want in your personal account. We don't share the information that you enter when completing documents at our website.