When using the online editor for PDFs by FormsPal, you can fill out or change mo ptc 2020 fillable form right here and now. To keep our editor on the forefront of efficiency, we strive to put into action user-driven features and improvements on a regular basis. We're at all times happy to receive suggestions - help us with revampimg PDF editing. All it requires is a couple of easy steps:

Step 1: Click on the orange "Get Form" button above. It will open up our pdf editor so you could start filling out your form.

Step 2: With the help of this state-of-the-art PDF editor, you'll be able to accomplish more than simply complete blank fields. Edit away and make your documents seem sublime with custom textual content added in, or tweak the original input to perfection - all that comes with the capability to insert almost any photos and sign the document off.

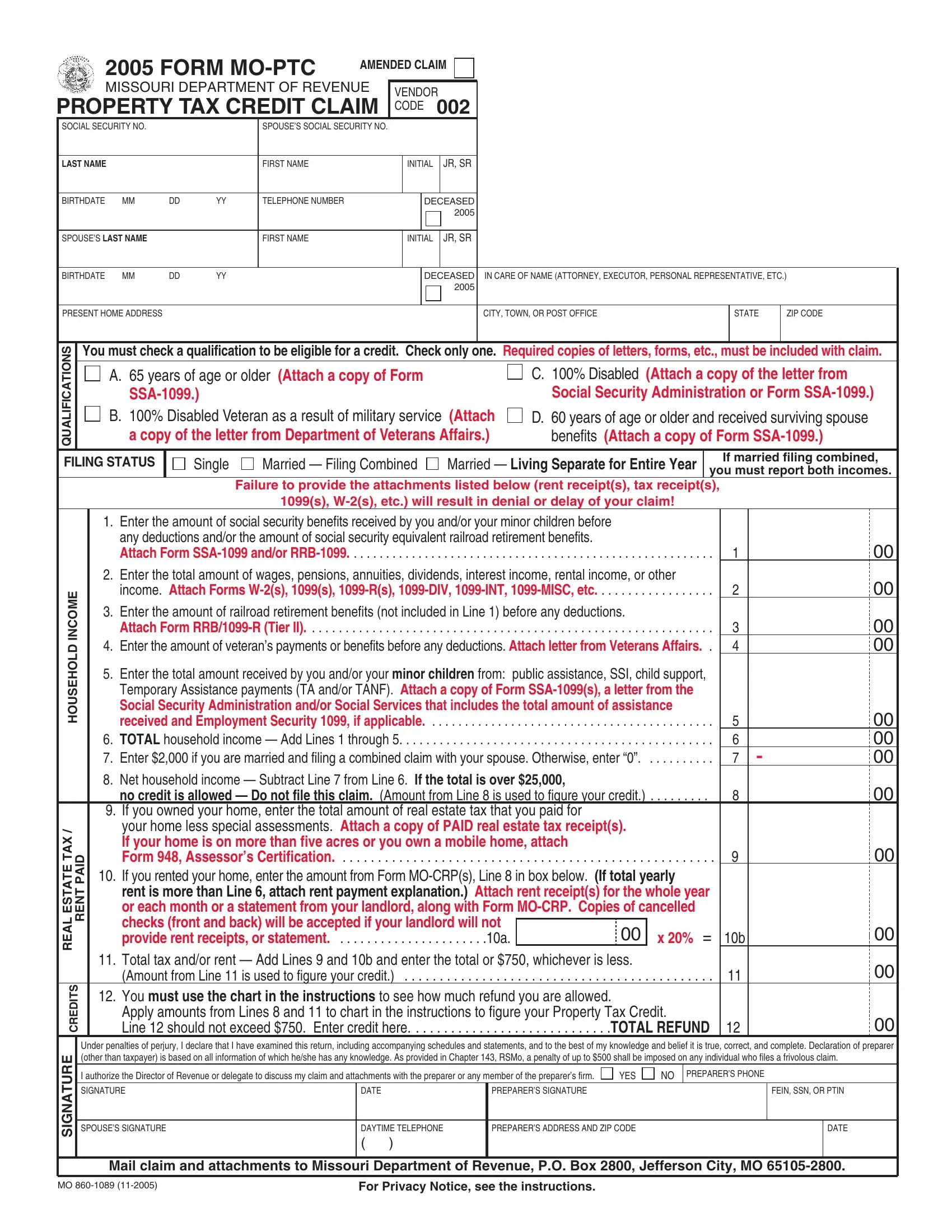

This document requires particular data to be filled out, thus make sure to take some time to fill in precisely what is requested:

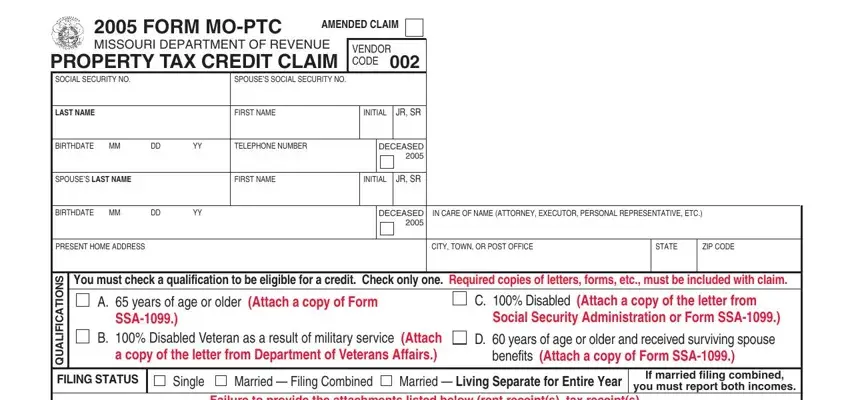

1. Fill out the mo ptc 2020 fillable form with a selection of major fields. Get all the important information and make certain there is nothing omitted!

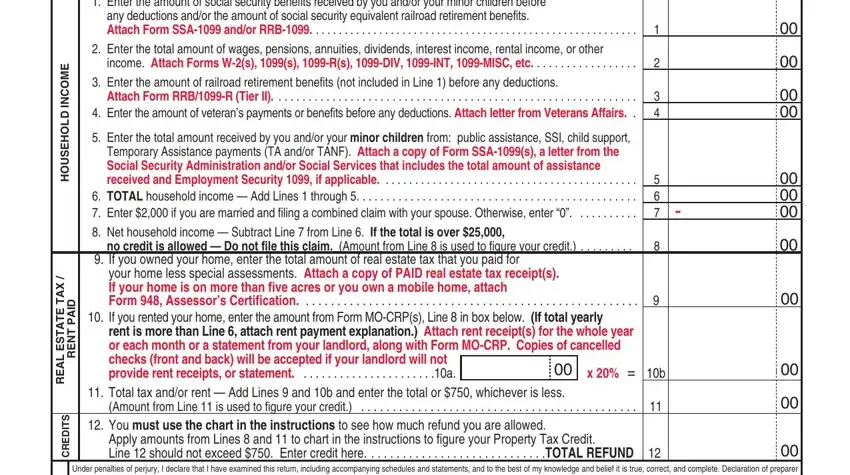

2. Once this segment is completed, you'll want to add the essential particulars in Enter the amount of social, any deductions andor the amount of, Enter the total amount of wages, income Attach Forms Ws s Rs DIV, Enter the amount of railroad, Attach Form RRBR Tier II, Enter the total amount received, Temporary Assistance payments TA, no credit is allowed Do not file, If you owned your home enter the, your home less special assessments, If you rented your home enter the, rent is more than Line attach, Total tax andor rent Add Lines, and x b so that you can move forward to the third part.

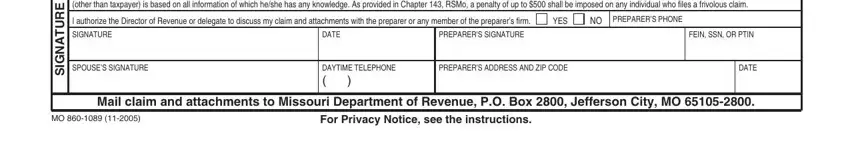

3. Completing E R U T A N G S, Under penalties of perjury I, I authorize the Director of, PREPARERS SIGNATURE, DATE, YES, PREPARERS PHONE, FEIN SSN OR PTIN, SPOUSES SIGNATURE, DAYTIME TELEPHONE, PREPARERS ADDRESS AND ZIP CODE, DATE, Mail claim and attachments to, and For Privacy Notice see the is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

A lot of people generally make mistakes when filling in I authorize the Director of in this area. Don't forget to revise what you enter here.

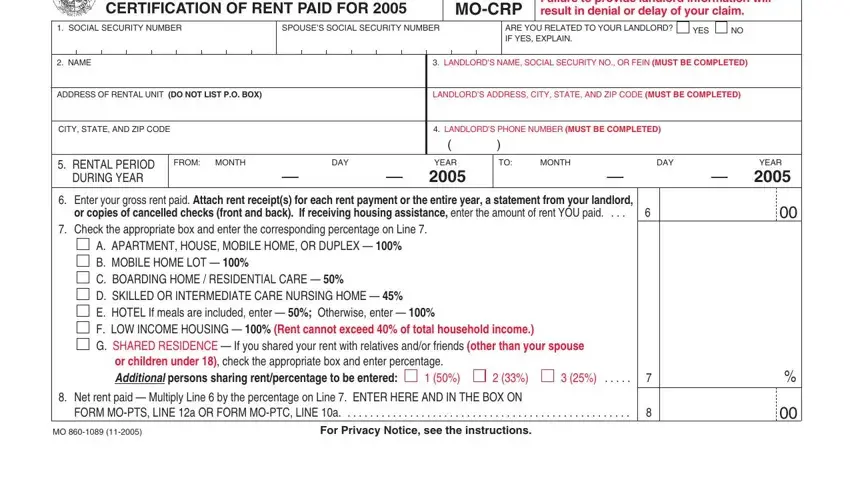

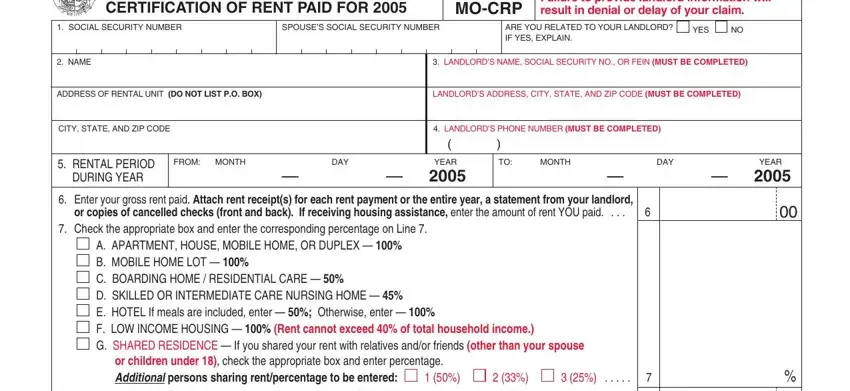

4. You're ready to fill out the next part! In this case you've got all of these MISSOURI DEPARTMENT OF REVENUE, SOCIAL SECURITY NUMBER, SPOUSES SOCIAL SECURITY NUMBER, FORM, MOCRP, cid Read instructions cid Print or, ARE YOU RELATED TO YOUR LANDLORD, YES, NAME, LANDLORDS NAME SOCIAL SECURITY NO, ADDRESS OF RENTAL UNIT DO NOT LIST, LANDLORDS ADDRESS CITY STATE AND, CITY STATE AND ZIP CODE, LANDLORDS PHONE NUMBER MUST BE, and RENTAL PERIOD blank fields to fill in.

5. As you draw near to the finalization of this form, you will find just a few extra points to complete. Specifically, MISSOURI DEPARTMENT OF REVENUE, SOCIAL SECURITY NUMBER, SPOUSES SOCIAL SECURITY NUMBER, FORM, MOCRP, cid Read instructions cid Print or, ARE YOU RELATED TO YOUR LANDLORD, YES, NAME, LANDLORDS NAME SOCIAL SECURITY NO, ADDRESS OF RENTAL UNIT DO NOT LIST, LANDLORDS ADDRESS CITY STATE AND, CITY STATE AND ZIP CODE, LANDLORDS PHONE NUMBER MUST BE, and RENTAL PERIOD must all be filled in.

Step 3: Look through the information you've inserted in the form fields and hit the "Done" button. Join us right now and easily get access to mo ptc 2020 fillable form, available for download. All modifications you make are saved , which means you can customize the file at a later point when required. Here at FormsPal.com, we strive to be sure that your information is maintained secure.