Using PDF files online is definitely super easy with our PDF tool. You can fill out LEASEBACKS here without trouble. The editor is continually improved by our team, receiving awesome features and growing to be greater. It merely requires just a few easy steps:

Step 1: Hit the "Get Form" button at the top of this page to get into our tool.

Step 2: This editor will allow you to customize PDF files in various ways. Improve it by writing personalized text, correct what's originally in the PDF, and add a signature - all possible within minutes!

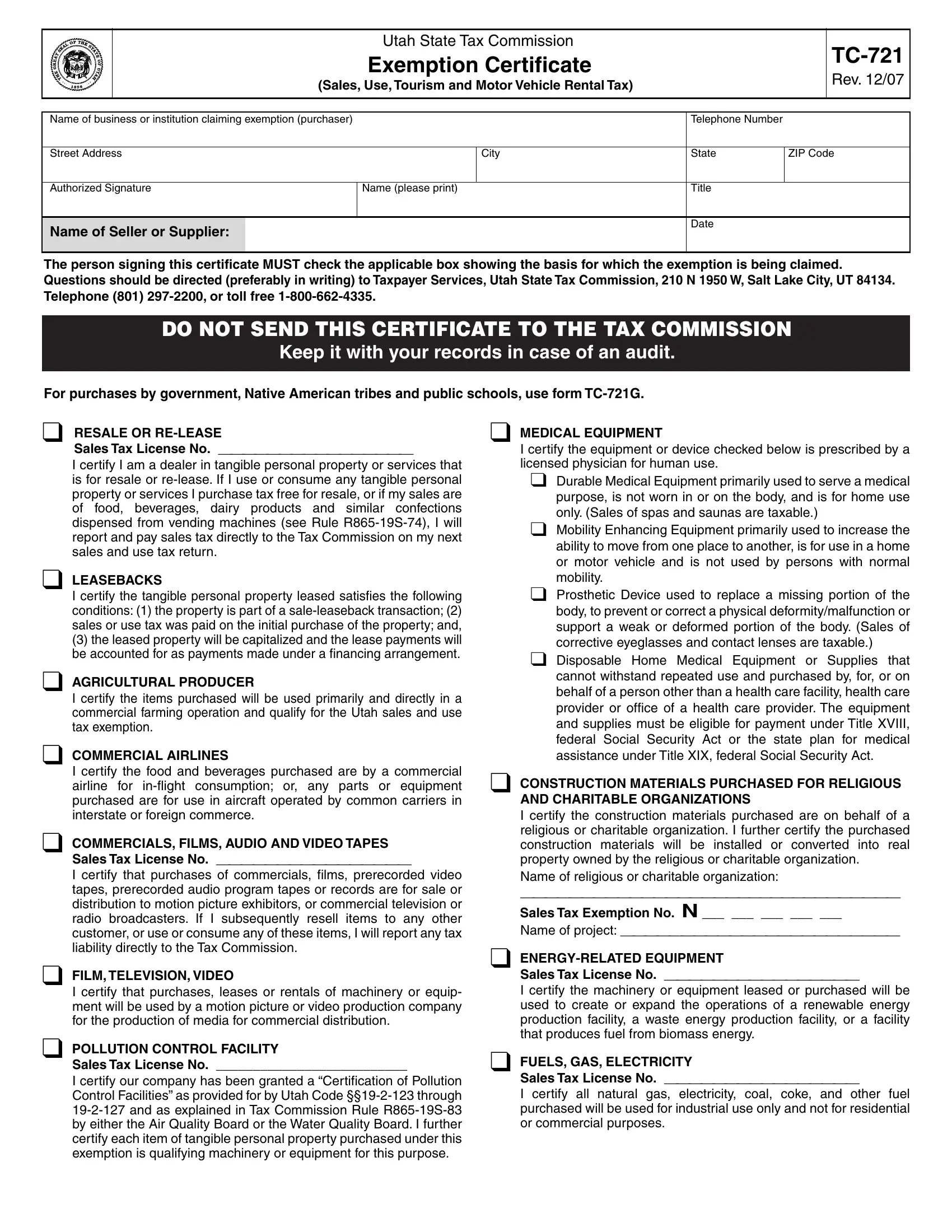

In order to complete this document, ensure you provide the information you need in each and every area:

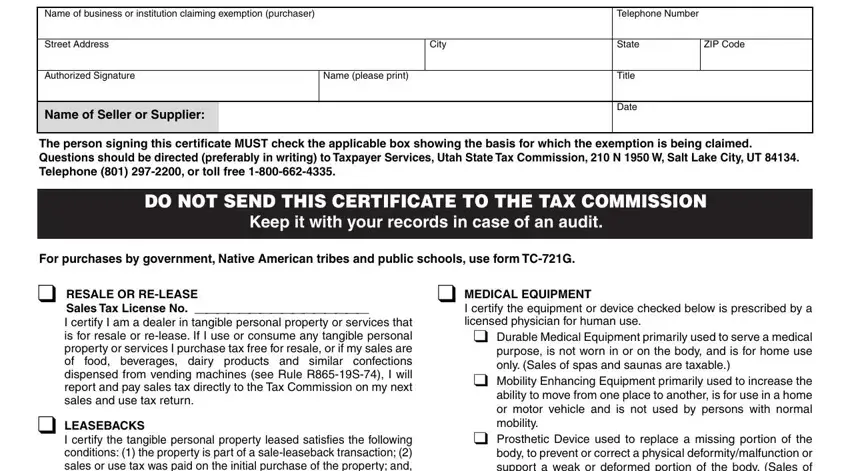

1. When filling in the LEASEBACKS, ensure to incorporate all important blank fields within the corresponding part. This will help to expedite the process, allowing your information to be handled quickly and correctly.

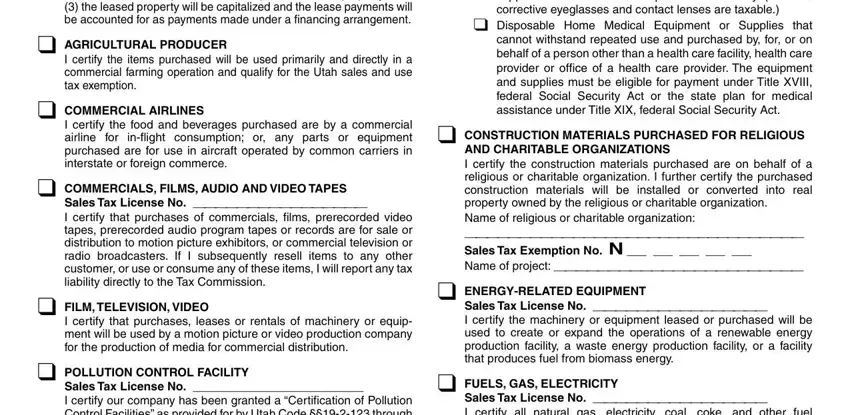

2. Soon after filling out the previous part, go on to the subsequent stage and complete all required particulars in all these blanks - I certify the tangible personal, AGRICULTURAL PRODUCER, I certify the items purchased will, COMMERCIAL AIRLINES, I certify the food and beverages, COMMERCIALS FILMS AUDIO AND VIDEO, Sales Tax License No I certify, FILM TELEVISION VIDEO, I certify that purchases leases or, POLLUTION CONTROL FACILITY, Sales Tax License No I certify, Prosthetic Device used to replace, Disposable Home Medical Equipment, CONSTRUCTION MATERIALS PURCHASED, and AND CHARITABLE ORGANIZATIONS I.

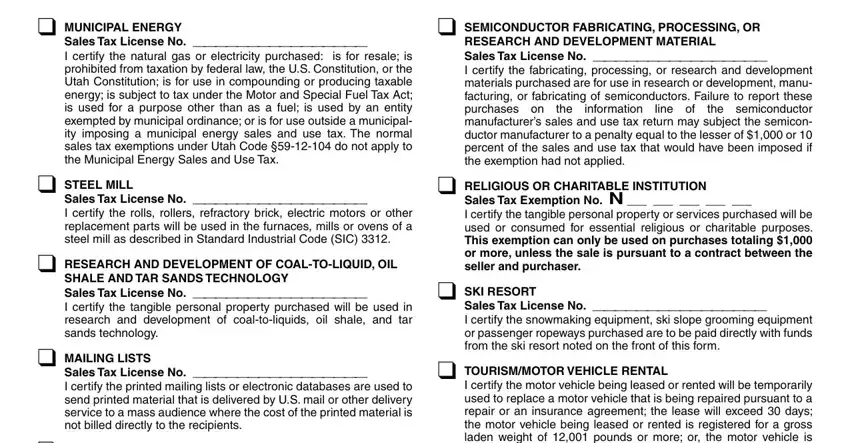

3. This third part should also be quite simple, MUNICIPAL ENERGY, SEMICONDUCTOR FABRICATING, Sales Tax License No I certify, STEEL MILL, Sales Tax License No I certify, RESEARCH AND DEVELOPMENT OF, SHALE AND TAR SANDS TECHNOLOGY, MAILING LISTS, Sales Tax License No I certify, MACHINERY AND EQUIPMENT AND, RESEARCH AND DEVELOPMENT MATERIAL, information, the, line of, and RELIGIOUS OR CHARITABLE - all these empty fields has to be completed here.

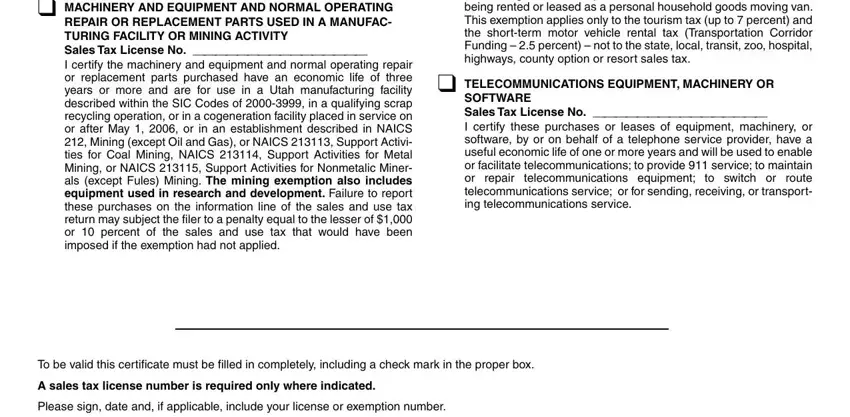

4. To move forward, this next form section involves filling out a couple of form blanks. Included in these are MACHINERY AND EQUIPMENT AND, I certify the motor vehicle being, TELECOMMUNICATIONS EQUIPMENT, SOFTWARE Sales Tax License No I, To be valid this certificate must, A sales tax license number is, and Please sign date and if applicable, which are fundamental to continuing with this particular process.

You can certainly make a mistake while completing your Please sign date and if applicable, therefore you'll want to go through it again prior to when you finalize the form.

Step 3: Go through the details you have typed into the form fields and press the "Done" button. Join us right now and immediately gain access to LEASEBACKS, available for downloading. All modifications you make are kept , allowing you to modify the file at a later stage anytime. FormsPal is dedicated to the privacy of our users; we make sure all information handled by our tool remains secure.