With the online editor for PDFs by FormsPal, you may complete or modify utah form tc 852r here and now. To make our editor better and more convenient to utilize, we consistently develop new features, bearing in mind feedback from our users. To get the ball rolling, take these basic steps:

Step 1: Open the PDF form in our editor by clicking on the "Get Form Button" in the top section of this page.

Step 2: With the help of this handy PDF editing tool, you're able to do more than merely fill out blank fields. Express yourself and make your docs look faultless with custom textual content put in, or optimize the original content to perfection - all supported by the capability to insert just about any pictures and sign the document off.

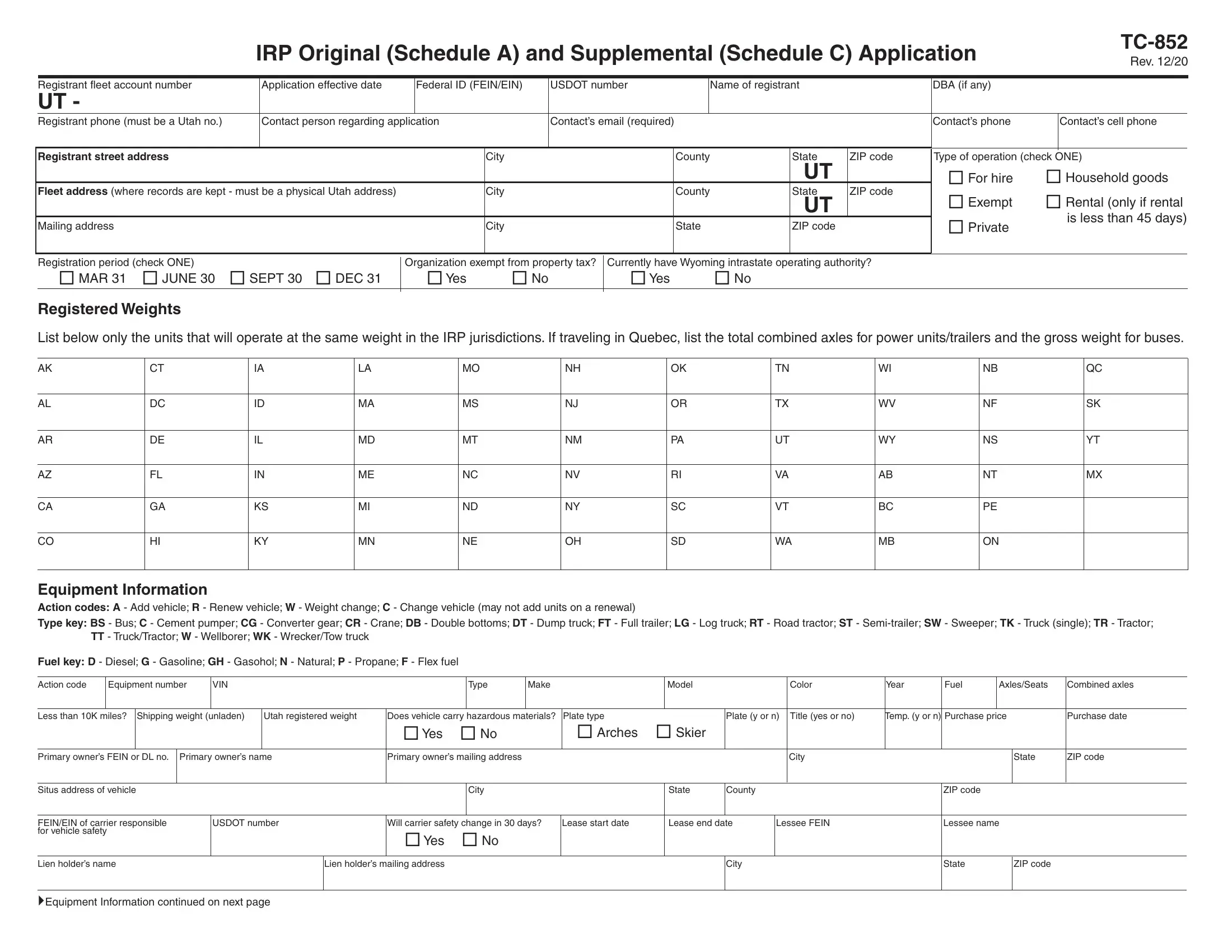

This document needs specific information; in order to guarantee accuracy, you should take heed of the subsequent guidelines:

1. You will want to complete the utah form tc 852r correctly, so be attentive when filling in the areas comprising these blanks:

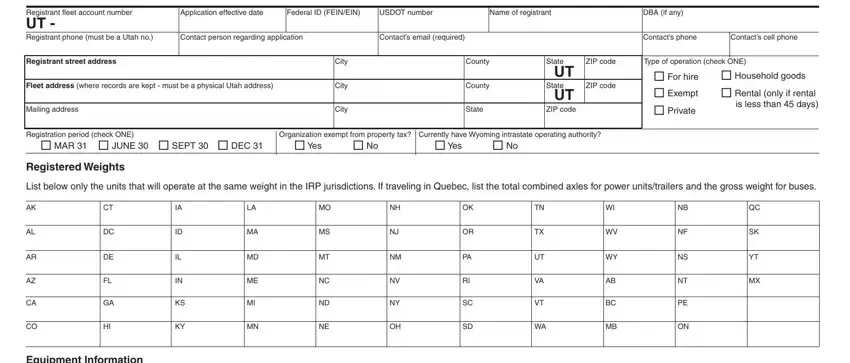

2. The subsequent part is usually to fill out the following blanks: Fuel key D Diesel G Gasoline GH, Action code, Equipment number, VIN, Type, Make, Model, Color, Year, Fuel, AxlesSeats, Combined axles, Less than K miles Shipping weight, Utah registered weight, and Does vehicle carry hazardous.

People who work with this PDF frequently make errors when filling in VIN in this area. Be sure to review everything you enter here.

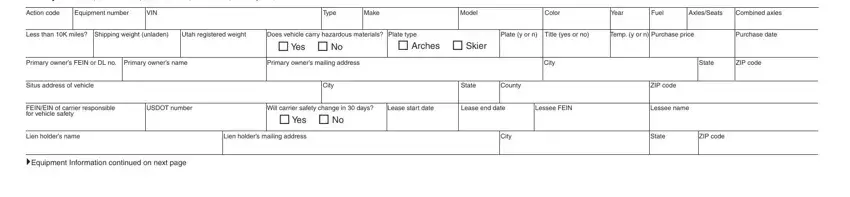

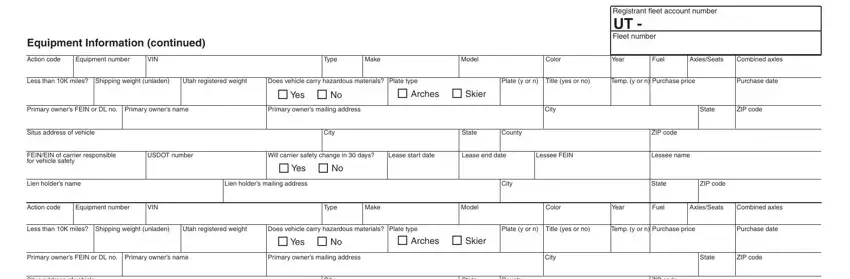

3. The following portion will be about Equipment Information continued, Registrant fleet account number UT, Action code, Equipment number, VIN, Type, Make, Model, Color, Year, Fuel, AxlesSeats, Combined axles, Less than K miles Shipping weight, and Utah registered weight - fill out each one of these blanks.

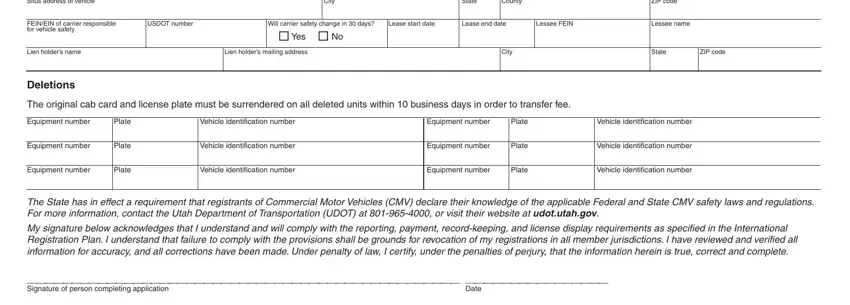

4. To go onward, the following step involves filling out a handful of empty form fields. Included in these are Situs address of vehicle, City, State, County, ZIP code, FEINEIN of carrier responsible for, USDOT number, Will carrier safety change in days, Lease start date, Lease end date, Lessee FEIN, Lessee name, Yes No, Lien holders name, and Lien holders mailing address, which are essential to moving forward with this PDF.

Step 3: Before moving forward, check that all form fields are filled out the right way. When you’re satisfied with it, click “Done." Right after setting up afree trial account here, you will be able to download utah form tc 852r or send it via email without delay. The PDF file will also be accessible via your personal account page with all your edits. When using FormsPal, you can easily fill out documents without worrying about information leaks or records being shared. Our protected platform ensures that your private data is kept safe.