|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registrant account number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UT- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fleet number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

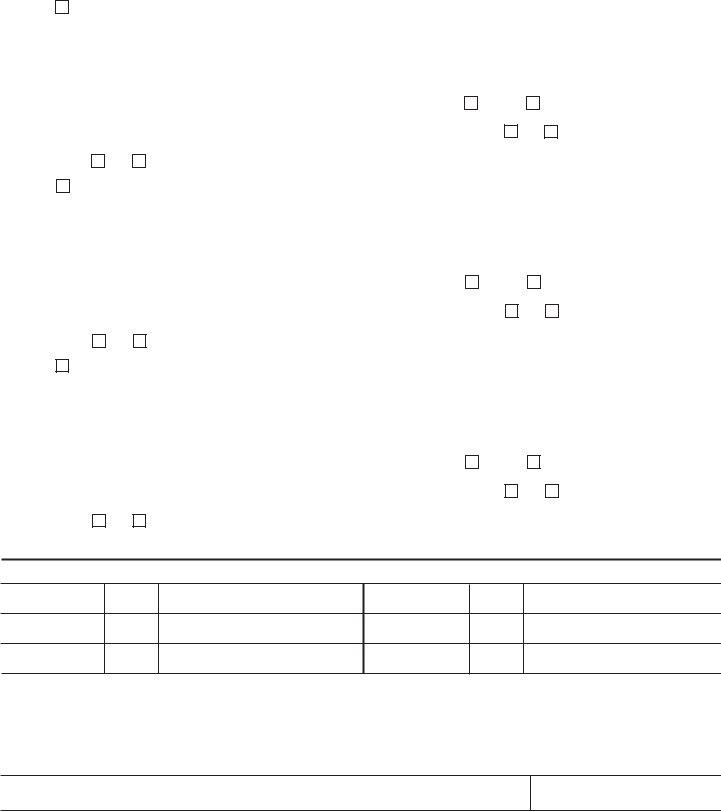

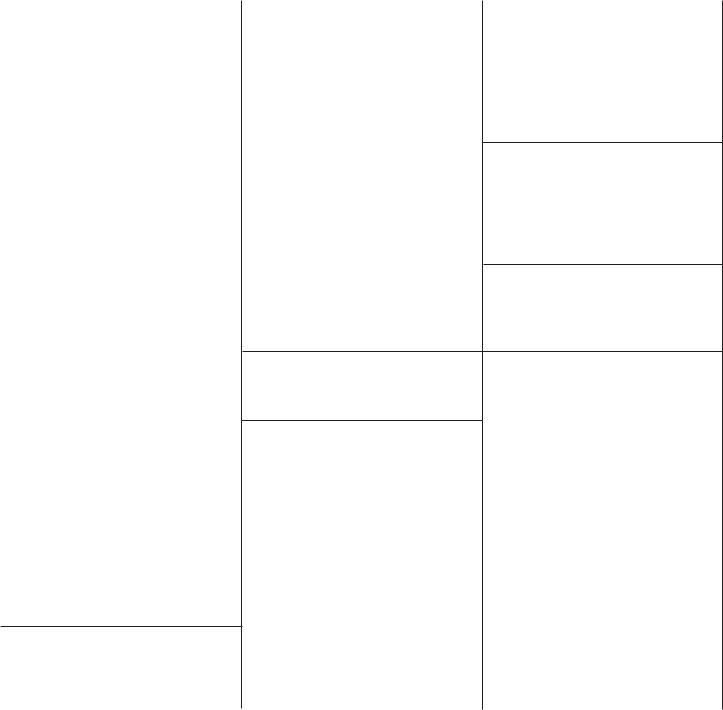

Equipment Information - continued |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Action code |

|

|

Do not |

|

FT Equipment number |

Vehicle identification number |

|

|

|

|

|

Type |

|

Make |

|

Year |

Fuel |

For Office Use Only |

|

|

|

|

renew |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Yr. Pro. tax _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Axles/Seats |

|

Name of titled owner/lessor |

|

|

|

|

|

|

|

|

|

Unladen weight |

Decl. comb. gross |

2 Yr. Pro. tax _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

wgt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HVUT verified _______ |

Situs of vehicle (physical location of vehicle if different than fleet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/M # verified _________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

County |

State |

ZIP code |

|

Select plate type |

|

|

Inspec # verified _________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LE Skier |

LE Arches |

Title verified ___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owned/Leased |

Lease start date |

Lease end date |

FEIN/EIN of carrier responsible for vehicle safety |

US DOT number |

Vehicle safety changed? |

Factory price ____________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Sales tax Y/N _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truck pull trailer? |

|

Less than 10K/miles |

Plate |

Title |

Temp. |

License plate number |

|

Purchase date |

|

Purchase price |

|

|

Curr. veh. value___________ |

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Action code |

|

Do not |

FT Equipment number |

Vehicle identification number |

|

|

|

|

|

Type |

|

Make |

|

Year |

Fuel |

For Office Use Only |

|

|

|

|

renew |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Yr. Pro. tax _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Axles/Seats |

Name of titled owner/lessor |

|

|

|

|

|

|

|

|

|

Unladen weight |

Decl. comb. gross |

2 Yr. Pro. tax _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

wgt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HVUT verified _______ |

Situs of vehicle (physical location of vehicle if different than fleet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/M # verified _________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inspec # verified _________ |

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

County |

State |

ZIP code |

|

Select plate type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LE Skier |

LE Arches |

Title verified ___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owned/Leased |

Lease start date |

Lease end date |

FEIN/EIN of carrier responsible for vehicle safety |

US DOT number |

Vehicle safety changed? |

Factory price ____________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Sales tax Y/N _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truck pull trailer? |

|

Less than 10K/miles |

Plate |

Title |

Temp. |

License plate number |

|

Purchase date |

|

Purchase price |

|

|

Curr. veh. value___________ |

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

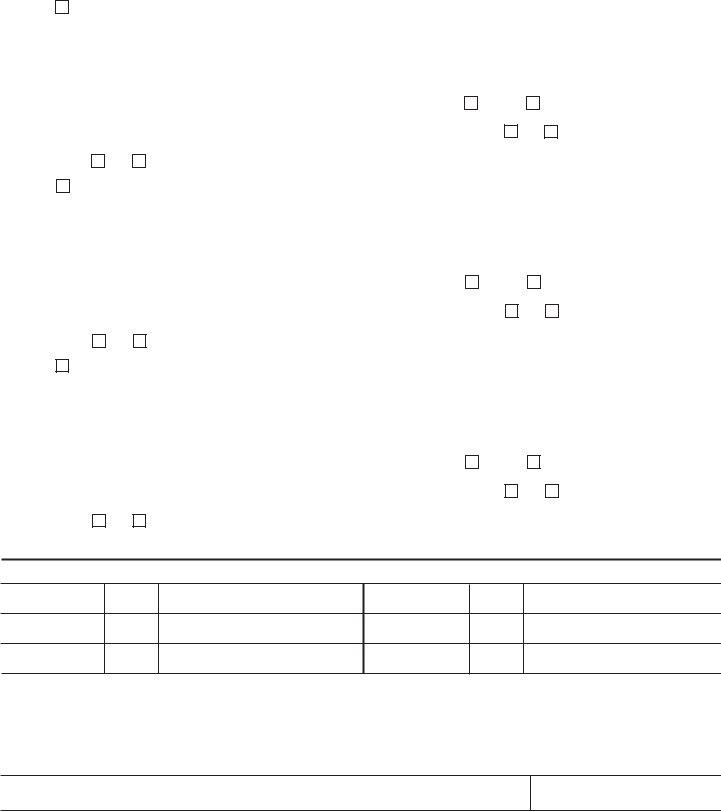

Action code |

|

|

Do not |

FT Equipment number |

Vehicle identification number |

|

|

|

|

|

Type |

|

Make |

|

Year |

Fuel |

For Office Use Only |

|

|

|

|

renew |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Yr. Pro. tax _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Axles/Seats |

Name of titled owner/lessor |

|

|

|

|

|

|

|

|

|

Unladen weight |

Decl. comb. gross |

2 Yr. Pro. tax _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

wgt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HVUT verified _______ |

Situs of vehicle (physical location of vehicle if different than fleet |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/M # verified _________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inspec # verified _________ |

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

County |

State |

ZIP code |

|

Select plate type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LE Skier |

LE Arches |

Title verified ___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owned/Leased |

Lease start date |

Lease end date |

FEIN/EIN of carrier responsible for vehicle safety |

US DOT number |

Vehicle safety changed? |

Factory price ____________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

Sales tax Y/N _______ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Truck pull trailer? |

|

Less than 10K/miles |

Plate |

Title |

Temp. |

License plate number |

|

Purchase date |

|

Purchase price |

|

|

Curr. veh. value___________ |

|

|

|

|

|

|

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

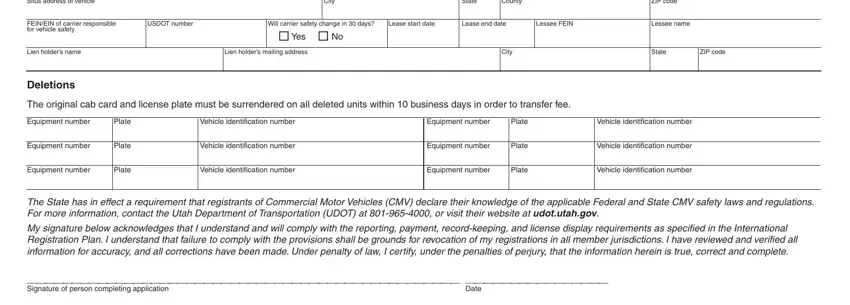

Deletions The original cab card and license plate must be surrendered on all deleted units within 10 business days in order to transfer fee

Vehicle identification number

Vehicle identification number

Vehicle identification number

Vehicle identification number

Vehicle identification number

Vehicle identification number

The State has in effect a requirement that registrants of Commercial Motor Vehicles (CMV) declare their knowledge of the applicable Federal and State CMV safety laws and regulations. For more information, contact Utah Department of Transportation (UDOT) at 801-965-4000 or go to their website

at udot.utah.gov.

My signature below acknowledges that I understand and will comply with the reporting, payment, record keeping, and license display requirements as specified in the International Registration Plan. I understand that failure to comply with the provisions shall be grounds for revocation of my registrations in all member jurisdictions. I have reviewed and verified all information for accuracy and all corrections have been made. Under penalty of law, I certify, under the penalties of perjury, that the information herein is true, correct, and complete.

Signature of person completing application

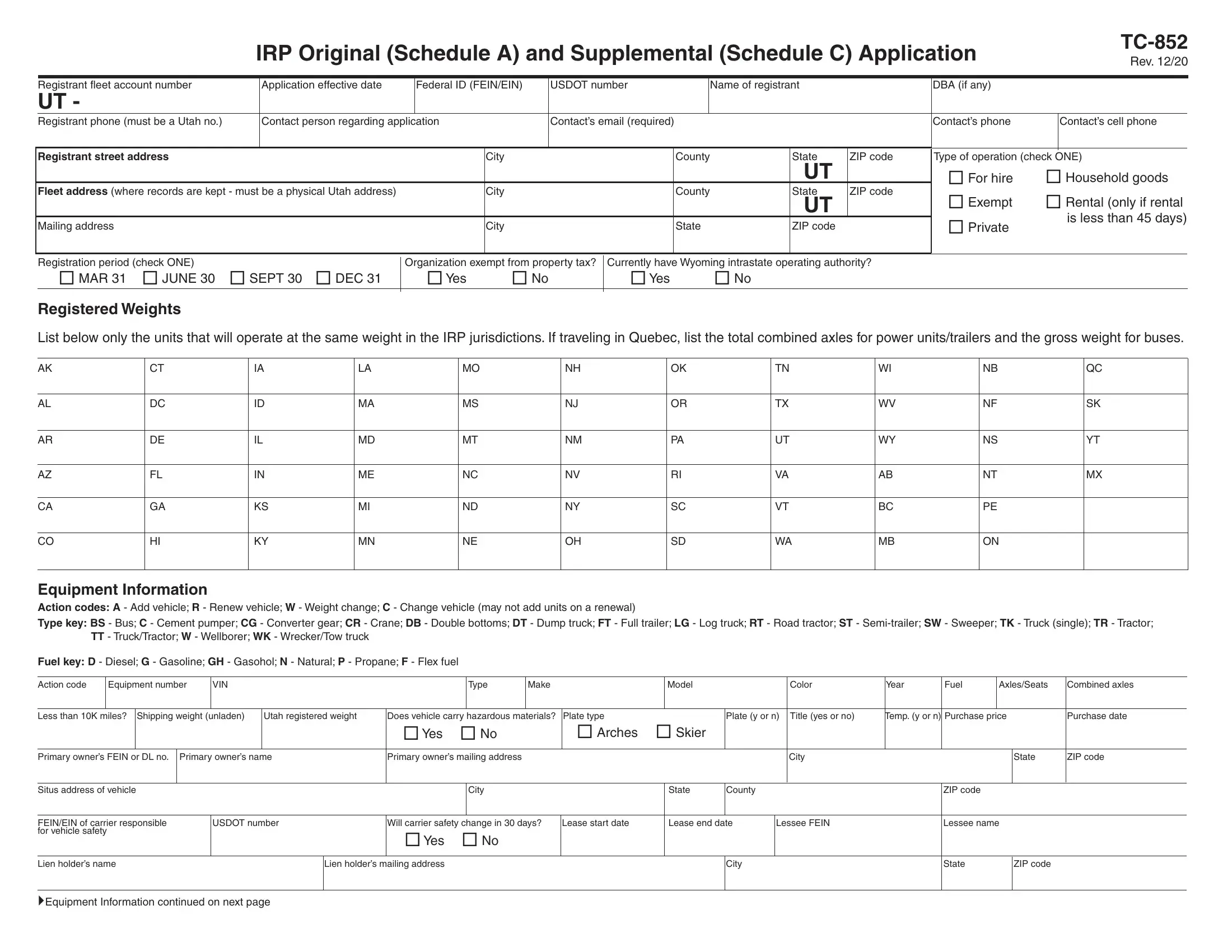

Instructions For IRP Original (Schedule A) and Supplemental (Schedule C) Application

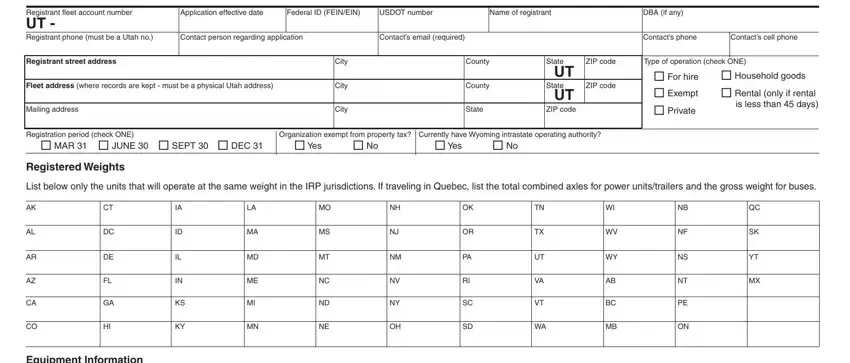

This form is to be used to add a new account, add and or delete vehicle(s) for Utah registration, to change ownership of vehicle(s) on an existing fleet, and for change in equivalent weights to other IRP Jurisdictions.

All vehicles are to be categorized by the combined gross weight in the same equivalent weight for all jurisdictions and submitted on separate pages according to the different weights.

FEIN/EIN: Federal Identification Number (can not be a Social Security Number).

Name of Registrant: Full name of registrant.

Fleet/Situs: Physical address of Fleet.

Contact person and Phone number: Individual's name and telephone number that is responsible for answering any questions regarding the application.

Registrant Fleet Account Number: Seven character account number assigned by Utah Motor Carrier Services.

Type of Operation: Check one that applies to the type of operation that you have.

Fleet: The fleet number you want the Vehicle(s) placed on.

Registration Period: Check a registration period you would like the fleet to expire in.

Weight Group number: List the weight group number for the weight group you would like the vehicles placed in.

Registered Weights: List the weights for the jurisdictions you want listed on your cab card.

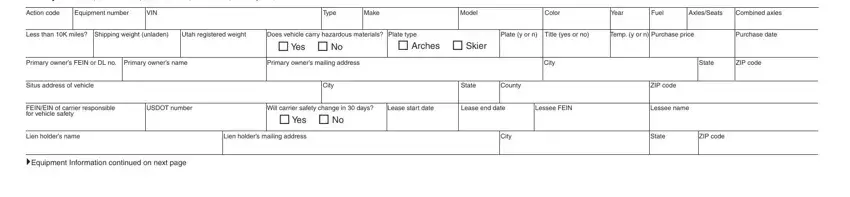

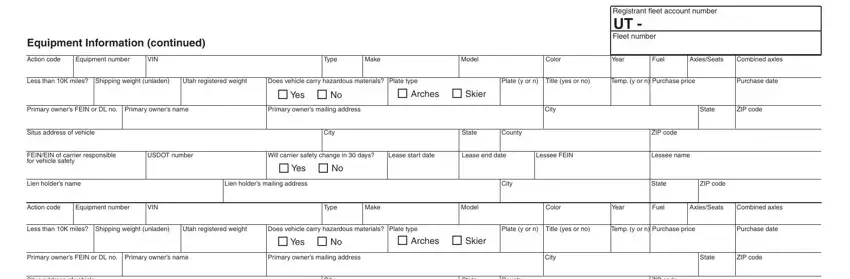

Action Code: A- Add vehicle, R- Renew vehicle, W- Weight change, C-Change vehicle (owner change).

FT Equipment Number: Unit number assigned to the vehicle.

Year: The model year the vehicle was manufactured. Use a 2-digit year (example "06").

Make: The first four characters of the vehicle manufacture (example "Dodg").

Vehicle Identification number: Complete all the letters and numbers used to identify the vehicle (VIN).

Type: Show the type based on description of the "Type key."

Axle/Seats: Show number of axles under each vehicle listed or show number of passengers for a Bus.

Fuel: Show type of fuel vehicle uses based on "Fuel Key."

Unladen Weight: The actual weight of the vehicle, excluding the weight of the load.

Declared Combined Gross Weight: The declared gross vehicle weight, including the load.

Purchase Date: The date the vehicle was purchased.

Name of Titled Owner/Lessor: Who is to be listed on the title as the vehicle owner.

Fein/Ein: Enter the Federal Employer Identification number of the person(s) responsible for the safety of the vehicle.

USDOT: Enter the USDOT number for the person(s) responsible for the safety of the vehicle.

Vehicle Safety Change: Will the USDOT and EIN of the person(s) responsible for the safety of the vehicle change during the registration period?

Less than 10K/Miles: Does the vehicle run less than 10,000 miles annually (individual vehicle miles)?

License Plate Number: Enter the Utah plate number if previously registered in Utah.

Proof of Payment of Federal Heavy Vehicle Use Tax

There is a requirement that the Internal Revenue Service (IRS) form 2290-Schedule 1, "Schedule of Heavy Highway Vehicles" must be submitted for all power units with a registered weight over 54,000 lbs GVW. Return the most current stamped copy of Schedule 1 (applicable year). Copies of the form 2290 may be obtained at www.irs.gov or from a local IRS office. The IRS has four locations in Utah for filing and obtaining these forms. Salt Lake Office, 50 S 200 E, SLC, UT 84111; Utah State Tax Commission, 210 N 1950 W, SLC UT 84134; Ogden Office, Federal Building, 25th Washington Blvd., Ogden, UT 84401; Provo Office, 173 E 100 N, Provo UT 84606; Office hours for all locations 8:30 am - 4:30 PM.

Safety Inspection and Emission Certificate (if required)

Safety inspection certificates for vehicle with a registered weight of less than 26,000 lbs must be dated within the previous two months. Fleets of 101 vehicles or more, the certificate for safety must be dated within the previous 11 months. Emissions certificates must be dated within the previous 11 months. Refer to website at http://motorcarrier.utah.gov.

MCS 150

The MCS-150 (USDOT registration) must be updated within one year prior to the beginning of the IRP registration year. Users are strongly encouraged to update the MCS-150 online at www.fmcsa.dot.gov to facilitate the registration process. Your PIN is required to update online. If you have misplaced the PIN, please click on the PIN request button and anticipate 5 - 7 days to receive your PIN in the mail. If you are unable to update online, the MCS-150 included in this packet must be completed and signed by an authorized company official so that it can be manually entered by our agents during registration.

Required to enter mileage in carrier mileage field.