You are able to prepare utah employee tax withholding form easily by using our PDFinity® PDF editor. Our editor is continually evolving to present the best user experience possible, and that's thanks to our commitment to constant improvement and listening closely to customer comments. To start your journey, consider these easy steps:

Step 1: Simply press the "Get Form Button" above on this site to open our pdf form editor. There you'll find all that is required to fill out your document.

Step 2: Once you access the PDF editor, you will see the form ready to be filled out. Apart from filling in different fields, you may also do other sorts of things with the Document, including writing custom text, modifying the original textual content, adding graphics, placing your signature to the PDF, and more.

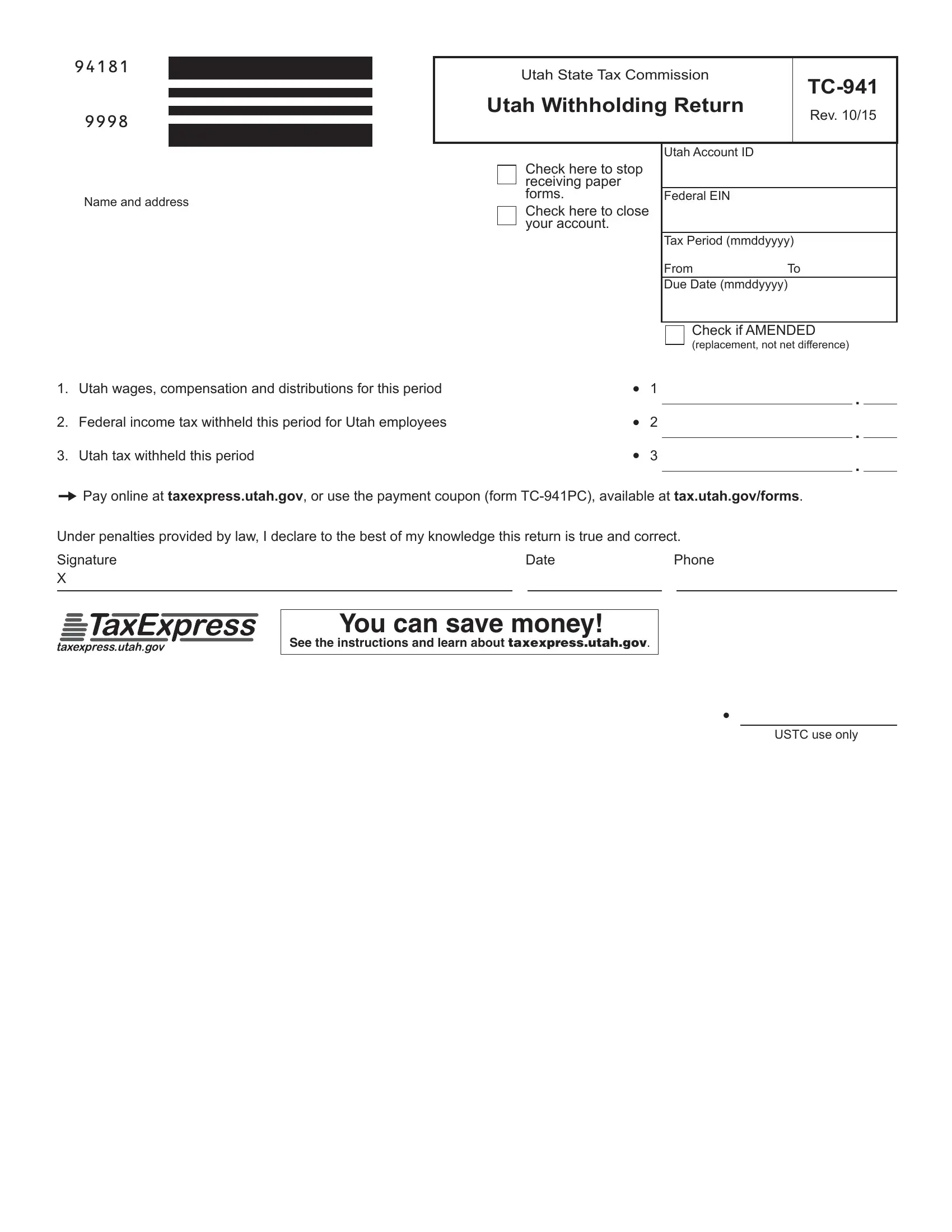

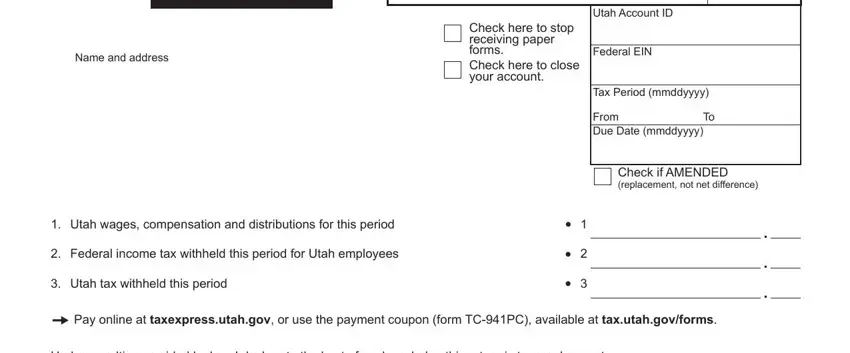

If you want to fill out this PDF form, be certain to type in the required information in every single blank:

1. Start completing your utah employee tax withholding form with a number of essential blanks. Consider all of the information you need and ensure nothing is overlooked!

Step 3: Spell-check what you've inserted in the blank fields and then click the "Done" button. Sign up with us now and instantly use utah employee tax withholding form, set for download. Every last edit made is handily preserved , making it possible to customize the document further if necessary. FormsPal is focused on the personal privacy of all our users; we make sure all information handled by our tool stays confidential.