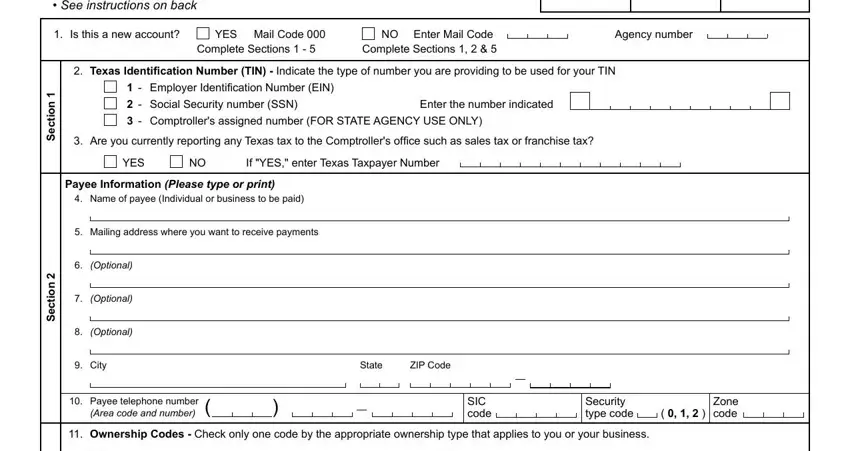

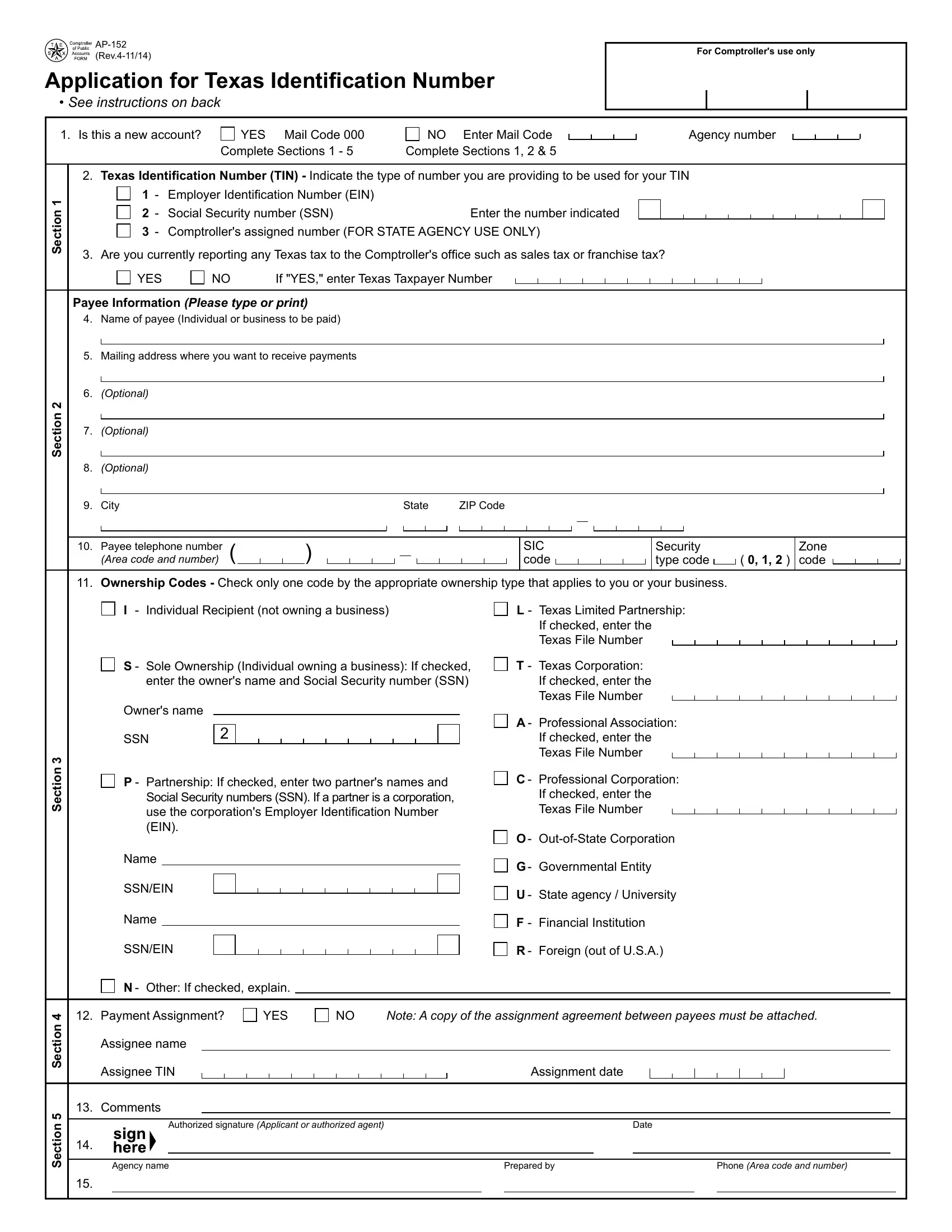

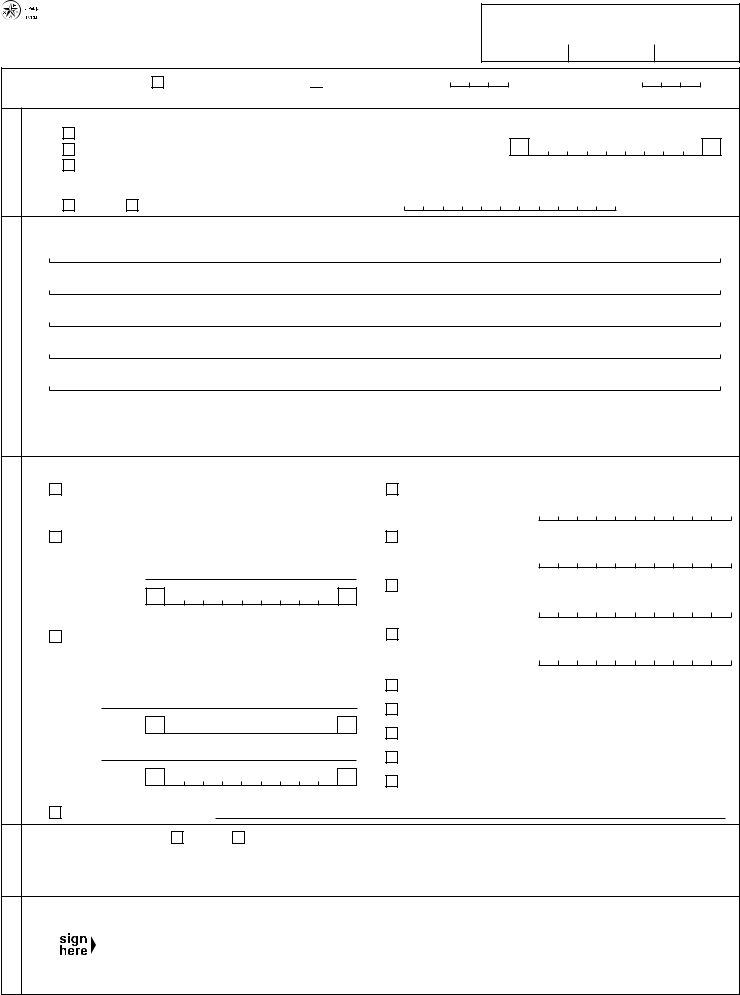

Application for Texas Identiication Number

F i s c a l M a n a g e m e n t

Austin, TX 78774 - 0100

Who Must Submit This Application -

This application must be submitted by every person (sole owner, individual recipient, partnership, corporation or other organization) who intends to bill agencies of the state government for goods, services provided, refunds, public assistance, etc. The Texas

Identiication Number (TIN) will be required on all maintenance submitted by state agencies. The use of this number on all billings will reduce the time required to process billings to the State of Texas.

Note: To expedite processing of this application, please return the completed application to the state agency with which you are conducting business. It is not necessary for the payee to sign or complete this form. The state agency representative may complete the form for the payee.

For Assistance -

For assistance in completing this application, please call the Texas Comptroller's ofice at (800) 531-5441, ext. 6-8138. The Austin number is (512) 936-8138.

Notice to State Agnecies -

When this form is used to set up additional mail codes, Sections 1, 2 and 5 must be completed. State agencies may refer to the Texas Identiication Number System (TINS) Guide at https://fmx.cpa.state.tx.us/fmx/pubs/tins/tinsguide for additional information.

General Instructions -

•Do not use dashes when entering Social Security, Employer Identiication or Comptroller's assigned numbers.

•Disclosure of your Social Security number is required. This disclosure requirement has been adopted under the Federal Privacy Act of 1974 (5 U.S.C.A. sec. 552a(note)(West 1977), the Tax Reform Act of 1976 (42 U.S.C.A. sec. 405(c)(2)(C) (West 1992), TEX. GOV'T. CODE ANN. sec. 403.055 (Vernon 2005) and TEX. GOV'T. CODE ANN. sec. 403.056 (Vernon 2005). Your Social Security number will be used to help the Texas Comptroller of Public Accounts administer the state's tax laws and for other purposes.

See Op Tex. Att'y Gen. No. H-1255 (1978).

Speciic Instructions -

Section 1 - Texas Identiication Number

EIN: For all ownership codes other than Individual Recipient listed in Section 3, enter a 9-digit Employer Identiication Number (EIN) issued by the Internal Revenue Service.

SSN: For Individual Recipient or Sole Owner without an EIN, enter your 9-digit Social Security number (SSN) issued by the Social Security Administration.

Comptroller Assigned Number: FOR STATE AGENCY USE ONLY. A Comptroller Assigned Number is an ID number that is given to a state agency that needs to pay either a foreign entity or a foreign individual who does not have an EIN or SSN.

Are you currently reporting any Texas tax to the Comptroller's ofice such as sales tax or franchise tax? If "YES," enter Texas Taxpayer Number.

Section 2 - Payee Information

Items 4 through 8 - Enter the complete name and mailing address where you want payments to be received. Names of individuals must be entered irst name irst. Each line cannot exceed 50 characters including spaces. If the name is more than 50 characters, continue the name in Item 5 and begin the address in Item 6.

Item 9 - Enter the city, state and ZIP Code. Item 10 - Enter payee telephone number.

SIC code, Security type code and Zone code: FOR STATE AGENCY USE ONLY.

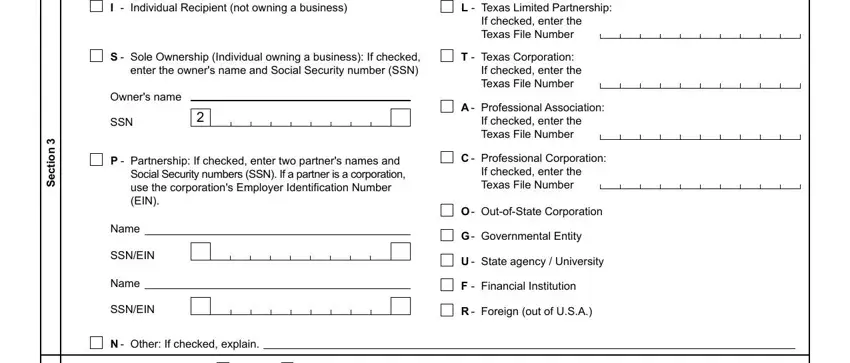

Section 3 - Ownership Codes

Item 11 - Check the box next to the appropriate ownership code and enter additional information as requested. Please check only one box in this section. The Secretary of State's ofice may be contacted at (512) 463-5555 for information regarding Texas ile numbers.

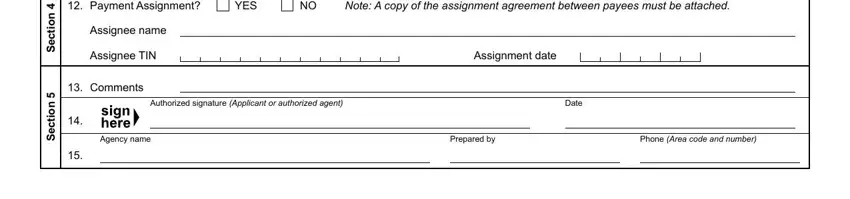

Section 4 - Payment Assignment

Item 12 - Use when one payee is assigning payment to another payee. When setting up an assignment payment, ill out this section

completely and include a copy of the assignment agreement between the assignee and the assignor.

Section 5 - Comments and Identiication

Item 13 - Enter any additional information that may be helpful in processing this applicatiion. Items 14 and 15 are for identiication purposes. Always complete the identiication section, including comments and authorized signature.

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on ile about you, with limited exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address

or phone numbers listed on this form.