In case you desire to fill out Texas Form 05 169, you won't have to install any kind of programs - simply try our online PDF editor. To keep our editor on the forefront of efficiency, we work to adopt user-driven capabilities and enhancements on a regular basis. We are at all times looking for feedback - play a pivotal role in remolding PDF editing. With some basic steps, you can begin your PDF journey:

Step 1: First, access the pdf editor by pressing the "Get Form Button" in the top section of this page.

Step 2: Using our handy PDF editor, it's possible to accomplish more than just fill out blanks. Express yourself and make your forms appear great with custom text put in, or optimize the original input to perfection - all accompanied by an ability to incorporate any images and sign the document off.

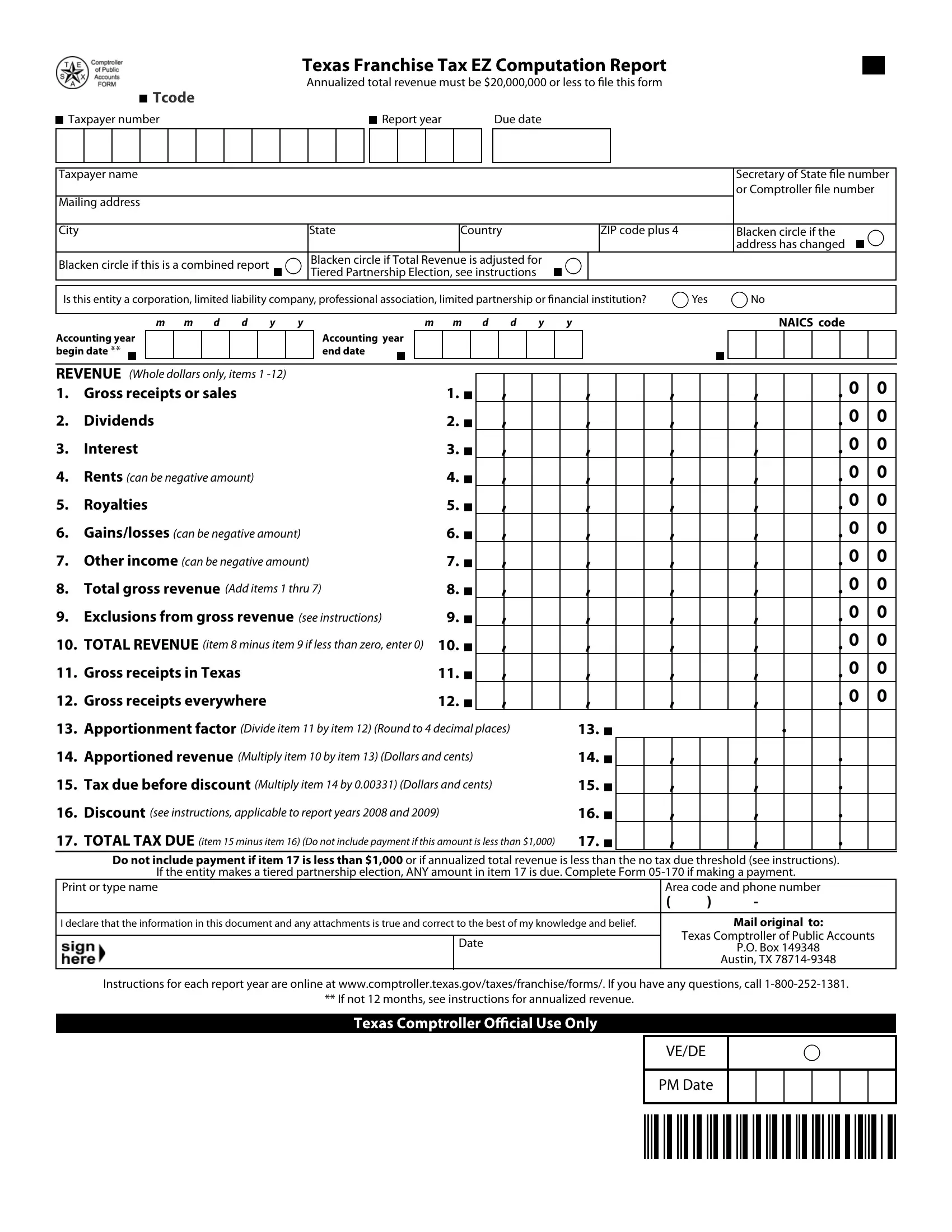

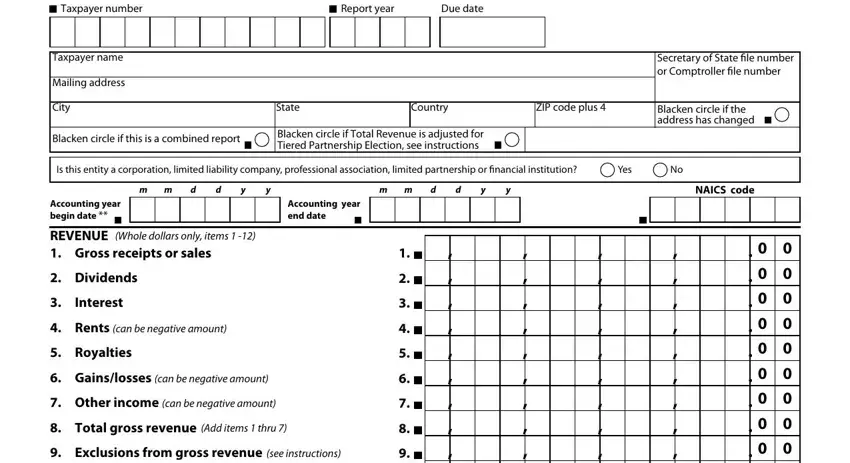

This form requires particular info to be filled in, so you should definitely take some time to type in what's asked:

1. The Texas Form 05 169 requires particular details to be entered. Ensure that the next blank fields are completed:

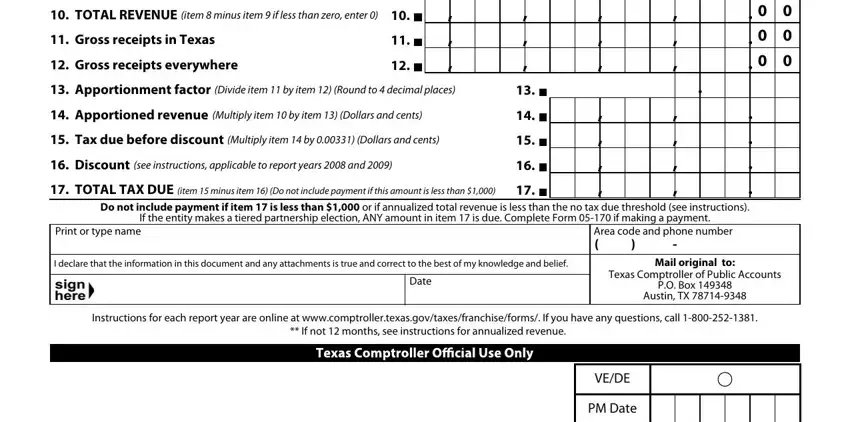

2. Right after this section is completed, go to type in the applicable details in all these - TOTAL REVENUE item minus item, Gross receipts in Texas, Gross receipts everywhere, Apportionment factor Divide item, Apportioned revenue Multiply item, Tax due before discount Multiply, Discount see instructions, TOTAL TAX DUE item minus item, Do not include payment if item is, If the entity makes a tiered, Print or type name, Area code and phone number, I declare that the information in, Mail original to, and Date.

Always be very mindful when filling out TOTAL TAX DUE item minus item and TOTAL REVENUE item minus item, since this is where a lot of people make a few mistakes.

Step 3: When you've reread the details in the blanks, press "Done" to finalize your FormsPal process. Find the Texas Form 05 169 after you subscribe to a free trial. Instantly use the pdf file from your FormsPal account page, together with any modifications and adjustments being automatically saved! At FormsPal.com, we do our utmost to be sure that your information is kept secure.