With the help of the online PDF tool by FormsPal, you're able to fill out or modify the 50 141 here and now. To keep our editor on the leading edge of practicality, we strive to put into action user-oriented features and enhancements on a regular basis. We're routinely looking for feedback - play a vital part in reshaping PDF editing. This is what you would have to do to begin:

Step 1: Access the PDF form in our tool by clicking on the "Get Form Button" above on this page.

Step 2: With our handy PDF editing tool, you are able to do more than just fill in blanks. Express yourself and make your forms look great with customized text added in, or adjust the file's original content to perfection - all that comes with the capability to add any graphics and sign the PDF off.

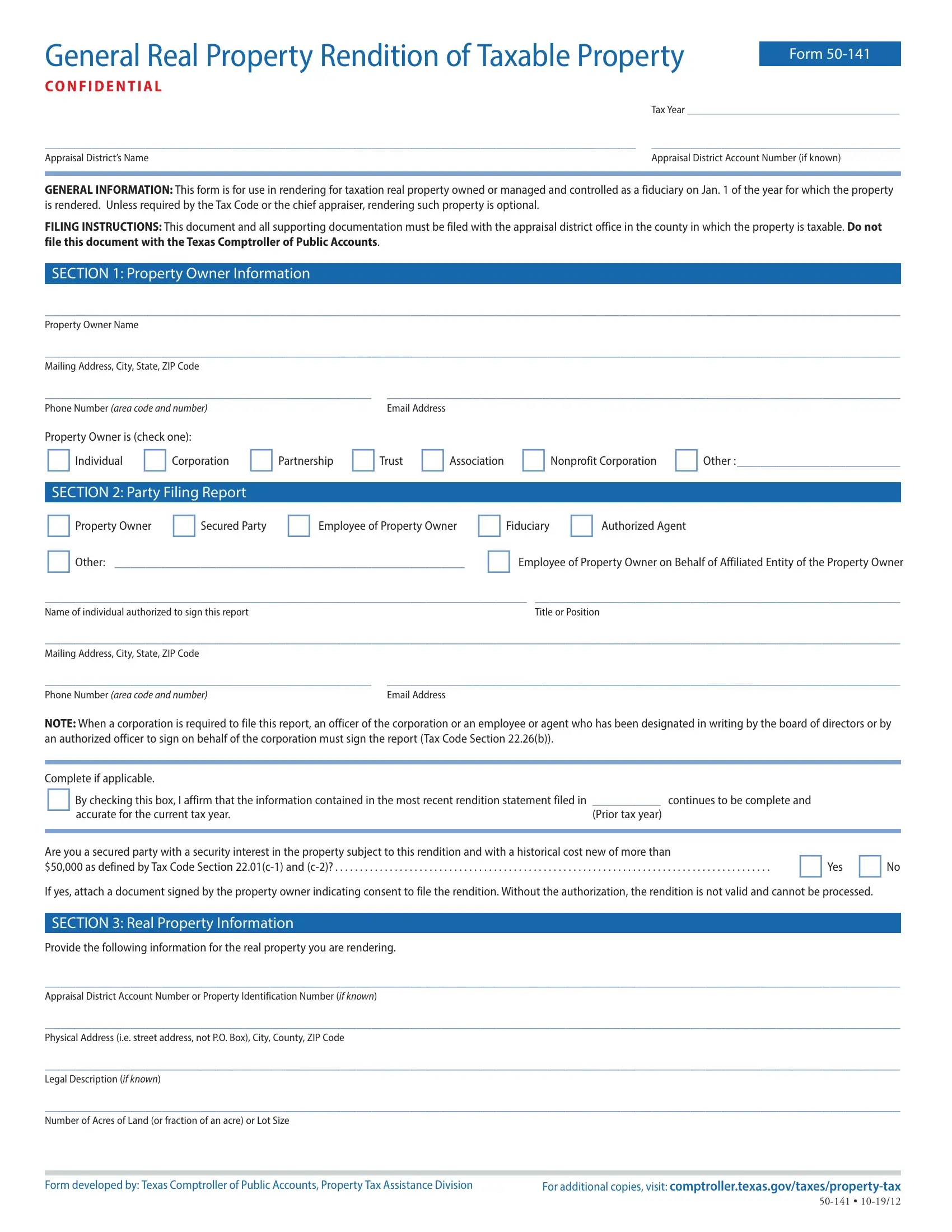

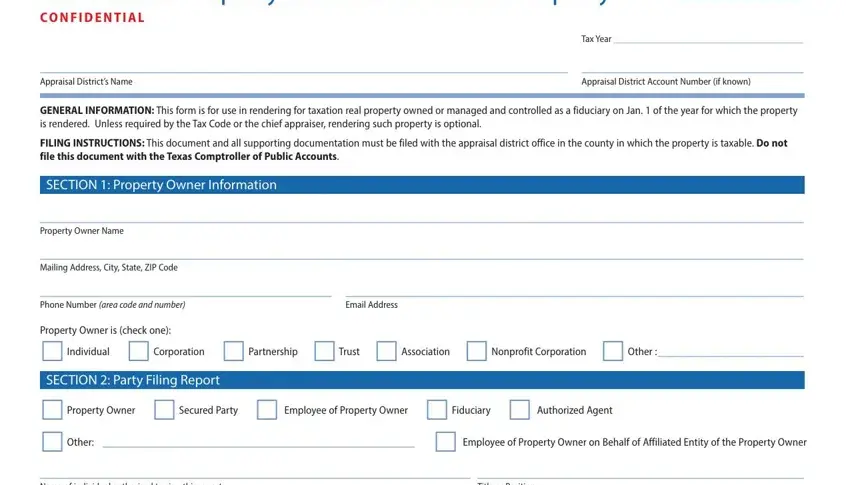

This form will require specific info to be typed in, thus you should take the time to type in what is required:

1. It is advisable to fill out the the 50 141 properly, thus pay close attention while working with the areas that contain these blank fields:

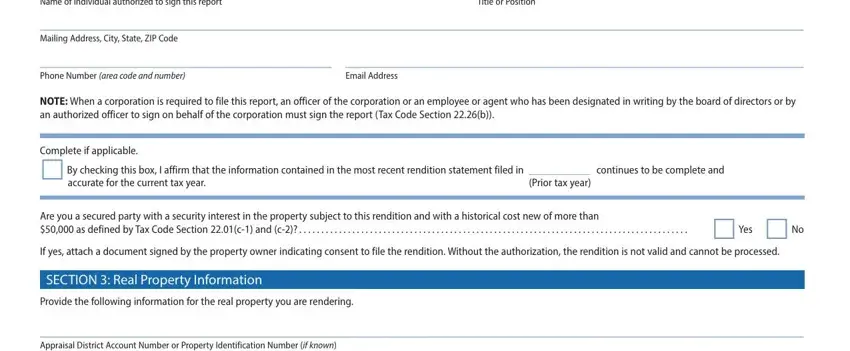

2. After completing the previous section, go on to the subsequent part and complete the necessary particulars in all these blanks - Name of individual authorized to, Title or Position, Mailing Address City State ZIP, Phone Number, area code and number, Email Address, NOTE When a corporation is, Complete if applicable, By checking this box I affirm, accurate for the current tax year, Prior tax year, Are you a secured party with a, If yes attach a document signed by, SECTION Real Property Information, and Provide the following information.

Always be extremely attentive when filling in SECTION Real Property Information and Email Address, because this is the section in which many people make some mistakes.

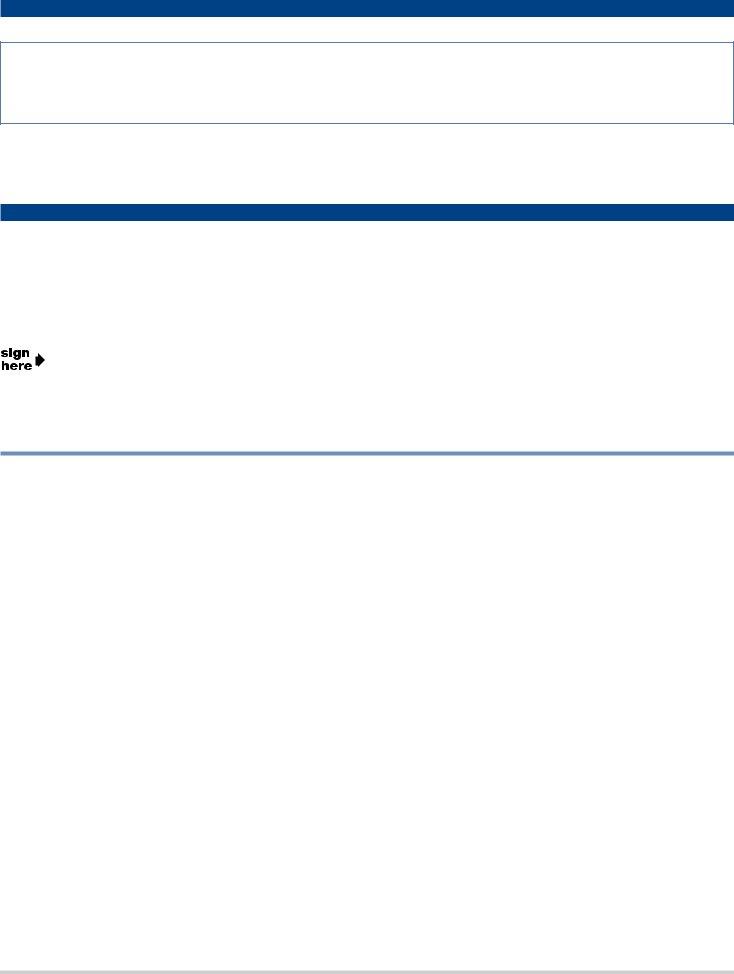

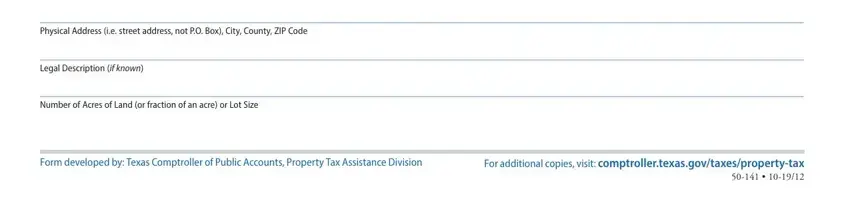

3. This third step is normally straightforward - fill out all the form fields in Appraisal District Account Number, if known, Physical Address ie street, Legal Description, if known, Number of Acres of Land or, Form developed by Texas, and For additional copies visit in order to finish this process.

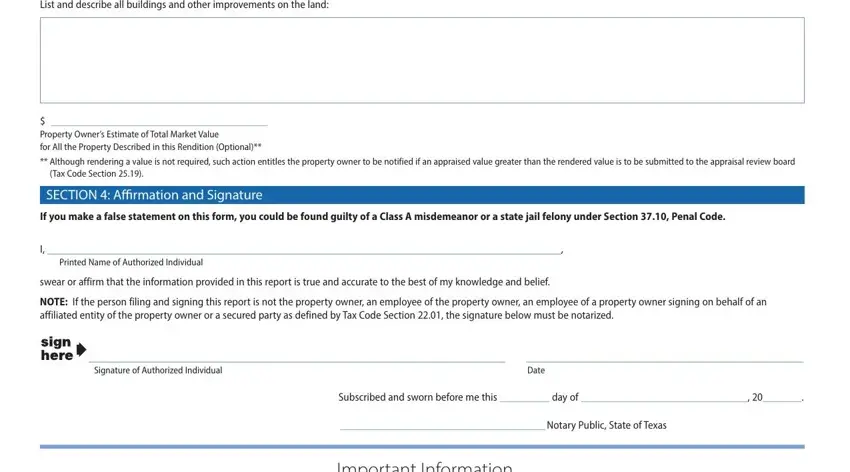

4. Your next section requires your involvement in the following places: List and describe all buildings, Property Owners Estimate of, Although rendering a value is not, Tax Code Section, SECTION Affirmation and Signature, If you make a false statement on, Printed Name of Authorized, swear or affirm that the, NOTE If the person filing and, Signature of Authorized Individual, Date, Subscribed and sworn before me this, day of, Notary Public State of Texas, and Important Information. Remember to give all needed information to move further.

Step 3: Immediately after proofreading the form fields, press "Done" and you're all set! Go for a free trial account with us and gain immediate access to the 50 141 - with all transformations saved and accessible in your personal cabinet. FormsPal is devoted to the privacy of our users; we make certain that all information put into our editor is kept confidential.