Dealing with PDF forms online is certainly super easy with this PDF editor. Anyone can fill in louisiana tier 3 financial disclosure here effortlessly. Our team is dedicated to giving you the perfect experience with our tool by consistently presenting new functions and enhancements. Our tool has become a lot more useful as the result of the most recent updates! Now, working with PDF documents is a lot easier and faster than before. With some simple steps, it is possible to begin your PDF journey:

Step 1: Click the "Get Form" button above. It'll open up our editor so you can begin filling in your form.

Step 2: The tool enables you to modify the majority of PDF files in many different ways. Transform it by including your own text, correct what is originally in the file, and place in a signature - all doable within a few minutes!

This PDF will need specific information to be typed in, so make sure to take your time to provide precisely what is required:

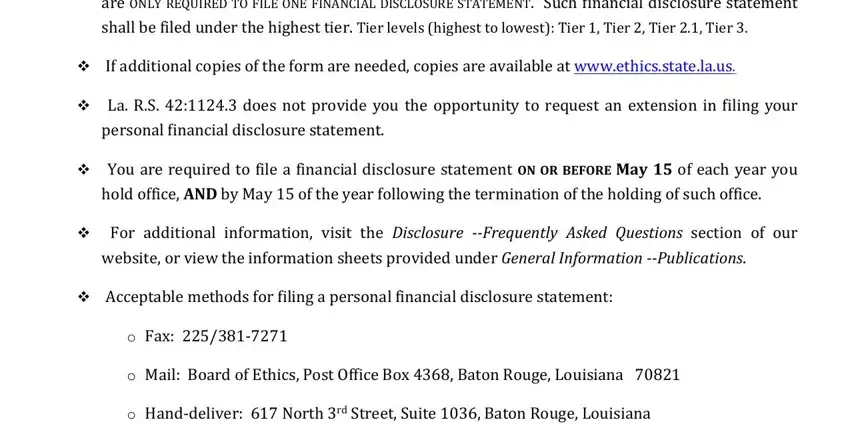

1. When completing the louisiana tier 3 financial disclosure, be certain to complete all necessary blanks in its relevant form section. This will help to speed up the process, allowing your information to be processed fast and appropriately.

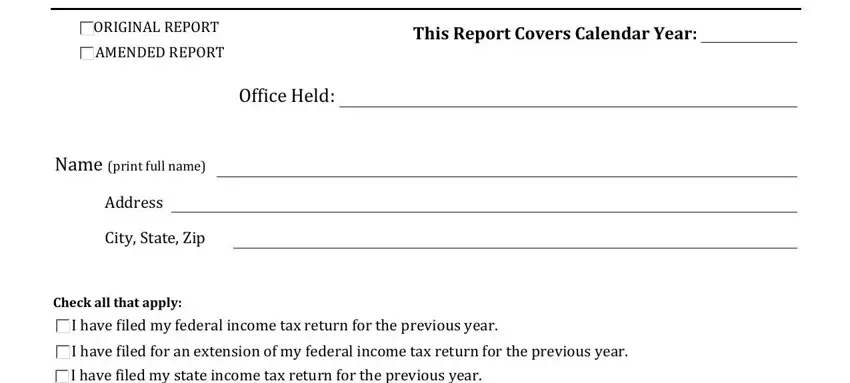

2. The next stage would be to fill out the following blanks: ORIGINAL REPORT, AMENDED REPORT, Office Held, This Report Covers Calendar Year, Name print full name, Address, City State Zip, Check all that apply, I have filed my federal income tax, I have filed for an extension of, and I have filed my state income tax.

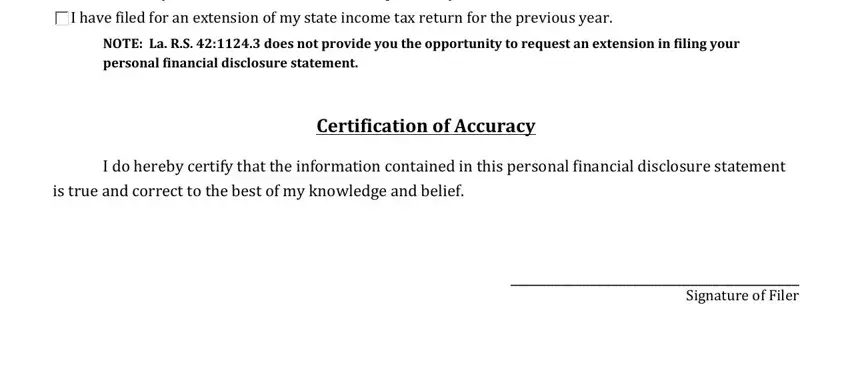

3. This next step will be easy - fill out all the empty fields in I have filed my state income tax, I have filed for an extension of, NOTE La RS does not provide you, Certification of Accuracy, I do hereby certify that the, is true and correct to the best of, and Signature of Filer to complete this segment.

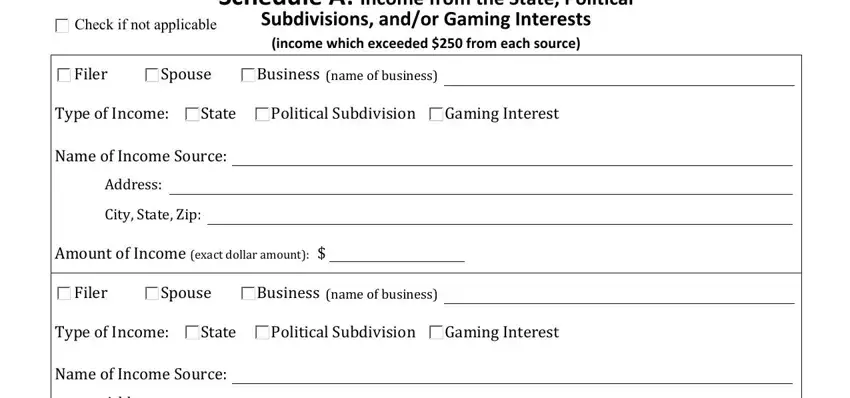

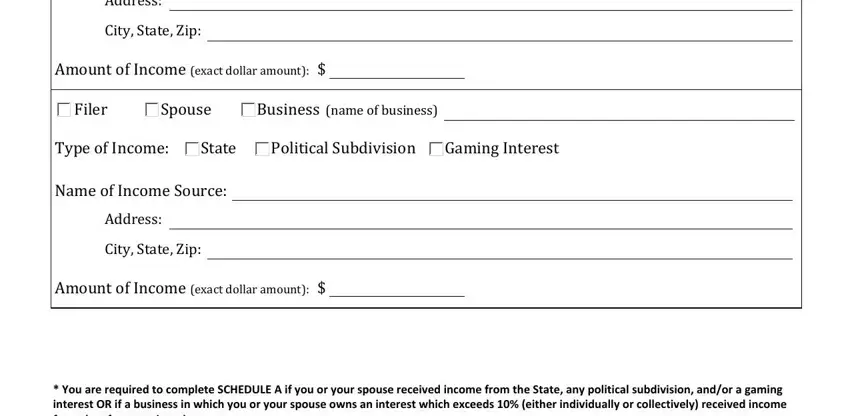

4. Filling out Check if not applicable, Schedule A Income from the State, Subdivisions andor Gaming Interests, income which exceeded from each, Filer, Spouse, Business name of business, Type of Income, State, Political Subdivision, Gaming Interest, Name of Income Source, Address, City State Zip, and Amount of Income exact dollar is key in this step - you should definitely be patient and fill out each and every blank!

It's easy to get it wrong when filling in your Filer, and so be sure you take a second look before you decide to finalize the form.

5. As a final point, this last part is what you'll have to complete prior to finalizing the PDF. The blank fields in this case include the following: Address, City State Zip, Amount of Income exact dollar, Filer, Spouse, Business name of business, Type of Income, State, Political Subdivision, Gaming Interest, Name of Income Source, Address, City State Zip, Amount of Income exact dollar, and You are required to complete.

Step 3: Just after proofreading your form fields you've filled out, click "Done" and you are all set! Right after setting up afree trial account at FormsPal, you will be able to download louisiana tier 3 financial disclosure or send it via email without delay. The PDF form will also be easily accessible via your personal account menu with all of your edits. FormsPal is invested in the confidentiality of all our users; we make certain that all information handled by our system continues to be protected.