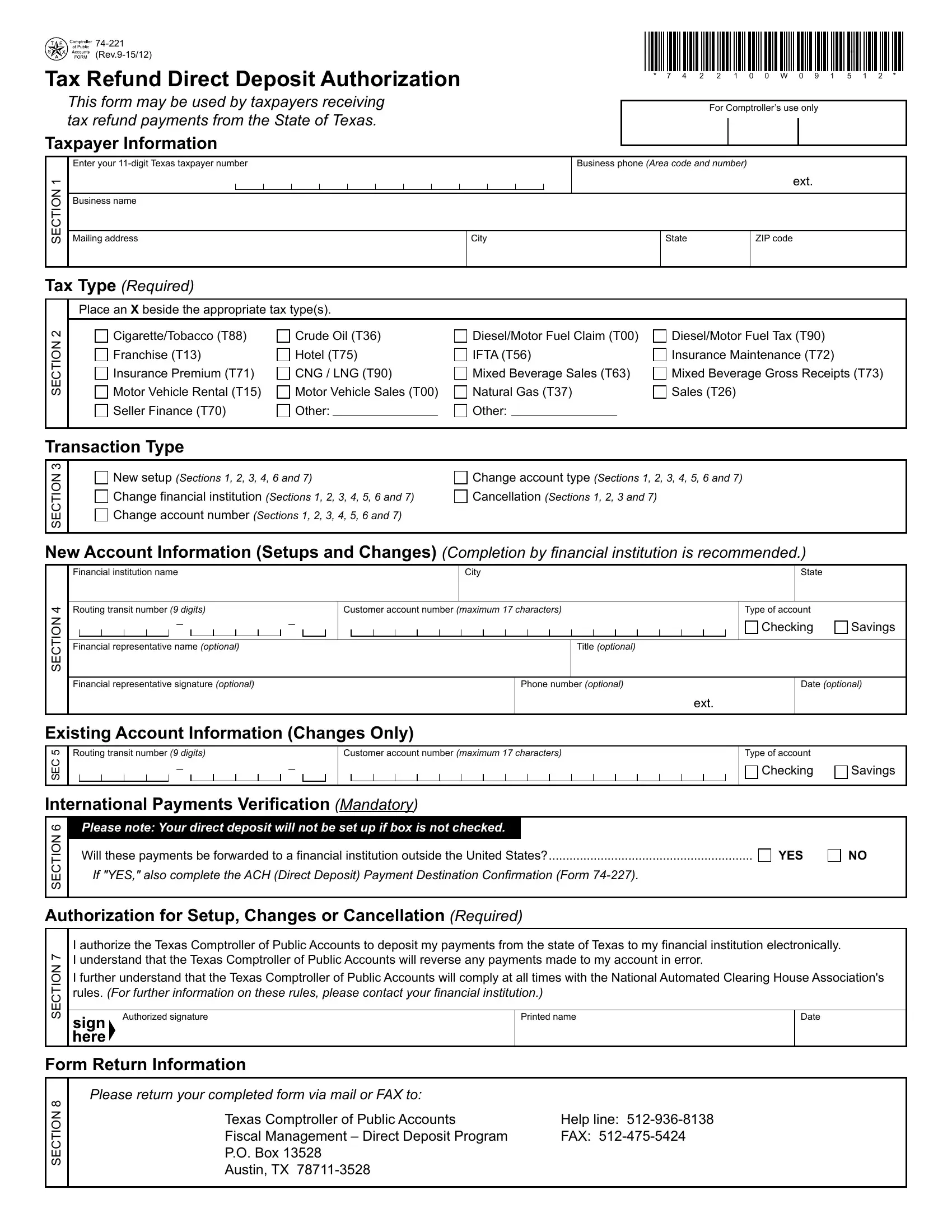

74-221 (Rev.9-15/12)

Tax Refund Direct Deposit Authorization

This form may be used by taxpayers receiving tax refund payments from the State of Texas.

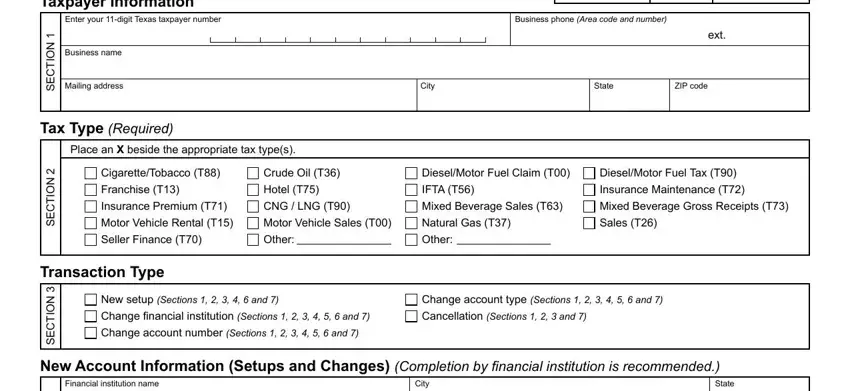

Taxpayer Information

Enter your 11-digit Texas taxpayer number

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION |

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

Business name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*7422100W091512*

*7422100W091512*

* 7 4 2 2 1 0 0 W 0 9 1 5 1 2 *

For Comptroller’s use only

Business phone (Area code and number)

ext.

Place an X beside the appropriate tax type(s).

Cigarette/Tobacco (T88) |

Crude Oil (T36) |

Diesel/Motor Fuel Claim (T00) |

Diesel/Motor Fuel Tax (T90) |

Franchise (T13) |

Hotel (T75) |

IFTA (T56) |

Insurance Maintenance (T72) |

Insurance Premium (T71) |

CNG / LNG (T90) |

Mixed Beverage Sales (T63) |

Mixed Beverage Gross Receipts (T73) |

Motor Vehicle Rental (T15) |

Motor Vehicle Sales (T00) |

Natural Gas (T37) |

Sales (T26) |

Seller Finance (T70) |

Other: |

|

|

Other: |

|

|

|

New setup (Sections.1,.2,.3,.4,.6.and.7)

Change inancial institution (Sections.1,.2,.3,.4,.5,.6.and.7) Change account number (Sections.1,.2,.3,.4,.5,.6.and.7)

Change account type (Sections.1,.2,.3,.4,.5,.6.and.7) Cancellation (Sections.1,.2,.3.and.7)

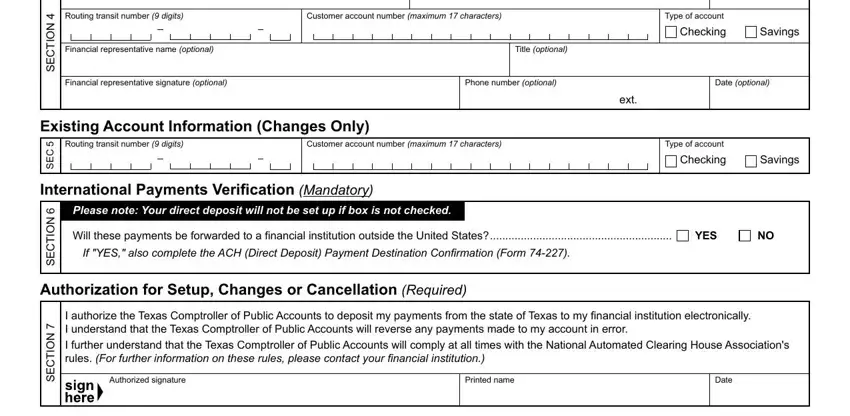

New Account Information (Setups and Changes) (Completion.by.inancial.institution.is.recommended.)

Financial institution name

Routing transit number (9 digits)

Financial representative name (optional)

Financial representative signature (optional)

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer account number (maximum.17.characters) |

|

|

|

|

|

|

|

|

|

Type of account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking |

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title (optional) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone number (optional) |

|

|

|

|

|

|

|

|

|

|

Date (optional) |

ext.

Existing Account Information (Changes Only)

5 |

Routing transit number (9 digits) |

|

|

|

|

|

|

|

Customer account number (maximum.17.characters) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of account |

SEC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

International Payments Veriication (Mandatory)

|

6 |

Please note: Your direct deposit will not be set up if box is not checked. |

|

|

|

SECTION |

|

|

|

|

Will these payments be forwarded to a inancial institution outside the United States? |

YES |

|

|

|

|

. If."YES,".also.complete.the.ACH.(Direct.Deposit).Payment.Destination.Conirmation.(Form.74-227). |

|

|

|

|

|

|

Authorization for Setup, Changes or Cancellation (Required)

I authorize the Texas Comptroller of Public Accounts to deposit my payments from the state of Texas to my inancial institution electronically. I understand that the Texas Comptroller of Public Accounts will reverse any payments made to my account in error.

I further understand that the Texas Comptroller of Public Accounts will comply at all times with the National Automated Clearing House Association's rules. (For.further.information.on.these.rules,.please.contact.your.inancial.institution.)

Authorized signature |

Printed name |

Date |

|

|

|

Please return your completed form via mail or FAX to: |

|

Texas Comptroller of Public Accounts |

Help line: 512-936-8138 |

Fiscal Management – Direct Deposit Program |

FAX: 512-475-5424 |

P.O. Box 13528 |

|

Austin, TX 78711-3528 |

|

Form 74-221 (Back)(Rev.9-15/12)

Instructions for Tax Refund Direct Deposit Authorization

You have certain rights.under.Chapters.552.and.559,.Government.Code,.to.review,.request.and.correct.information.we.have.on. file.about.you..To.request.information.for.review.or.to.request.error.correction,.use.the.contact.information.on.this.form.

Section 1: Taxpayer Information

Enter Texas taxpayer number, business phone, business/payee name and enter payee contact information.

Section 2: Tax Type

Place an "X" in the appropriate box(s) to indicate type of tax refund.

Section 3: Transaction Type

Select the appropriate type of direct deposit transaction.

Section 4: New Account Information (Needed for setups and changes)

Completion by financial institution is recommended.

Important: Your direct deposit account information may be different from what is printed on your checks. It is recommended that you contact your financial institution to confirm your direct deposit account information.

Prenote Test:

A prenote test will be sent to your financial institution for the account information provided. The prenote test is for a period of six banking days, and it is to verify your account information. If no further action is required by your financial institution, your direct deposit information will become effective when the six banking day prenote time frame has expired.

Section 5: Existing Account Information (Needed for changes to existing account information)

When requesting a change to your existing direct deposit account information, you must complete Section 5 with the existing account information for verification purposes. This measure will help the paying state agency verify accuracy of the requested change.

Any change to banking information begins a prenote test period. See explanation in Section 4, above.

Section 6: International Payments Veriication

Check "YES" or "NO" to indicate if direct deposit payments to the account information designated in

Section 3 of this form will be forwarded to a financial institution outside the United States.

If "YES," also complete the ACH (Direct Deposit) Payment Destination Confirmation (Form 74-227).

Section 7: Authorization for Setup, Changes or Cancellation

Must be completed in its entirety, and no alterations to the authorization language will be accepted.