Handful of tasks are simpler than managing documentation through our PDF editor. There isn't much you should do to edit the tx report texas file - only adopt these measures in the next order:

Step 1: Choose the orange "Get Form Now" button on the following page.

Step 2: At this point, you can alter the tx report texas. Our multifunctional toolbar helps you include, remove, adjust, highlight, as well as undertake other sorts of commands to the words and phrases and areas inside the form.

All of the following segments are going to make up the PDF file:

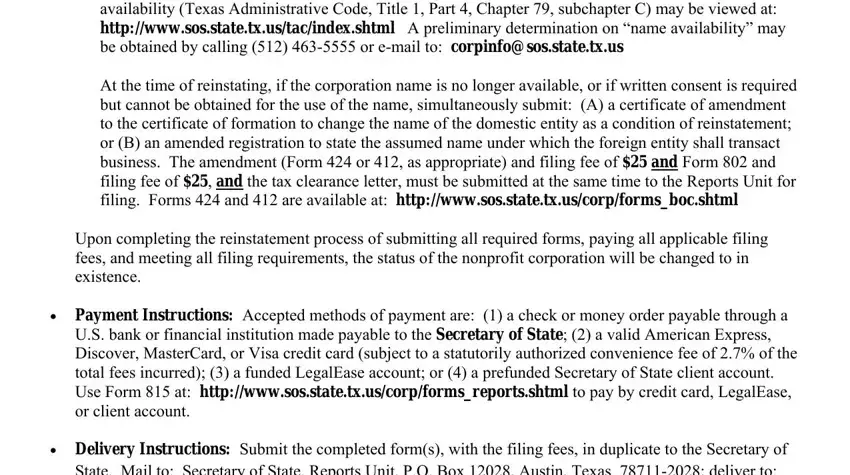

Please type in the appropriate details in the Amendment to Certificate of, At the time of reinstating if the, Upon completing the reinstatement, Payment Instructions Accepted, and Delivery Instructions Submit the area.

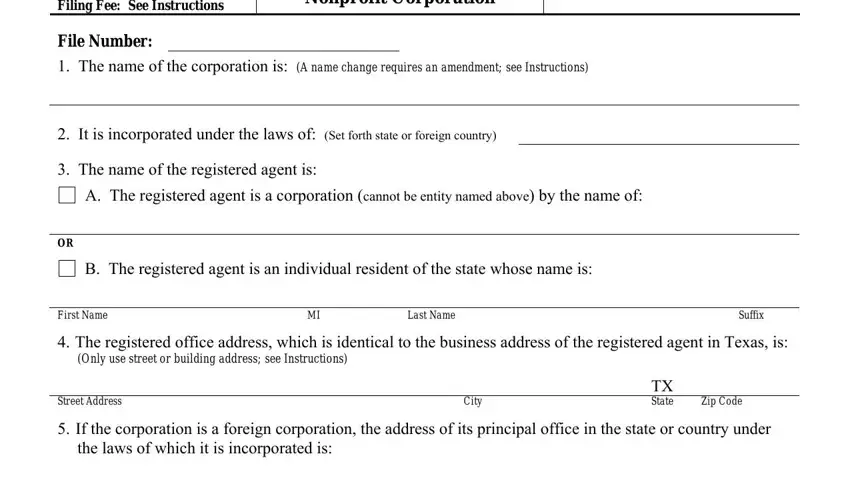

Write the necessary particulars in Form Revised Submit in duplicate, Periodic Report of a Nonprofit, File Number The name of the, It is incorporated under the laws, Set forth state or foreign country, The name of the registered agent, A The registered agent is a, B The registered agent is an, First Name, Last Name, Suffix, The registered office address, Only use street or building, Street Address, and City area.

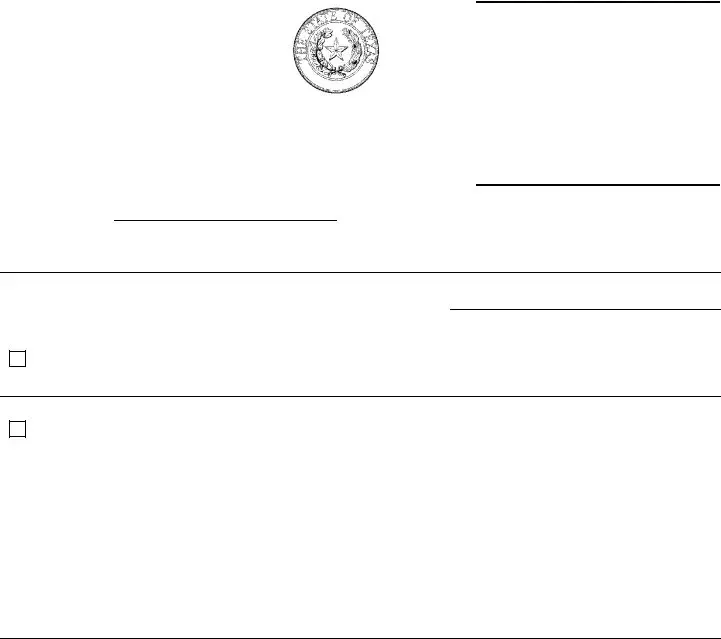

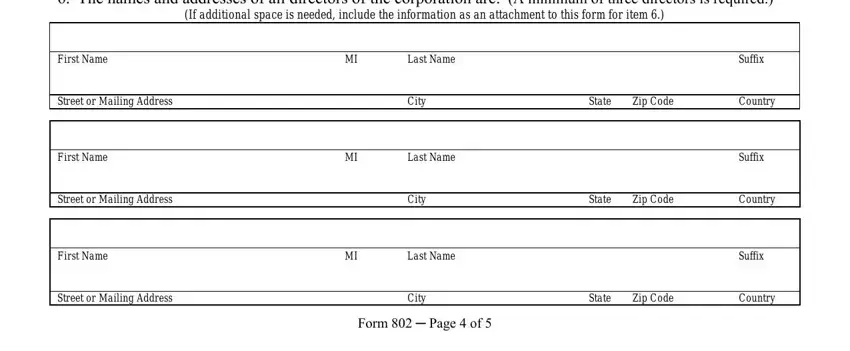

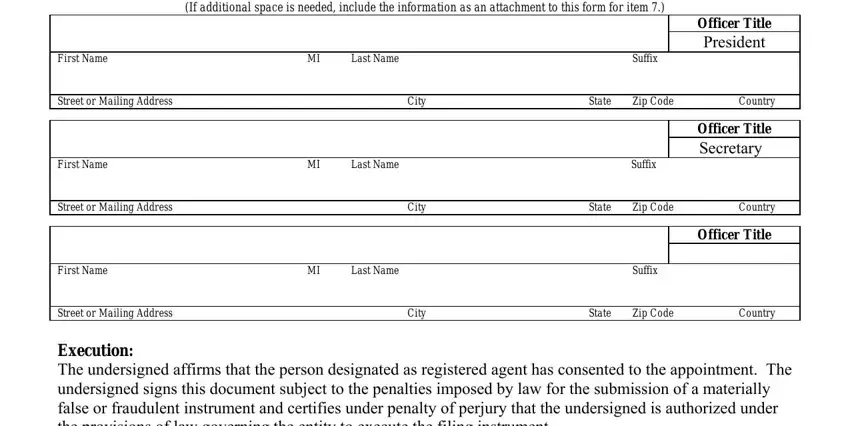

The The names and addresses of all, If additional space is needed, First Name, Last Name, Suffix, Street or Mailing Address, City, State, Zip Code, Country, First Name, Last Name, Suffix, Street or Mailing Address, and City field could be used to indicate the rights and responsibilities of each side.

Look at the sections must be filled but both may not be, If additional space is needed, First Name, Last Name, Suffix, Street or Mailing Address, City, State, Zip Code, Country, Officer Title President, First Name, Last Name, Suffix, and Street or Mailing Address and thereafter fill them in.

Step 3: Select the Done button to save the document. At this point it is at your disposal for transfer to your device.

Step 4: You can generate duplicates of the file toprevent different potential concerns. Don't be concerned, we do not display or track your data.