Navigating the complexities of tax obligations and business presence in Texas can be a daunting endeavor for entities operating within the state. The Texas AP-114 form, officially known as the Texas Nexus Questionnaire, serves as a pivotal tool for entities to communicate their business activities and connections to the Lone Star State to the Texas Comptroller of Public Accounts. This form is not only a requirement for companies seeking to establish or confirm their nexus in Texas but also provides a comprehensive overview of the entity's operations, including legal names, business structures, tax permits, and types of business activities conducted within the state. By detailing information on the entity's formation, accounting periods, and specific operations in Texas such as manufacturing, retailing, or providing services, the AP-114 form assists the Texas Comptroller in assessing tax liabilities and ensures entities comply with state tax regulations. With spaces dedicated to describing the physical presence, such as offices, warehouses, and employees in Texas, as well as outlining the nature of any solicitation, contracts, or advertising efforts conducted within the state, the form underscores the breadth of activities that might establish a taxable nexus. It also touches on operational aspects, including mergers, partnerships, and franchise relations, further emphasizing the diverse criteria considered in Texas's tax evaluation process. To aid in accurate and efficient processing, the form concludes with a requirement for an authorized signature, asserting the veracity of the provided information which plays a crucial role in defining a business's tax responsibilities in Texas.

| Question | Answer |

|---|---|

| Form Name | Texas Form Ap 114 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | 17th, AP-114, LLC, MISCAPP |

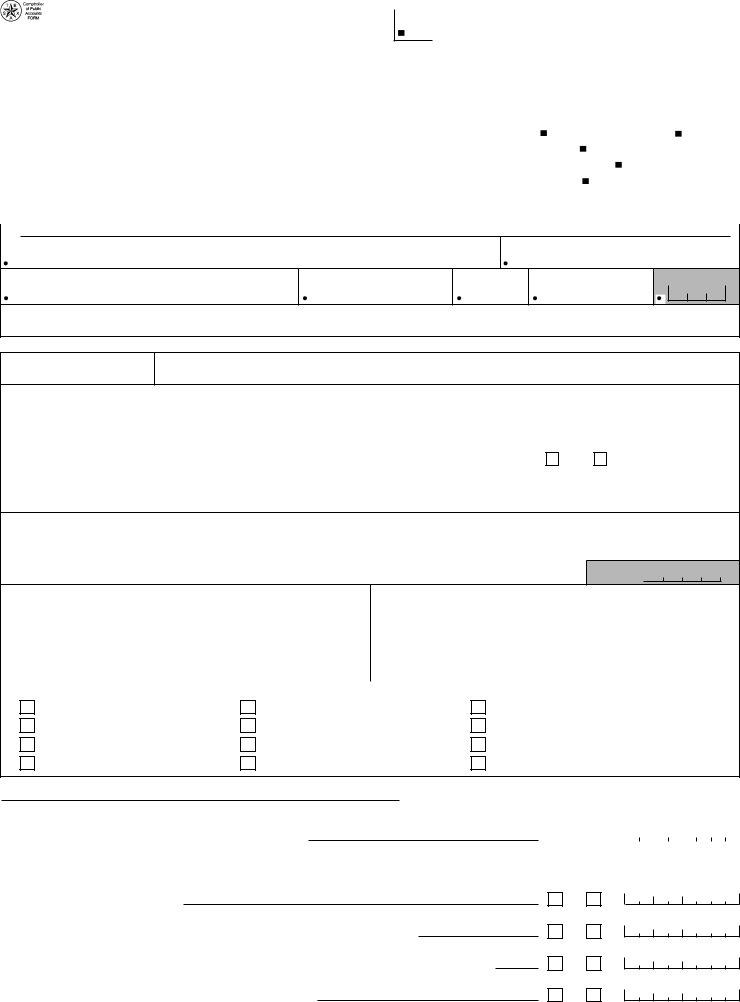

TEXAS NEXUS QUESTIONNAIRE

Under Ch. 559, Government Code, you are entitled to review, request, and correct information we have on file about you, with limited exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or

|

1. Entity legal name and mailing address |

|

INTERNAL US E ONLY |

|||

|

|

Job type: |

MI SCAPP |

T code: 0 0 9 9 1 |

||

|

|

Taxpayer number: |

|

|

||

|

|

Tax type and reason code: |

1 3 2 4 |

|

||

|

|

|

|

|

||

|

|

Reference number: |

|

|

|

|

|

|

File number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2A. If the information printed above is incorrect, enter the correct information. |

|

|

|

|

|

Entity legal name

Business phone (Area code & number)

Street Address or P.O. Box

City

State

ZIP Code

County Code

2B. Business name ("Doing Business As" or "DBA")

3A. Federal E.I. Number

3B. Does the entity have any Texas tax permit number(s) issued by the Texas Comptroller of Public Accounts - (Sales, Use, Fuels, etc.)? (If yes, please list.)

4. Type of business (If "D" is checked, attach a list of general partners, names, FEIN, and addresses.)

|

|

A. Corporation |

|

B. Limited Liability Company |

|

C. Sole Proprietorship |

|

D. Partnership |

|

|

|

E. Other |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

5A. State of formation |

|

|

5B. Date of formation |

5C. Has the entity been involved in a merger within the last seven years? |

5D. Accounting year end |

|||||||||||||

|

|

|

|

|

|

|

(Attach a detailed explanation.) |

|

|

YES |

|

|

NO |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6.Do you have a Certificate of Authority to do business in Texas issued by the Texas Secretary of State (SOS)?

(If "YES," please provide the SOS file number and the date issued.)

SOS file number |

Date issued |

|

|

YES

NO

7. Briefly describe the entity's business activities in Texas.

SIC code

8. Contact person and mailing address |

9. Daytime phone (Area code and number) |

|

|

|

|

|

10. |

|

|

|

|

|

11. |

Web site address |

|

|

|

12. Check the items you have located in Texas. |

|

|

A.MANUFACTURING PLANT

B.OFFICE

C.WAREHOUSE (owned or leased)

D.RETAIL OUTLET

E.REAL PROPERTY

F.PERSONAL PROPERTY

G.STOCK OF GOODS, INVENTORY

H.LEASED PROPERTY

I.SPACE IN DEPT. OR CHAIN STORE

J.TERMINAL FACILITY

K.EMPLOYEES

L.INDEPENDENT REPRESENTATIVES

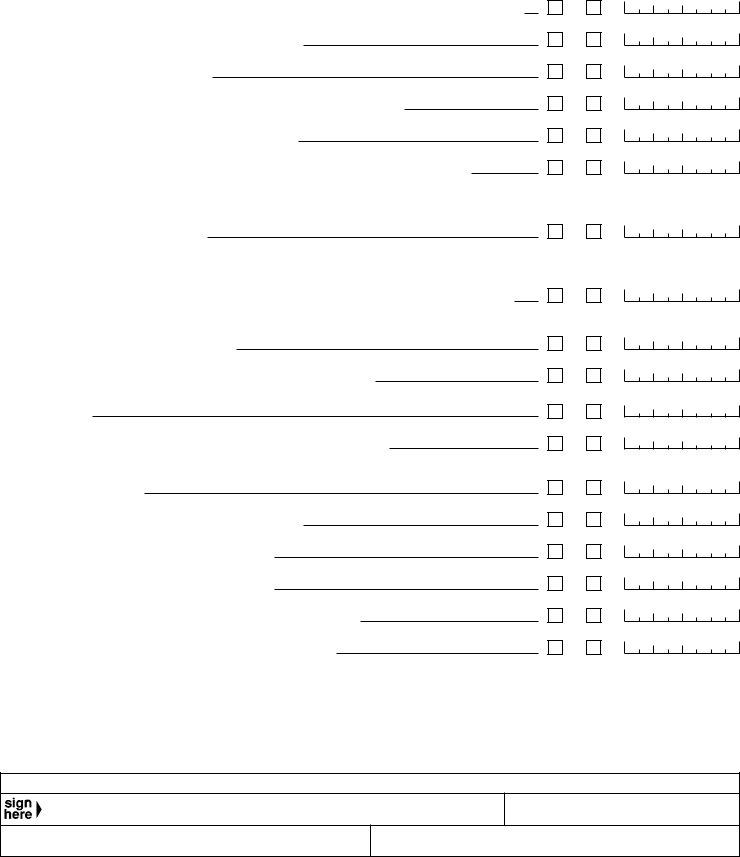

ANS WER THE QUES TIONS BELOW AS THEY PERTAIN TO THE LAS T 7 YEARS .

13. Does the entity do any of the following in Texas (If "YES," indicate beginning date.) |

YES |

NO |

Date |

|||||

|

|

|

|

|

|

|

|

|

A. solicitation: have employees, independent contractors, agents, or other representatives in Texas to |

|

|

|

|

|

|

|

|

promote or induce sales of the entity's goods or services; |

|

|

|

|

|

|

|

|

B.services:

1.provide any service in Texas (regardless of whether the employees, independent contractors,

agents, or other representatives performing the services reside, have a home office or have a place of business in Texas);

2. install, erect, modify, maintain, or repair real or personal property in Texas; or

3. do warranty work in Texas, regardless of whether such warranty work is done by a third party.

C. place of business: maintain a place of business in Texas;

Form

YES NO Date

13.(Continued)

D. partners: act as a general partner in a general or limited partnership which is doing business in Texas;

E. contracting: perform a contract in Texas regardless of whether the entity brings its own employees into the state, hires local labor, or subcontracts with another;

F. inventory: have inventory in Texas;

G. real estate: hold, acquire, lease, or dispose of any property located in Texas;

H. shows: the staging of shows or other events in Texas;

I.transportation:

1. carry passengers or property in Texas if both pickup and delivery occur within Texas; or

2.have facilities and/or employees, independent contractors, agents, or other representatives in Texas for storage, delivery, or shipment of goods; for servicing, maintaining, or repairing of vehicles or other

equipment; for coordinating and directing the transportation of passengers or property; or for doing other business of the corporation/LLC;

J. franchisers: enter into one or more contracts with persons or other business entities located in Texas, by which:

1. the franchisee is granted the right to engage in the business of offering, selling, or distributing goods or services under a marketing plan or system prescribed in substantial part by the franchiser; and

2.the operation of a franchisee's business pursuant to such plan is substantially associated with the franchiser's trademark, service mark, trade name, logotype, advertising, or other commercial symbol

designating the franchiser or its affiliate;

K. processing: assemble, process, manufacture, or store goods in Texas;

L. advertising: enter Texas to purchase, place, or display advertising when the advertising is for the benefit of another;

M. processing and shipment: send materials to a Texas manufacturer, processor, repairer, or printer to be processed and stored in completed form awaiting orders for their shipment;

N. loan production activities: solicit sales contracts or loans, gather financial data, make credit checks, or perform other financial activities in Texas through employees, independent contractors, agents, or other representatives;

O. holding companies: maintain a place of business in Texas or manage direct, and/or perform services in Texas for subsidiaries or investee corporations/LLCs;

P. federal enclaves: do business in any area within Texas, even if the area is leased by, owned by, ceded to, or under the control of the federal government;

Q. consignments: have consigned goods in Texas;

R. delivering: deliver into Texas items it has sold, in company vehicles;

S. leasing: lease tangible personal property that is used in Texas.

Remarks:

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief.

Authorized signature (Officer, director, authorized agent)

Date

Type or print name

Title

PROVIDING COMPLETE AND ACCURATE BUSINESS INFORMATION WILL EXPEDITE

THE PROCESSING OF YOUR QUESTIONNAIRE.

Please return the questionnaire to: Texas Comptroller of Public Accounts 111 E. 17th Street

Austin, TX

For assistance, call

(TDD), the toll free number is