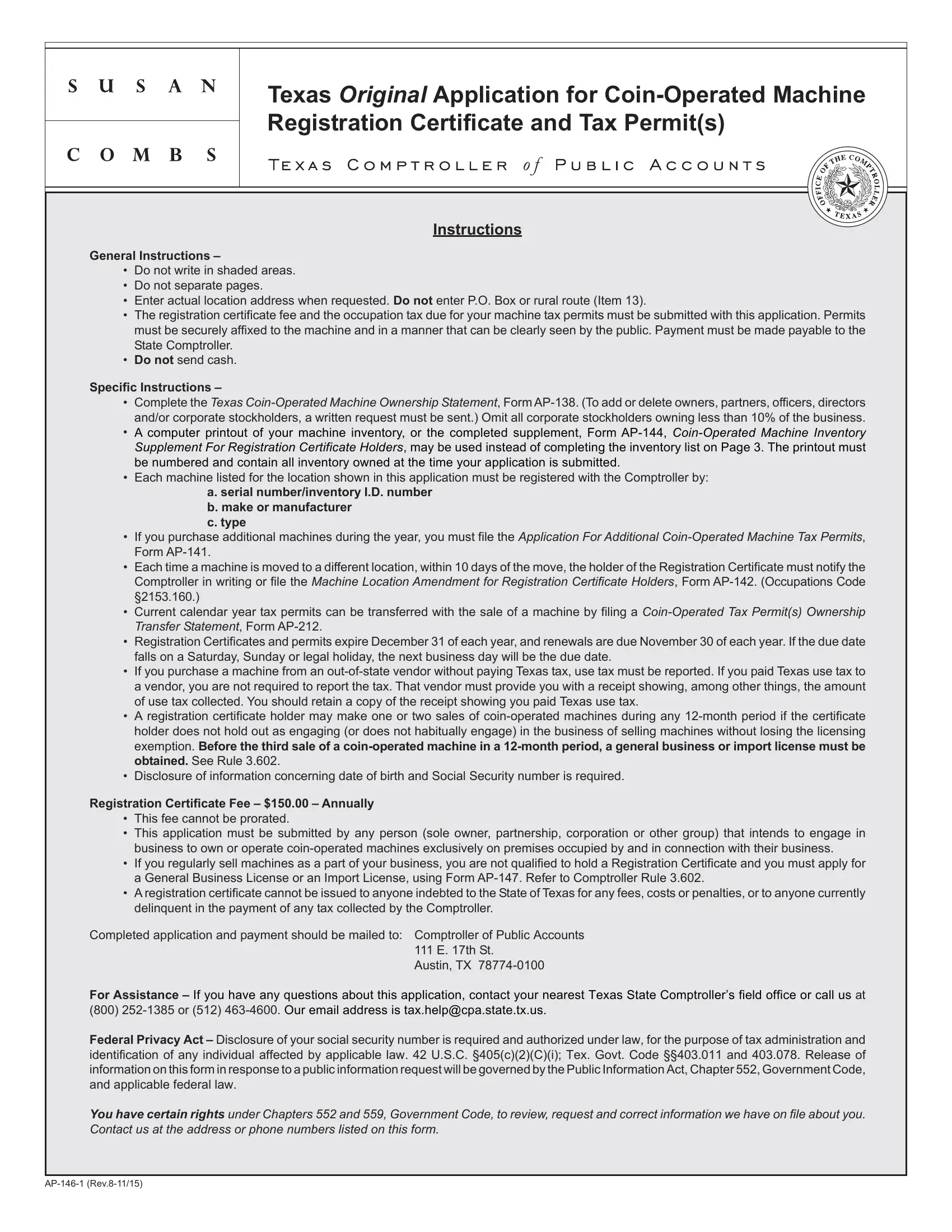

Texas Original Application for Coin-Operated Machine

Registration Certificate and Tax Permit(s)

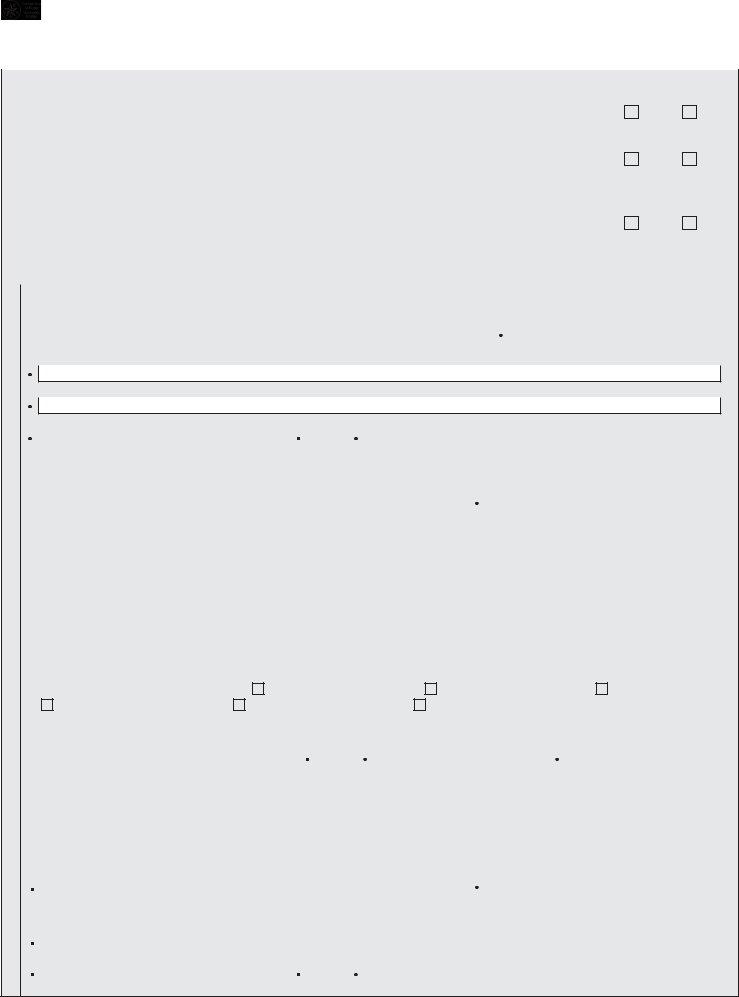

Instructions

General Instructions –

•Do not write in shaded areas.

•Do not separate pages.

•Enter actual location address when requested. Do not enter P.O. Box or rural route (Item 13).

•The registration certificate fee and the occupation tax due for your machine tax permits must be submitted with this application. Permits must be securely affixed to the machine and in a manner that can be clearly seen by the public. Payment must be made payable to the State Comptroller.

•Do not send cash.

Specific Instructions –

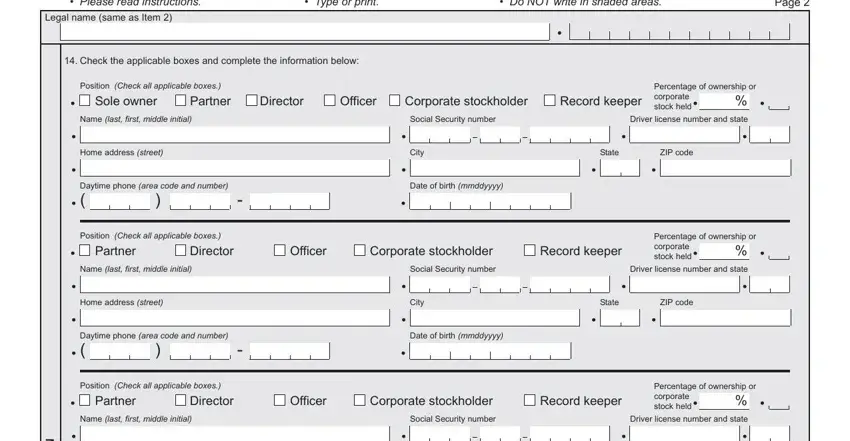

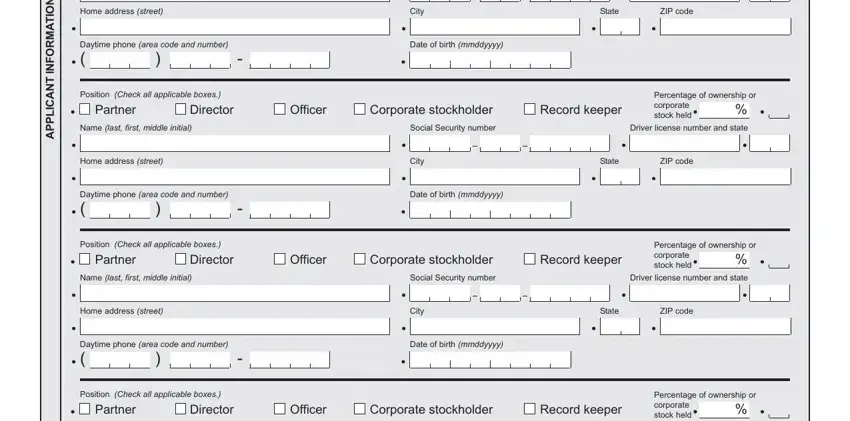

•Complete the Texas Coin-Operated Machine Ownership Statement, Form AP-138. (To add or delete owners, partners, officers, directors and/or corporate stockholders, a written request must be sent.) Omit all corporate stockholders owning less than 10% of the business.

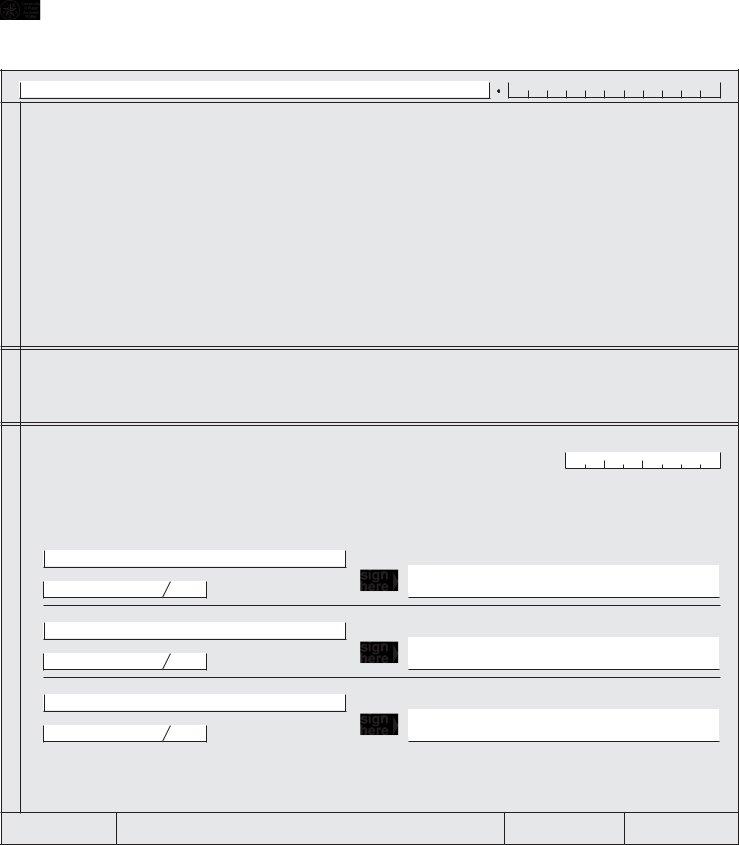

•A computer printout of your machine inventory, or the completed supplement, Form AP-144, Coin-Operated Machine Inventory Supplement For Registration Certificate Holders, may be used instead of completing the inventory list on Page 3. The printout must be numbered and contain all inventory owned at the time your application is submitted.

•Each machine listed for the location shown in this application must be registered with the Comptroller by:

a.serial number/inventory I.D. number

b.make or manufacturer

c.type

•If you purchase additional machines during the year, you must file the Application For Additional Coin-Operated Machine Tax Permits, Form AP-141.

•Each time a machine is moved to a different location, within 10 days of the move, the holder of the Registration Certificate must notify the Comptroller in writing or file the Machine Location Amendment for Registration Certificate Holders, Form AP-142. (Occupations Code §2153.160.)

•Current calendar year tax permits can be transferred with the sale of a machine by filing a Coin-Operated Tax Permit(s) Ownership Transfer Statement, Form AP-212.

•Registration Certificates and permits expire December 31 of each year, and renewals are due November 30 of each year. If the due date falls on a Saturday, Sunday or legal holiday, the next business day will be the due date.

•If you purchase a machine from an out-of-state vendor without paying Texas tax, use tax must be reported. If you paid Texas use tax to a vendor, you are not required to report the tax. That vendor must provide you with a receipt showing, among other things, the amount of use tax collected. You should retain a copy of the receipt showing you paid Texas use tax.

•A registration certificate holder may make one or two sales of coin-operated machines during any 12-month period if the certificate holder does not hold out as engaging (or does not habitually engage) in the business of selling machines without losing the licensing exemption. Before the third sale of a coin-operated machine in a 12-month period, a general business or import license must be obtained. See Rule 3.602.

•Disclosure of information concerning date of birth and Social Security number is required.

Registration Certificate Fee – $150.00 – Annually

•This fee cannot be prorated.

•This application must be submitted by any person (sole owner, partnership, corporation or other group) that intends to engage in business to own or operate coin-operated machines exclusively on premises occupied by and in connection with their business.

•If you regularly sell machines as a part of your business, you are not qualified to hold a Registration Certificate and you must apply for a General Business License or an Import License, using Form AP-147. Refer to Comptroller Rule 3.602.

•A registration certificate cannot be issued to anyone indebted to the State of Texas for any fees, costs or penalties, or to anyone currently delinquent in the payment of any tax collected by the Comptroller.

Completed application and payment should be mailed to: Comptroller of Public Accounts 111 E. 17th St.

Austin, TX 78774-0100

For Assistance – If you have any questions about this application, contact your nearest Texas State Comptroller’s field office or call us at (800) 252-1385 or (512) 463-4600. Our email address is tax.help@cpa.state.tx.us.

Federal Privacy Act – Disclosure of your social security number is required and authorized under law, for the purpose of tax administration and identification of any individual affected by applicable law. 42 U.S.C. §405(c)(2)(C)(i); Tex. Govt. Code §§403.011 and 403.078. Release of information on this form in response to a public information request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

You have certain rights under Chapters 552 and 559, Government Code, to review, request and correct information we have on file about you. Contact us at the address or phone numbers listed on this form.

AP-146-1 (Rev.8-11/15)

AP-146-2 (Rev.8-11/15)

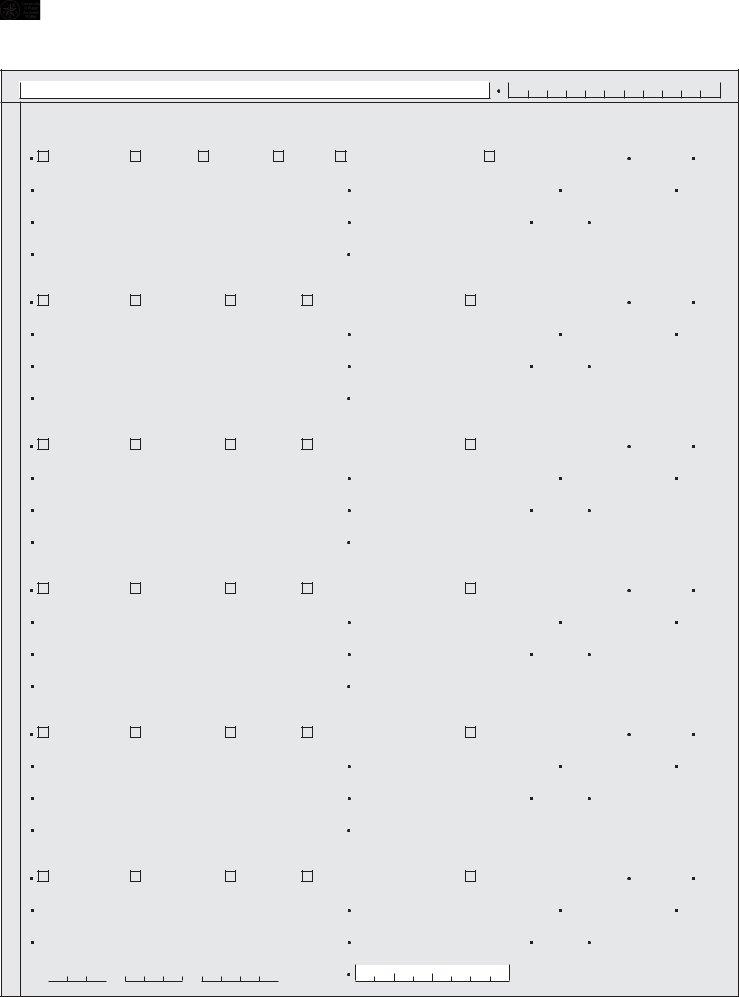

Below is a listing of taxes and fees collected by the Comptroller of Public Accounts. If you are responsible for reporting or paying one of the listed taxes or fees, and you do not have a permit or an account with us for this purpose, please obtain the proper application by calling (800) 252-5555 or by visiting your local Texas Comptroller field office.

9-1-1 Emergency Service Fee/Equalization Surcharge - If you are a telecommunications utility, a mobile service provider or a busi- ness service user that provides local exchange access, equiva- lent local exchange access, wireless telecommunications connec- tions or intrastate long-distance service, and you are responsible for collecting emergency communications charges and/or sur- charges, you must complete Form AP-201.

Automotive Oil Sales Fee - If you manufacture and sell automotive oil in Texas; or you import or cause automotive oil to be imported into Texas for sale, use or consumption; or you sell more than 25,000 gallons of automotive oil annually and you own a warehouse or distri- bution center located in Texas, you must complete Form AP-161.

Battery Sales Fee - If you sell or offer to sell new or used lead acid batteries, you must complete Form AP-160.

Cement Production Tax - If you manufacture or produce cement in Texas, or you import cement into Texas and you distribute or sell cement in intrastate commerce or use the cement in Texas, you must complete Form AP-171.

Cigarette, Cigar and/or Tobacco Products Tax - If you wholesale, distribute, store or make retail sales of cigarettes, cigars and/or tobacco products, you must complete Form AP-175 or Form AP-193.

Coastal Protection Fee - If you transfer crude oil and condensate from or to vessels at a marine terminal located in Texas, you must complete Form AP-159.

Coin-Operated Machine Tax - If you engage in any business deal- ing with coin-operated amusement machines OR engage in busi- ness to own or operate coin-operated amusement machines ex- clusively on premises occupied by and in connection with the busi- ness, you must complete Form AP-146 or Form AP-147.

Crude Oil and Natural Gas Production Taxes - If you produce and/ or purchase crude oil and/or natural gas, you must complete Form AP-134.

Direct Payment Permit - If you annually purchase at least $800,000 worth of taxable items for your own use and not for resale, you must complete Form AP-101 to qualify for the permit.

Fireworks Tax - If you collect tax on the retail sale of fireworks, you must complete Form AP-201. This is in addition to the sales tax permit. You are required to charge both the sales tax and the fireworks tax.

Franchise Tax - If you are a general partnership or a non-Texas entity without a certificate of authority or certificate of registration, you must complete Form AP-114.

Fuels Tax - If you are required to be licensed under Texas Fuels Tax Law for the type and class permit required, you must complete Form AP-133.

Gross Receipts Tax - If you provide certain services on oil and gas wells OR are a utility company located in an incorporated city or town having a population of more than 1,000 according to the most recent federal census and intend to do business in Texas, you must complete Form AP-110.

Off-Road,Heavy-DutyDiesel-PoweredEquipmentSurcharge- If you sell, lease or rent off-road, heavy duty diesel powered equipment, you must complete Form AP-201. This is in addition to the sales tax permit. You are required to charge both the sales tax and the surcharge.

Hotel Occupancy Tax - If you provide sleeping accommodations to the public for a cost of $15 or more per day, you must complete Form AP-102.

International Fuel Tax Agreement (IFTA) - If you operate qualified motor vehicles which require you to be licensed under the International Fuel Tax Agreement, you must com- plete Form AP-178.

Manufactured Housing Sales Tax - If you are a manufacturer of manufactured homes or industrialized housing engaged in business in Texas, you must complete Form AP-118.

Maquiladora Export Permit - If you are a maquiladora enterprise and wish to make tax-free purchases in Texas for export to Mexico, you must complete Form AP-153 to receive the permit.

Motor Vehicle Seller-Financed Sales Tax - If you finance sales of motor vehicles and collect Motor Vehicle Sales Tax in periodic payments, you must complete Form AP-169.

Motor Vehicle Gross Rental Tax - If you rent motor vehicles in Texas, you must complete Form AP-143.

Petroleum Products Delivery Fee - If you are required to be licensed under Texas Water Code, sec. 26.3574, you must complete Form AP-154.

Sales and Use Tax - If you engage in business in Texas, AND you sell or lease tangible personal property or provide taxable services in Texas to customers in Texas, and/or you acquire tangible personal property or taxable services from out-of- state suppliers that do not hold a Texas Sales or Use Tax permit, you must complete Form AP-201.

Sulphur Production Tax - If you own, control, manage, lease or operate a sulphur mine, well or shaft or produce sulphur by any method, system or manner, you must complete Form AP-171.

Telecommunications Infrastructure Fund - If you are a tele- communications utility company or a mobile service provider who collects and pays taxes on telecommunications receipts under Texas Tax Code, Chapter 151, you must complete Form AP-201.

Texas Customs Broker License - If you have been licensed by the United States Customs Service AND want to issue export certifications, you must complete Form AP-168.

AP-146-3 |

|

Texas Original Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Rev.8-11/15) |

for Coin-Operated Machine |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registration Certificate and Tax Permit(s) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

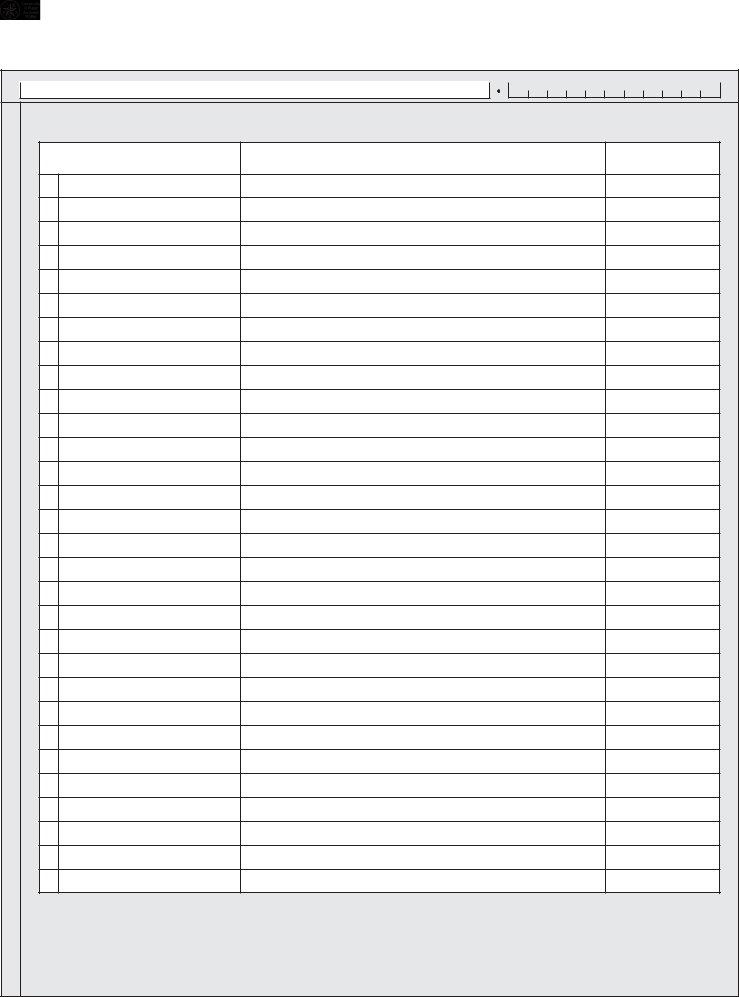

• Please read instructions. |

• Type or print. |

• Do NOT write in shaded areas. |

|

|

|

|

|

|

|

|

|

|

|

|

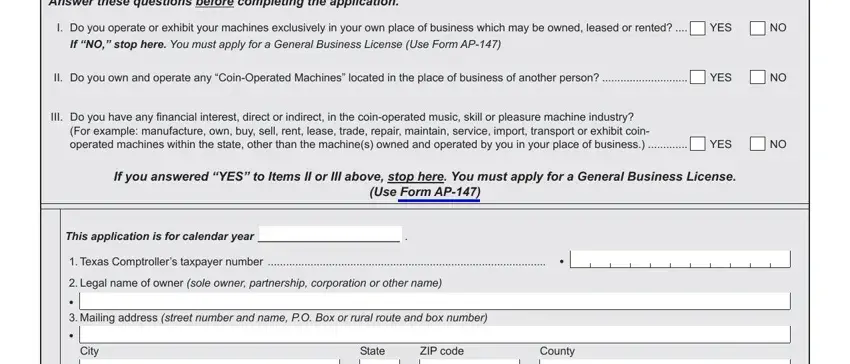

Answer these questions before completing the application. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I. Do you operate or exhibit your machines exclusively in your own place of business which may be owned, leased or rented? |

|

|

YES |

|

|

|

NO |

|

|

|

|

|

If “NO,” stop here. You must apply for a General Business License (Use Form AP-147) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

II. Do you own and operate any “Coin-Operated Machines” located in the place of business of another person? |

|

|

|

YES |

|

|

|

NO |

|

|

|

|

|

III. Do you have any financial interest, direct or indirect, in the coin-operated music, skill or pleasure machine industry? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(For example: manufacture, own, buy, sell, rent, lease, trade, repair, maintain, service, import, transport or exhibit coin- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.............operated machines within the state, other than the machine(s) owned and operated by you in your place of business.) |

|

|

YES |

|

|

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If you answered “YES” to Items II or III above, stop here. You must apply for a General Business License. |

|

|

|

|

|

|

|

|

|

|

(Use Form AP-147) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This application is for calendar year |

_______________________ |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Texas Comptroller’s taxpayer number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

........................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.Legal name of owner (sole owner, partnership, corporation or other name)

3.Mailing address (street number and name, P.O. Box or rural route and box number)

|

|

City |

|

|

|

|

|

State |

|

|

ZIP code |

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

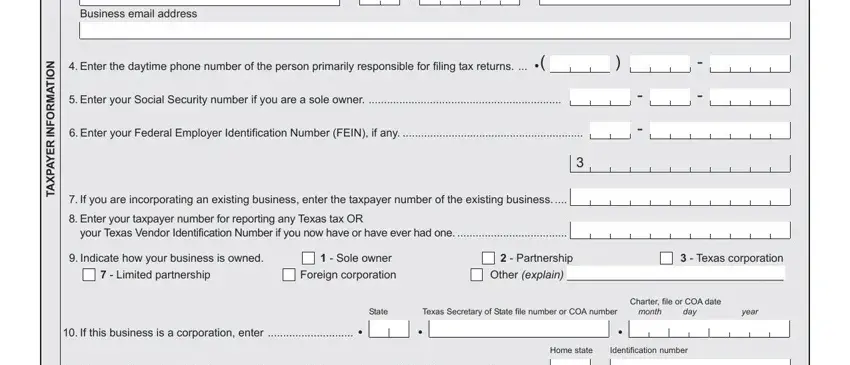

Business email address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION |

6. Enter your Federal Employer Identification Number (FEIN), if any |

........................................................... |

|

|

|

|

|

|

|

|

|

... |

( |

|

|

|

|

|

) |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

4. Enter the daytime phone number of the person primarily responsible for filing tax returns. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAXPAYER |

. ...............................................................5. Enter your Social Security number if you are a sole owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.....7. If you are incorporating an existing business, enter the taxpayer number of the existing business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. Enter your taxpayer number for reporting any Texas tax OR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

your Texas Vendor Identification Number if you now have or have ever had one |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Indicate how your business is owned. |

|

|

|

1 - Sole owner |

|

|

|

|

|

|

|

|

|

|

2 - Partnership |

|

|

|

|

|

|

3 - Texas corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 - Limited partnership |

|

Foreign corporation |

|

|

|

|

|

|

|

|

Other (explain) |

___________________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Charter, file or COA date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

Texas Secretary of State file number or COA number |

month |

day |

year |

|

|

10. If this business is a corporation, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Home state |

Identification number |

|

|

|

|

|

|

11. If your business is a limited partnership, enter the home state and identification number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

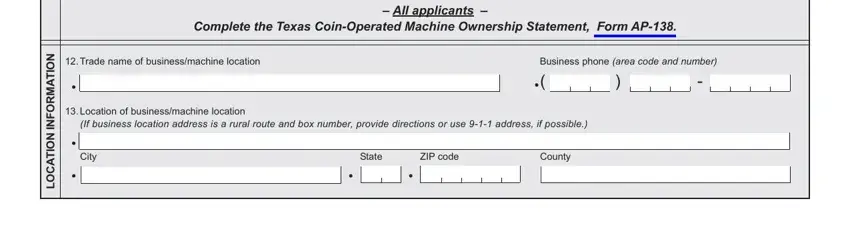

– All applicants |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete the Texas Coin-Operated Machine Ownership Statement, Form AP-138. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION |

|

(If business location address is a rural route and box number, provide directions or use 9-1-1 address, if possible.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. Trade name of business/machine location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business phone (area code and number) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

|

|

|

) |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

13. Location of business/machine location |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

State |

|

|

ZIP code |

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|