Using PDF files online is actually surprisingly easy using our PDF tool. Anyone can fill in texas form application exemption here painlessly. FormsPal is aimed at providing you with the perfect experience with our tool by consistently presenting new features and upgrades. With these improvements, using our tool becomes easier than ever before! With some basic steps, you are able to begin your PDF journey:

Step 1: Firstly, open the tool by clicking the "Get Form Button" at the top of this page.

Step 2: This editor grants the opportunity to change PDF forms in a range of ways. Improve it by adding your own text, adjust what is originally in the PDF, and put in a signature - all possible in no time!

Concentrate when filling in this form. Make sure that all mandatory areas are filled out accurately.

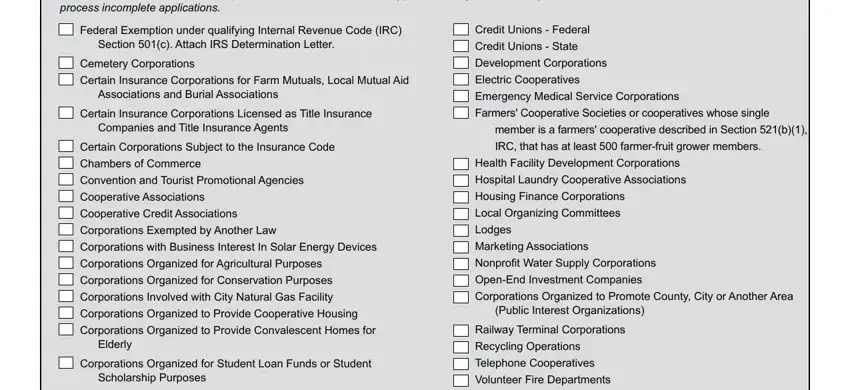

1. It is crucial to complete the texas form application exemption accurately, therefore take care while filling in the sections including these blank fields:

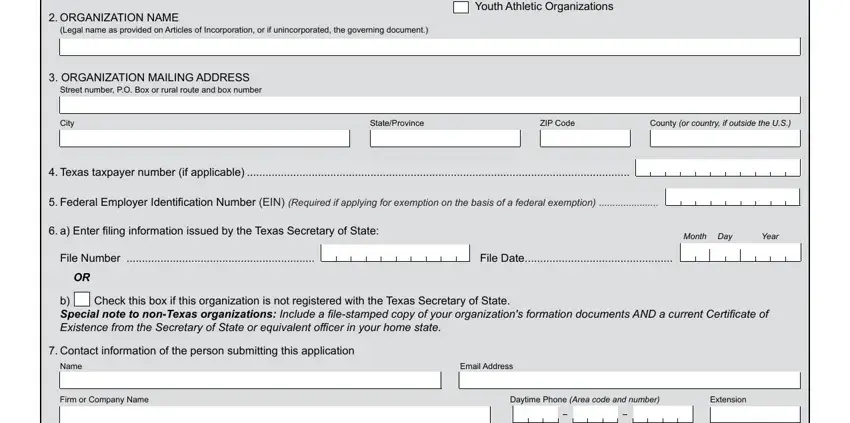

2. Just after finishing the last step, go on to the subsequent step and enter all required particulars in all these fields - ORGANIZATION NAME, Youth Athletic Organizations, Legal name as provided on Articles, ORGANIZATION MAILING ADDRESS, Street number PO Box or rural, City, StateProvince, ZIP Code, County or country if outside the US, Texas taxpayer number if, Month Day, Year, File Number, File Date, and Check this box if this.

It is easy to get it wrong when filling in your ORGANIZATION MAILING ADDRESS, for that reason make sure you go through it again prior to deciding to submit it.

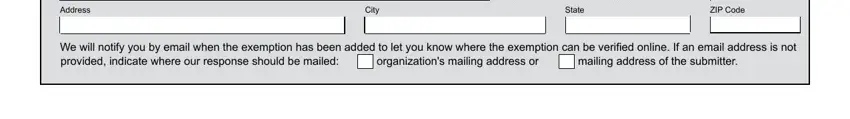

3. Your next part is going to be hassle-free - complete every one of the form fields in Address, City, State, ZIP Code, We will notify you by email when, organizations mailing address or, and mailing address of the submitter to complete this process.

Step 3: Once you have reread the information in the file's blank fields, simply click "Done" to finalize your document creation. Sign up with FormsPal now and immediately get texas form application exemption, all set for download. All adjustments made by you are preserved , helping you to edit the document later on when required. Here at FormsPal, we aim to ensure that all of your details are stored protected.