You can work with KEETON without difficulty by using our PDFinity® online tool. To make our editor better and easier to work with, we constantly come up with new features, with our users' feedback in mind. If you are seeking to begin, here's what it requires:

Step 1: Hit the "Get Form" button above on this webpage to get into our PDF tool.

Step 2: Once you open the tool, you will get the form all set to be completed. Other than filling in various blanks, you may as well do other things with the PDF, that is adding custom words, editing the initial text, adding images, signing the form, and much more.

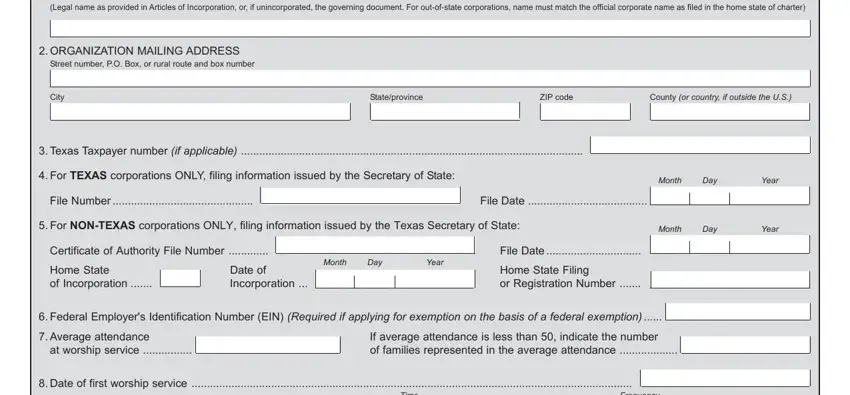

This document will require specific information to be filled out, thus be sure you take your time to provide exactly what is expected:

1. While completing the KEETON, make certain to incorporate all essential blank fields within the relevant section. This will help expedite the work, making it possible for your details to be processed efficiently and correctly.

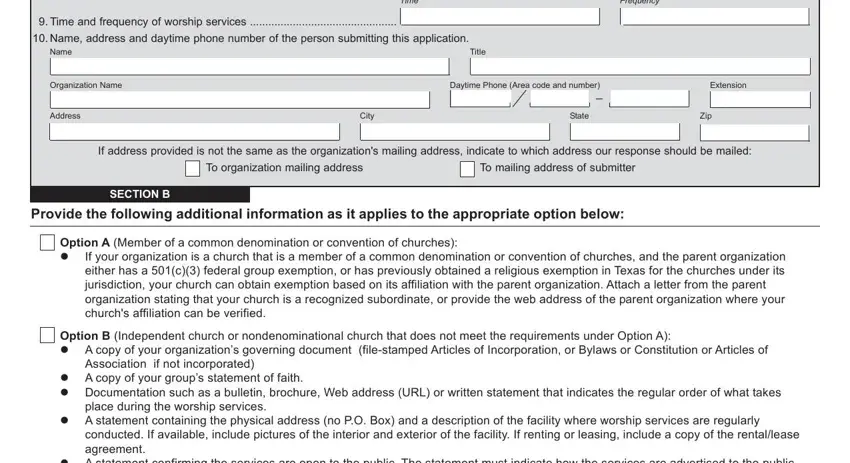

2. Just after filling out the last section, head on to the subsequent stage and fill out the essential details in these blank fields - Time, Frequency, Time and frequency of worship, Name address and daytime phone, Name, Organization Name, Address, Title, Daytime Phone Area code and number, Extension, City, State, Zip, If address provided is not the, and To organization mailing address.

When it comes to Name address and daytime phone and Organization Name, be certain that you don't make any errors in this current part. These are definitely the key fields in the file.

Step 3: Make certain your details are right and then click "Done" to conclude the process. Join us today and easily gain access to KEETON, available for downloading. Every single change made is handily saved , so that you can edit the pdf at a later time as needed. FormsPal offers secure form editor with no personal information record-keeping or distributing. Rest assured that your information is secure here!