Working with PDF files online is actually a breeze with this PDF tool. Anyone can fill out Texas Form C 83 here painlessly. Our professional team is constantly working to improve the tool and make it even faster for users with its extensive features. Enjoy an ever-evolving experience now! In case you are seeking to get going, here's what it requires:

Step 1: Click on the "Get Form" button at the top of this page to access our tool.

Step 2: With the help of this handy PDF editor, you could do more than just fill out blank form fields. Edit away and make your forms appear great with customized textual content incorporated, or optimize the original input to perfection - all that comes with the capability to add any type of images and sign it off.

It will be simple to fill out the form with this helpful guide! Here is what you have to do:

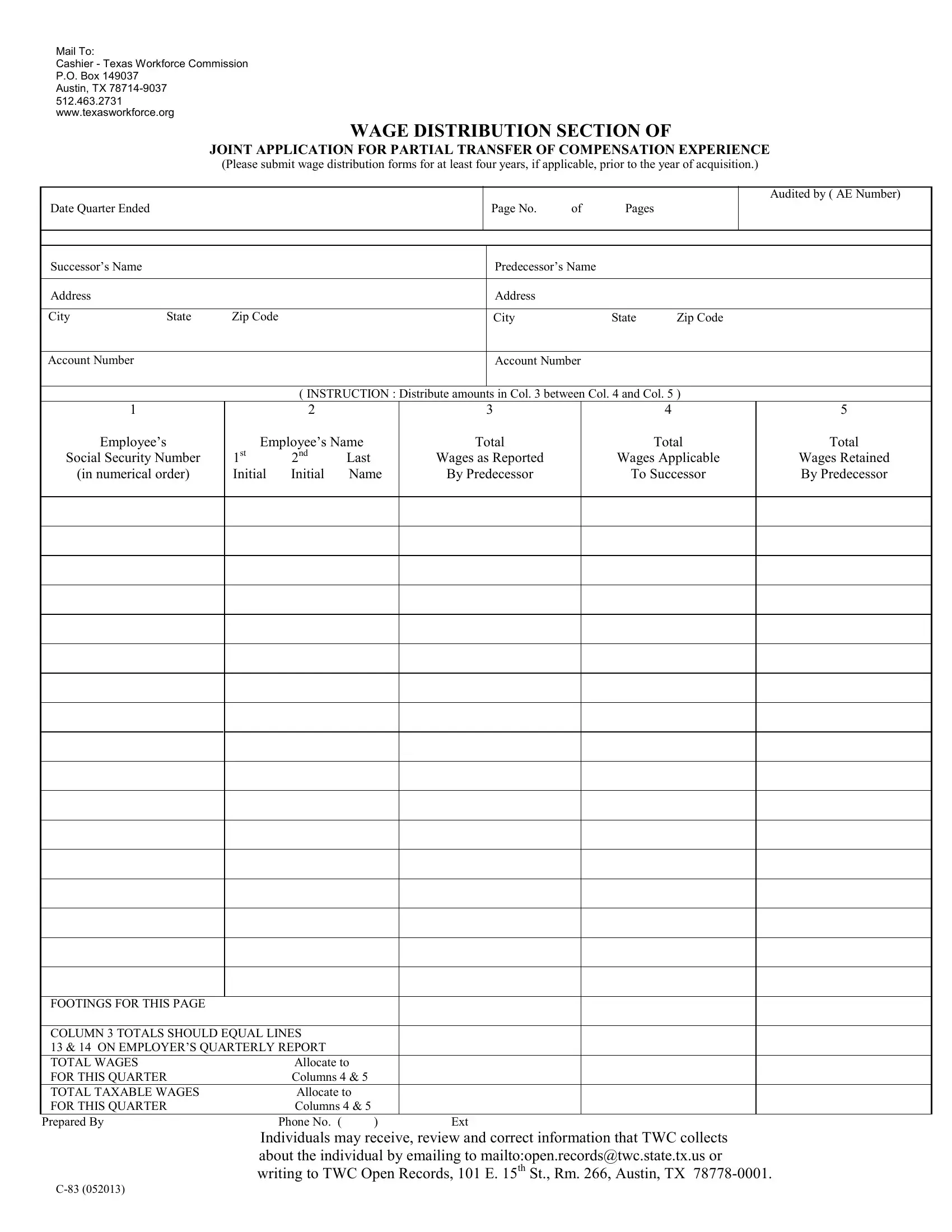

1. When filling out the Texas Form C 83, be sure to incorporate all needed fields within its relevant form section. This will help to expedite the process, which allows your information to be processed without delay and appropriately.

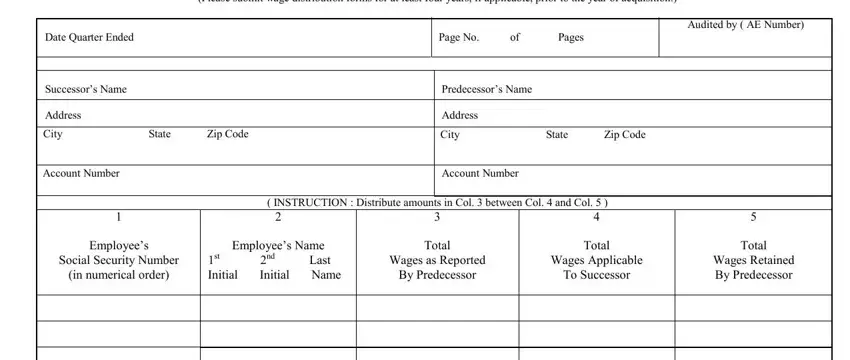

2. Once this section is done, go on to enter the applicable information in these - .

Always be very mindful when filling out this field and next field, because this is where a lot of people make a few mistakes.

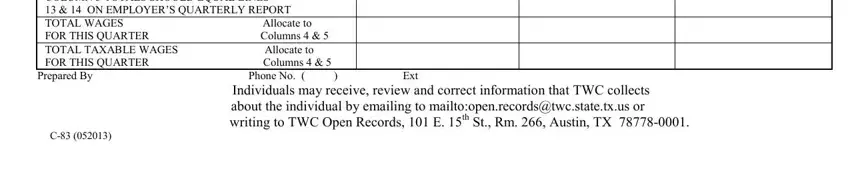

3. The following segment will be focused on FOOTINGS FOR THIS PAGE COLUMN, Prepared By, Phone No, Ext, and Individuals may receive review and - fill in every one of these blanks.

Step 3: Just after proofreading your entries, press "Done" and you're all set! Sign up with us right now and immediately get Texas Form C 83, available for downloading. Each modification you make is conveniently kept , letting you modify the form further as required. When using FormsPal, it is simple to complete forms without being concerned about personal data incidents or entries getting distributed. Our protected platform helps to ensure that your private data is maintained safe.