Affidavit of Heirship for a Motor Vehicle

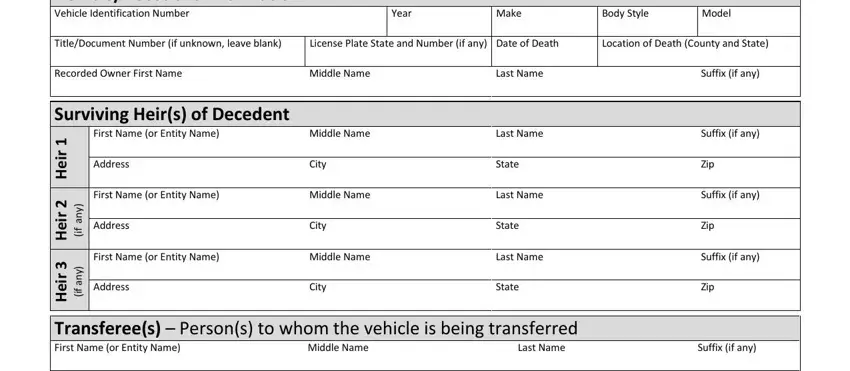

Vehicle/Decedent Information

Vehicle Identification Number |

|

Year |

Make |

|

|

|

|

Title/Document Number (if unknown, leave blank) |

License Plate State and Number (if any) |

Date of Death |

|

|

|

Recorded Owner First Name |

Middle Name |

Last Name |

Surviving Heir(s) of Decedent

|

1 |

|

First Name (or Entity Name) |

Middle Name |

Last Name |

|

|

|

|

|

|

Heir |

|

Address |

City |

State |

|

|

|

|

|

|

First Name (or Entity Name) |

Middle Name |

Last Name |

|

Heir2 |

(ifany) |

|

Address |

City |

State |

|

|

|

|

|

|

First Name (or Entity Name) |

Middle Name |

Last Name |

|

Heir3 |

(ifany) |

|

Address |

City |

State |

|

|

|

|

|

|

|

|

|

Transferee(s) – Person(s) to whom the vehicle is being transferred

First Name (or Entity Name) |

Middle Name |

Last Name |

Additional First Name (if applicable) |

Middle Name |

Last Name |

Address |

City |

State |

Location of Death (County and State)

Suffix (if any)

Suffix (if any)

Zip

Suffix (if any)

Zip

Suffix (if any)

Zip

Suffix (if any)

Suffix (if any)

Zip

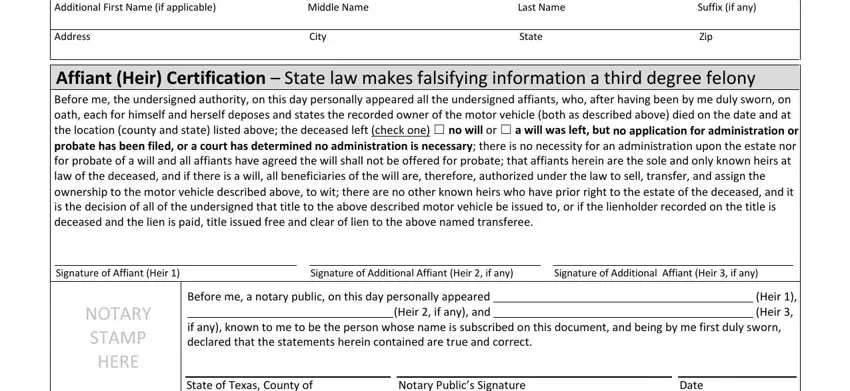

Affiant (Heir) Certification – State law makes falsifying information a third degree felony

Before me, the undersigned authority, on this day personally appeared all the undersigned affiants, who, after having been by me duly sworn, on oath, each for himself and herself deposes and states the recorded owner of the motor vehicle (both as described above) died on the date and at the location (county and state) listed above; the deceased left (check one) ☐ no will or ☐ a will was left, but no application for administration or probate has been filed, or a court has determined no administration is necessary; there is no necessity for an administration upon the estate nor for probate of a will and all affiants have agreed the will shall not be offered for probate; that affiants herein are the sole and only known heirs at law of the deceased, and if there is a will, all beneficiaries of the will are, therefore, authorized under the law to sell, transfer, and assign the ownership to the motor vehicle described above, to wit; there are no other known heirs who have prior right to the estate of the deceased, and it is the decision of all of the undersigned that title to the above described motor vehicle be issued to, or if the lienholder recorded on the title is deceased and the lien is paid, title issued free and clear of lien to the above named transferee.

Signature of Affiant (Heir 1) |

|

Signature of Additional Affiant (Heir 2, if any) |

|

Signature of Additional Affiant (Heir 3, if any) |

|

|

|

|

|

|

|

|

|

|

|

|

Before me, a notary public, on this day personally appeared |

|

|

|

(Heir |

1), |

|

|

|

(Heir 2, if any), and |

|

|

|

(Heir 3, |

|

if any), known to me to be the person whose name is subscribed on this document, and being by me first duly sworn, |

|

declared that the statements herein contained are true and correct. |

|

|

|

|

|

|

|

|

|

|

|

State of Texas, County of |

|

Notary Public’s Signature |

|

Date |

|

|

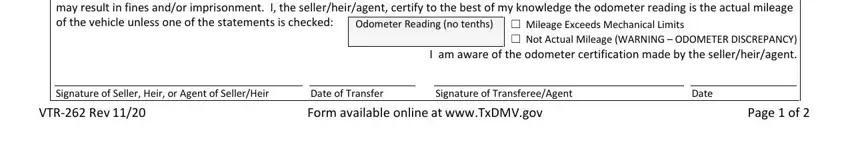

Odometer Disclosure Statement |

|

|

|

|

|

|

|

|

Federal and state law require that you state the mileage upon transfer of ownership. Providing a false statement or failure to complete this form |

|

|

may result in fines and/or imprisonment. I, the seller/heir/agent, certify to the best of my knowledge the odometer reading is the actual mileage |

|

|

of the vehicle unless one of the statements is checked: |

|

|

|

|

|

|

|

Odometer Reading (no tenths) |

☐ Mileage Exceeds Mechanical Limits |

|

|

|

|

|

|

|

|

|

☐ Not Actual Mileage (WARNING – ODOMETER DISCREPANCY) |

|

|

|

|

|

|

I am aware of the odometer certification made by the seller/heir/agent. |

|

|

|

|

|

|

|

|

|

|

|

Signature of Seller, Heir, or Agent of Seller/Heir |

|

Date of Transfer |

|

Signature of Transferee/Agent |

Date |

|

VTR-262 Rev 11/20 |

Form available online at www.TxDMV.gov |

Page 1 of 2 |

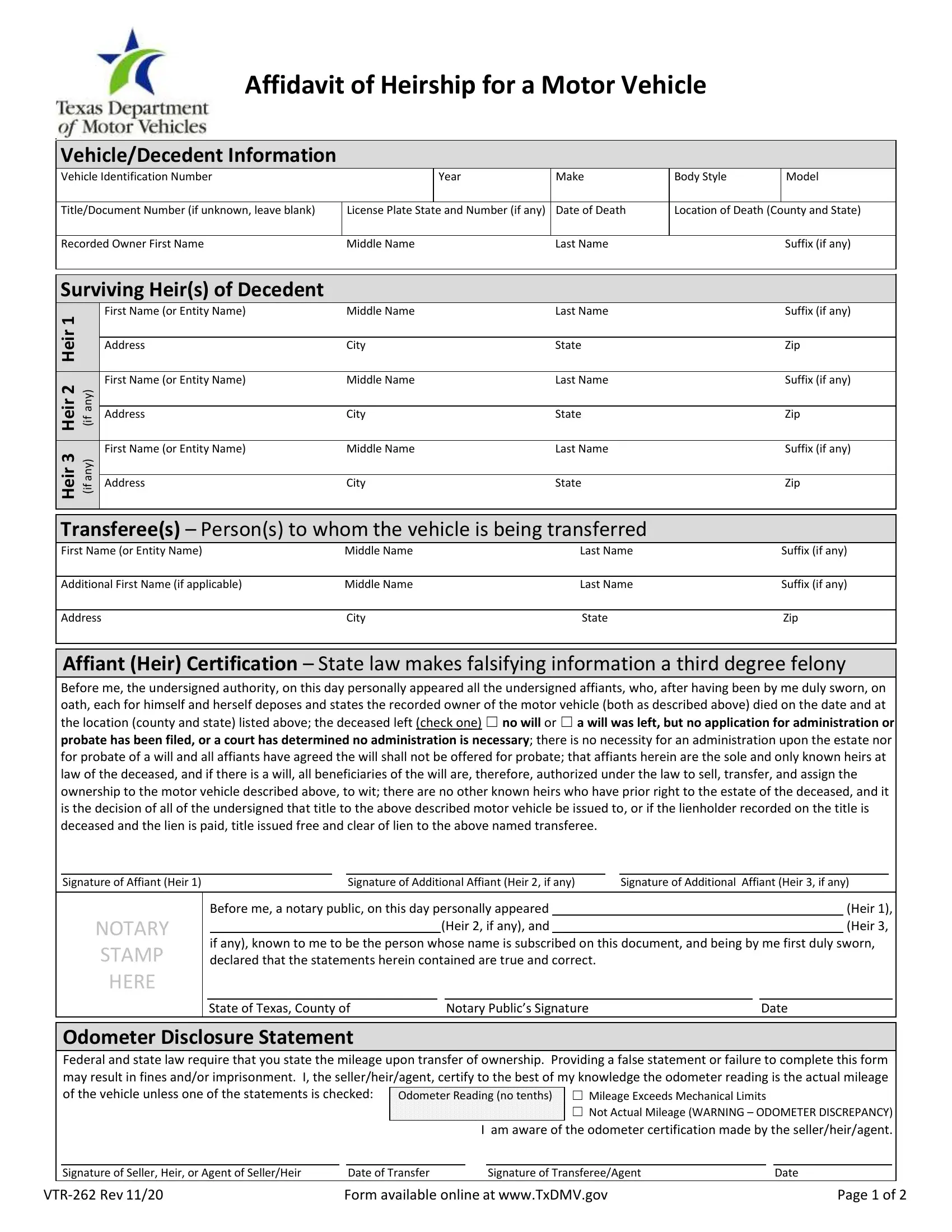

Affidavit of Heirship for a Motor Vehicle

Information

The section is for informational purposes only. Affiant(s) must obtain their own legal advice if required.

If the estate has been probated, the executor or administrator may assign the title provided a certified copy of the probate proceedings, Letters Testamentary, or Letters of Administration is attached. In this situation, this form is not required. Otherwise, the procedures in the “Instructions” section below must be met to transfer ownership.

If there has been no administration on the estate, and no administration is necessary, the heirs may complete this form, and no further documentation is required.

If an heirship affidavit is used when a court has determined no administration is necessary, the affiant(s) must attach the original or certified copy of the court document indicating no administration of the will is necessary and the portions of the will that specify the will is in the deceased owner’s name and indicates the name(s) of the heir(s).

If all heirs cannot appear before one notary public on the same date, or there are more than three heirs, additional copies of this form must be completed. If additional copies of this form are completed, all copies must be submitted by the transferee (or purchaser) with the title application at the time of application to a county tax assessor-collector’s office.

If one of the heirs is a surviving spouse, that heir is the only heir needing to complete this form unless there are surviving children of the decedent with a parent who is other than the surviving spouse in which case all surviving children must also complete this form.

If there is no surviving spouse, all children of the decedent (if any) must sign as affiants.

If the decedent left neither a spouse nor children, consult legal counsel as to who are the “heirs at law.”

Children

Children born to or legally adopted by the decedent qualify for this procedure as “children” of the decedent.

A guardian must sign for any surviving minor children of the decedent and attach Letters of Guardianship.

Instructions

1.Complete the “Vehicle/Decedent Information” section on page 1. All fields are required unless indicated otherwise.

2.The heir(s) (up to three) must complete the “Surviving Heir(s) of Decedent” section on page 1. Refer to the “Information” section above for additional information. If there are more than three heirs, additional completed forms are necessary.

3.Complete the “Transferee(s)” section to indicate to whom the vehicle is being transferred. An heir may also be listed as a transferee.

4.Complete the “Affiant (Heir) Certification” section by marking the appropriate selection as to the will. The preceding three sections of the form must be completed prior to completion of this section. Each heir (up to three) must sign this form before a notary. All signatures must be notarized. This section may not be completed by execution of a power of attorney.

5.The “Odometer Disclosure Statement” section must be completed by an heir (or any agent of an heir) and the purchaser of the motor vehicle if the vehicle is subject to odometer disclosure. This section may be completed after the notarization has been completed. Only one seller/heir is required to execute the odometer disclosure statement.

6.The following documentation is required in order for a title transfer to be processed by the county tax assessor- collector’s office in the name of the title applicant(s):

Application for Texas Title and/or Registration (Form 130-U);

Affidavit of Heirship for a Motor Vehicle (Form VTR-262);

If a court has determined no administration is necessary:

Original or certified copy of the court document indicating no administration of the will is necessary; and

The portions of the will specifying the will is in the decedent’s name and indicating the heir(s);

Title and/or registration verification if the vehicle was last titled out of state;

Release of Lien (if a lien is recorded on the title record); and

A copy of current proof of liability insurance in the applicant’s name (if applying for registration).

Note: Errors that have been lined through and corrected require a statement of fact. Erasures and significant alterations may require a new form to be completed.

VTR-262 Rev 11/20 |

Form available online at www.TxDMV.gov |

Page 2 of 2 |