Having the goal of allowing it to be as quick to operate as possible, we designed our PDF editor. The whole process of filling up the texas ifta report is going to be quick in the event you check out the next actions.

Step 1: To start with, select the orange "Get form now" button.

Step 2: Now you are able to enhance texas ifta report. You have lots of options with our multifunctional toolbar - you'll be able to add, delete, or modify the content material, highlight the certain components, as well as carry out other commands.

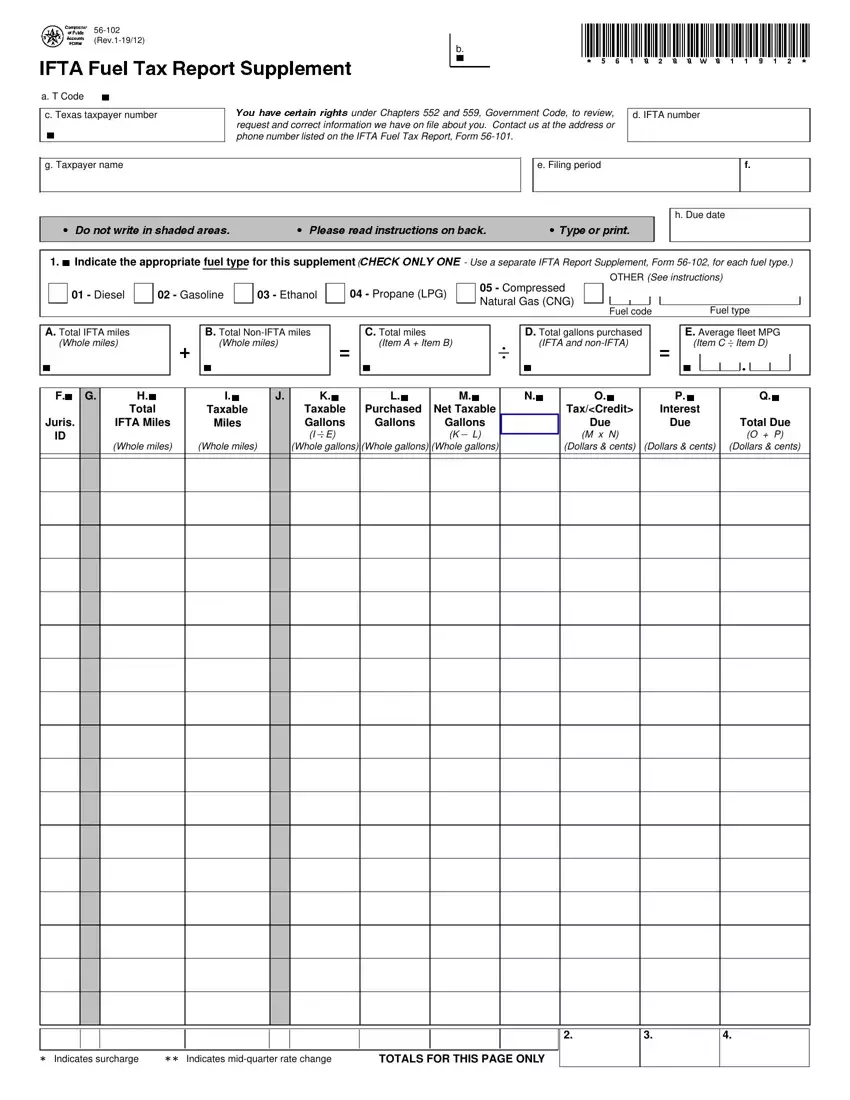

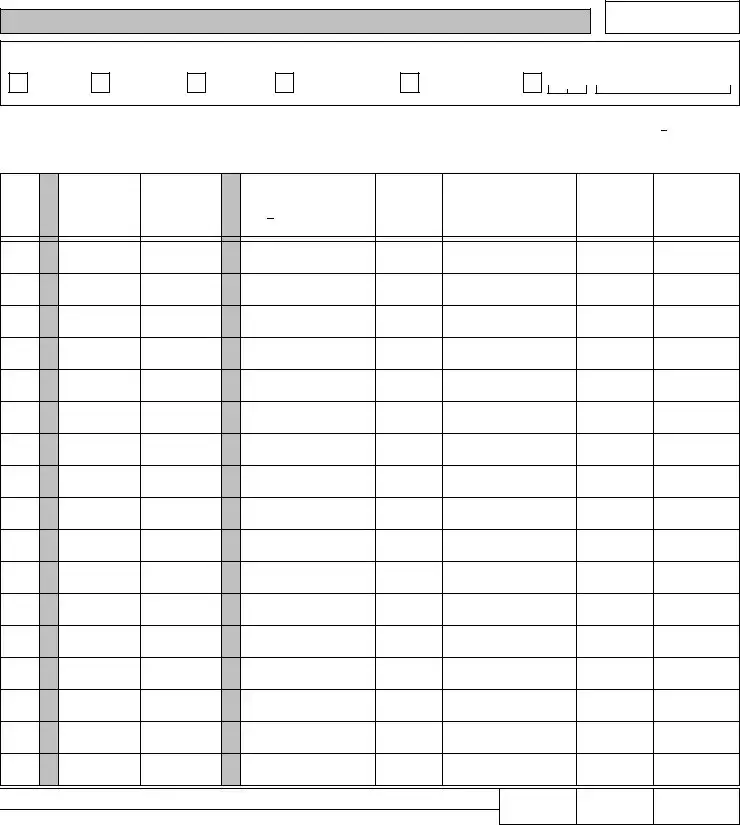

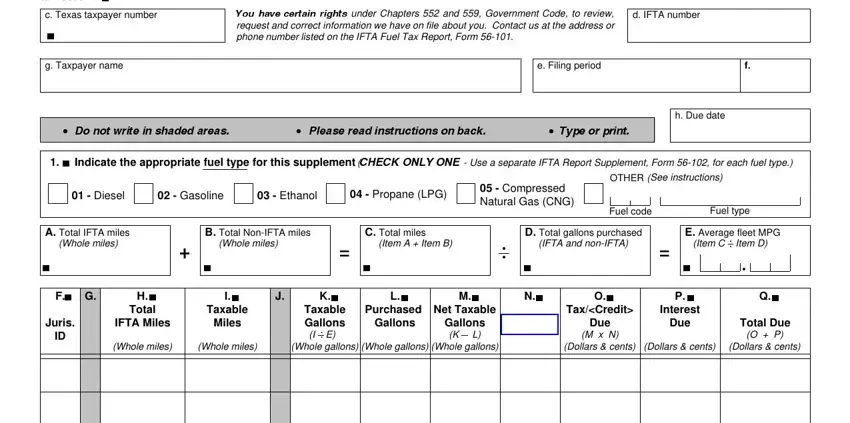

If you want to complete the document, provide the content the application will request you to for each of the next segments:

Type in the required data in the field .

In the Indicates surcharge, Indicates midquarter rate change, and TOTALS FOR THIS PAGE ONLY area, identify the crucial data.

Step 3: As soon as you select the Done button, the finalized document is readily transferable to each of your gadgets. Alternatively, you can deliver it by using email.

Step 4: Make sure to stay away from forthcoming problems by generating at least a couple of duplicates of your file.