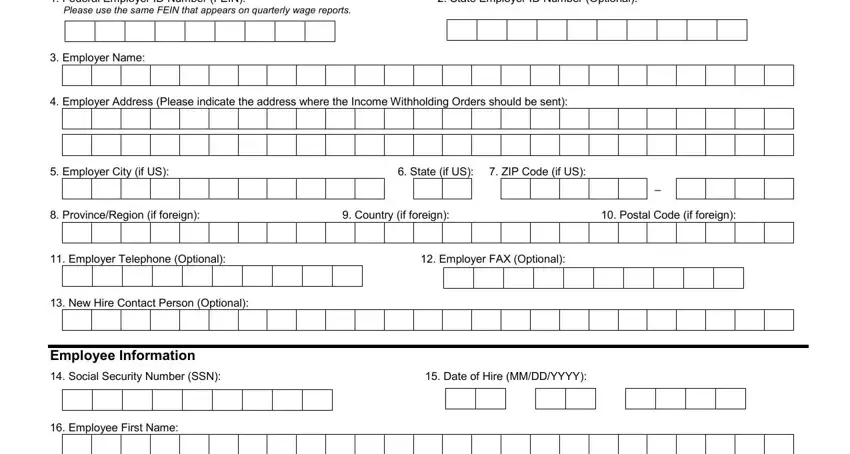

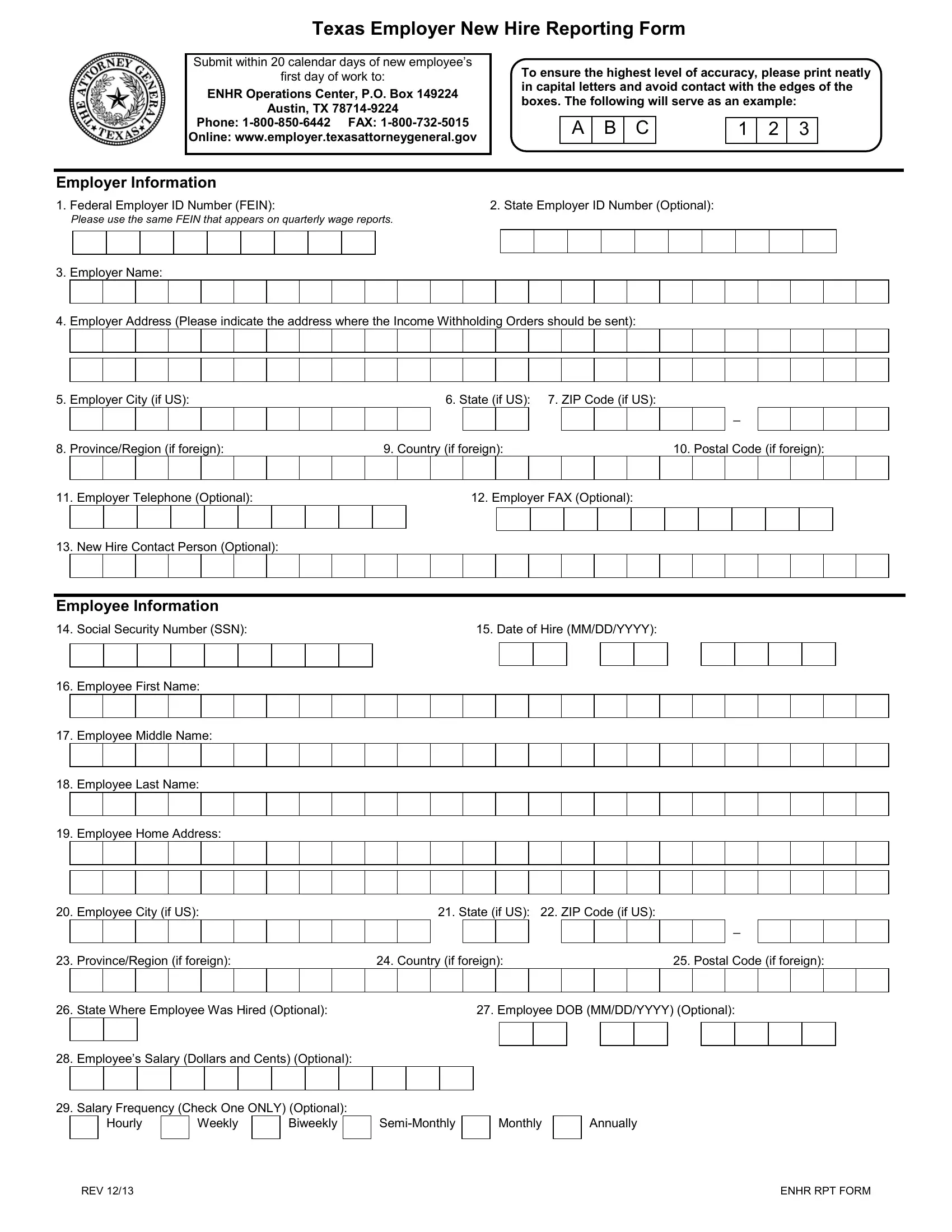

INSTRUCTIONS FOR COMPLETING THE TEXAS EMPLOYER NEW HIRE REPORTING FORM

The purpose of the Texas New Hire Reporting Form is to allow employers to fulfill new hire reporting requirements. You may enter your

employer information and photocopy a supply and then enter employee information on the copies.

REPORTING OF NEW HIRES IS REQUIRED:

All required items (numbers 1, 3, 4, 5, 6, 7, 14, 15, 16, 17, 18, 19, 20, 21, 22) on this form must be completed.

Box 1: Federal Employer ID Number (FEIN). Provide the 9-digit employer identification number that the federal government assigns to the employer. This is the same number used for federal tax reporting. Please use the same FEIN that appears on quarterly wage reports.

Box 2: State Employer ID Number (Optional). Identification number assigned to the employer by the Texas Workforce Commission.

Box 3: Employer Name. The employer name as listed on the employee’s W4 form. Please do not provide more than one employer name (for example, “ABC, Inc DBA. John Doe Paint and Body Shop” is not correct).

Box 4: Employer Address. Please indicate the address where the Income Withholding Orders should be sent. Do not provide more than one address (for example, P.O. Box 123, 1313 Mockingbird Lane is not correct).

Box 8: Employer Province/Region (if foreign). Provide this information if the employer address is not in the United States.

Box 9: Employer Country (if foreign). Provide the two letter country abbreviation if the employer address is not in the United States.

Box 10: Postal Code (if foreign). Provide the postal code if the employer address is not in the United States.

Box 13: New Hire Contact Person (Optional). Providing the name of a contact staff person will facilitate communication between the employer and the Texas Employer New Hire Reporting Program.

Box 15: Date of Hire. List the date in month, day and year order. Use four digits for the year (for example, 2001). This should be the first day that services are performed for wages by an individual. If you are reporting a rehire (where a new W-4 is prepared) use the return date, not the original date of hire.

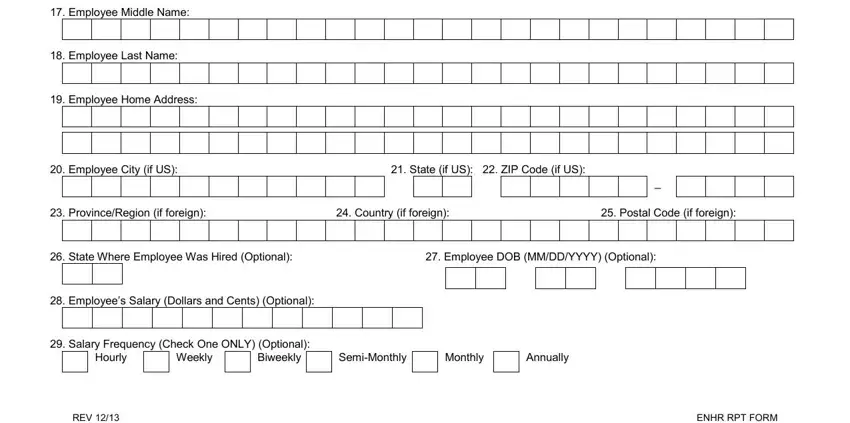

Box 23: Employee Province/Region (if foreign). Provide this information if the employee does not reside in the United States.

Box 24: Employee Country (if foreign). Provide the two letter country abbreviation if the employee address is not in the United States.

Box 25: Postal Code (if foreign). Provide the postal code if the employee address is not in the United States.

Box 26: State Where Employee was Hired. Use the abbreviation recognized by the U.S. Postal Service for the state in which the employee was hired.

Box 27: Employee DOB (Date of Birth) (Optional). List the date in month, day and year order. Use four digits for the year (for example, 1985).

Box 28: Employee Salary (Optional). Enter employee’s exact wages in dollars and cents. This should correspond to the salary pay

frequency indicated in Box 29.

Box 29: Salary (Check One ONLY) (Optional). Check the appropriate box relating to the employee’s salary pay frequency. Check “ Bi- weekly” if the salary is based on 26 pay periods. Check “Semi-monthly” if the salary is based on 24 pay periods. Check “Annually” if salary

payment is a one-time distribution.

SUBMISSION OF NEW HIRE REPORTS. The Texas Employer New Hire Reporting Program offers a variety of methods that employers can use to submit new hire reports. For further information on which method may be best for you, call 1-800-850-6442. Employers are encouraged to keep photocopies or electronic records of all reports submitted. When the form is completed, send it to the Texas Employer New Hire Reporting Program using one of the following means:

∙FAX: 1-800-732-5015

∙U.S. Mail:

ENHR Operations Center

P.O. Box 149224

Austin, TX 78714-9224

∙Telephone Submissions: 1-800-850-6442

∙Internet Submissions: www.employer.texasattorneygeneral.gov

Employers must provide all of the required information within 20 calendar days of the employee's first day of work to be in compliance. State law provides a penalty of $25 for each employee an employer knowingly fails to report, and a penalty of $500 for conspiring with an employee to 1) fail to file a report or 2) submit a false or incomplete report.