SECTION 8: ELIGIBILITY REQUIREMENTS (continued)

•If your five consecutive, complete years of qualifying teaching service began before October 30, 2004:

o You may receive up to $5,000 in loan forgiveness if, as certified by the chief administrative officer of the eligible school or educational service agency where you were employed, you were:

A full-time teacher for elementary school students and you demonstrated knowledge and teaching skills in reading, writing, mathematics, and other areas of the elementary school curriculum; or

A full-time teacher for secondary school students and you taught in a subject area that was relevant to your academic major.

oYou may receive up to $17,500 in loan forgiveness if, as certified by the chief administrative officer of the eligible school or educational service agency where you were employed, you were:

A highly qualified full-time teacher of mathematics or science to secondary school students; or

A highly qualified special education teacher whose primary responsibility was to provide special education to children with disabilities, and you taught children with disabilities that corresponded to your area of special education training and have demonstrated knowledge and teaching skills in the content areas of the curriculum that you taught.

•If your five consecutive, complete years of qualifying teaching service began on or after October 30, 2004:

oYou may receive up to $5,000 in loan forgiveness if, as certified by the chief administrative officer of the school or educational service agency where you were employed, you were a highly qualified full-time teacher for elementary or secondary school students.

oYou may receive up to $17,500 in loan forgiveness if, as certified by the chief administrative officer of the school or educational service agency where you were employed, you were:

A highly qualified full-time teacher of mathematics or science to secondary school students; or

A highly qualified special education teacher whose primary responsibility was to provide special education to children with disabilities, and you taught children with disabilities that corresponded to your area of special education training and have demonstrated knowledge and teaching skills in the content areas of the curriculum that you taught.

•If you were unable to complete an academic year of teaching, that year may still be counted toward the required five consecutive, complete academic years if:

oYou completed at least one-half of the academic year; and

oYour employer considers you to have fulfilled your contract requirements for the academic year for the purposes of salary increases, tenure, and retirement; and o You were unable to complete the academic year because:

You returned to postsecondary education, on at least a half-time basis, in an area of study directly related to the performance of the teaching service described above; or

You had a condition covered under the Family and Medical Leave Act of 1993 (FMLA); or

You were called or ordered to active duty status for more than 30 days as a member of a reserve component of the Armed Forces.

Note: Absence due to a period of postsecondary education, a condition covered under the FMLA, or active duty service, including the time needed for you to resume teaching no later than the beginning of the next regularly scheduled academic year, does not constitute a break in the required five consecutive, complete years of qualifying teaching service.

SECTION 9: WHERE TO SEND THE COMPLETED TEACHER LOAN FORGIVENESS APPLICATION

Return the completed form and any attachments to: |

If you need help completing this form, call: |

(If no address is shown, return to your loan holder.) |

(If no phone number is shown, call your loan holder.) |

Student Assistance Foundation |

Student Assistance Foundation |

PO Box 5209 |

(800) 852-2761 ext. 6657 |

Helena MT 59604-5209 |

Or email customerservice@safmt.org |

Fax: (406) 495-7880

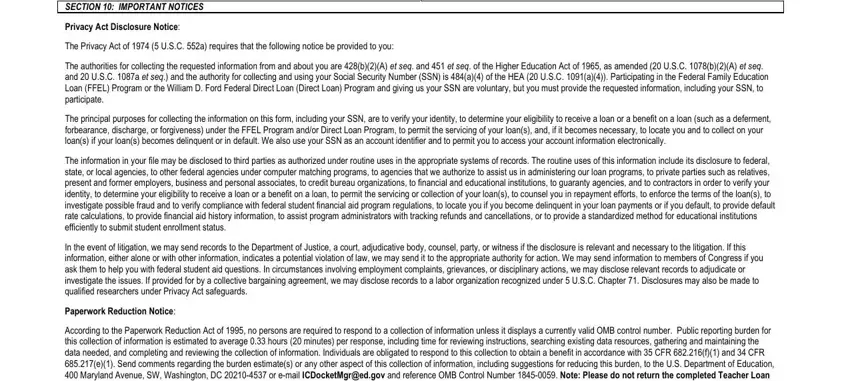

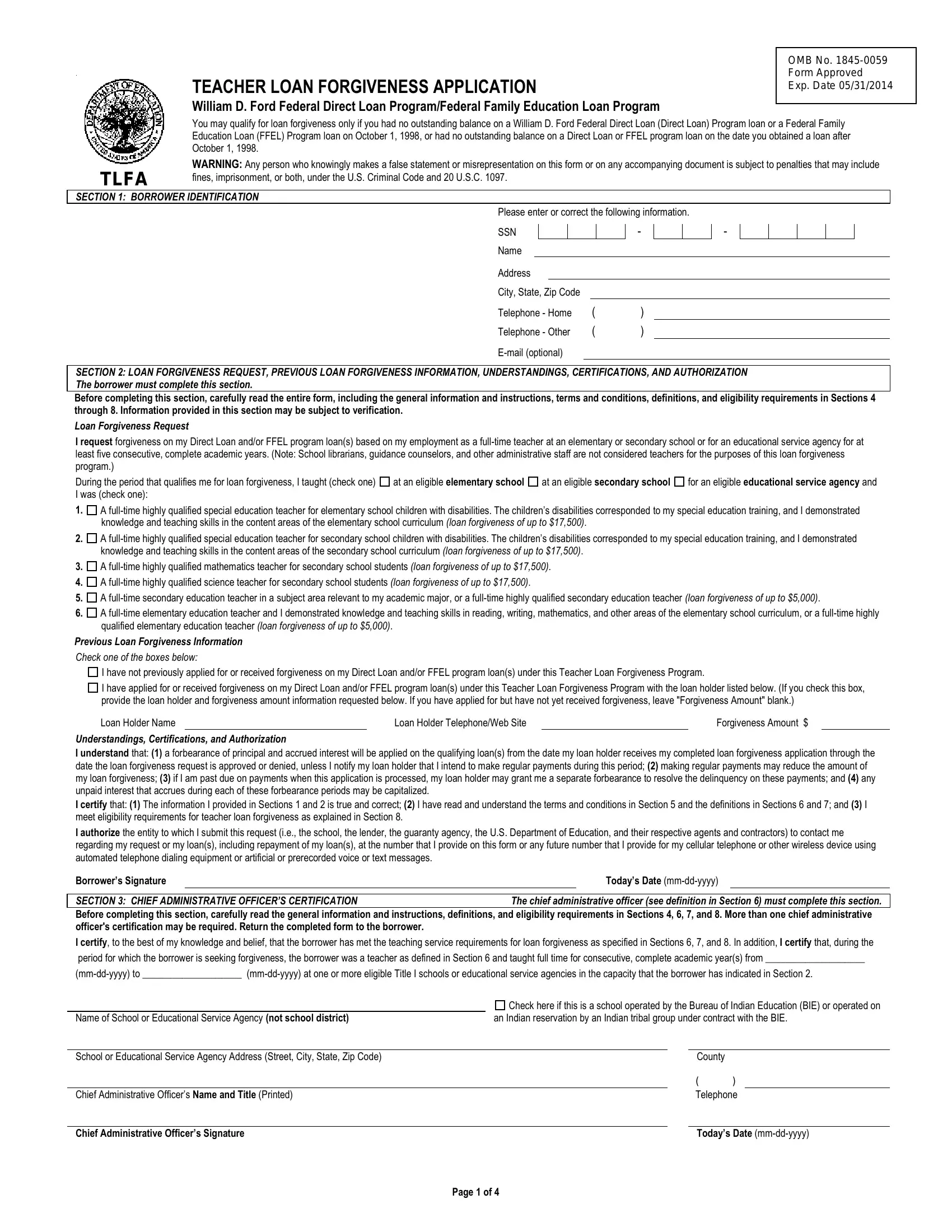

SECTION 10: IMPORTANT NOTICES

Privacy Act Disclosure Notice:

The Privacy Act of 1974 (5 U.S.C. 552a) requires that the following notice be provided to you:

The authorities for collecting the requested information from and about you are 428(b)(2)(A) et seq. and 451 et seq. of the Higher Education Act of 1965, as amended (20 U.S.C. 1078(b)(2)(A) et seq. and 20 U.S.C. 1087a et seq.) and the authority for collecting and using your Social Security Number (SSN) is 484(a)(4) of the HEA (20 U.S.C. 1091(a)(4)). Participating in the Federal Family Education Loan (FFEL) Program or the William D. Ford Federal Direct Loan (Direct Loan) Program and giving us your SSN are voluntary, but you must provide the requested information, including your SSN, to participate.

The principal purposes for collecting the information on this form, including your SSN, are to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan (such as a deferment, forbearance, discharge, or forgiveness) under the FFEL Program and/or Direct Loan Program, to permit the servicing of your loan(s), and, if it becomes necessary, to locate you and to collect on your loan(s) if your loan(s) becomes delinquent or in default. We also use your SSN as an account identifier and to permit you to access your account information electronically.

The information in your file may be disclosed to third parties as authorized under routine uses in the appropriate systems of records. The routine uses of this information include its disclosure to federal, state, or local agencies, to other federal agencies under computer matching programs, to agencies that we authorize to assist us in administering our loan programs, to private parties such as relatives, present and former employers, business and personal associates, to credit bureau organizations, to financial and educational institutions, to guaranty agencies, and to contractors in order to verify your identity, to determine your eligibility to receive a loan or a benefit on a loan, to permit the servicing or collection of your loan(s), to counsel you in repayment efforts, to enforce the terms of the loan(s), to investigate possible fraud and to verify compliance with federal student financial aid program regulations, to locate you if you become delinquent in your loan payments or if you default, to provide default rate calculations, to provide financial aid history information, to assist program administrators with tracking refunds and cancellations, or to provide a standardized method for educational institutions efficiently to submit student enrollment status.

In the event of litigation, we may send records to the Department of Justice, a court, adjudicative body, counsel, party, or witness if the disclosure is relevant and necessary to the litigation. If this information, either alone or with other information, indicates a potential violation of law, we may send it to the appropriate authority for action. We may send information to members of Congress if you ask them to help you with federal student aid questions. In circumstances involving employment complaints, grievances, or disciplinary actions, we may disclose relevant records to adjudicate or investigate the issues. If provided for by a collective bargaining agreement, we may disclose records to a labor organization recognized under 5 U.S.C. Chapter 71. Disclosures may also be made to qualified researchers under Privacy Act safeguards.

Paperwork Reduction Notice:

According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a currently valid OMB control number. Public reporting burden for this collection of information is estimated to average 0.33 hours (20 minutes) per response, including time for reviewing instructions, searching existing data resources, gathering and maintaining the data needed, and completing and reviewing the collection of information. Individuals are obligated to respond to this collection to obtain a benefit in accordance with 35 CFR 682.216(f)(1) and 34 CFR 685.217(e)(1). Send comments regarding the burden estimate(s) or any other aspect of this collection of information, including suggestions for reducing this burden, to the U.S. Department of Education, 400 Maryland Avenue, SW, Washington, DC 20210-4537 or e-mail ICDocketMgr@ed.gov and reference OMB Control Number 1845-0059. Note: Please do not return the completed Teacher Loan

Forgiveness Application to this address.

If you have any questions regarding the status of your individual submission of this form, contact your loan holder (see Section 9).