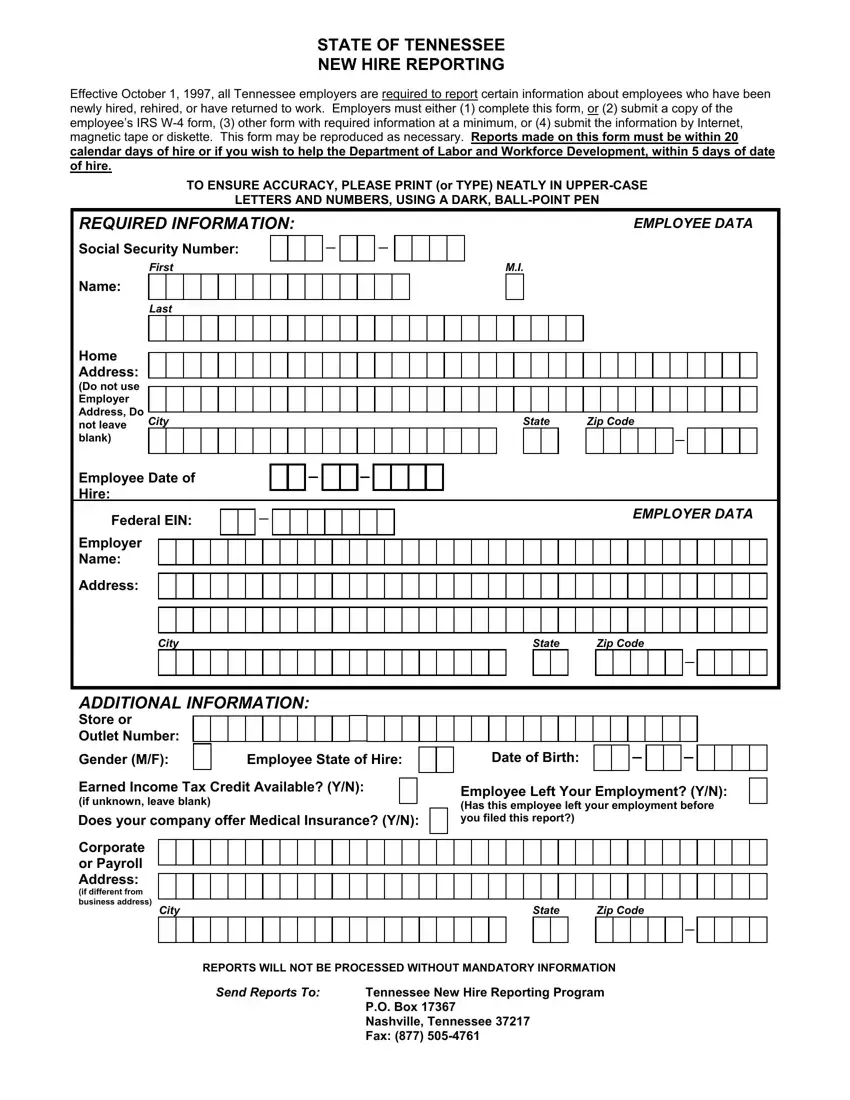

Our top level computer programmers worked hard to implement the PDF editor we are excited to deliver to you. The app permits you to simply fill in new hire tn form and can save your time. You just have to keep up with the following guide.

Step 1: Hit the button "Get form here" to open it.

Step 2: So you are going to be on the file edit page. You can include, change, highlight, check, cross, insert or erase fields or words.

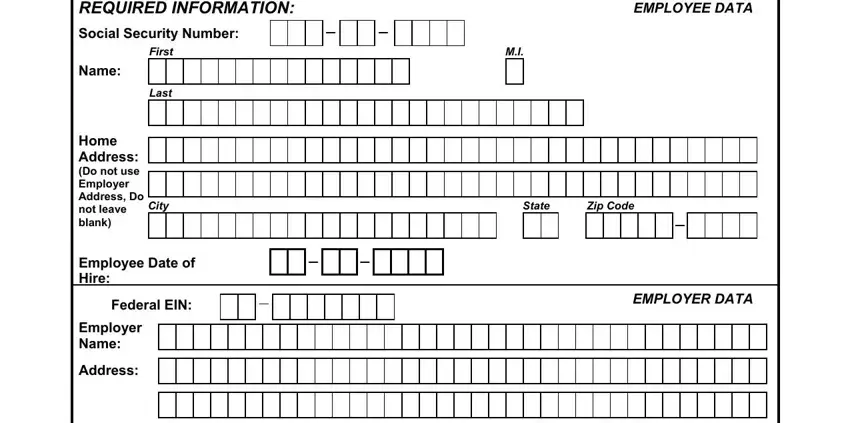

All of the following parts will help make up your PDF file:

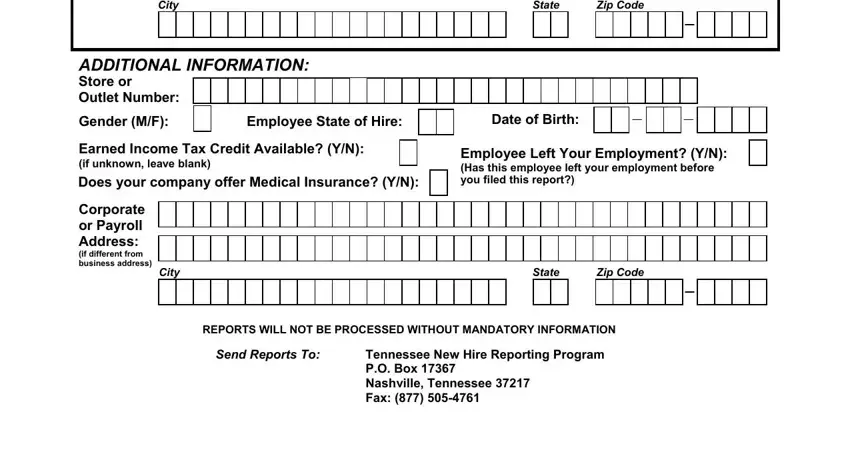

Fill in the City, State, Zip Code, ADDITIONAL INFORMATION Store or, Gender MF, Employee State of Hire, Date of Birth, Earned Income Tax Credit Available, Employee Left Your Employment YN, Corporate or Payroll Address if, City, State, Zip Code, REPORTS WILL NOT BE PROCESSED, and Send Reports To space with the particulars asked by the system.

Step 3: Press the Done button to be sure that your finalized form is available to be exported to every electronic device you want or mailed to an email you specify.

Step 4: To avoid all of the headaches as time goes on, be sure to prepare a minimum of two or three duplicates of your form.