In case you want to fill out fillable tr2 ft revenue, you won't need to install any kind of programs - simply try using our PDF tool. To make our tool better and simpler to work with, we continuously work on new features, with our users' suggestions in mind. Starting is simple! All you need to do is adhere to the next basic steps below:

Step 1: Simply press the "Get Form Button" in the top section of this webpage to open our pdf editing tool. This way, you'll find all that is necessary to work with your file.

Step 2: This editor enables you to modify your PDF in many different ways. Change it by including any text, correct existing content, and place in a signature - all when it's needed!

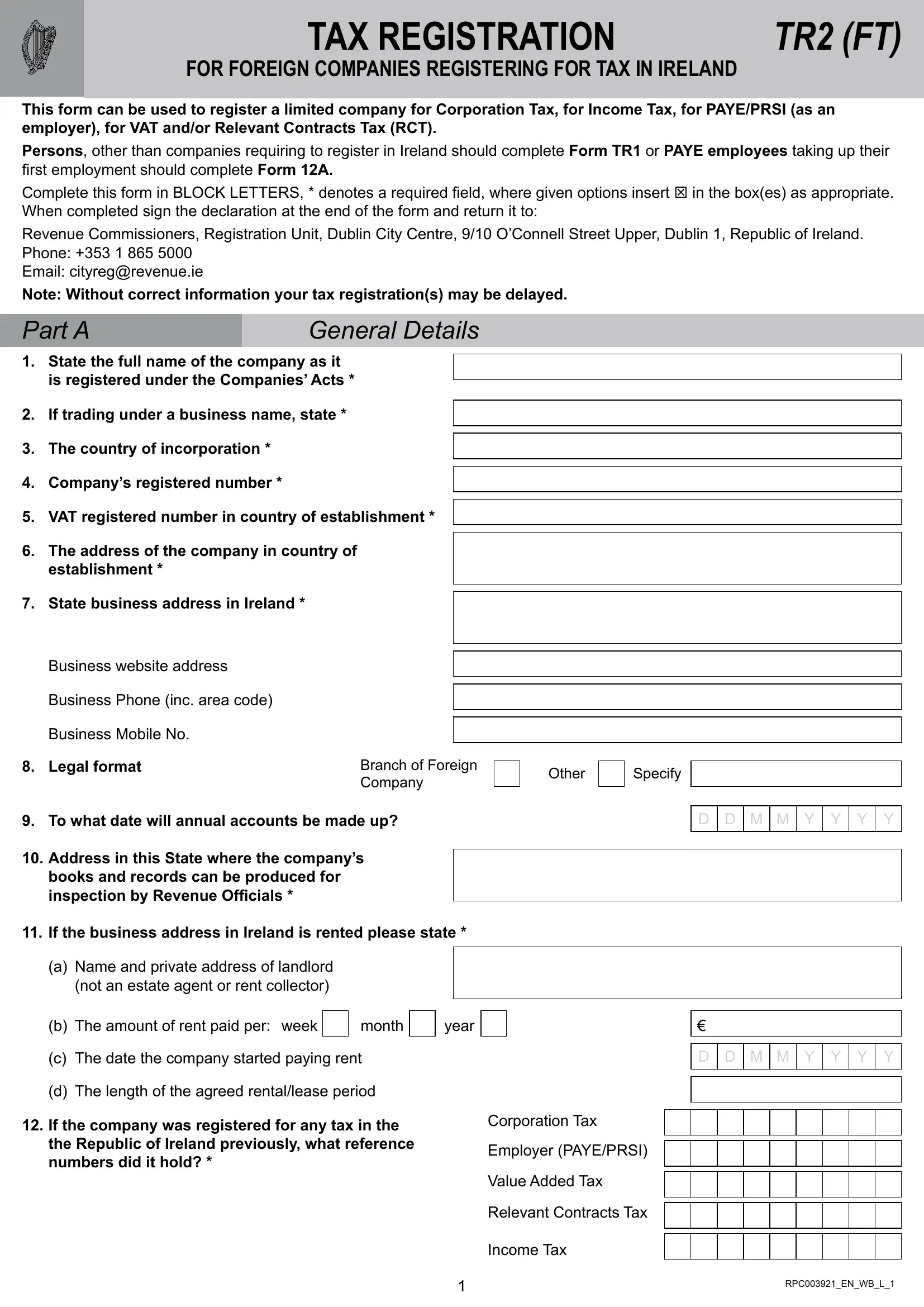

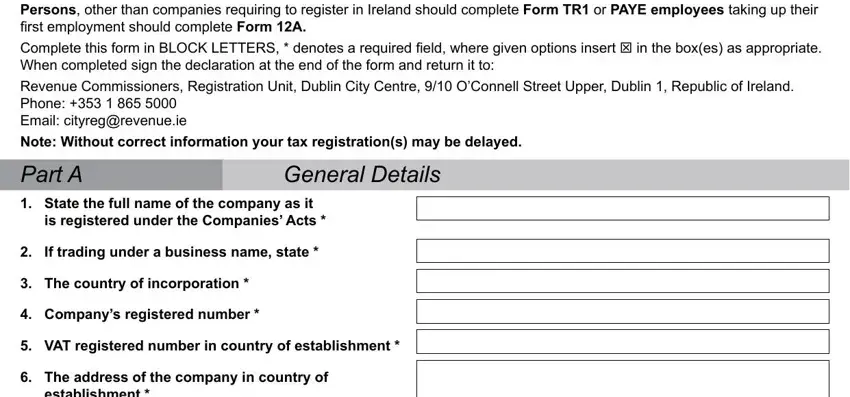

When it comes to blanks of this precise document, this is what you should consider:

1. It is important to complete the fillable tr2 ft revenue accurately, thus take care while working with the segments comprising these particular blank fields:

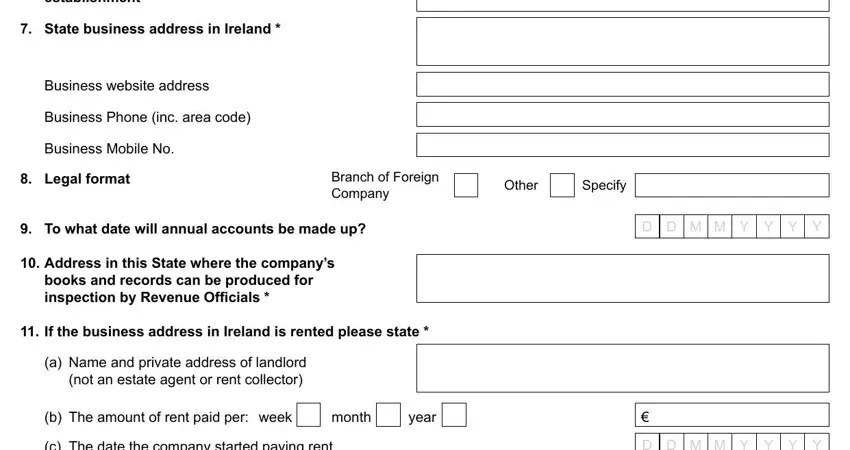

2. After this section is completed, you're ready to insert the required specifics in The address of the company in, establishment, State business address in Ireland, Business website address, Business Phone inc area code, Business Mobile No, Legal format, Branch of Foreign Company, Other, Specify, To what date will annual accounts, D D M M Y Y Y Y, Address in this State where the, books and records can be produced, and If the business address in so you can go further.

Be extremely careful while filling out Address in this State where the and establishment, since this is where many people make errors.

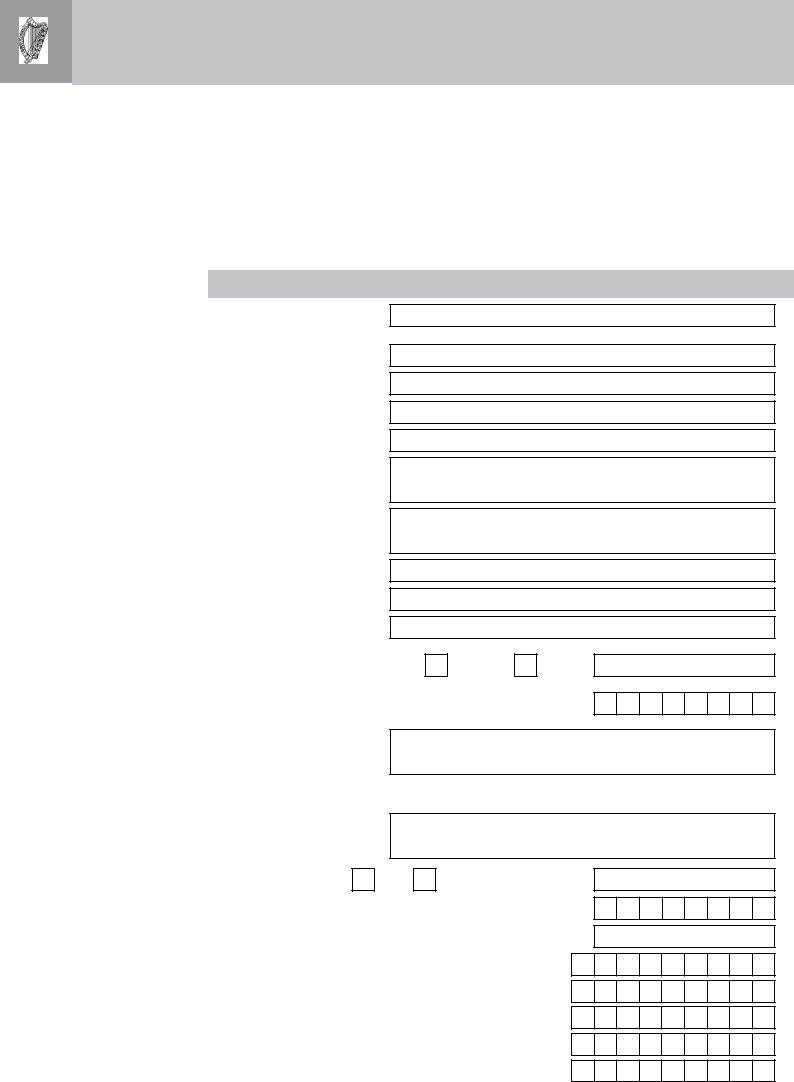

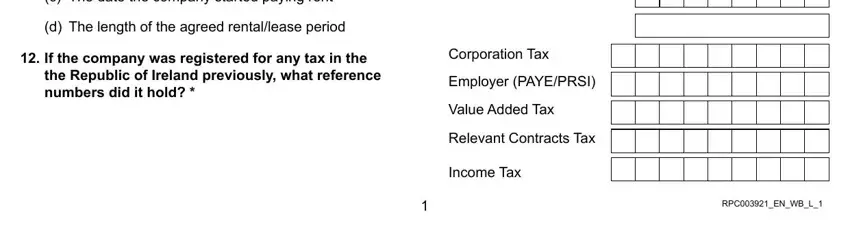

3. This next step is quite simple, c The date the company started, d The length of the agreed, D D M M Y Y Y Y, If the company was registered for, the Republic of Ireland previously, Corporation Tax, Employer PAYEPRSI, Value Added Tax, Relevant Contracts Tax, Income Tax, and RPCENWBL - all these empty fields needs to be filled in here.

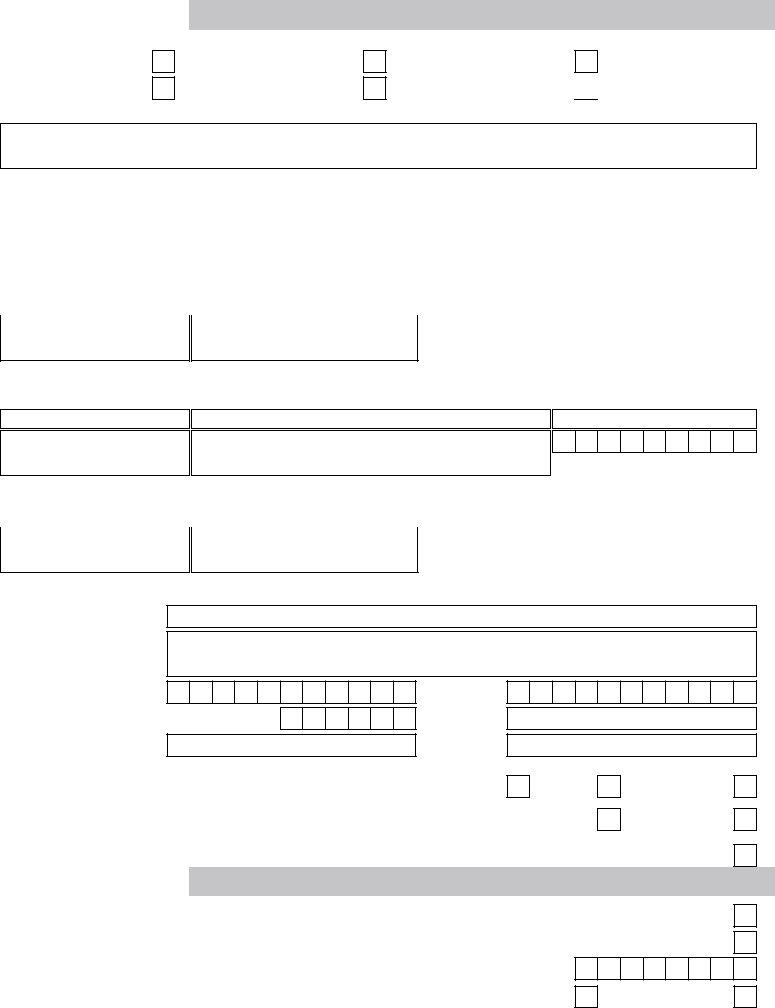

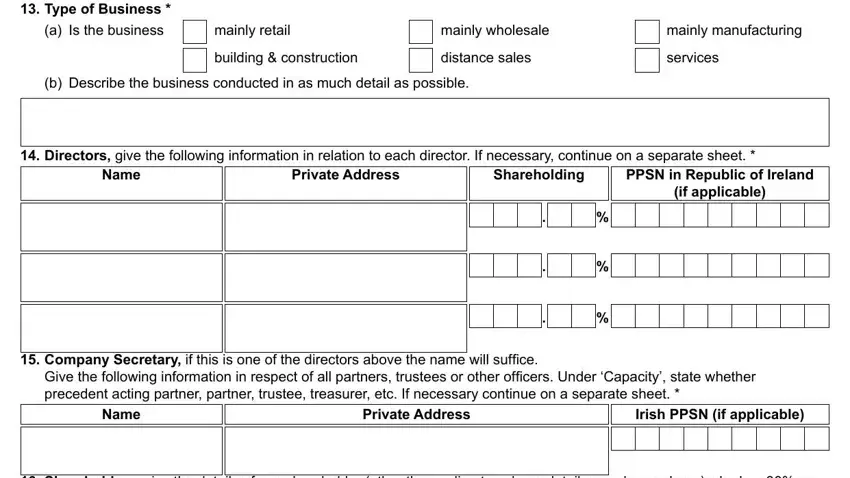

4. This next section requires some additional information. Ensure you complete all the necessary fields - Part A continued Type of Business, mainly retail building, mainly wholesale distance sales, mainly manufacturing services, Directors give the following, Name, Private Address, Shareholding, PPSN in Republic of Ireland, if applicable, Company Secretary if this is one, precedent acting partner partner, Name, Private Address, and Irish PPSN if applicable - to proceed further in your process!

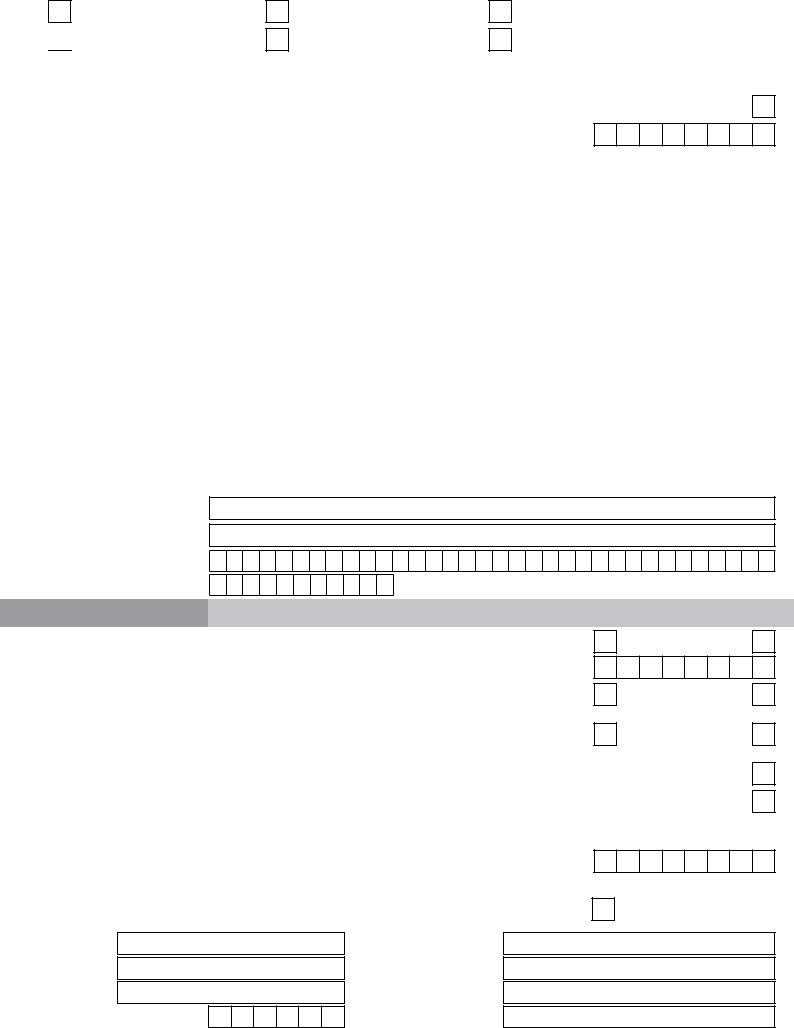

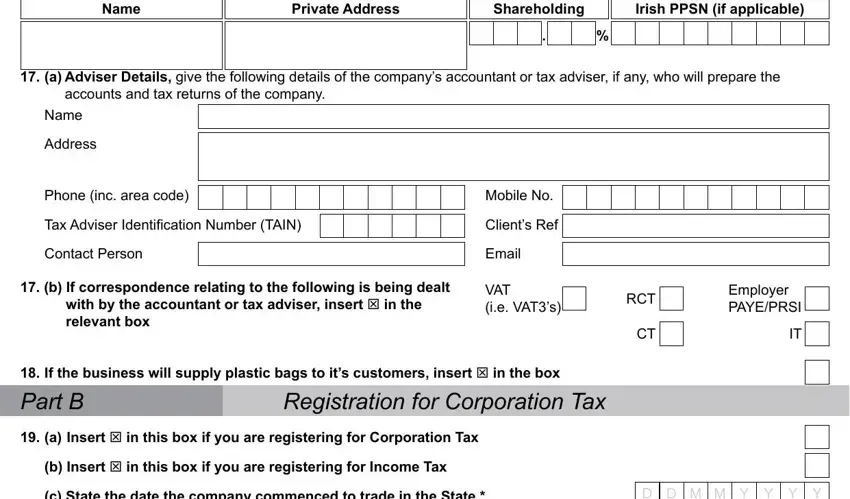

5. This pdf has to be concluded by filling in this area. Here you can see a detailed set of form fields that require appropriate details in order for your form submission to be accomplished: Name, Private Address, Shareholding, Irish PPSN if applicable, a Adviser Details give the, accounts and tax returns of the, Address, Phone inc area code, Tax Adviser Identiication Number, Contact Person, b If correspondence relating to, with by the accountant or tax, relevant box, Mobile No, and Clients Ref.

Step 3: Before moving on, it's a good idea to ensure that blank fields were filled out the right way. The moment you are satisfied with it, click “Done." Sign up with FormsPal right now and instantly gain access to fillable tr2 ft revenue, prepared for downloading. Every single edit made is handily saved , allowing you to change the form at a later stage anytime. With FormsPal, you can certainly fill out forms without worrying about personal data breaches or records being distributed. Our protected platform makes sure that your personal data is stored safe.