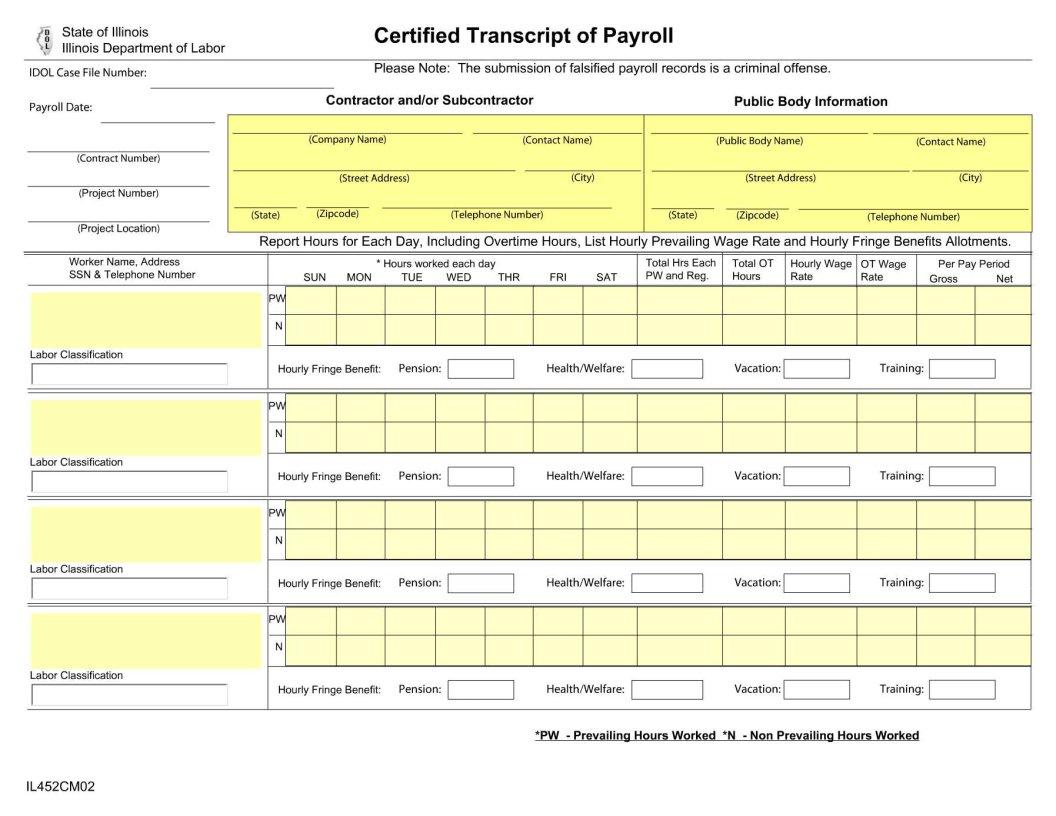

The Transcript Payroll form is a critical document issued by the State of Illinois and overseen by the Illinois Department of Labor (IDOL). It plays a vital role in maintaining transparency and adherence to labor laws concerning payroll practices. The form requires contractors and subcontractors working on projects to meticulously report a variety of details, highlighting the importance of accuracy and compliance. These details include personal information about workers such as names, addresses, and Social Security numbers, alongside the project-specific information including contract and project numbers, and details of the public body involved. The form delves deeper into the specifics of labor by asking for daily reports on hours worked, including overtime, and lists the prevailing wage rates alongside any fringe benefits like pensions, health and welfare contributions, vacation, and training allowances. It is specifically noted that the submission of falsified records is a criminal offense, underlining the seriousness with which this process must be undertaken. The inclusion of instructions about fringe benefits and their payment methods reflects the form’s comprehensive approach to ensuring workers are fairly compensated. Moreover, the requirement for listing subcontractors and independent contractors emphasizes a broad scope of responsibility among primary contractors. The IDOL also offers resources for further guidance, indicating a commitment to assisting employers in understanding their obligations under the law. This form is thus a crucial tool in enforcing labor laws, safeguarding workers' rights, and promoting a fair working environment in Illinois.

| Question | Answer |

|---|---|

| Form Name | Transcript Payroll Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | illinois certified payroll, illinois certified payroll forms printable, illinois certified payroll form, form certified transcript payroll |