Dealing with PDF files online is actually super easy with our PDF tool. Anyone can fill in when on death to report here in a matter of minutes. Our team is aimed at providing you the perfect experience with our tool by continuously introducing new capabilities and upgrades. Our editor has become much more user-friendly thanks to the latest updates! At this point, filling out PDF forms is easier and faster than before. All it takes is just a few easy steps:

Step 1: Click the "Get Form" button above on this page to open our PDF editor.

Step 2: The tool enables you to customize PDF documents in various ways. Improve it by adding your own text, correct original content, and place in a signature - all readily available!

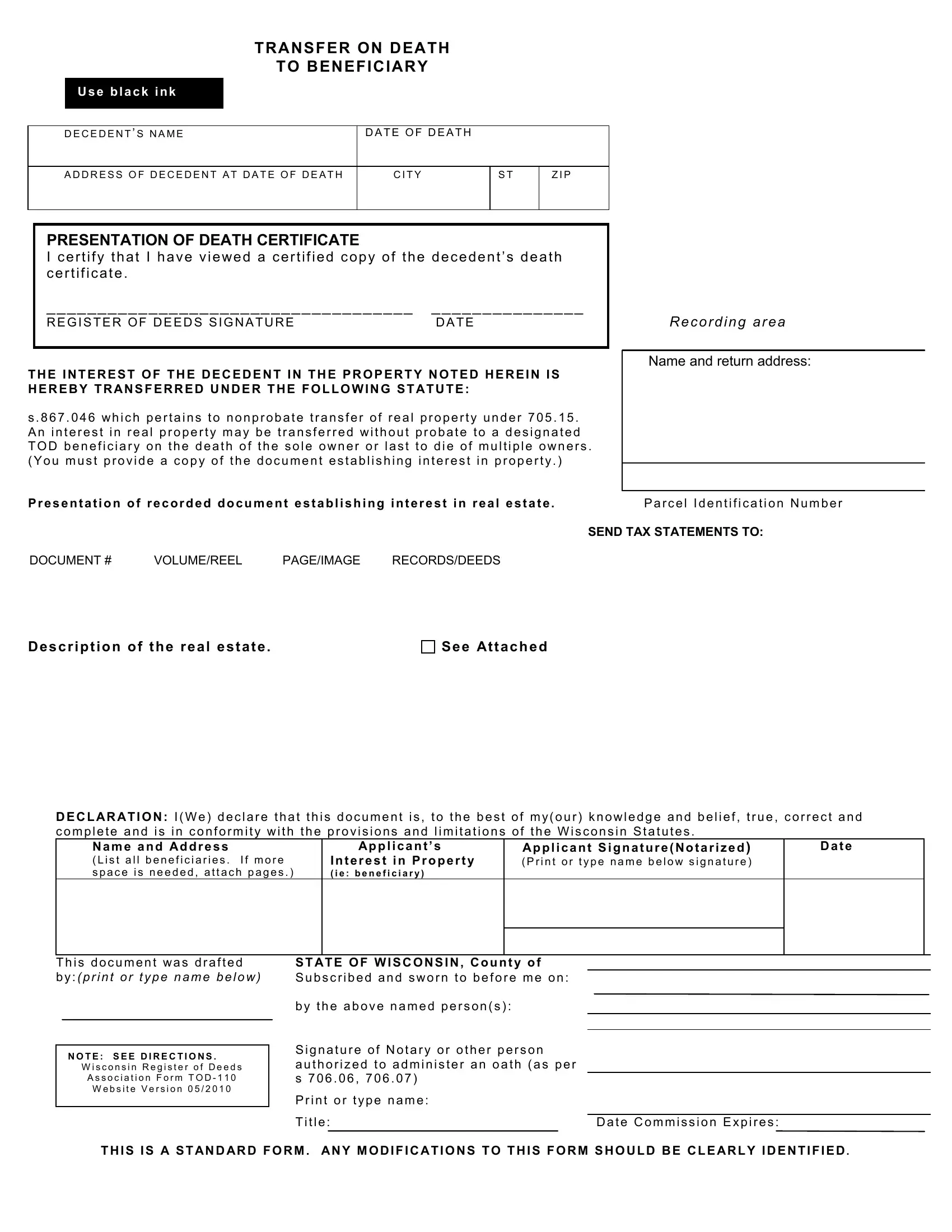

As a way to fill out this PDF form, make certain you type in the information you need in each field:

1. To start with, once filling out the when on death to report, start in the page that has the following fields:

2. When this part is completed, proceed to type in the relevant details in these - A WHO MAY USE THIS FORM This form, Revised, each parcel of real estate A copy, and NOTE If you are the persons.

It is easy to make an error while completing your each parcel of real estate A copy, thus make sure to reread it before you decide to finalize the form.

Step 3: Right after you've looked again at the details entered, just click "Done" to finalize your document generation. Sign up with FormsPal right now and immediately get access to when on death to report, ready for download. All adjustments you make are kept , which means you can modify the form at a later time if required. At FormsPal.com, we aim to ensure that all of your details are maintained secure.