You could fill in blank truth in lending form effortlessly with the help of our PDFinity® PDF editor. Our tool is continually evolving to provide the best user experience achievable, and that's thanks to our commitment to continual development and listening closely to customer feedback. All it takes is several simple steps:

Step 1: Press the orange "Get Form" button above. It's going to open up our editor so that you could start filling in your form.

Step 2: Once you launch the PDF editor, you'll notice the document made ready to be completed. Besides filling in various fields, you may also do some other actions with the Document, namely writing your own textual content, editing the initial textual content, inserting illustrations or photos, signing the form, and more.

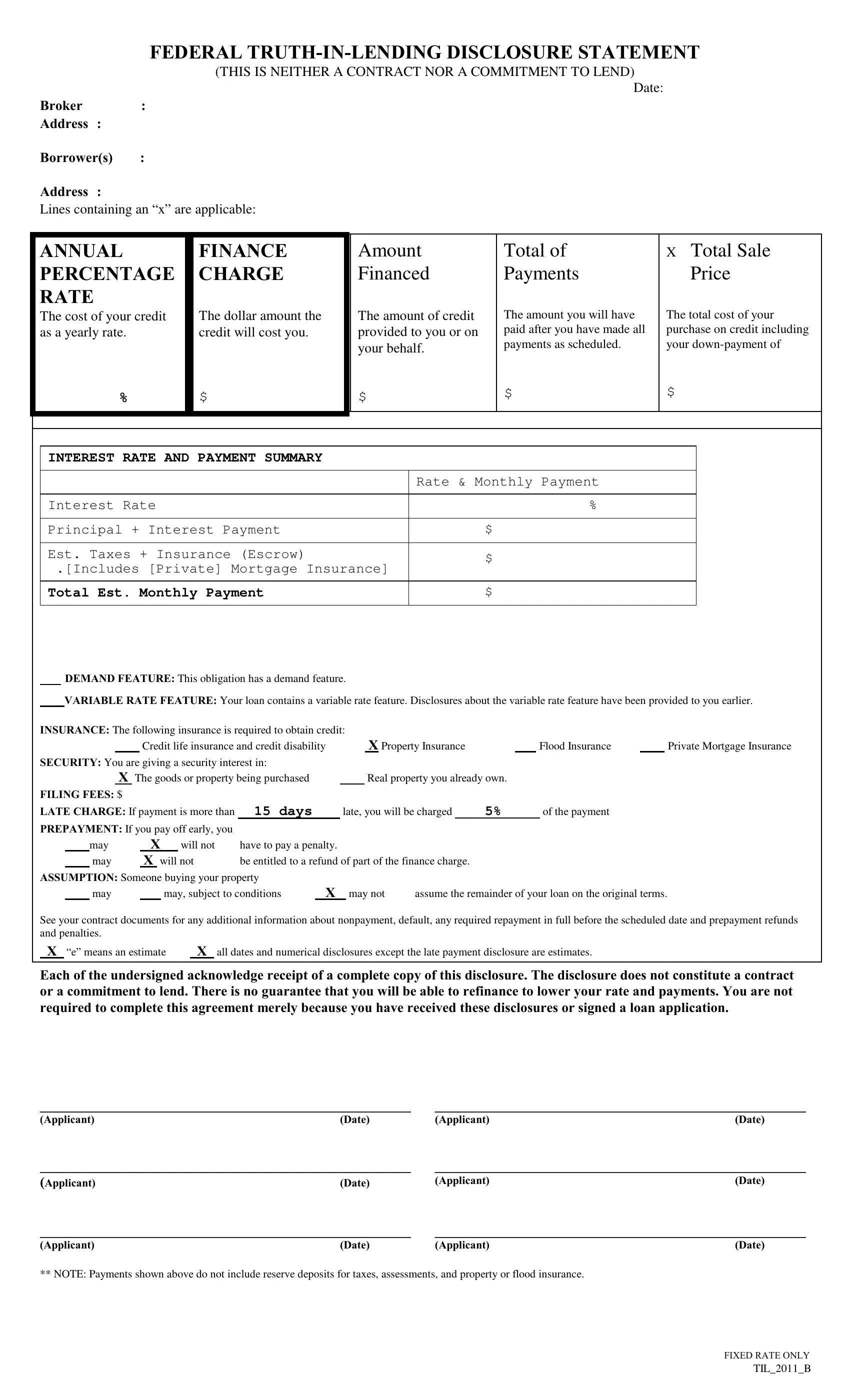

So as to finalize this PDF form, be sure to provide the required details in every single field:

1. Begin completing the blank truth in lending form with a selection of essential blank fields. Gather all of the information you need and ensure not a single thing missed!

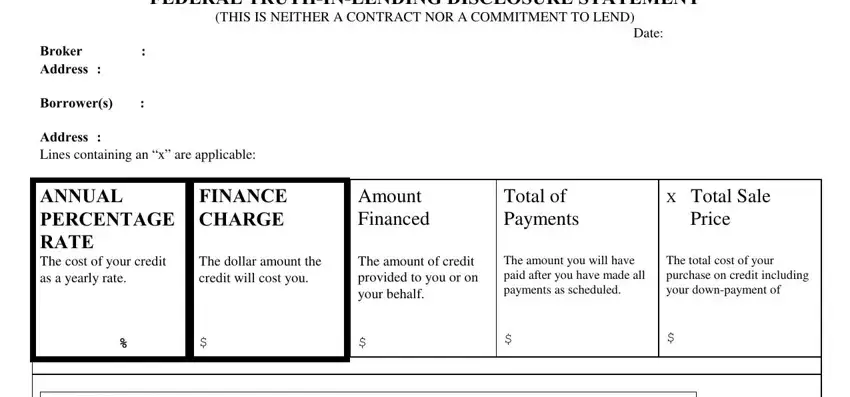

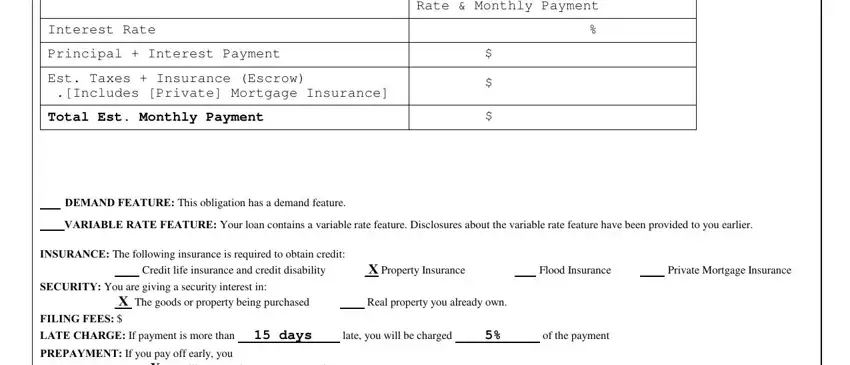

2. The third stage is to complete the following fields: Interest Rate, Principal Interest Payment, Est Taxes Insurance Escrow, Total Est Monthly Payment, Rate Monthly Payment, DEMAND FEATURE This obligation has, Credit life insurance and credit, X The goods or property being, Real property you already own, of the payment, X Property Insurance, Flood Insurance, have to pay a penalty, Private Mortgage Insurance, and may may.

Always be very mindful when completing Principal Interest Payment and Credit life insurance and credit, as this is the section where many people make some mistakes.

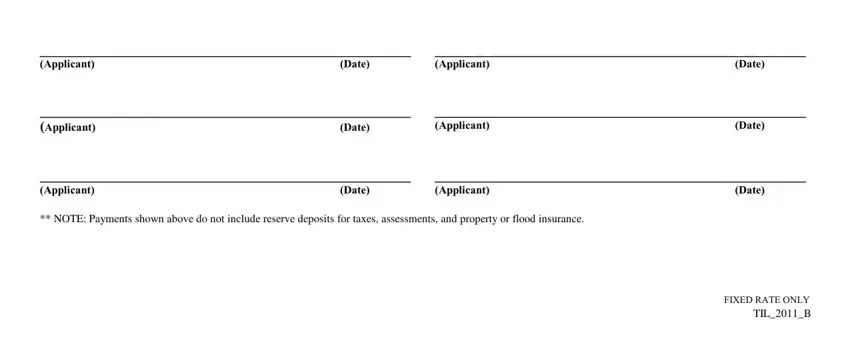

3. Completing Applicant Applicant Applicant, Applicant Applicant Applicant, Date, Date, Date, Date, Date, Date, FIXED RATE ONLY, and TILB is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Step 3: After you have looked again at the details provided, click on "Done" to conclude your form at FormsPal. Go for a 7-day free trial plan at FormsPal and gain instant access to blank truth in lending form - downloadable, emailable, and editable in your personal account. FormsPal guarantees your information confidentiality by using a secure system that in no way saves or shares any kind of sensitive information used in the PDF. Be confident knowing your paperwork are kept safe each time you work with our services!