Managing the tsp form 60 fillable file is not difficult with our PDF editor. Follow the next steps to get the document ready straight away.

Step 1: You should select the orange "Get Form Now" button at the top of the following web page.

Step 2: When you've entered the tsp form 60 fillable editing page you can find all of the functions you'll be able to conduct with regards to your template from the top menu.

Make sure you enter the next details to prepare the tsp form 60 fillable PDF:

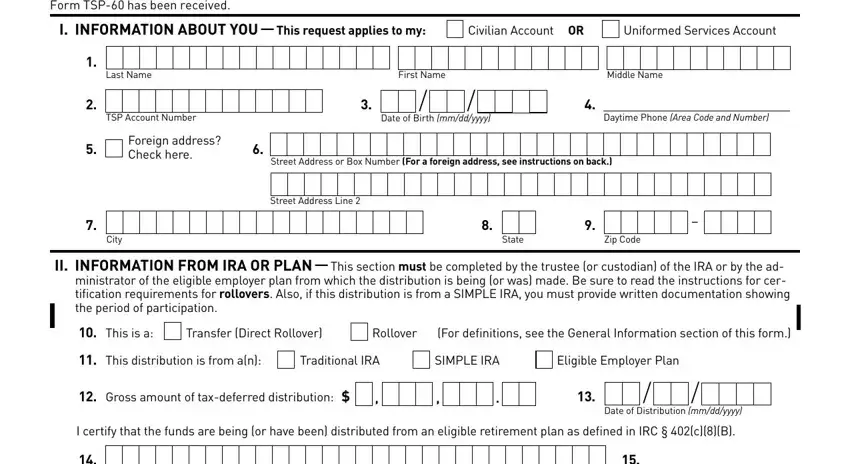

Fill in the Use this form to request a, Uniformed Services Account, Civilian Account OR, Last Name, First Name, Middle Name, TSP Account Number, Foreign address Check here, Date of Birth mmddyyyy, Daytime Phone Area Code and Number, Street Address or Box Number For a, City, State, Zip Code, and Street Address Line section using the particulars requested by the application.

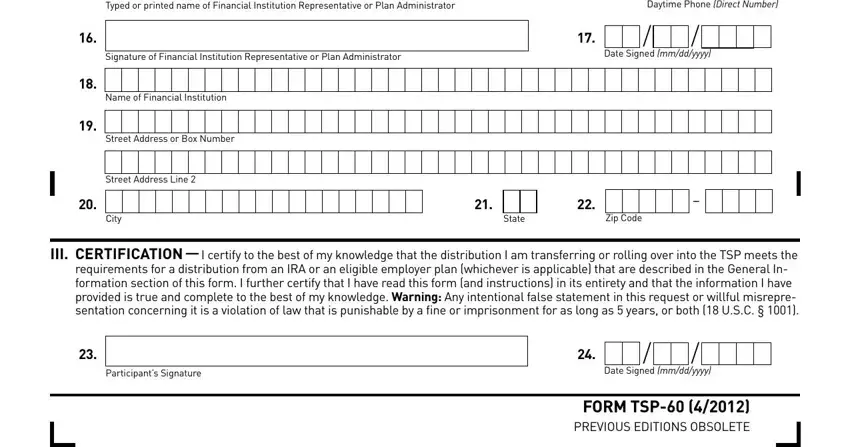

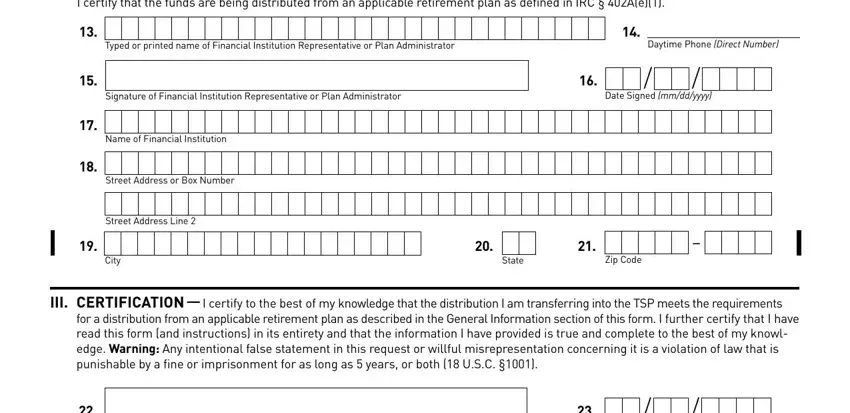

The program will request details to quickly complete the section Typed or printed name of Financial, Daytime Phone Direct Number, Signature of Financial Institution, Date Signed mmddyyyy, Name of Financial Institution, Street Address or Box Number, Street Address Line, City, State, Zip Code, III CERTIFICATION I certify to, Participants Signature, Date Signed mmddyyyy, and FORM TSP PREVIOUS EDITIONS.

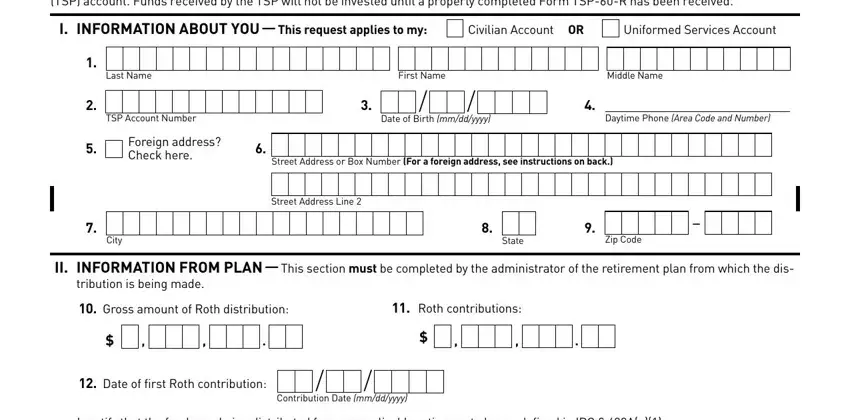

The Use this form to request a, I INFORMATION ABOUT YOU This, Civilian Account OR, Uniformed Services Account, Last Name, First Name, Middle Name, TSP Account Number, Foreign address Check here, Date of Birth mmddyyyy, Daytime Phone Area Code and Number, Street Address or Box Number For a, City, State, and Zip Code space is the place where both parties can put their rights and responsibilities.

Fill in the form by reading all of these sections: I certify that the funds are being, Typed or printed name of Financial, Daytime Phone Direct Number, Signature of Financial Institution, Date Signed mmddyyyy, Name of Financial Institution, Street Address or Box Number, Street Address Line, City, State, Zip Code, III CERTIFICATION I certify to, and for a distribution from an.

Step 3: Click the "Done" button. Next, you may export the PDF document - download it to your device or deliver it by using electronic mail.

Step 4: You can make duplicates of the document tostay clear of all of the possible future complications. Don't be concerned, we cannot display or track your data.

/

/

/

/