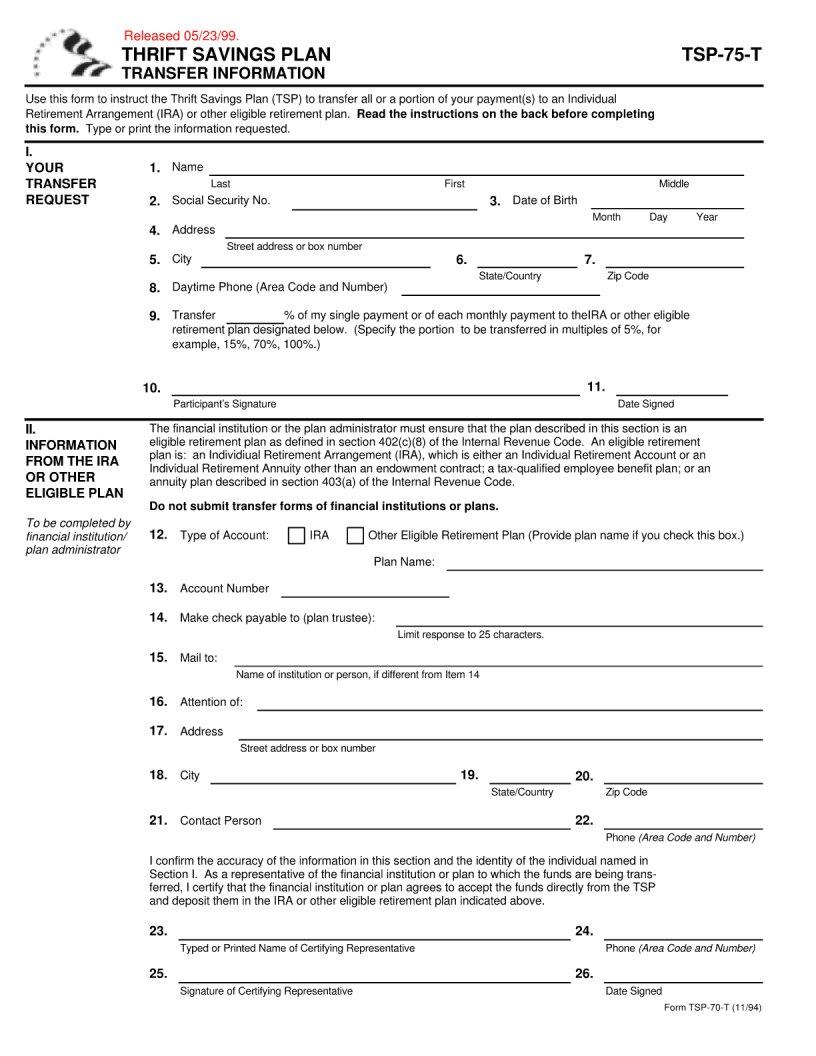

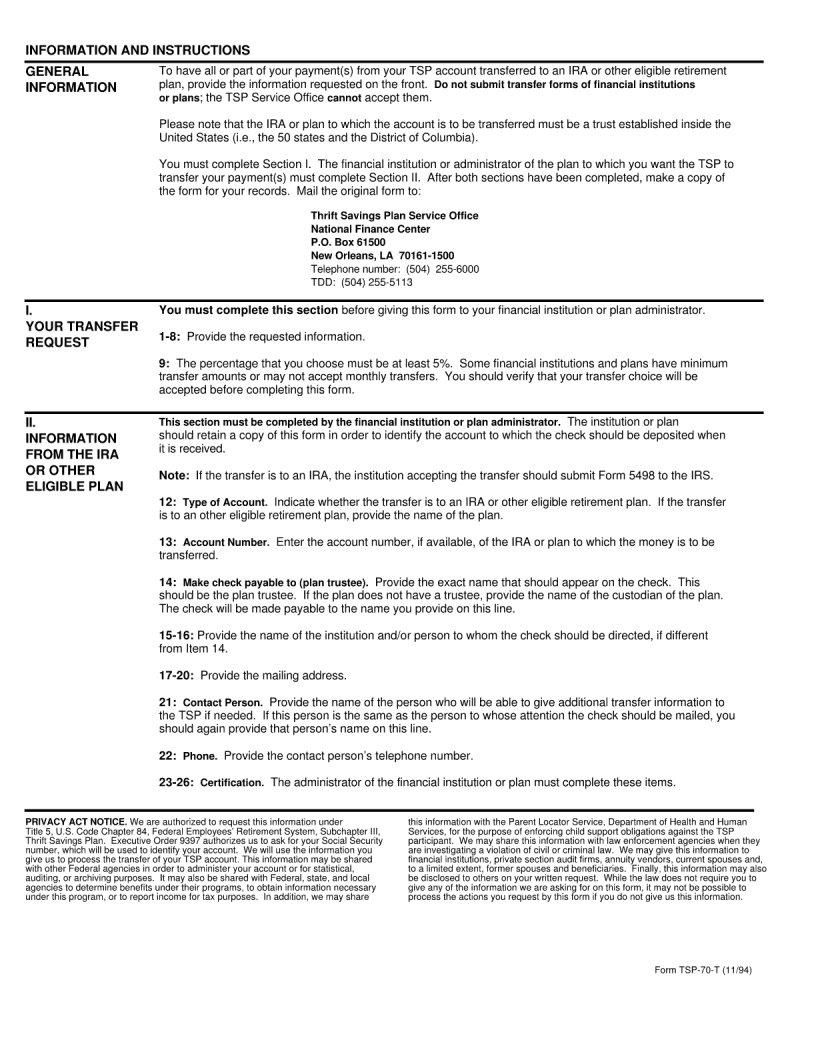

Deciding to move a portion of your retirement savings can feel like navigating a maze without a map. The TSP 75 T form, introduced by the Thrift Savings Plan on May 23, 1999, serves as a crucial tool for federal employees aiming to transfer their TSP account funds into an Individual Retirement Arrangement (IRA) or other eligible retirement plans. This form outlines a structured process for making such transfers, detailing the necessary steps both the account holder and receiving financial institution must follow. By filling out this form, an account holder can specify the exact percentage of their payment(s) they wish to move, in increments of at least 5%. It also requires the receiving plan to confirm its eligibility and agree to accept the transferred funds, emphasizing compliance with section 402(c)(8) of the Internal Revenue Code. The form not only facilitates a smoother transition of funds but also ensures that both parties adhere to federal guidelines, making it an essential document for those looking to optimize their retirement planning strategies. With sections designated for personal information, transfer details, and certifications by the receiving institution, the TSP 75 T form encapsulates the intricacies of transferring retirement savings in a manner that is both structured and secure.

| Question | Answer |

|---|---|

| Form Name | Tsp 75 T Form Fillable |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | tsp 75 form printable, tsp 75 2015, tsp 75 2018, blank security incident report fillable |