Number of tasks can be quicker than managing files taking advantage of the PDF editor. There isn't much for you to do to enhance the tsp hardship withdrawal form form - just simply follow these steps in the next order:

Step 1: Hit the orange button "Get Form Here" on this web page.

Step 2: At this point, you're on the document editing page. You may add information, edit current information, highlight certain words or phrases, insert crosses or checks, insert images, sign the document, erase unnecessary fields, etc.

Create the tsp hardship withdrawal form PDF by typing in the data meant for each part.

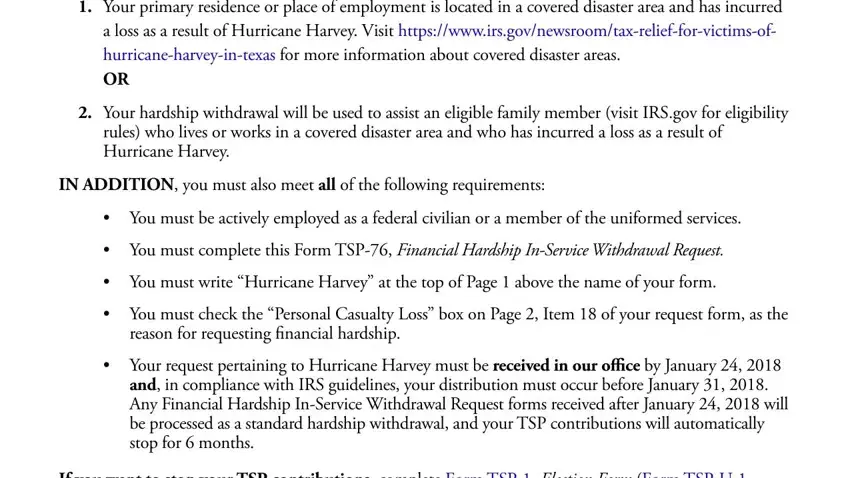

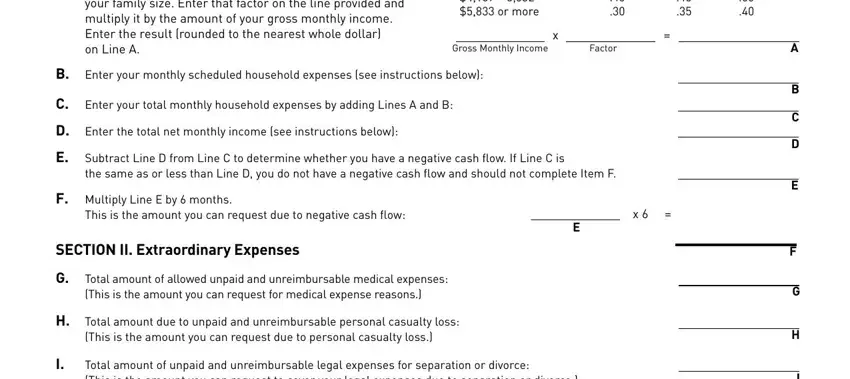

Type in the necessary information in the Spouses Rights for InService, Classification, FERS and Uniformed Services, Requirement, Exceptions, Spouse must provide consent to the, Exception may be requested if, CSRS, The TSP must notify your spouse of, Exception may be requested if, If you cannot obtain your spouses, The TSP cannot certify to the IRS, and you must provide the justification segment.

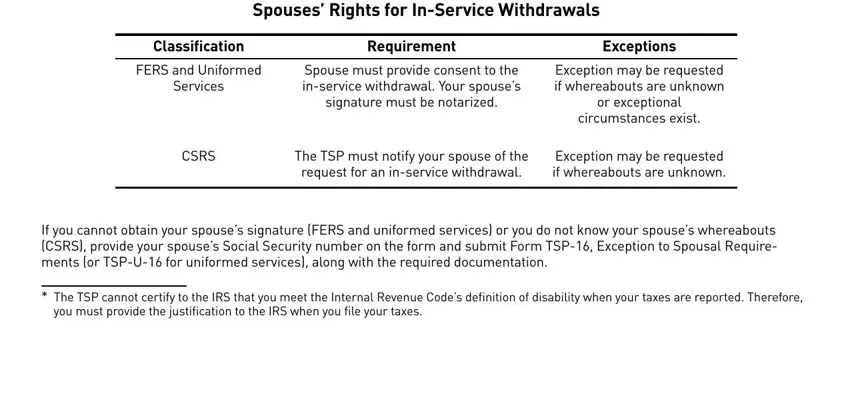

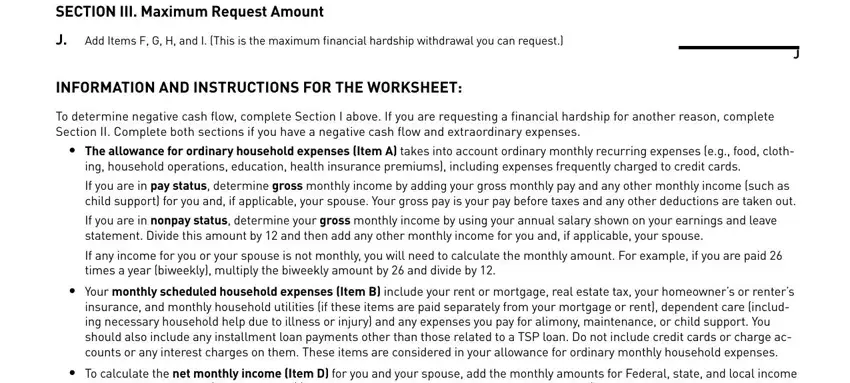

In the A To determine your allowance for, or more, Factor for Family Size of or, or more, Gross Monthly Income, Factor, B Enter your monthly scheduled, C Enter your total monthly, D Enter the total net monthly, E Subtract Line D from Line C to, the same as or less than Line D, F Multiply Line E by months, This is the amount you can request, SECTION II Extraordinary Expenses, and G Total amount of allowed unpaid segment, emphasize the essential details.

The SECTION III Maximum Request Amount, J Add Items F G H and I This is, INFORMATION AND INSTRUCTIONS FOR, To determine negative cash flow, The allowance for ordinary, ing household operations education, If you are in pay status determine, If you are in nonpay status, If any income for you or your, and Your monthly scheduled household area is the place where both sides can indicate their rights and responsibilities.

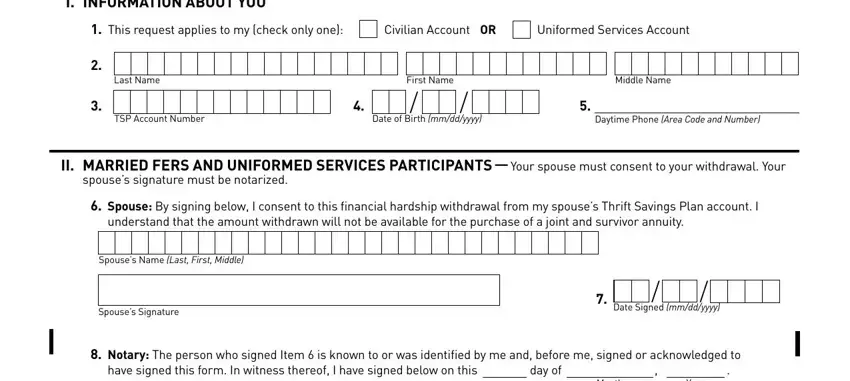

Prepare the document by looking at all these sections: I INFORMATION ABOUT YOU, This request applies to my check, Civilian Account OR, Uniformed Services Account, Last Name, First Name, Middle Name, TSP Account Number, Date of Birth mmddyyyy, Daytime Phone Area Code and Number, II MARRIED FERS AND UNIFORMED, spouses signature must be notarized, Spouse By signing below I consent, understand that the amount, and Spouses Name Last First Middle.

Step 3: Press "Done". Now you may transfer the PDF document.

Step 4: To prevent potential future concerns, take the time to possess a minimum of two or more copies of each and every form.

Thrift Savings Plan

Thrift Savings Plan

Thrift Savings Plan

Thrift Savings Plan