Our qualified developers have worked collectively to create the PDF editor you are going to take advantage of. The following software makes it easy to get http ui texasworkforce org forms immediately and conveniently. This is certainly everything you need to do.

Step 1: On the following web page, hit the orange "Get form now" button.

Step 2: Now you are ready to change http ui texasworkforce org. You've got a wide range of options with our multifunctional toolbar - you can include, erase, or modify the information, highlight the certain areas, as well as conduct similar commands.

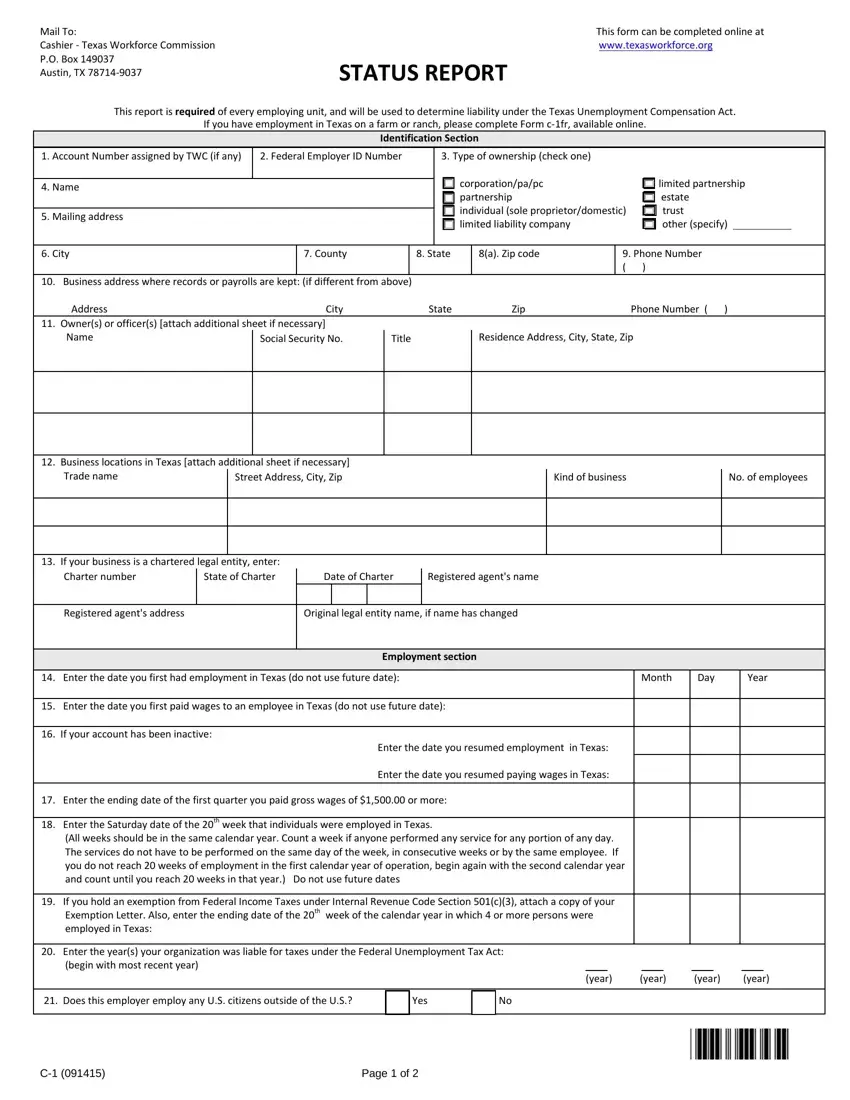

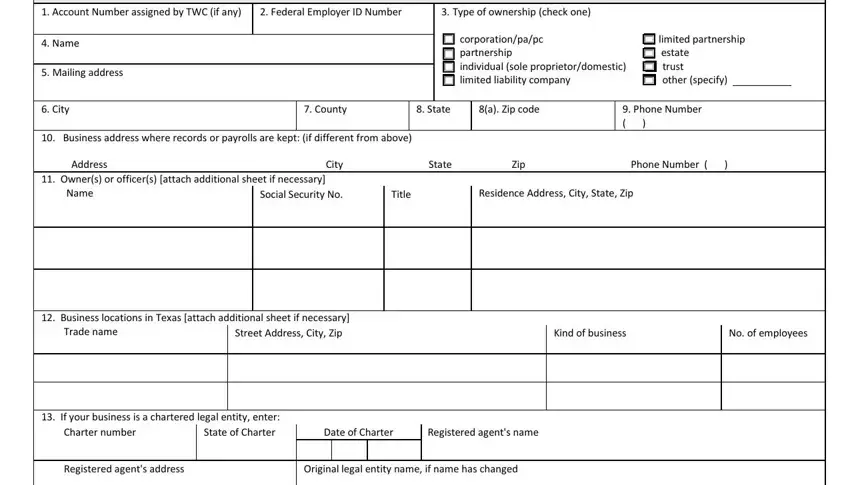

These particular segments will make up your PDF document:

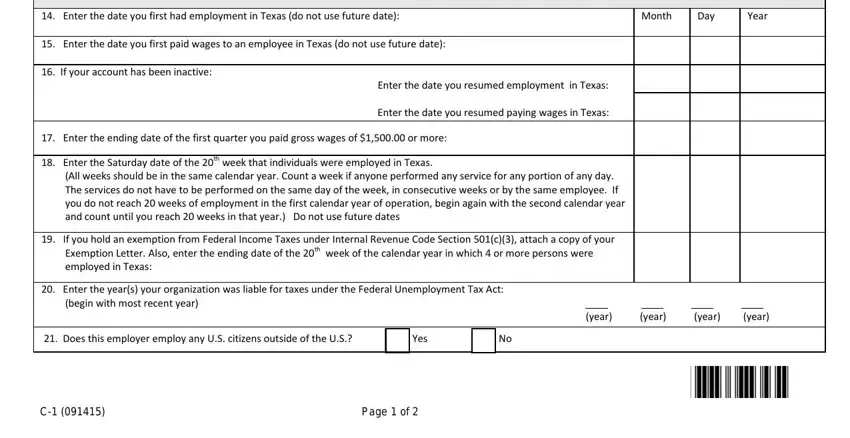

Make sure you fill up the Enter the date you first had, Month, Day, Year, Enter the date you first paid, Employment section, If your account has been inactive, Enter the date you resumed, Enter the date you resumed paying, Enter the ending date of the, Enter the Saturday date of the th, All weeks should be in the same, If you hold an exemption from, Enter the years your organization, and begin with most recent year area with the essential data.

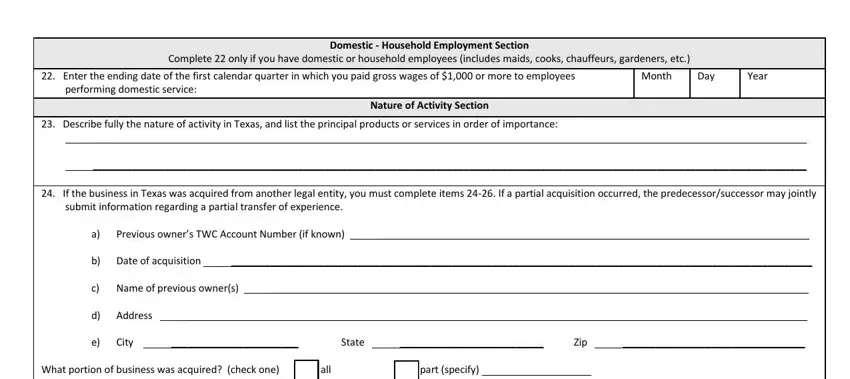

Jot down the crucial particulars in Domestic Household Employment, Enter the ending date of the, Month, Day, Year, performing domestic service, Nature of Activity Section, Describe fully the nature of, If the business in Texas was, submit information regarding a, Previous owners TWC Account Number, b Date of acquisition, c Name of previous owners, d Address, and City State Zip segment.

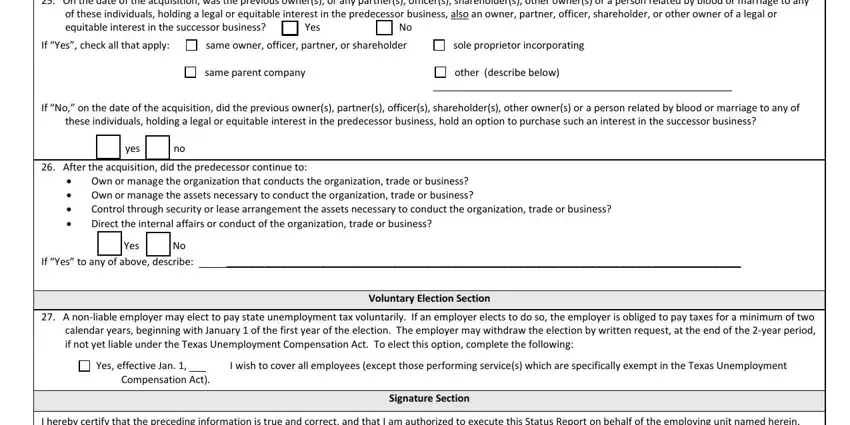

The On the date of the acquisition, Yes, If Yes check all that apply, same owner officer partner or, sole proprietor incorporating, same parent company, other describe below, If No on the date of the, these individuals holding a legal, yes, After the acquisition did the, Own or manage the organization, Yes, If Yes to any of above describe, and A nonliable employer may elect to area should be applied to provide the rights or obligations of both sides.

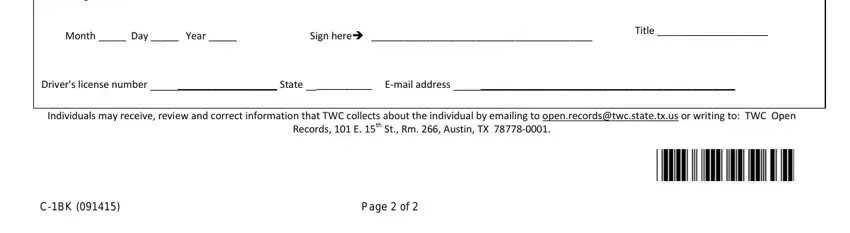

End by reviewing all these fields and filling them out as required: Date of signature, Month Day Year, Sign here, Title, Drivers license number State, Individuals may receive review and, CBK, and Page of.

Step 3: Choose the button "Done". Your PDF document can be transferred. You will be able download it to your computer or send it by email.

Step 4: Make duplicates of the form - it may help you keep clear of upcoming issues. And don't get worried - we cannot display or watch your details.