When using the online PDF editor by FormsPal, you're able to fill in or edit Tsp Form 77 Request here. In order to make our editor better and simpler to work with, we constantly develop new features, with our users' suggestions in mind. To get the process started, take these basic steps:

Step 1: Firstly, access the editor by clicking the "Get Form Button" in the top section of this page.

Step 2: This editor provides you with the ability to change most PDF forms in a variety of ways. Modify it by writing customized text, adjust existing content, and add a signature - all close at hand!

It is an easy task to complete the document with this practical guide! Here's what you need to do:

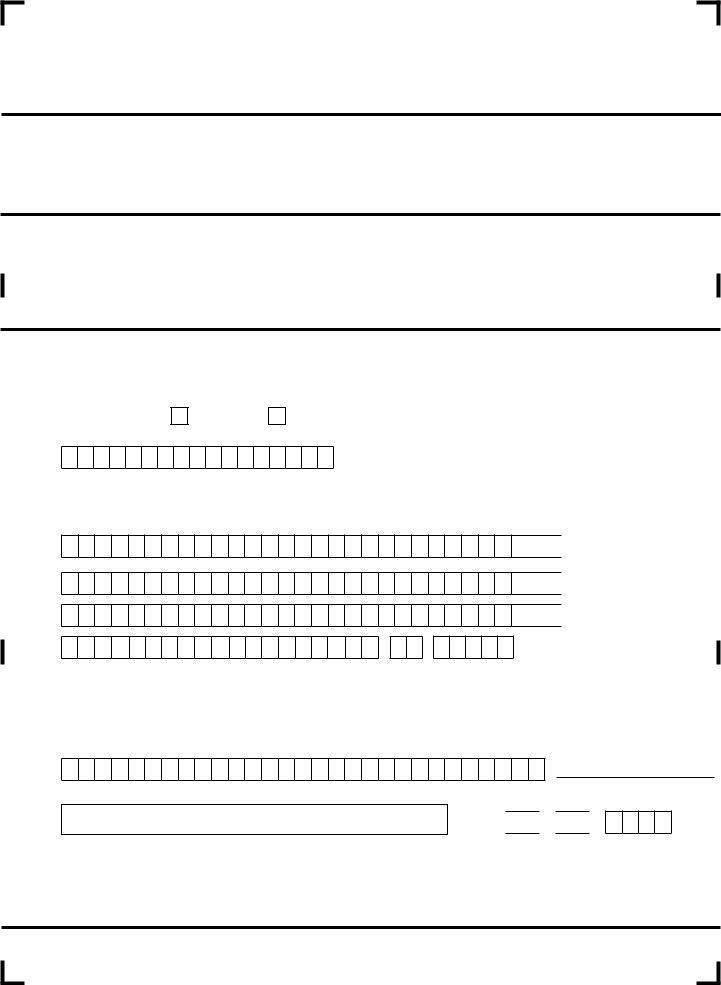

1. Whenever filling in the Tsp Form 77 Request, ensure to include all of the important blank fields within the corresponding area. It will help to expedite the process, which allows your details to be processed fast and accurately.

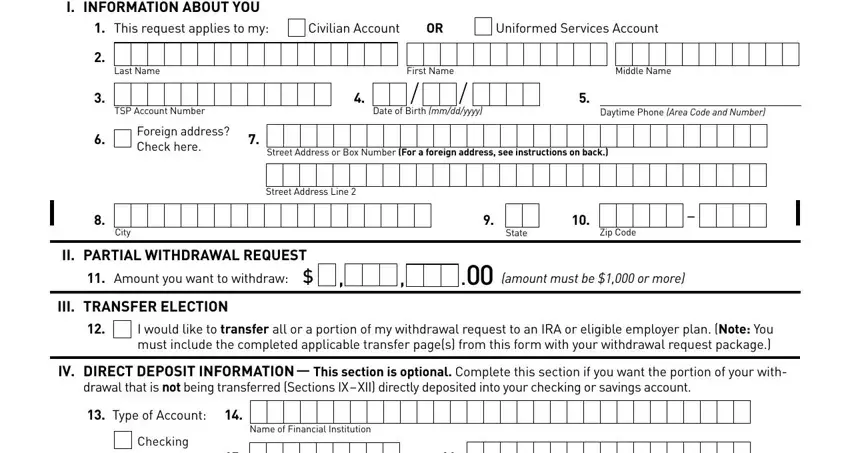

2. The third step is usually to fill out these particular blank fields: Savings, ACH Routing Number Must be digits, Checking or Savings Account Number, V ADDITIONAL TAX WITHHOLDING This, In addition to the mandatory, VI CERTIFICATION AND NOTARIZATION, request is true and complete to, Participants Signature Notary, day of, Date Signed mmddyyyy, Month, Year, Date mmddyyyy, Notarys Signature, and Notarys Phone Number.

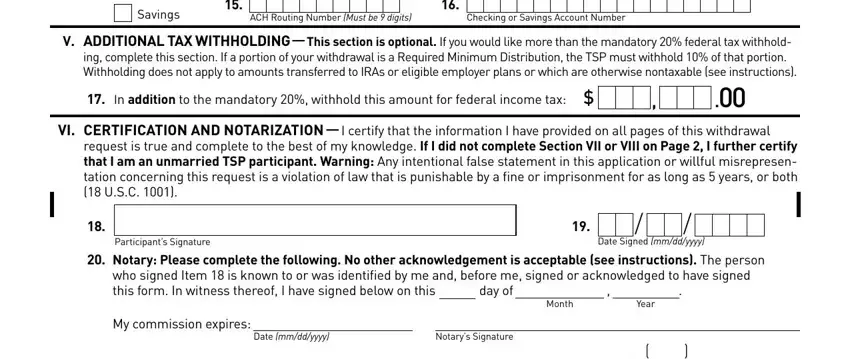

3. Within this part, examine Notarys Printed Name, Jurisdiction, Do Not Write Below This Line, Notarys Phone Number, P I I S P I I S, and FORM TSP Page PREVIOUS EDITIONS. These will have to be completed with highest focus on detail.

As for Do Not Write Below This Line and P I I S P I I S, ensure that you double-check them in this section. Those two could be the key fields in the form.

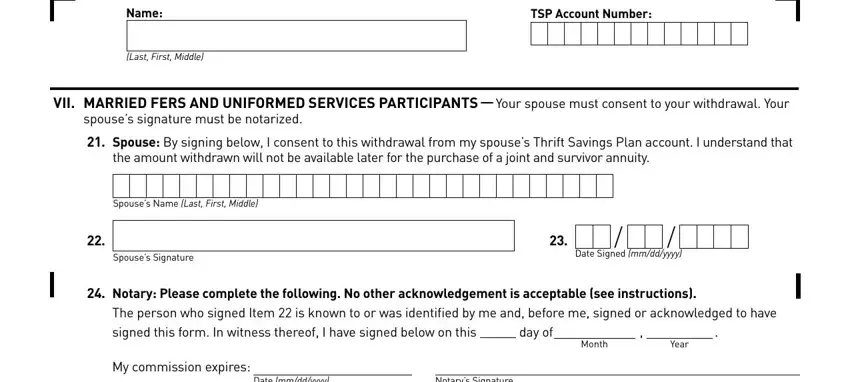

4. Your next paragraph needs your input in the subsequent places: Name, Last First Middle, TSP Account Number, VII MARRIED FERS AND UNIFORMED, spouses signature must be notarized, Spouse By signing below I consent, the amount withdrawn will not be, Spouses Name Last First Middle, Spouses Signature, Date Signed mmddyyyy, Notary Please complete the, day of, Month, Year, and Date mmddyyyy. Just remember to enter all of the required info to move further.

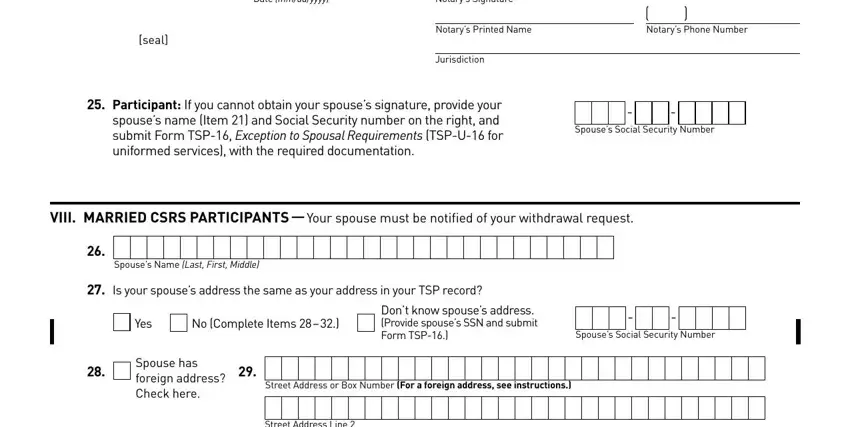

5. As a final point, the following final subsection is precisely what you should wrap up before submitting the PDF. The blanks under consideration include the next: Date mmddyyyy, Notarys Signature, seal, Notarys Printed Name, Jurisdiction, Notarys Phone Number, Participant If you cannot obtain, Spouses Social Security Number, VIII MARRIED CSRS PARTICIPANTS, Spouses Name Last First Middle, Is your spouses address the same, Yes, No Complete Items, Dont know spouses address Provide, and Spouses Social Security Number.

Step 3: Right after you have reviewed the information provided, press "Done" to conclude your form. After starting afree trial account at FormsPal, you'll be able to download Tsp Form 77 Request or send it via email directly. The PDF file will also be available via your personal cabinet with all of your modifications. We don't share or sell the information you type in whenever working with documents at our site.