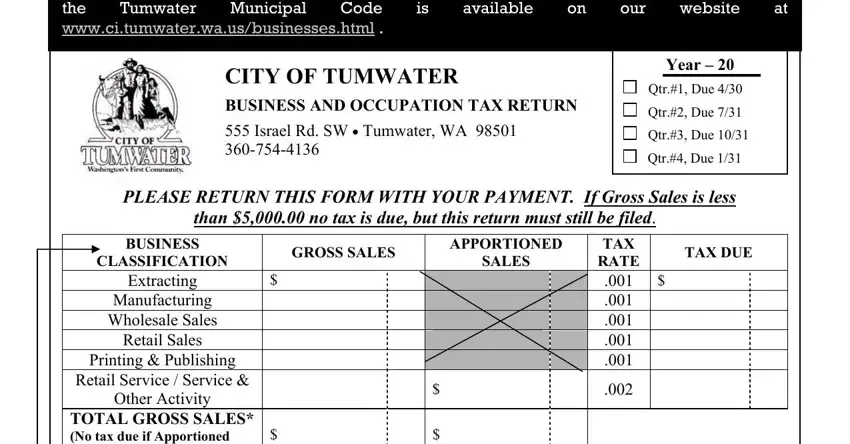

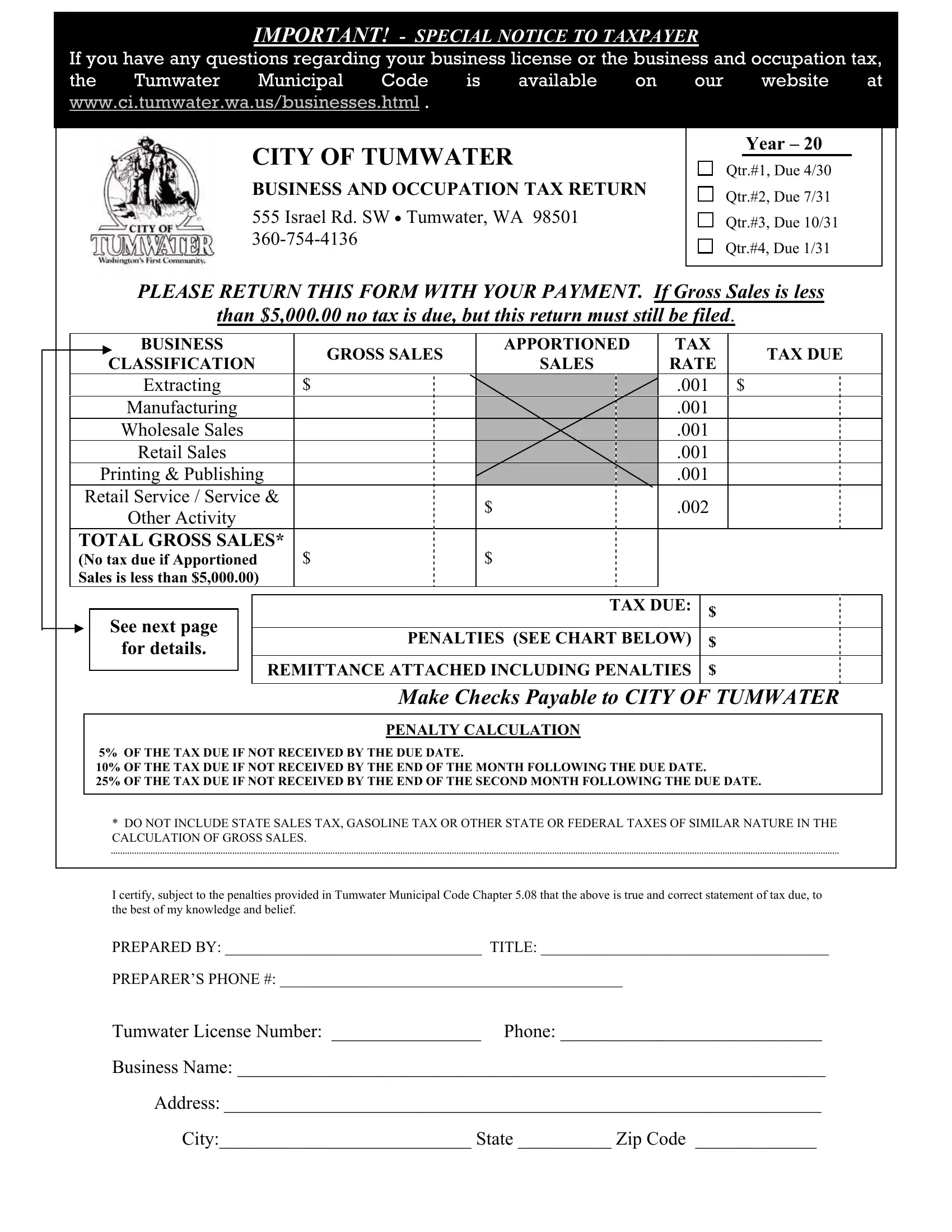

IMPORTANT! - SPECIAL NOTICE TO TAXPAYER

If you have any questions regarding your business license or the business and occupation tax, the Tumwater Municipal Code is available on our website at www.ci.tumwater.wa.us/businesses.html .

CITY OF TUMWATER

BUSINESS AND OCCUPATION TAX RETURN

555 Israel Rd. SW • Tumwater, WA 98501

360-754-4136

Year – 20

Qtr.#1, Due 4/30

Qtr.#2, Due 7/31

Qtr.#3, Due 10/31

Qtr.#4, Due 1/31

PLEASE RETURN THIS FORM WITH YOUR PAYMENT. If Gross Sales is less than $5,000.00 no tax is due, but this return must still be filed.

|

|

BUSINESS |

GROSS SALES |

|

APPORTIONED |

TAX |

TAX DUE |

|

|

CLASSIFICATION |

|

SALES |

RATE |

|

|

|

|

|

|

|

|

|

Extracting |

$ |

|

|

|

|

|

.001 |

$ |

|

|

|

Manufacturing |

|

|

|

|

|

|

.001 |

|

|

|

|

Wholesale Sales |

|

|

|

|

|

|

.001 |

|

|

|

|

Retail Sales |

|

|

|

|

|

|

.001 |

|

|

|

|

Printing & Publishing |

|

|

|

|

|

|

.001 |

|

|

|

Retail Service / Service & |

|

|

$ |

|

|

.002 |

|

|

|

|

Other Activity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL GROSS SALES* |

|

|

|

|

|

|

|

|

|

|

|

(No tax due if Apportioned |

$ |

|

$ |

|

|

|

|

|

|

|

Sales is less than $5,000.00) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX DUE: |

|

$ |

|

|

|

|

See next page |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PENALTIES (SEE CHART BELOW) |

|

$ |

|

|

|

|

for details. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REMITTANCE ATTACHED INCLUDING PENALTIES |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Make Checks Payable to CITY OF TUMWATER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PENALTY CALCULATION |

|

|

|

|

|

|

|

5% OF THE TAX DUE IF NOT RECEIVED BY THE DUE DATE. |

|

|

|

|

|

|

|

|

|

|

|

10% OF THE TAX DUE IF NOT RECEIVED BY THE END OF THE MONTH FOLLOWING THE DUE DATE. |

|

|

|

|

|

25% OF THE TAX DUE IF NOT RECEIVED BY THE END OF THE SECOND MONTH FOLLOWING THE DUE DATE. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*DO NOT INCLUDE STATE SALES TAX, GASOLINE TAX OR OTHER STATE OR FEDERAL TAXES OF SIMILAR NATURE IN THE CALCULATION OF GROSS SALES.

I certify, subject to the penalties provided in Tumwater Municipal Code Chapter 5.08 that the above is true and correct statement of tax due, to the best of my knowledge and belief.

PREPARED BY: _________________________________ TITLE: _____________________________________

PREPARER’S PHONE #: ____________________________________________

Tumwater License Number: ________________ Phone: ____________________________

Business Name: _______________________________________________________________

Address: ________________________________________________________________

City:___________________________ State __________ Zip Code _____________

EXPLANATION OF CATEGORIES

Extracting

Directly or indirectly by contracting with others for labor and mechanical services to remove from your own land or land of others from mines or quarries coal, oil, natural gas, ore, stone, sand, grave, clay mineral or other natural resource product; or fells cuts or takes timber, Christmas Trees, other than plantation Christmas trees, or other products; or takes fish, shellfish, or other sea or inland water foods or products. The tax is based on the value of the product, including by-products, so extracted, regardless of the place of sale or the fact that deliveries may be made to points outside the city. (Note: A contractor hired to perform the extraction for another is considered a processor for hire and shall report gross taxable income in the Retail Sales category.)

Manufacturing

Every person who, either directly or by contracting with others for the necessary labor or mechanical services, manufactures for sale or for commercial or industrial use from the person’s own materials or ingredients any products. The measure of the tax is the value of the products, including by-products, so manufactured, regardless of the place of sale or the fact that deliveries may be made to points outside the city. (Note: When the owner of equipment or facilities furnishes or sells to the customer prior to manufacture, materials or ingredients equal to less than twenty percent (20%) of the total value of all materials or ingredients that become part of the finished product, the owner of the equipment or facilities will be deemed a processor for hire, and not a manufacturer, and shall report gross taxable income in the Wholesale Sales category.

Wholesale Sales

Any sale of tangible personal property which is not a retail sale, and any charge made for labor and services rendered for persons who are not consumers, in respect to real or personal property and retail services, if such charge is expressly defined as a retail sale or retail service when rendered to or for consumers.

Retail Sales

The sale of or charge made for tangible personal property consumed and/or for labor and services rendered in respect to the following:

•The installing repairing, cleaning, altering, imprinting or improving of tangible personal property for consumers.

•The construction or repairing, decorating, painting, papering, repairing, furnace or septic tank cleaning, snow removal, sandblasting or improving of new or existing buildings or other structures for consumers.

•Service provided to clear land and the moving of earth.

•Cleaning, fumigating, razing or removing buildings or structures.

•Automobile towing and similar automotive transportation services.

•The sale and charge made for the furnishing of lodging and all other services by a hotel, rooming house, tourist court, motel or trailer camp. (Note: this does not include these services that are provided for a continuous period of one month or more.)

•Sale of canned software regardless of the method of delivery to the end user, but does not include custom software or the customization of canned software.

•Sales of labor and services rendered with respect to building, repairing, or improving of any street, easement, or any other vehicular, foot, or any other tangible transportation asset owned by the city, county, state, or any other political subdivision of the state.

•Sale of an extended warranty.

Printing & Publishing

Printing, printing and publishing of newspapers, magazines, periodicals, books, music, and other printed items.

IF YOU REPORT IN THE FOLLOWING TWO CATEGORIES (RETAIL SERVICE OR SERVICE & OTHER ACTIVITY) AND YOU PERFORM WORK OUTSIDE THE CITY LIMITS, YOU MUST USE THE APPORTIONMENT WORKSHEET TO DETERMINE YOR TAXABLE INCOME. THE FORM AND INSTRUCTIONS ARE AVAILABLE AT WWW.CI.TUMWATER.WA.US /BUSINESSES.HTML

Retail Service

Sale or charge made for personal, business, or professional services including amounts designated as interest, rents, fees, admissions, and other services by persons engaged in:

•Amusement and recreation services including but not limited to golf, pool, billiards, skating, bowling, swimming, bungee jumping, basketball, racquetball, handball, squash, tennis, batting cages, day trips for sightseeing.

•Abstract, title insurance, and escrow services.

•Credit bureau services.

•Automobile parking and storage garage services.

•Landscape maintenance and horticultural services.

•These specific personal services: Physical fitness services, tanning salons, tattoo parlor services, steam bath services, Turkish bath services, escort services, and dating services.

•Rental or lease of tangible personal property to consumers and the rental of equipment with an operator.

Service & Other Activity

Persons engaging within the city in any business activity other than or in addition to those enumerated in the above descriptions. This would include but not be limited to businesses or professionals that provide medical, legal, engineering, architectural, janitorial, instructional, consulting and accounting services.

THESE DESCRIPTIONS DO NOT REPRESENT ALL TYPES OF BUSINESS ACTIVITIES, BUT REPRESENT THE MAJORITY OF SERVICES PROVIDED BY BUSINESSES AND INDIVIDUALS SUBJECT TO BUSINESS AND OCCUPATION TAX. PLEASE REFER TO THE CITY WEBSITE, WWW.CI.TUMWATER.WA.US , FOR FURTHER DETAILS. IF YOU DO NOT HAVE ACCESS TO THE INTERNET, PLEASE CALL 360-754-4136 FOR A COPY OF THE CHAPTERS OF THE TUMWATER MUNICIPAL CODE THAT RELATE TO BUSINESS LICENSING AND BUSINESS AND OCCUPATION TAX AND OTHER REFERENCE MATERIALS AVAILABLE TO YOU.