Whenever you need to fill out Tx Form 50 144, you don't need to download and install any sort of applications - simply try our PDF editor. To have our editor on the leading edge of practicality, we work to integrate user-oriented features and enhancements on a regular basis. We are at all times pleased to receive suggestions - play a vital role in revampimg PDF editing. To get the process started, go through these easy steps:

Step 1: Click on the orange "Get Form" button above. It will open our tool so you can begin filling out your form.

Step 2: As you open the tool, you will see the document ready to be filled in. Besides filling out different blank fields, it's also possible to perform other things with the PDF, that is adding your own text, editing the original text, inserting images, placing your signature to the PDF, and much more.

It is actually straightforward to fill out the pdf using out helpful guide! Here is what you want to do:

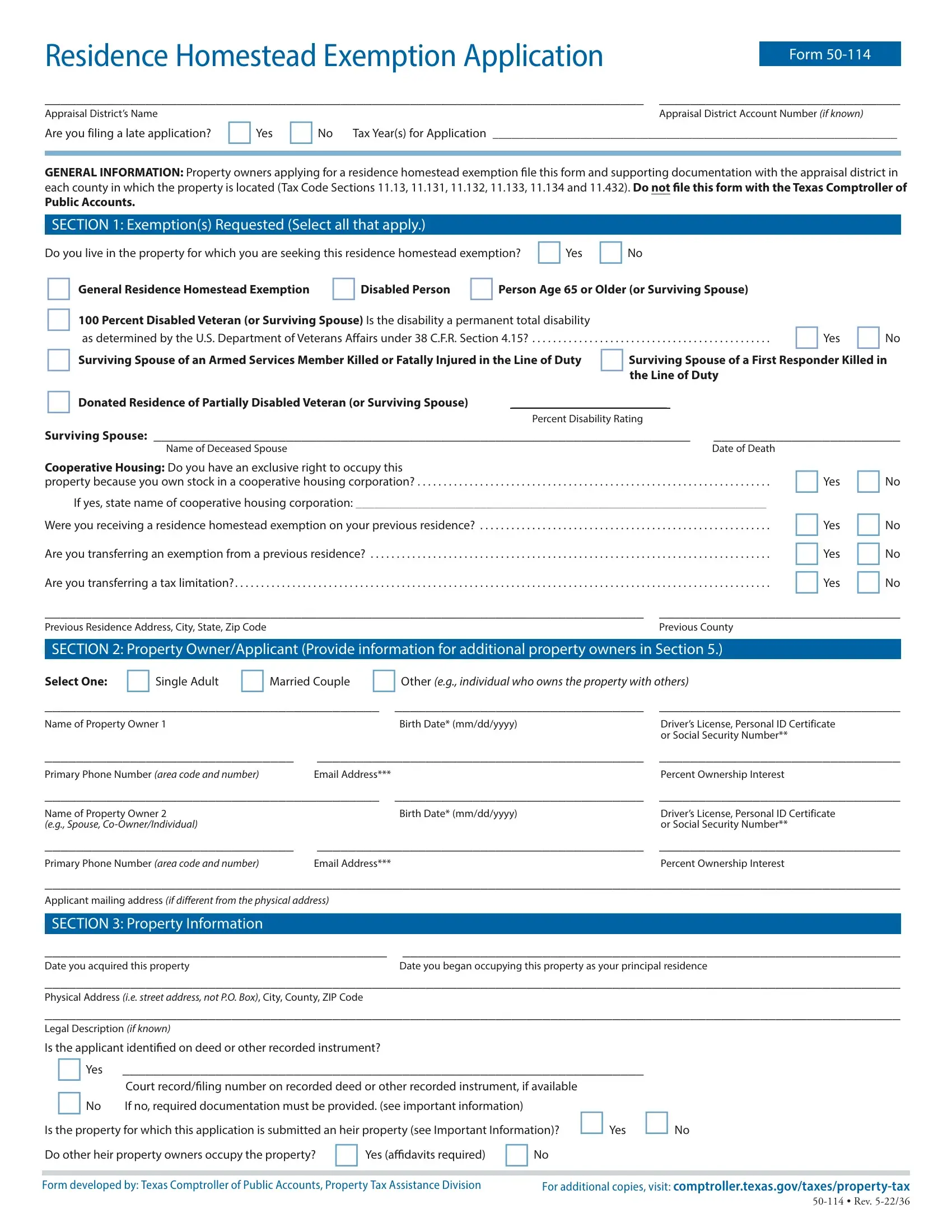

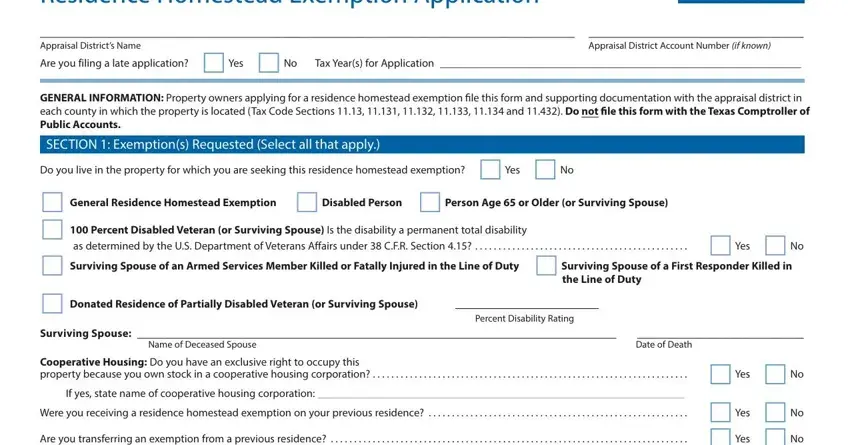

1. To get started, while filling out the Tx Form 50 144, beging with the form section with the next blank fields:

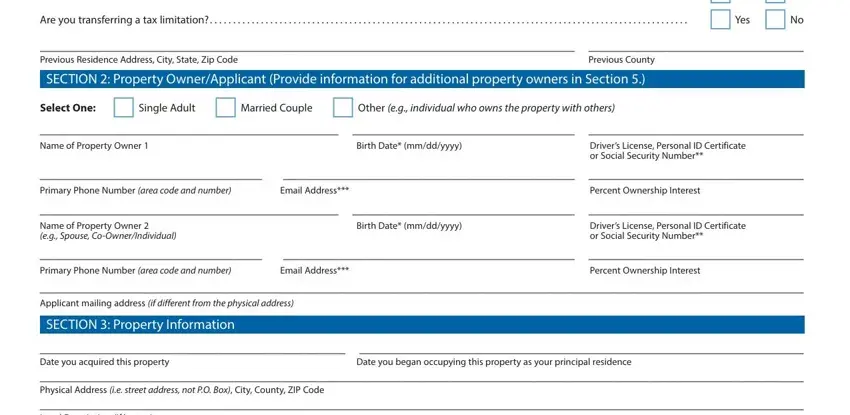

2. Your next part would be to fill in the next few blank fields: property because you own stock in, Previous Residence Address City, Previous County, SECTION Property OwnerApplicant, Select One Single Adult Married, Name of Property Owner, Birth Date mmddyyyy, Drivers License Personal ID, Primary Phone Number area code, Email Address, Percent Ownership Interest, Name of Property Owner eg, Birth Date mmddyyyy, Drivers License Personal ID, and Primary Phone Number area code.

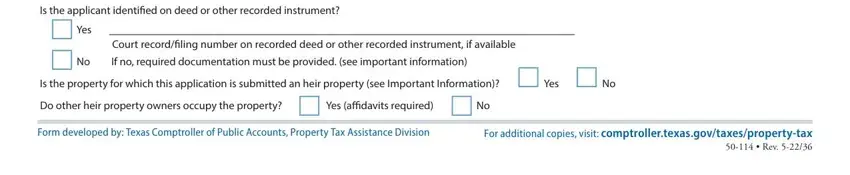

3. The following section is focused on Is the applicant identified on, Court recordfiling number on, Yes No Is the property for which, If no required documentation must, Form developed by Texas, and For additional copies visit - fill in each one of these blanks.

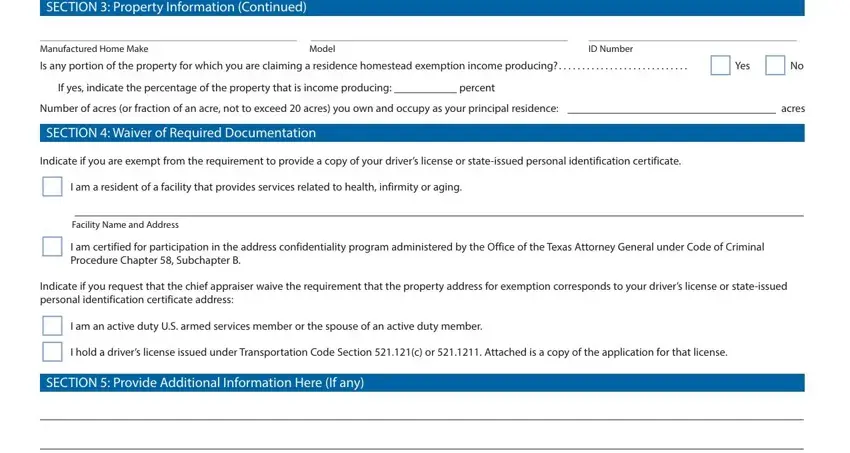

4. To go ahead, this section involves filling out a couple of blanks. Examples include SECTION Property Information, Manufactured Home Make, Model, ID Number, Is any portion of the property for, If yes indicate the percentage of, Number of acres or fraction of an, SECTION Waiver of Required, Indicate if you are exempt from, I am a resident of a facility, Facility Name and Address, I am certified for participation, Procedure Chapter Subchapter B, Indicate if you request that the, and I am an active duty US armed, which you'll find key to carrying on with this process.

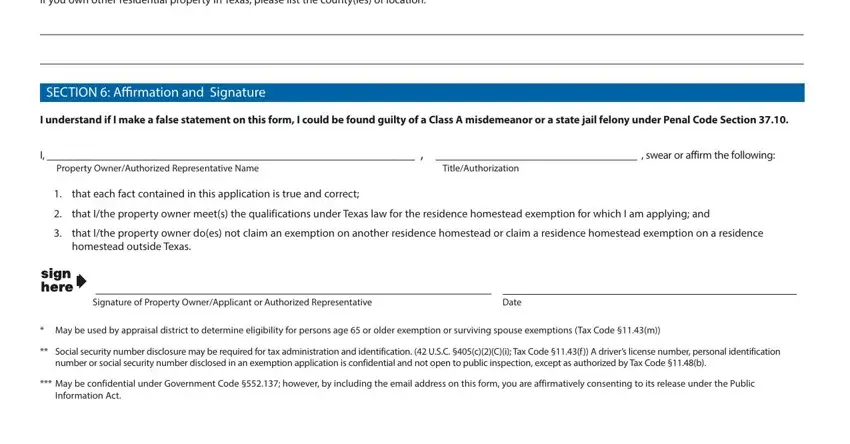

5. The final notch to submit this form is crucial. Make sure to fill in the appropriate blanks, like If you own other residential, SECTION Affirmation and Signature, I understand if I make a false, swear or affirm the following, Property OwnerAuthorized, TitleAuthorization, that each fact contained in this, that Ithe property owner meets the, that Ithe property owner does not, Signature of Property, Date, May be used by appraisal district, Social security number disclosure, number or social security number, and May be confidential under, prior to finalizing. Neglecting to do it can end up in an unfinished and possibly nonvalid form!

A lot of people frequently get some things incorrect while filling out that Ithe property owner meets the in this section. Be sure you read again whatever you type in right here.

Step 3: Soon after going through the fields, click "Done" and you are all set! Right after starting a7-day free trial account at FormsPal, you will be able to download Tx Form 50 144 or email it right away. The PDF form will also be accessible in your personal cabinet with all of your adjustments. When using FormsPal, you can easily complete documents without stressing about information breaches or data entries being shared. Our protected platform makes sure that your personal information is kept safe.