When businesses undergo significant transitions such as acquisitions, mergers, or sales, notifying the Ohio Bureau of Workers' Compensation (BWC) using the U118 form is a critical step for ensuring compliance with state regulations. This form serves as a formal notification to the BWC when one business is succeeding another in whole or in part in the operation. It includes different sections that must be completed by both the former and the succeeding employers, detailing the specifics of the transaction and ensuring that the new employer is properly established for workers' compensation coverage if they do not already have it. Importantly, the U118 form triggers a review process by the BWC to evaluate the succession for experience rating purposes, which can significantly affect the workers' compensation insurance premiums of the succeeding employer. The information required spans from general data about the businesses involved to detailed transaction specifics, such as the extent of the business purchased, details on continuity of operation, employee rosters, and certifications by the parties involved. For those new to the realm of business transitions, navigating the completion and submission of the U118 form is essential for a smooth transition and maintaining compliance with Ohio's workers' compensation rules.

| Question | Answer |

|---|---|

| Form Name | U118 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | oforn u 118, ohio u 118 form, bwc form u 118, oh acquisition |

Notification of Business

Acquisition/Merger or Purchase/Sale

Have questions? Need assistance? BWC is here to help!

Call

Use this form to notify BWC when succeeding, in whole or in part, another in the operation of a business.

If you are the successor/new employer and do not have Ohio workers’ compensation coverage, you must complete an Application for Ohio Workers’ Compensation Coverage

Ohio workers’ compensation rule (Rule

Whenever one employer succeeds another employer in the operation of a business, in whole or in part, BWC requires information on the succession to calculate the experience rating of the succeeding employer. Additionally for successions taking place on or after Sept. 1, 2006, where one employer wholly succeeds in the operation of a business, BWC shall transfer to the successor any and all existing and future liabilities or credits of the former employer in addition to the experience transfer.

If an employer purchases or acquires only a portion of the business, BWC transfers only that portion of the former employer’s experience to the succeeding employer. BWC will inspect the former employer’s payroll and claims records to determine what should transfer to the successor for rate calculation purposes.

Notify BWC by following these steps:

1Complete all sections of this form and provide as many details as possible to avoid unnecessary requests for additional information;

2 Sign and date the form;

3Mail the completed form to: Ohio Bureau of Workers’ Compensation Policy Processing, 22nd floor

OR |

30 W. Spring St. |

|

Columbus, Ohio |

||

|

4 Fax completed form to: Policy processing

Section A - General information

Provide general information for the succeeding new employer and former employer. If you are the successor/new employer and do not have Ohio workers’ compensation coverage, you must complete the

Section B - Transaction detail to be completed by the former employer

BWC uses the information provided in this section to determine if a succession has occurred. BWC evaluates criteria, including but not limited to, criteria listed below to make this determination.

•Business ownership

•Continuity of business operations

•Real estate, plant and equipment, material inventories and other real property

•Customer proiles

•Industrial pursuit

•Employee roster

Section C - Transaction detail to be completed by the new/successor employer

BWC uses the information provided in this section to determine if a succession has occurred. BWC evaluates criteria, including but not limited to, criteria listed below to make this determination.

•Business ownership

•Continuity of business operations

•Real estate, plant and equipment, material inventories and other real property

•Customer proiles

•Industrial pursuit

•Employee roster

Section D - Certiication

This section is where the parties associated with the transaction read the certiication statement and provide their signatures. BWC has the authority to proceed with processing the transaction without the signature or agreement of one or both of the parties.

1 of 4 |

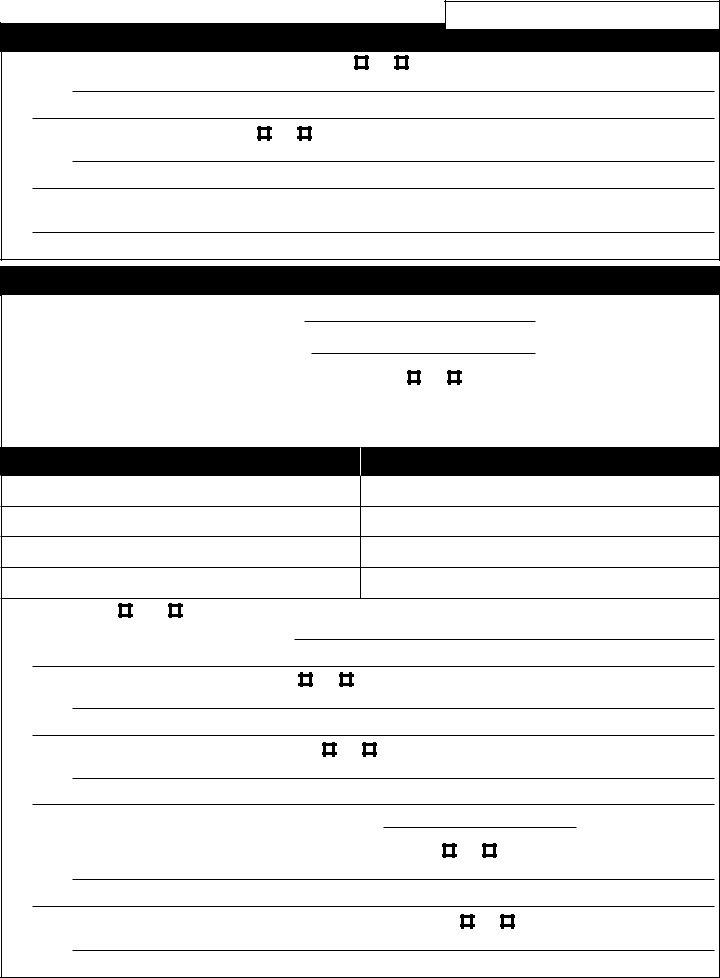

SECTION A - General information

If you do not have Ohio workers’ compensation coverage, you must complete and submit the

Succeeding employer - complete section A, C and D only

Legal business name

Ohio workers’ compensation policy number

Trade name or doing business as name (DBA)

Telephone number

Former employer - complete section A, B and D only

Legal business name |

Ohio workers compensation policy number |

|

|

Trade name or doing business as name (DBA) |

Telephone number |

|

|

SECTION B - Transaction detail to be completed by the former employer

1.On what date did you sell the business?

2.If you are no longer operating in Ohio, what was the date you last employed Ohio employees?

3.Did you sell n all or n part of your business? If this is a partial acquisition or sale, of an existing business, explain what portion or location of the entire operation was sold.

4.Is there a purchase/sale agreement associated with this transaction? n Yes n No (BWC may request a copy of the purchase/ sale agreement.)

5.Do you continue to operate any additional Ohio locations under this policy? n Yes n No Explain:

6.Provide the names of all partners, corporate oficers or individuals that have ownership interest for the former and succeeding employer.

|

Ownership interests for former employer |

Ownership interests for succeeding employer |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

Has the business been in continuous operation? n Yes n No |

|

|

|||

|

Explain: |

|

|

|

|

|

|

|

|

|

|||

8. |

Is the succeeding employer continuing to operate in the same location? n Yes n No |

|||||

|

Explain: |

|

|

|

||

|

|

|

||||

9. |

How many employees did you have prior to the sale? ________________________ |

|||||

|

|

|

|

|

|

|

Policy number

SECTION B - Transaction detail to be completed by the former employer (continued)

10.Did you sell any machinery or equipment to the successor? Explain:

n Yes n No

11.Did you sell any contracts or customers? Explain:

n Yes n No

12. Provide any additional information you believe pertinent to this transaction. (Attach additional information as needed)

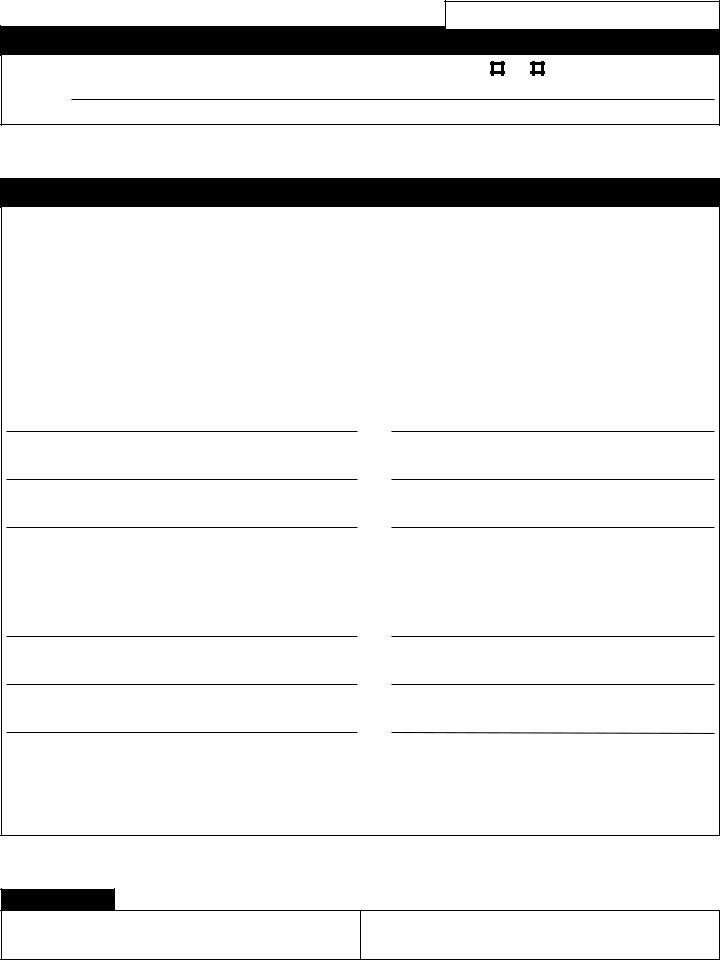

SECTION C - Transaction detail to be completed by the new/successor employer

1.What date did you acquire/purchase the business?

2.From whom did you acquire/purchase the business?

3.Is there a purchase/sale agreement associated with this transaction? (If yes, BWC may request a copy of this agreement.)

n Yes n No

4.Provide the names of all partners, corporate oficers or individuals that have an ownership interest for the New/Successor and former employer.

Ownership interests for former employer

Ownership interests for succeeding employer

5.Did you acquire n all or n part of an existing business? Please explain what was acquired or purchased.

6.Has the business been in continuous operation? Explain:

n Yes n No

7.Are you operating in the former employer’s location? Explain:

n Yes n No

8.How many employees of the former employer did you retain/hire?

9.Did you acquire or purchase the former employer’s contacts or customers? Explain:

n Yes n No

10.Will you conduct business in the same/similar manner as the former employer? Explain:

n Yes n No

Policy number

SECTION C - Transaction detail to be completed by the new/successor employer (continued)

11.Did you acquire or purchase any machinery or equipment from the former employer? Explain:

nYes

n

No

SECTION D - Certification

By my signature, I certify I have the authority to notify BWC of this transfer, and the facts set forth on this notiication form are true and correct to the best of my knowledge. I am aware that any person who misrepresents, conceals facts or makes false statements may be subject to civil, criminal and/or administrative penalties.

Furthermore, I am aware that pursuant to BWC Rule

Succeeding employer

Signature of owner, partner, member or executive oficer |

Title |

Print name of above signature |

Date |

Telephone number |

Former employer

Signature of owner, partner, member or executive oficer |

Title |

Print name of above signature |

Date |

Telephone number |

BWC has the right to proceed with processing a transaction to transfer the former employers experience and the liabilities or credits when the successor wholly succeeds another employer in the operation of a business without one or both of the parties’ signature or approval.

BWC USE ONLY

Team number

Account examiner name