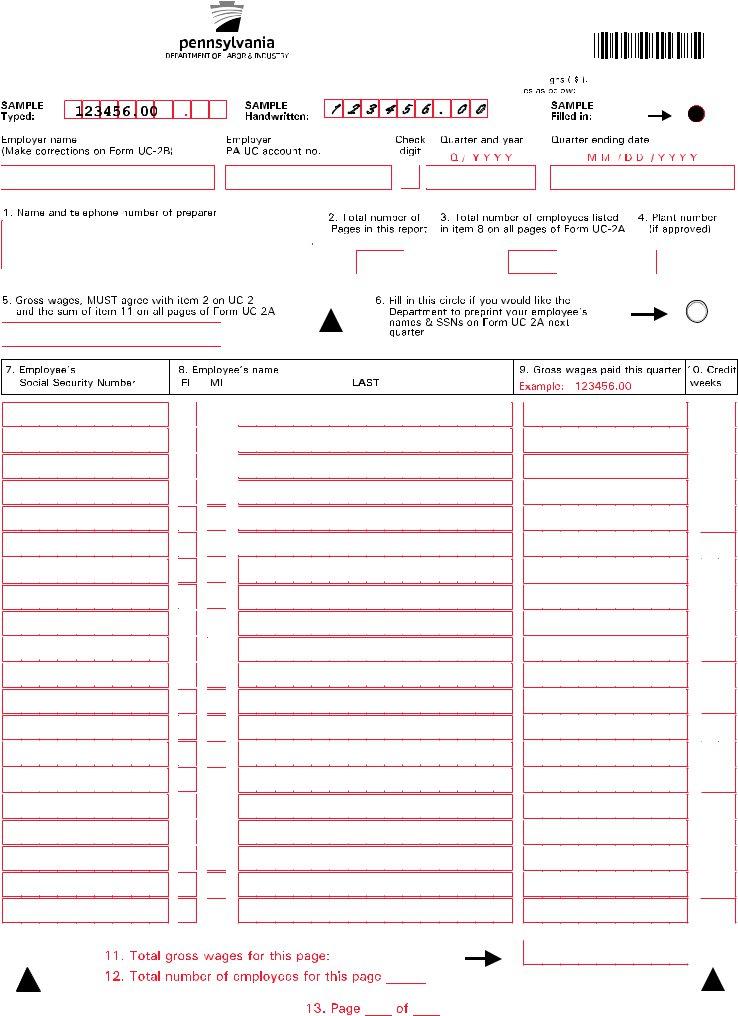

In the realm of employment and tax reporting within Pennsylvania, the UC-2A form plays a crucial role, ensuring compliance and facilitating the accurate calculation of unemployment insurance contributions by employers. Known formally as the Employer’s Quarterly Report of Wages Paid to Each Employee, this document serves as a comprehensive record that businesses must submit on a quarterly basis. By detailing wages paid to each worker, the form aids in maintaining the integrity of the unemployment compensation system, allowing for a fair and efficient distribution of benefits. The current iteration, labeled as revision 07-19, underscores the ongoing efforts to refine and adapt the reporting process to meet evolving standards and requirements. Employers find this form to be an essential part of their administrative duties, ensuring they contribute appropriately to the state's safety nets designed to support individuals in times of job loss. Though it may appear as a mere procedural step, the UC-2A form embodies a critical link in the chain of financial and social accountability between businesses and the workforce they employ.

| Question | Answer |

|---|---|

| Form Name | Uc 2A Form |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | pennsylvania form uc 2a, uc2a form, pa uc2a, uc 2a form |

PA Form

Report of Wages Paid to Each Employee

1 2 3 4 5 6 . 0 0