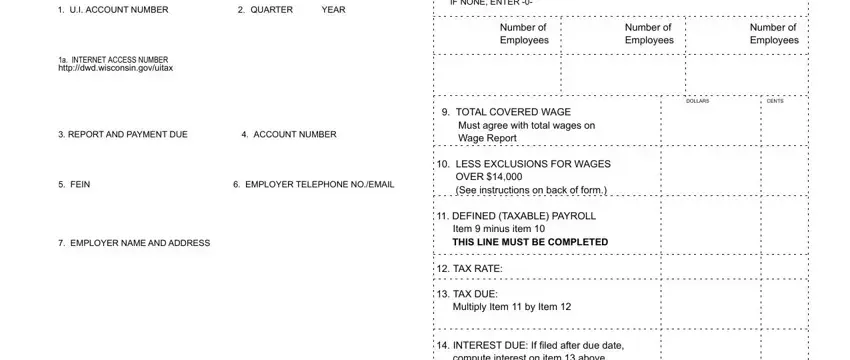

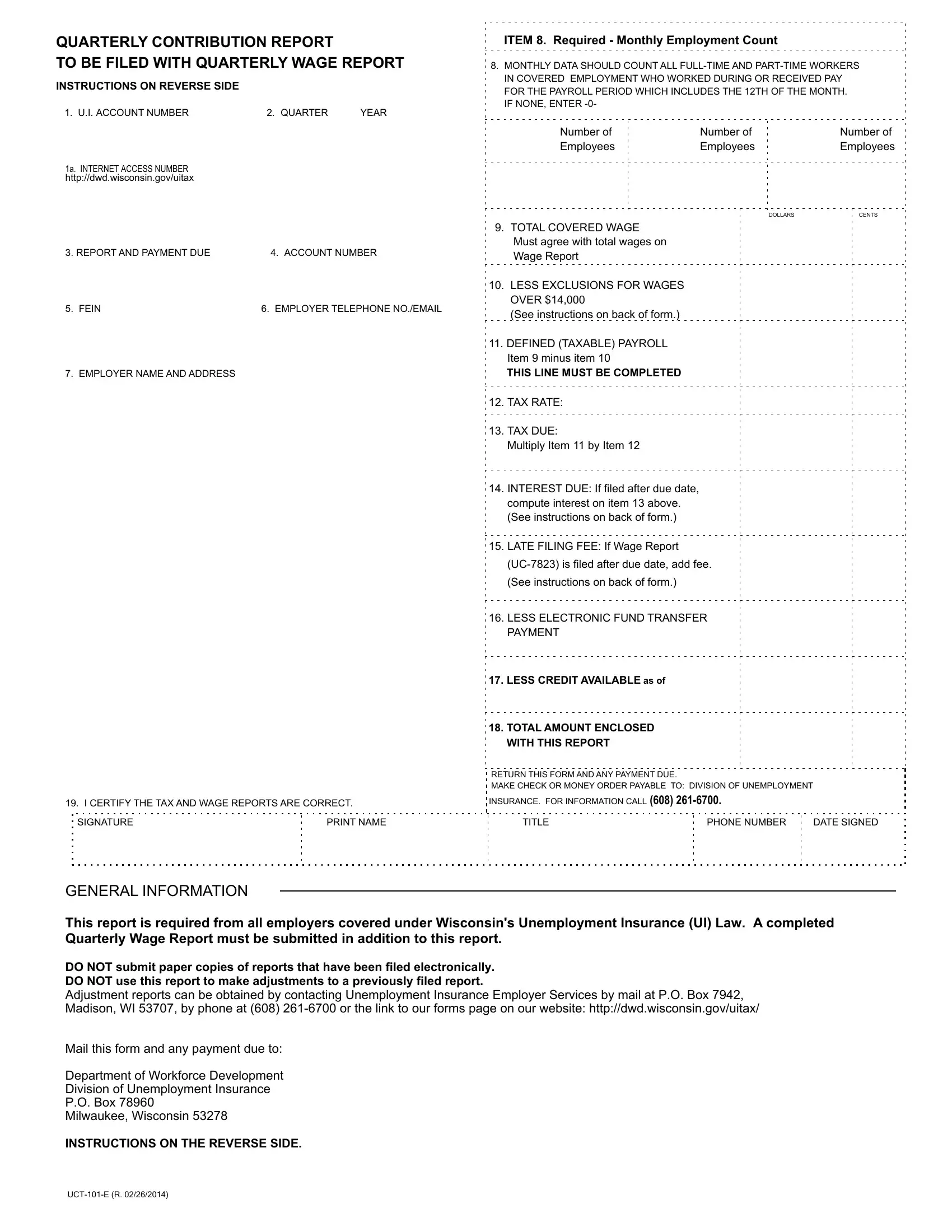

INSTRUCTIONS FOR COMPLETION OF CONTRIBUTION REPORT

This report is required from all employers covered under Wisconsin's Unemployment Insurance (UI) Law. This is required in addition to your Quarterly Wage Report. You can file this report on the Internet using the access number on line 1a, and creating a user ID and password. See http://dwd.wisconsin.gov/uitax. Items 1-7 are preprinted. They show:

1. Ten-digit UI employer account number.

1a. Eight-digit Internet Access Number - Used for filing report on the Internet.

2.Time period this report covers.

3.Report and payment due date. In order to be considered timely, your report must be received by the department on or before the quarterly due date.

4.14-digit account number.

5.6. 7. Employer information. Includes Federal Employer Identification Number (FEIN), telephone number, name and address.

8.The monthly employment data reported on line 8 should be a count of all full-time and part-time workers in covered employment under Wisconsin’s UI Law, who performed services during or received pay for the payroll period which includes the 12th of the month. If no employment in the payroll period, enter zero (-0-).

9.Enter COVERED wages PAID within this quarter before deductions. Wages include: salaries; commissions; bonuses; tips; sick or disability; termination; holiday and vacation pay; value of room, meals, and payments in kind to all full time, part time and temporary employees for services “localized” in Wisconsin. Include agricultural and domestic service wages if you have been determined covered for either employment. Do not include wages paid for employment excluded under s. 108.02(15)(k) unless such wages are subject to the Federal Unemployment Tax Act. NOTE: ITEM 9 OF THIS REPORT SHOULD AGREE WITH TOTAL WAGES ON THE QUARTERLY WAGE REPORT.

10.Enter wages paid this quarter in excess of the $14,000 per employee wage base. To determine the exclusion amount follow the steps below: Step 1 - Determine which of your employees has been paid more than $14,000 since the beginning of the year.

Step 2 - If any of the employees identified in step 1 have already been paid more than $14,000 for the year during a previous quarter, all of the wages paid to them during this quarter are excluded. Add the wages paid during this quarter to each of these employees to arrive at a total.

Step 3 - If any of the employees which you identified in step 1 went over $14,000 for the year during the quarter, the amount paid in excess of $14,000 for the year is excluded. Add the excess paid each employee this quarter to arrive at a total.

Step 4 - Add the totals derived in step 2 and step 3 and enter in item 10. This constitutes excluded wages paid during this quarter which are not taxed. (The amount on line 10 can be equal to but should not be more than the amount shown on line 9.)

11.Subtract item 10 from item 9 to obtain your defined (taxable) payroll. Always indicate an amount in this item. If item 10 is zero, the amount in item 9 should also appear in item 11. If the amount in item 10 is equal to item 9, place a zero in item 11.

Items 12 through 14 do not apply to employers on reimbursement financing.

12.Your tax rate is shown as a decimal fraction on this report.

13.Enter your tax liability for this quarter. Multiply Item 11 (taxable payroll) by Item 12 (tax rate) to determine tax due.

14.The interest rate can change annually. Please refer to the Interest Assessment guide at http://dwd.wisconsin.gov/uitax/interestrate/ for additional information regarding interest rates and calculations.

Starting Month Assessed Interest |

Ending Month Assessed Interest |

Monthly Interest Rate |

|

|

|

May 1982 |

July 2012 |

1.00% |

|

|

|

August 2012 |

Current Month |

0.75% |

|

|

|

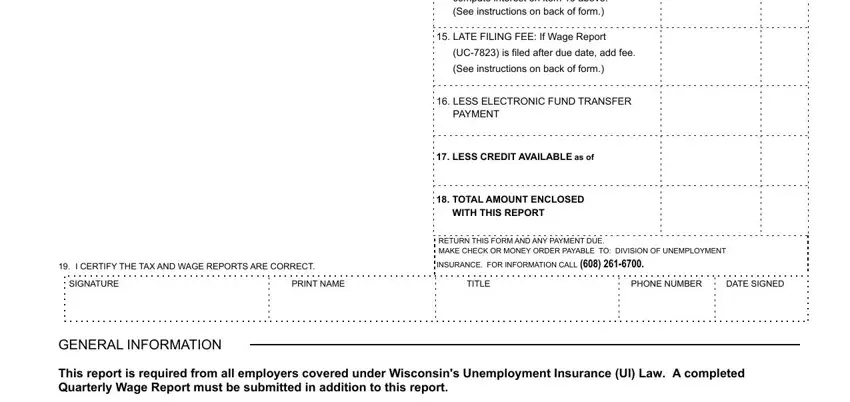

15.If filing the Wage Report (Form UC-7823) within 30 days after the due date, the late filing fee is $50. If filing the Wage Report (Form UC-7823) more than 30 days after the due date, the late filing fee is the greater of $100 or $20 per reported employee.

In addition, an employer who has 25 or more employees and fails to file its tax and wage reports electronically may be assessed a penalty of $20 for each employee reported on paper and a $25 penalty for filing the tax report on paper.

16.If you have paid your taxes for this quarter by Electronic Fund Transfer (EFT), enter that amount here.

17.If you have been notified of any available credit, enter here.

18.Add Items 13 through 15 and subtract Items 16 and 17 to determine amount to be paid. If the total on line 18 is zero, enter zero on line 18.

19.Sign the report, print your name, enter your title, your phone number, and the date signed.

DO NOT STAPLE ATTACHMENTS TO THIS REPORT.

For information on formats, more detailed instructions or additional pages for wage detail, contact Wage Reporting,

Division of Unemployment Insurance, P.O. Box 7962, Madison, Wisconsin 53707, e-mail wagenet@dwd.wisconsin.gov, or |

______ |

telephone (608)266-6877. See http://dwd.wisconsin.gov/uiben/wagehome.htm for formats and specifications. |

|