You can fill in ui quarterly effortlessly in our PDF editor online. To maintain our tool on the cutting edge of convenience, we aim to integrate user-oriented features and improvements regularly. We are always glad to get feedback - help us with remolding PDF editing. All it takes is a few simple steps:

Step 1: Click the "Get Form" button in the top section of this page to access our editor.

Step 2: The tool grants the opportunity to customize the majority of PDF documents in a variety of ways. Improve it with any text, correct existing content, and put in a signature - all at your convenience!

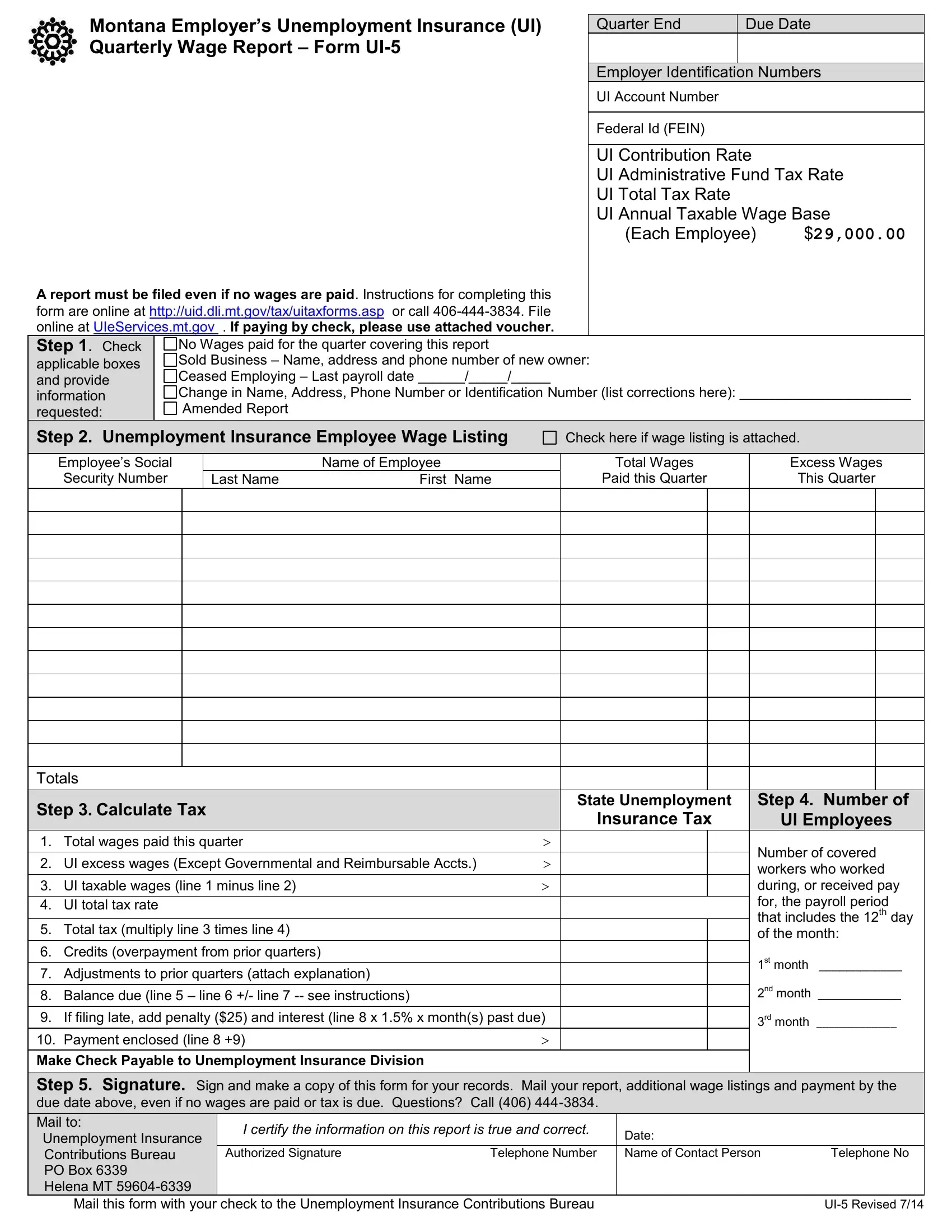

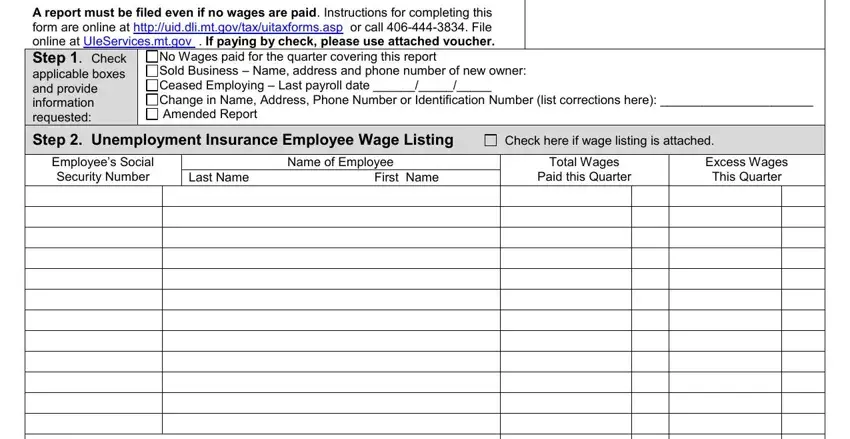

With regards to the blank fields of this particular PDF, here's what you want to do:

1. First, while filling out the ui quarterly, start with the page that includes the next fields:

Step 3: Go through the information you have inserted in the blank fields and then press the "Done" button. Try a 7-day free trial plan with us and gain direct access to ui quarterly - download or edit inside your FormsPal account. FormsPal provides protected form editing devoid of personal data record-keeping or any sort of sharing. Feel at ease knowing that your details are secure here!