Any time you wish to fill out ui19 form 2021 word download, you don't need to install any kind of applications - simply give a try to our online PDF editor. In order to make our tool better and easier to use, we continuously work on new features, with our users' suggestions in mind. This is what you'll need to do to begin:

Step 1: Press the "Get Form" button at the top of this webpage to open our tool.

Step 2: This tool offers the ability to change PDF files in many different ways. Transform it by including personalized text, adjust what's originally in the document, and put in a signature - all at your disposal!

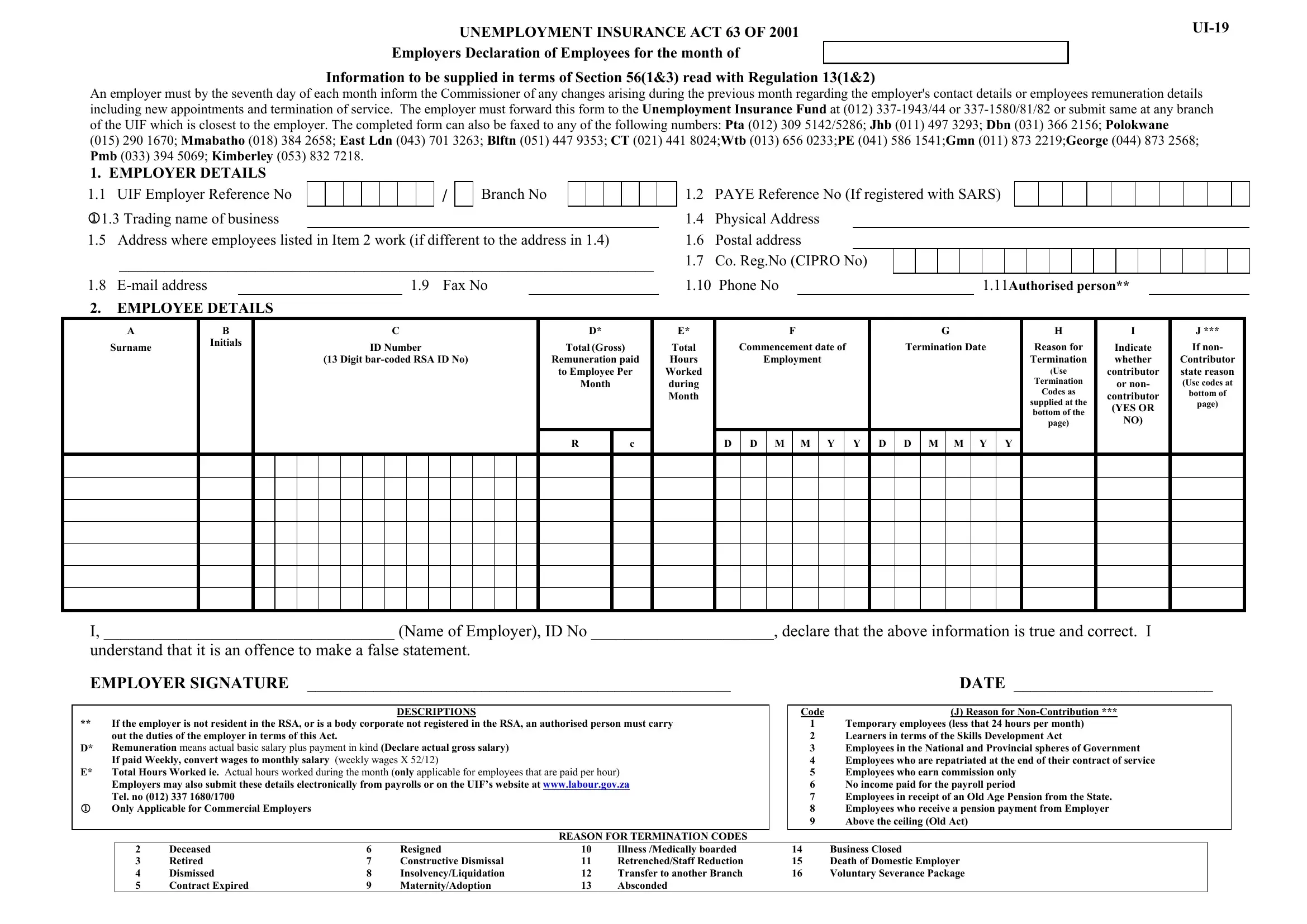

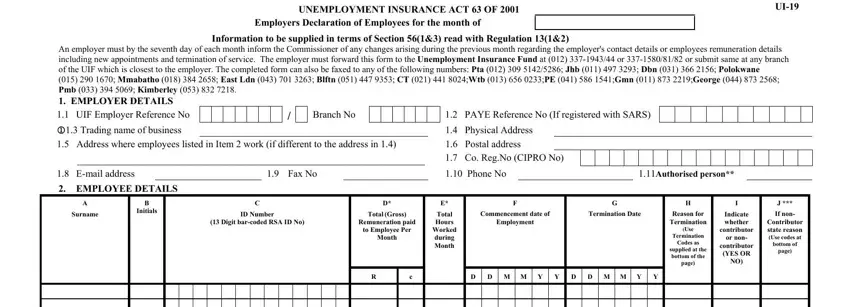

Completing this form generally requires thoroughness. Ensure that all necessary blank fields are filled in properly.

1. The ui19 form 2021 word download involves particular information to be entered. Ensure that the following fields are completed:

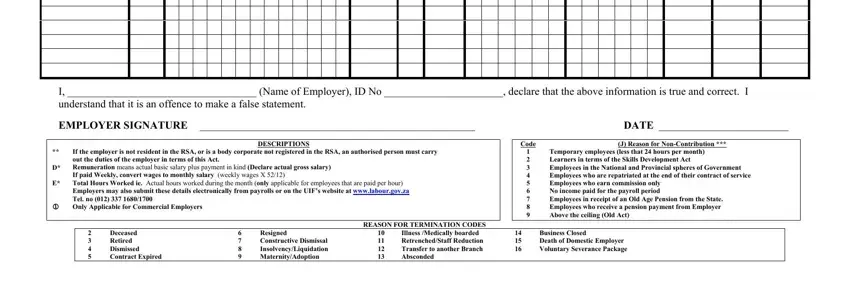

2. Right after filling out this part, go to the subsequent step and fill in the necessary details in all these fields - I Name of Employer ID No declare, DATE, DESCRIPTIONS, If the employer is not resident in, Code, J Reason for NonContribution, Temporary employees less that, Deceased Retired Dismissed, Resigned Constructive Dismissal, REASON FOR TERMINATION CODES, Illness Medically boarded, Business Closed Death of Domestic, and D E.

Many people often make errors when filling out Temporary employees less that in this area. You need to reread whatever you enter here.

Step 3: Reread all the information you have inserted in the blank fields and press the "Done" button. Right after getting afree trial account at FormsPal, it will be possible to download ui19 form 2021 word download or send it via email immediately. The PDF file will also be readily available through your personal cabinet with all your modifications. FormsPal ensures your information privacy with a secure method that in no way records or shares any type of private data used. Feel safe knowing your files are kept safe every time you use our service!