It is possible to fill in uia form 1920 effectively by using our PDFinity® editor. FormsPal team is continuously working to improve the editor and ensure it is much better for users with its extensive features. Uncover an constantly progressive experience now - take a look at and find new opportunities along the way! This is what you'll want to do to get going:

Step 1: Just click on the "Get Form Button" above on this webpage to see our pdf form editor. This way, you'll find all that is required to fill out your file.

Step 2: After you open the file editor, you will get the document prepared to be filled out. Besides filling in various blank fields, you can also do many other actions with the file, including putting on your own words, changing the original textual content, adding images, affixing your signature to the document, and more.

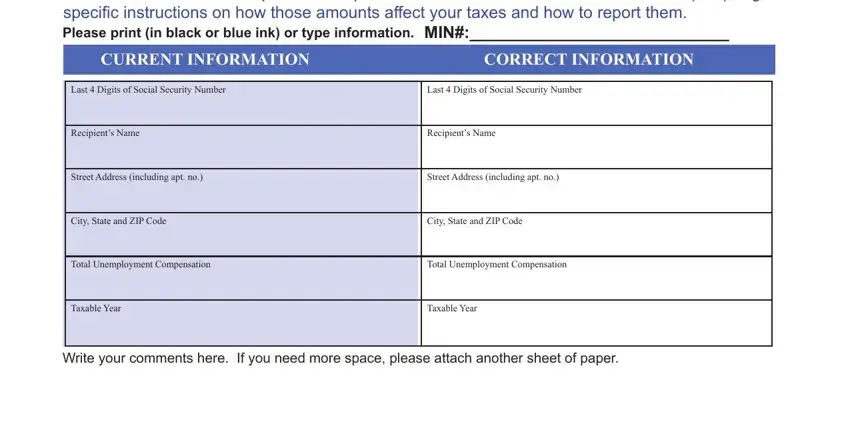

In order to complete this document, make sure that you enter the required information in each and every blank:

1. The uia form 1920 involves particular details to be typed in. Be sure that the next blank fields are complete:

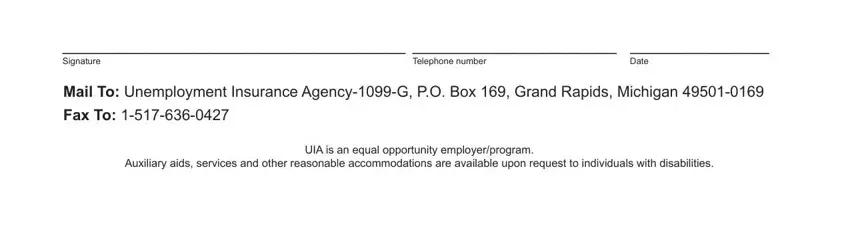

2. Once the previous part is finished, you'll want to put in the required particulars in Signature, Telephone number, Date, Mail To Unemployment Insurance, Auxiliary aids services and other, and UIA is an equal opportunity allowing you to move on further.

Be really mindful while completing Mail To Unemployment Insurance and Signature, as this is where a lot of people make errors.

Step 3: Check the information you have inserted in the blank fields and click on the "Done" button. Grab your uia form 1920 after you join for a free trial. Easily view the form from your FormsPal cabinet, along with any edits and adjustments conveniently synced! FormsPal ensures your information confidentiality with a secure system that in no way saves or distributes any sort of personal data involved in the process. Be assured knowing your documents are kept confidential whenever you work with our tools!