The PDF editor allows you to complete the colorado ui account document. You should be able to obtain the document immediately through these simple steps.

Step 1: Select the "Get Form Now" button to begin the process.

Step 2: Once you have entered your colorado ui account edit page, you'll discover all options you may undertake regarding your file at the upper menu.

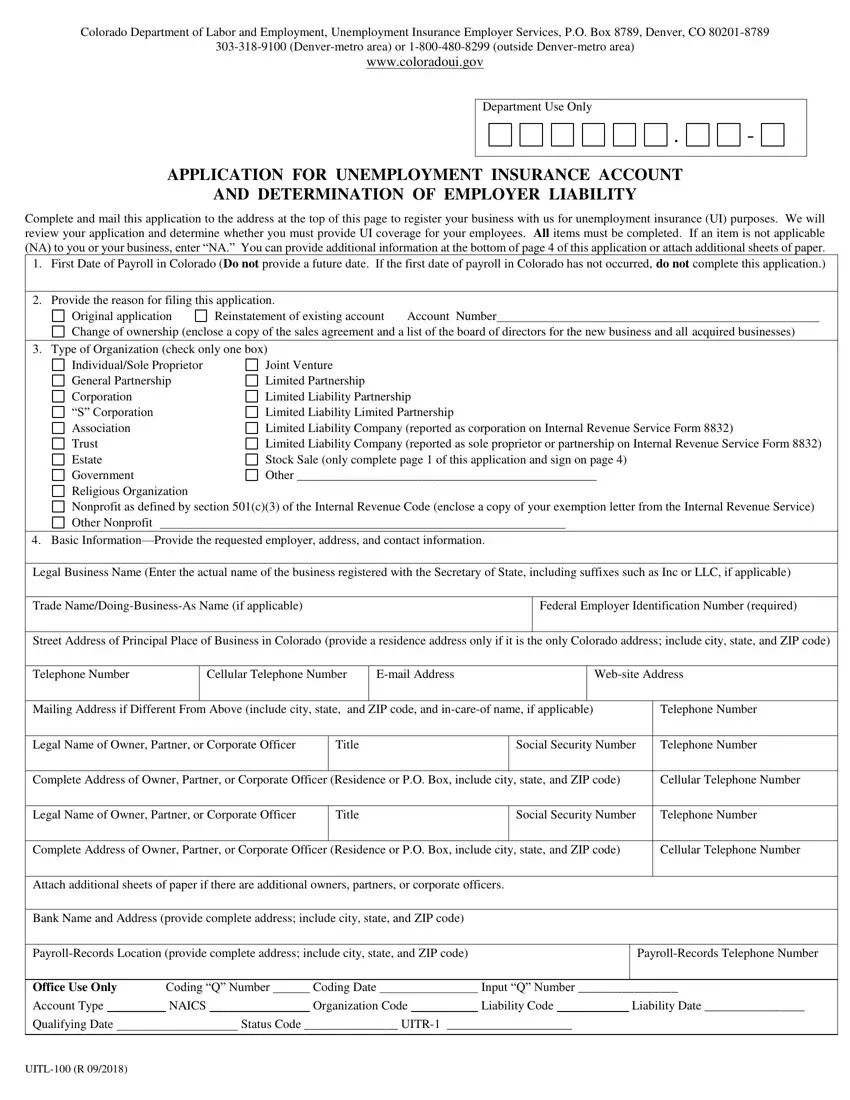

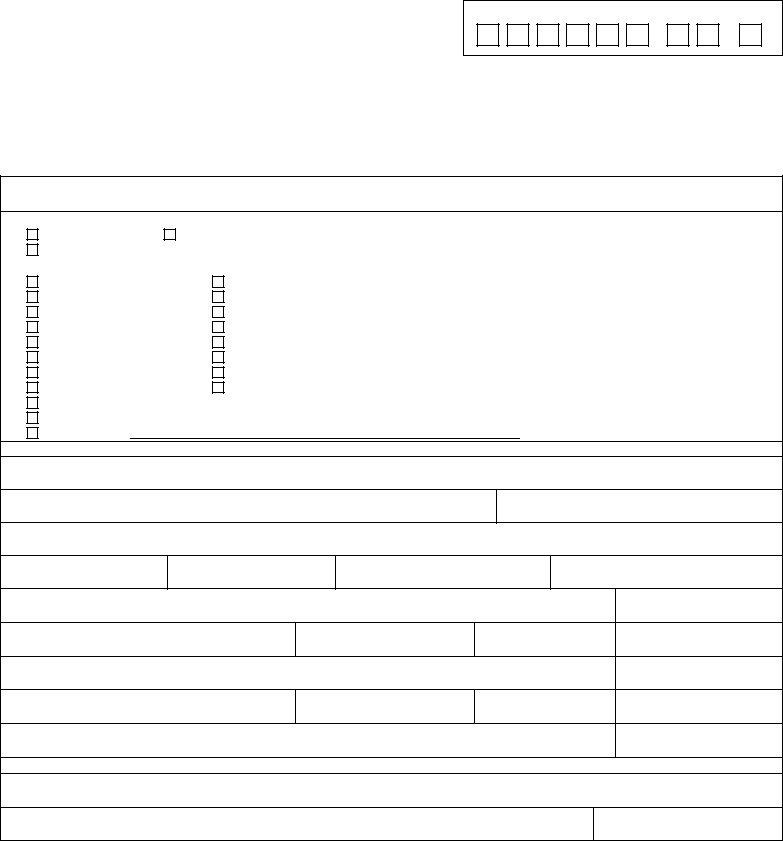

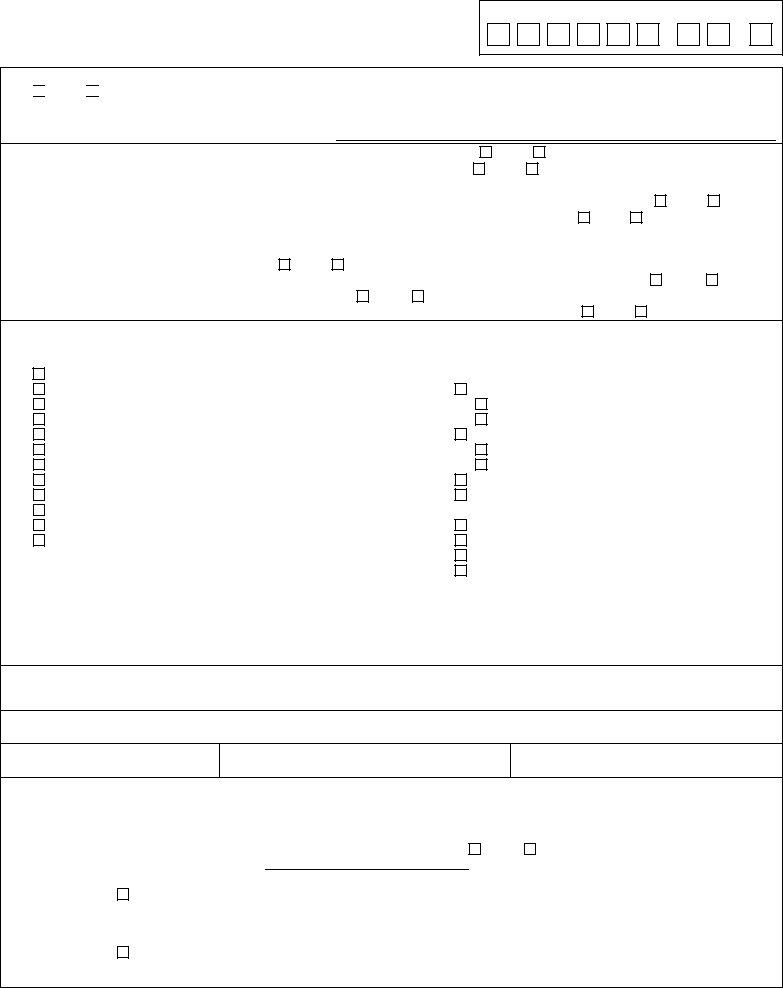

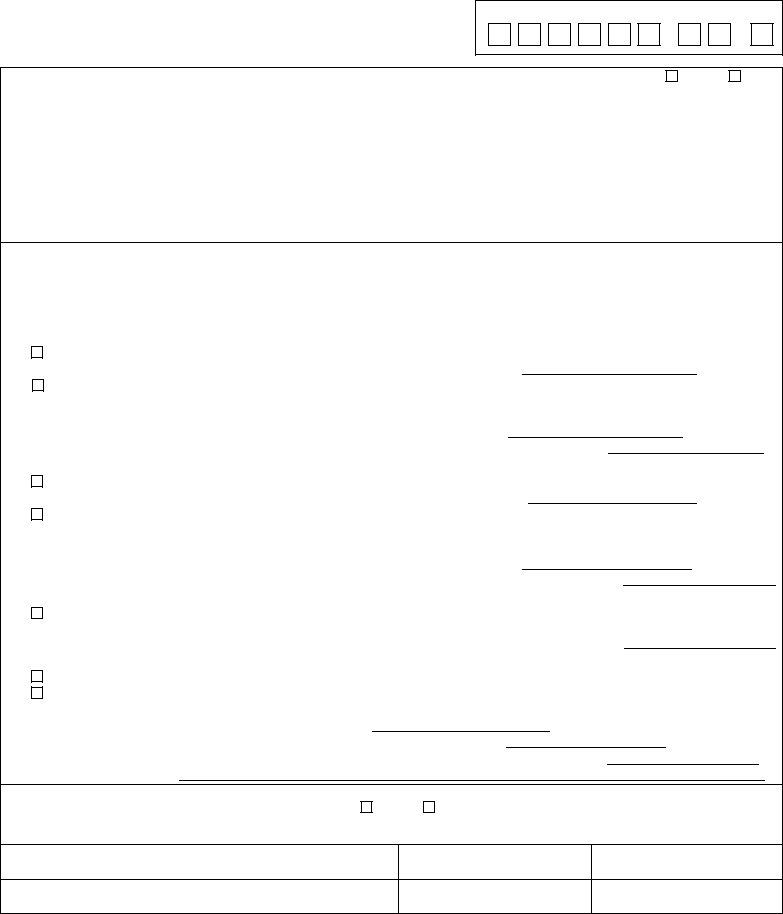

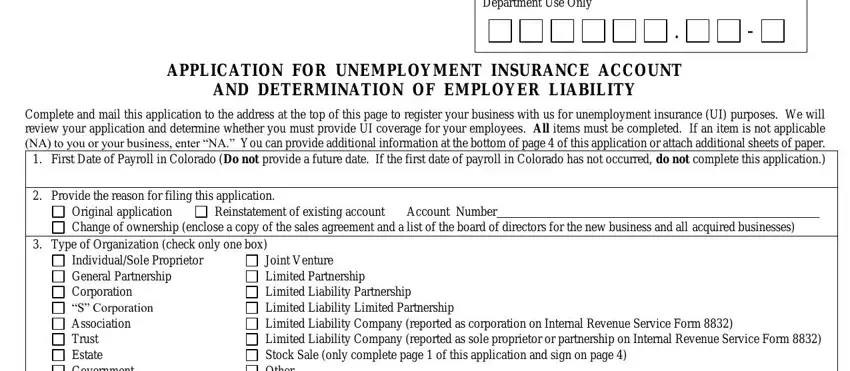

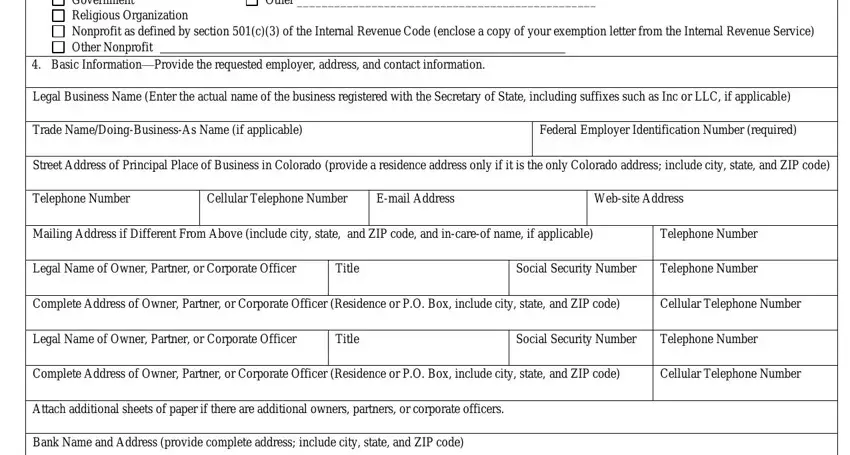

For every single area, fill in the information demanded by the platform.

Remember to insert the particulars within the part Cellular, Telephone, Number Email, Address Social, Security, Number Title, Social, Security, Number and Title.

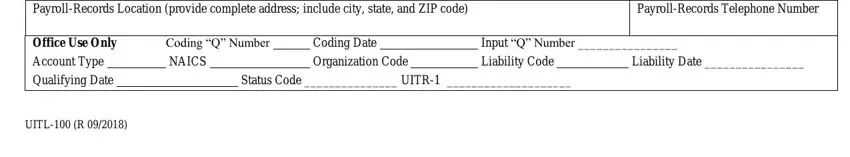

The application will request you to insert some vital data to conveniently fill in the part Coding, Q, Number Coding, Date Input, Q, Number Payroll, Records, Telephone, Number Account, Type NAIC, S Organization, Code Liability, Code Liability, Date Qualifying, Date Status, Code, U, IT, R and U, IT, LR

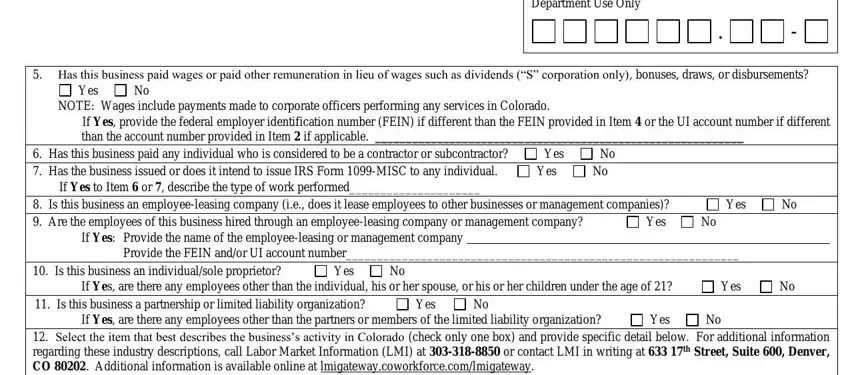

The Department, Use, Only Yes, Yes, Yes, Yes, Yes, Provide, the, FEIN, and, or, UI, account, number Yes, Yes, Yes, and Yes area can be used to identify the rights and responsibilities of each side.

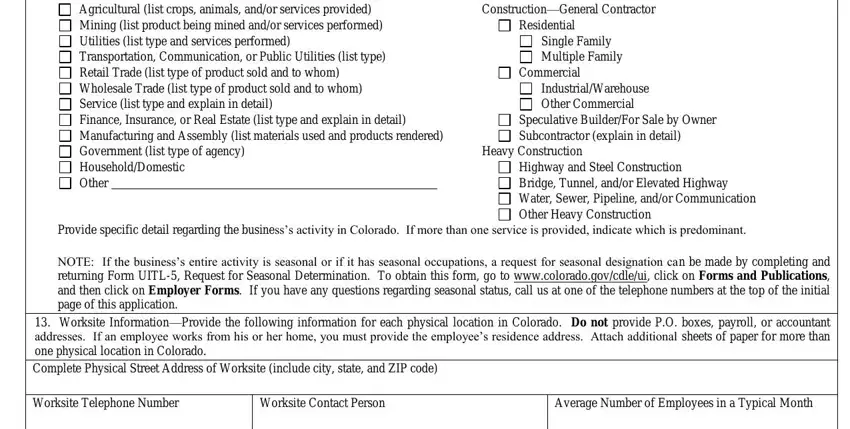

Finish by analyzing the next fields and filling them in as needed: Residential, Commercial, Single, Family, Multiple, Family Industrial, Warehouse, Other, Commercial and Work, site, Contact, Person

Step 3: Select the Done button to assure that your finished document can be transferred to every electronic device you select or forwarded to an email you indicate.

Step 4: Ensure that you stay clear of possible future worries by making around two copies of the document.