The IRS Form 1040 and related schedules allow taxpayers to calculate and report their income, deductions, credits, and other tax-related information. In recent years, the IRS has introduced an additional form called the Uitl 18 (for Unincorporated Businesses) that streamlines the process for filing taxes on unincorporated businesses. This expanded eligibility requirement shifts small business tax filing from individual to Uitl 18 form requirements in some cases – a major change that could benefit many small business owners! In this post we’ll cover how you can use Uitl 18 to maximize your potential savings beyond what is available through more standard forms like the 1040 of its associated schedules.

| Question | Answer |

|---|---|

| Form Name | Uitl 18 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | request for facts about a former employee's employment, form uib 290, colorado department of labor and unemployment uib 290 form, uib 290 colorado |

Colorado Department of Labor and Employment

Unemployment Insurance Operations, P.O. Box 8789, Denver, CO

POWER OF ATTORNEY

Please print or type the information. Instructions for completing this form are provided on the reverse.

Employer Information

Employer Name |

|

Trade Name |

|

|

Employer Account Number (Required) |

|

|

|

|

|

|

|

|

Street Address |

|

City |

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

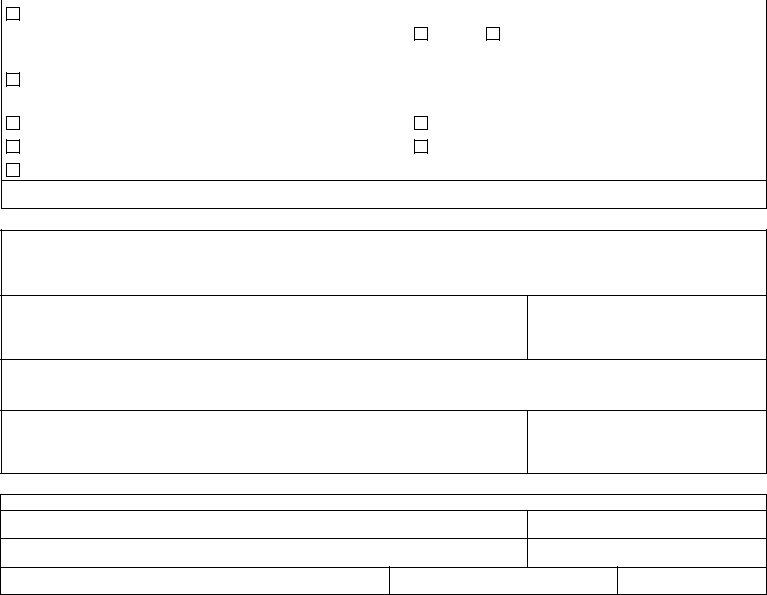

Purpose of Application (Check all that apply) |

|

|

|

|

|

|

Acceptance of power of attorney |

Effective Date _____________________________ |

|

||||

Does this power of attorney supersede a previous power of attorney? |

Yes |

No |

|

|||

If Yes, complete Discontinuation of power of attorney below. |

|

|

|

|

||

Discontinuation of power of attorney |

Effective Date _____________________________ |

|

||||

Name of the entity or individual with power of attorney to be discontinued _________________________________________________

For all unemployment insurance (UI) information |

For UI |

For UI |

For all distribution points of this account number |

For specified distribution points of this account number |

|

Name of Power of Attorney

Provide your preferred mailing address for UI correspondence. All UI correspondence will be mailed to the address you provide below unless you elect to have

Complete Mailing Address

Telephone Number

Complete only if different from above. If you prefer to have UI

Complete Mailing Address

Telephone Number

Employer Approval

I hereby grant permission to the

Employer Name (Printed)

Title

Employer Signature (Required)

Date

Power of Attorney Representative Signature (Required)

Title

Date

City of |

__________________________________________ |

) |

County of |

__________________________________________ |

) SS. |

State of |

__________________________________________ |

) |

Subscribed and sworn to before me this ________ day of _________________________, ____________.

My Commission Expires |

|

|

Notary Public |

|

|

|

|

|

|

|

|

Office Use Only |

Date |

Initials |

|

Power of attorney approved by UI Operations |

|

|

|

INSTRUCTIONS FOR COMPLETING THE POWER OF ATTORNEY

Employer Information

Employer Name: Type or write the entity name or business name.

Trade Name: Type or write the

Employer Account Number: Type or write the

Street Address, City, State, and ZIP Code: Type or write the entity’s or business's location address.

Purpose of Application

Acceptance of power of attorney: Check this box if you want to name or change an entity or individual to have power of attorney. If you check this box, you must provide an effective date.

Discontinuation of power of attorney: Check this box if you want to remove or change the entity or individual with power of attorney. If you check this box, you must provide an effective date.

For all unemployment insurance (UI) information: Check this box if you want to accept or discontinue power of attorney for all information related to your UI account number.

For UI

For UI benefit

For all distribution points of this account number: Check this box if all the

For specific distribution points of this account number: Check this box if only specific

Name of Power of Attorney: Type or write the name of the entity or individual you want to accept as the power of attorney. Do not list an individual employee of a business unless that is the business name.

Complete Mailing Address: Complete the first section if you are adding, changing, or removing a power of attorney from an entity or individual. This information must be complete so that the UI Program is informed as to who will be responsible for UI correspondence. Provide a second mailing address only if you want the

NOTE: You are responsible for forwarding any UI document that is sent to an incorrect mailing address.

Employer Approval

Employer Signature: You must sign this form, provide your title, and date the form in order to make this a valid document.

Power of Attorney Representative Signature: A representative of the entity or the individual who you want to accept as the power of attorney must sign this form, provide his or her title, and date the form in order to make this a valid document.

NOTE: A signature is required only of the entity or individual you want to accept as the power of attorney. You do not need a signature from the entity or individual whose power of attorney is being discontinued.